Skip to content

BofA Says Benign Trump Policies to Spark Rally in Stock Laggards (bloomberg )

China’s Social Security Fund Told To Buy Stocks (chinalastnight )

China Eases Rules for Long-Term Funds to Boost Stock Market (bloomberg )

How Javier Milei’s Tough Remake of Argentina Made Him a MAGA Hero (wsj )

Putin and Xi Stick Together in Video Call After Trump’s Inauguration (wsj )

20 value stocks primed for rapid revenue growth (marketwatch )

Trump’s dream TikTok deal could set a blueprint for doing business with China (nypost )

Here’s the key date to watch for Trump’s tariff policies, one analyst says (marketwatch )

Trump’s Day 1 executive orders target EVs, inflation, immigration. Here’s what could come next. (marketwatch )

Opinion: Trump’s first 100 days: What he must do on trade, immigration and tax cuts (marketwatch )

Opinion: Faster growth can fix many of America’s problems. Here’s how Trump can succeed. (marketwatch )

Is it time to shift to a value-focused investment strategy? (yahoo )

Jamie Dimon says US stock market ‘kind of inflated,’ critics need to ‘get over’ Trump tariffs (nypost )

Americans flocked to this southern US state in droves in 2024 (nypost )

Trump Threatens 10% Tariff on China, Cites Trade Deficit With EU (bloomberg )

US Mortgage Rates Drop to 7.02%, First Decline in Six Weeks (bloomberg )

Einhorn says the market is at the fartcoin stage of the cycle. His fund bought Peloton and made these moves. (marketwatch )

New Tariffs Didn’t Come on Trump’s Day One. A Trade War May Not Be in the Wings. (barrons )

Trump ‘Uncertainty’ Claims a Victim. Ford Stock Catches a Downgrade. (barrons )

Davos Reaction to Trump 2.0: Buckled Up and Ready for His New Term (wsj )

Musk Pours Cold Water on Trump-Backed Stargate AI Project (wsj )

The Alcohol Industry Is Hooked on Its Heaviest Drinkers (wsj )

Five Things to Know About Trump’s Energy Orders (wsj )

A List of Trump’s Key Executive Orders—So Far (wsj )

Trump Keeps China Guessing on Tariff Threats (wsj )

An Anxious Federal Workforce Bids Goodbye to Job Stability and Remote Work (wsj )

Trump to Spur US Tech Deals Boom, Qatar’s $510 Billion Fund Says (bloomberg )

Why Trump Is Pledging to Refill the US Oil Reserve (bloomberg )

TikTok Saga Shows Americans Can’t Be Bothered to Take On China (bloomberg )

Trump Says He’s Open to Elon Musk or Larry Ellison Purchasing TikTok (bloomberg )

Jamie Dimon says Trump’s tariff policy is positive for national security so people should ‘get over it’ (cnbc )

A Chinese startup just showed every American tech company how quickly it’s catching up in AI (businessinsider )

S. investors liked the Stargate AI news. Asian investors loved it. (marketwatch )

All Federal DEI Offices To Be Closed By Wednesday EOD, Workers Placed On Paid Leave: White House (zerohedge )

Extremes Become More Extreme, Then Revert To The Mean (zerohedge )

Trump highlights partnership investing $500 billion in AI (apnews )

China directs funds to stabilise stock market amid Trump tariff threats (scmp )

China’s consumer sector, long plagued by a property slump that has slowed the economy and dampened sentiment, could be nearing a “tipping point”, as consumers save less and spend more following last September’s stimulus blitz, analysts said. (scmp )

Intel’s Potential Buyers Speculated Ahead of Trump’s Inauguration: A Quick Round-up (trendforce )

Trump Holds Off on Immediate China Tariffs, Calls for Study (bloomberg )

Xi Calls for Proactive Macro Policies to Keep China Momentum (bloomberg )

Hartnett suggests being long on international stocks like Europe, China and emerging markets amid policy easing in those regions. He also recommends buying rate-sensitive stocks like homebuilders, utilities, financials and REITs as the 30-year Treasury yield has peaked below 5%. (bloomberg )

Analysts Agree These 8 Warren Buffett Stocks Will Soar In 2025 (investors )

Trump’s Inflation-Cutting Push Suggests Regulatory Cuts Are Coming (barrons )

Trump Signs Order Freezing Government Hiring, Mandates Workers Return to Office (barrons )

Tariffs on Mexico, Canada Could Come as Soon as Feb. 1, Trump Says (barrons )

Trump’s Day 1 orders target EVs, inflation, immigration. Here’s what could come next. (marketwatch )

Trump Signs Executive Orders Focused on the Border, Energy (wsj )

China Signals It Is Open to a Deal Keeping TikTok in U.S. (wsj )

Big Pharma, Beaten Down Under Biden, Hopes for New Chapter Under Trump (wsj )

Trump’s Tariff Shifts Are a Warning for Corporate America to Expect Whiplash (bloomberg )

Trump Signs Executive Order to Cancel Federal DEI Requirements (bloomberg )

Trump Again Calls for EU to Buy More US Energy to Avoid Tariffs (bloomberg )

Trump Lifts Biden’s Freeze On Liquefied Natural Gas Exports (bloomberg )

Treasuries Rally on First Trading Day Under Trump Presidency (bloomberg )

Trump May Be a Net Positive for the Jobs Market, Randstad Says (bloomberg )

Japanese Stocks Drop After Trump Talks About Tariff Plan (bloomberg )

Trump Says He Will Stop Leasing Federal Land for Wind Farms (bloomberg )

Trump Says He’ll Fill US Strategic Oil Reserve ‘Right to the Top’ (bloomberg )

Trump to Sign Orders Defining Sexes, Ending DEI in Agencies (bloomberg )

Jefferies downgrades Apple to rare underperform rating (cnbc )

Stanley Druckenmiller says ‘animal spirits’ are back in markets because of Trump (cnbc )

Trump trade memorandum doesn’t impose tariffs, but he says some could be coming (cnbc )

As WEF gets underway, the list of world leaders not attending Davos speaks volumes (cnbc )

Should you sell Apple’s stock? This analyst makes the case with 3 reasons. (marketwatch )

These are the 2 most important questions for 2025, according to BofA (streetinsider )

Stuart Varney: Patriotism has made a comeback (foxbusiness )

Tech war: China creates US$8.2 billion AI investment fund amid tightened US trade controls (scmp )

Chinese regulators express support for capital markets ahead of Trump’s inauguration (scmp )

Hong Kong stocks rise on positive talks between Trump and Xi (scmp )

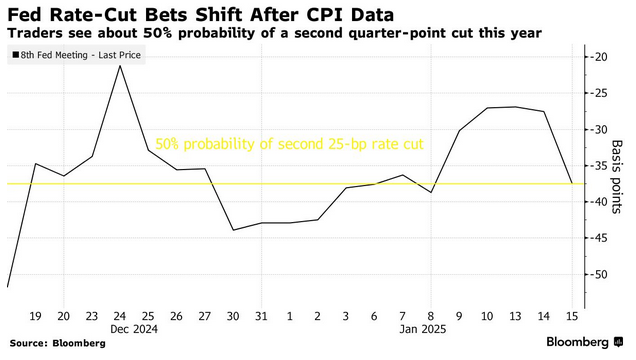

Guggenheim expects Fed to cut rates about every quarter in 2025 (reuters )

It’s a Tough Time for Builders. D.R. Horton’s Outlook Could Be a Bright Spot. (barrons )

Is Elon Musk About to Buy Intel (INTC)? (247wallst )

Dollar Eases as Trump’s Second Term Approaches (tradingeconomics )

China Stocks Climb After Xi-Trump Call (tradingeconomics )

TikTok Restores US Service, Credits Trump (zerohedge )

Hartnett: Historic Rout In Treasuries Ending As “Trump Can’t Allow Bigger Debt And Deficits” (zerohedge )

Trump wants to visit China, strengthen relationship: Report (yahoo )

The truth behind your $12 dress: Inside the Chinese factories fuelling Shein’s success (bbc )

Don Julio (Diageo Owned) Debuts ‘Year Of The Snake’ 1942 Añejo Tequila (maxim )

Pagani Utopia Has Vision-Blurring Performance (roadandtrack )

China ready to work with US for steady growth of ties: Chinese VP (globaltimes )

Trump Says He’ll Give TikTok a 90-Day Reprieve. The App Threatens to Shut Down at Midnight. (barrons )

How Buffett and Munger helped Americans become savvy investors (nypost )

Voters Want MAGA Lite From Trump, WSJ Poll Finds (wsj )

Trump Told Advisers He Wants to Visit China as President (wsj )

Bank of Japan Is Set to Raise Interest Rates, Trump Permitting (bloomberg )

Perplexity Said to Submit Bid to Merge With TikTok’s US Unit (bloomberg )

Trump Says He’ll Likely Visit California Next Week, NBC Says (bloomberg )

Walgreens CEO Admits That Locking Merchandise Away From Shoplifters Makes Regular People Not Buy It (futurism )

The Single Biggest Individual Financier In The World. The Richest Woman In America: Hetty Green (founders )

Your Guide to Trump’s Day-One Agenda — From Taxes to Tariffs (bloomberg )

Traders Pile into Bullish China ETF Wagers After Trump-Xi Call (bloomberg )

What Trump is planning for day one — and what could matter most for investors (yahoo )

Trump, China’s Xi Discuss Trade, TikTok Before Inauguration (bloomberg )

Why Trump’s Plan to Escalate Tariffs Has So Many Haters (bloomberg )

S&P 500 Has Its Best Week Since November Election (bloomberg )

Can an EV Ever Really Be a Muscle Car? (bloomberg )

Sources Say Intel Is An Acquisition Target (semiaccurate )

SLB Stock Jumps on Earnings. AI Is the ‘X Factor’ for Energy-Tech Industry. (barrons )

Chinese Stocks in Hong Kong Cap Best Week in Three Months (bloomberg )

This Gorgeous Lamborghini Miura Is Up For Grabs (maxim )

China’s fourth-quarter GDP grows at 5.4%, beating market expectations as stimulus measures kick in (cnbc )

China Home Prices Fall at Slower Pace as Stimulus Takes Hold (bloomberg )

EV, hybrid sales reached a record 20% of U.S. vehicle sales in 2024 (cnbc )

How Hershey Stock Could Gain 9% (barrons )

US Retail Sales Broadly Advance, Capping a Solid Holiday Season (bloomberg )

Fed may cut rates sooner and faster than expected if inflation keeps cooling, key official predicts (nypost )

Trump Is Making a Last-Ditch Attempt to Save TikTok. Meta and Snap Stocks Fall. (barrons )

DuPont Stock Is Rising. ‘Deal Limbo’ Might Be Over. (barrons )

Disney Stock Will Take a Hit From L.A. Fires, High Costs, and More. This Analyst Says It’s Still a Buy. (barrons )

Treasury yields end at lowest levels in weeks on rate-cut possibilities (marketwatch )

Where Does L.A.’s Luxury Home Market Go From Here? (wsj )

From Cartier to Target, Investors Find Cheer in Holiday Spending (wsj )

Cartier Owner Richemont’s Sales Beat Buoys Luxury Stocks (wsj )

TSMC Expects Continued AI-Driven Growth After Ending 2024 Strong (wsj )

Economic Toll of Los Angeles Fires Goes Far Beyond Destroyed Homes (nytimes )

E-Commerce Boom to Drive 10% Freight Growth, Qatar Airways Says (bloomberg )

“Chinese President Xi Jinping will skip US President-elect Donald Trump’s inauguration on Monday but will send Vice President Han Zheng instead, the country’s Foreign Ministry said. An announcement Friday from an unnamed ministry spokesperson confirming Han’s participation said China wanted a “stable, healthy and sustainable relationship” with the US and was ready to work with the new American government to “find the right way for the two countries to get along with each other.” (bloomberg )

Commentary: China’s economic resilience makes a case for faith (cn )

Chicago Fed President Sees Promising Progress on Inflation (barrons )

Intuitive Surgical Stock Jumps. ‘Da Vinci’ Robots Guide the Future. (barrons )

Short Seller Hindenburg Research Closes Up Shop (barrons )

Balance of Power Shifts Back Toward Bosses (wsj )

Even Harvard M.B.A.s Are Struggling to Land Jobs (wsj )

Where Does L.A.’s Luxury Home Market Go From Here? (wsj )

TikTok may get reprieve from Trump over US ban — after vow to go dark on Sunday (nypost )

Strong Winds Ease in L.A. as Fire Crews Make Progress (nytimes )

Chinese imports spiked as US buyers prepared for tariffs (usatoday )

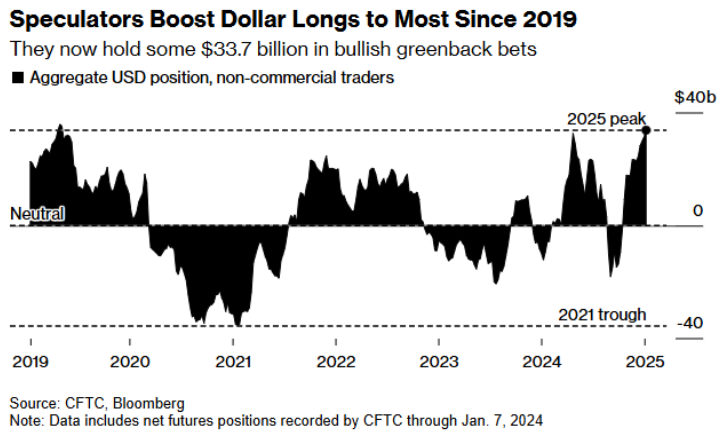

Bessent to Say Dollar’s Global Status Is Critical to US Economy (bloomberg )

Goldman Sachs CEO Solomon says IPO market is ‘going to pick up’ along with dealmaking (cnbc )

10-year Treasury yield pulls back after core inflation is light in December (cnbc )

Disney wins the 2024 box office as year-end receipts offer a welcome boost (cnbc )

Treasuries Surge as Easing Inflation Boosts Fed Rate-Cut Bets (bloomberg )

China Faces Harsh Dilemma as Its Currency Comes Under Pressure (wsj )

Consumer & Technology Stocks Lead China Rally (chinalastnight )

China stocks rise on report that Trump is considering a gradual approach to tariffs (yahoo )

Joseph Tsai: BABA-W Imports US$50B Worth US Goods Annually to Help Cushion Trade Deficit (aastocks )

Microsoft pauses hiring in U.S. consulting unit as part of cost-cutting plan, memo says (cnbc )

Meta announces 5% cuts in preparation for ‘intense year’ — read the internal memo (cnbc )

Intel to spin off venture capital arm as chipmaker continues to restructure (cnbc )

Odds of Multiple Rate Cuts in 2025 Are Rising (barrons )

Treasury Yields, Dollar Fall Following December Inflation Data (barrons )

Trump Plans ‘Energy Dominance’ Executive Orders After Inauguration (wsj )

Access to Your Airport Lounge Is Getting Even Harder (wsj )

‘Red Note,’ a Chinese App, Is Dominating Downloads, Thanks to TikTok Users (nytimes )

Housing Costs Show Signs of Cooling But Remain Sticky (bloomberg )

China State Grid Plans Record $89 Billion Spend Amid Green Surge (bloomberg )

Wall Street Sees Best CPI Day Since October 2023: Markets Wrap (bloomberg )

How Scott Bessent Won Over MAGA and Wall Street (bloomberg )

‘Accidents waiting to happen’ in private credit, says Wellcome Trust (ft )

Investors pour billions into S&P equal weight fund as tech fears rise (ft )

Dow adds more than 350 points, but Nasdaq closes lower as investors rotate out of tech (cnbc )

Trump Team Studies Gradual Tariff Hikes Under Emergency Powers (bloomberg )

Buy on dips in this Chinese internet stock, JPM says (investing )

US Wholesale Inflation Surprisingly Eases on Drop in Food Prices (bloomberg )

Producer Inflation Cooled Slightly in December (barrons )

Palantir Stock Is Down This Year After an Incredible 2024. Why Jefferies Remains Bearish. (barrons )

Manufacturers Could Shine in 2025. Eight Stocks to Watch. (barrons )

Growth Stocks Are Getting Crushed. Here Are 8 Bargains. (barrons )

Large-cap U.S. stocks may be heading for a lost decade, this contrarian warns. What to buy instead. (marketwatch )

Which insurance companies have the most exposure in California? (foxbusiness )

An out-of-the box idea for China and Trump (ft )

A Bond Selloff Is Rocking the World. You Might Want to Take the Other Side. (wsj )

China Boosts Yuan Support With Warning, Capital Control Tweaks (bloomberg )

China’s Trade Surplus Reaches a Record of Nearly $1 Trillion (nytimes )

Boeing Stock Would Benefit From a Breakup, Specialist Says (barrons )

China and the U.K. have the opposite problem. They just struck a deal. (marketwatch )

The bull market is still intact. This pullback is just the cost of doing business, says strategist (marketwatch )

Goldman Sachs Is All-In on the American Exceptionalism Trade (barrons )

Moderna Stock Sinks. It Disappoints With Covid-19 Vaccine Forecast. (barrons )

China Downplays Deflation Troubles. Bond Vigilantes Aren’t Buying It. (barrons )

The Car Market’s Hottest Deal: The Cheap EV Lease (wsj )

Stocks Are Close to Wiping Out Trump Bump as Rate Fears Kick In (bloomberg )

Investors Hope Earnings Season Can Revive Faltering Stock Rally (wsj )

We’re ‘cautiously optimistic’ about the economic outlook, says JPMorgan’s Gabriela Santos (cnbc )

December Imports Increase On Domestic Demand (chinalastnight )

China’s Export Boom Means Trump Tariffs Would Hit Beijing Where It Hurts (wsj )

Meet Trump’s Economic Whisperers (nytimes )

China Securities Regulator Vows Efforts to Stabilize Market (bloomberg )

China’s imports post surprise growth in December; exports beat expectations as higher tariffs loom (cnbc )

Opinion: The stock market’s ‘Trump bump’ will be back. Just be patient. (marketwatch )

There goes 80% of the market, says one reaction to new White House microchip rules (marketwatch )

Trump should declare California an ‘opportunity zone’: Jeff Sica (foxbusiness )

Natural-Gas Stocks Are Set to Beat the Market. Here’s Why. (yahoo )