Skip to content

Advance Auto Parts Closes on Sale of Worldpac to Carlyle. Advance Auto Parts said the transaction strengthens its balance sheet and liquidity with $1.5 billion of cash proceeds. (aftermarketnews )

The SALT Deduction Fight Is Coming Back—Whoever Wins the Election (wsj )

The ‘Trump Trade’ Isn’t What You Think (wsj )

China gears up for a big week as markets await U.S. elections and stimulus details (cnbc )

China’s Singles Day shopping festival is more than halfway over. Here’s how consumers are spending (cnbc )

Striking Boeing machinists vote on union-backed contract proposal, this time with a warning (cnbc )

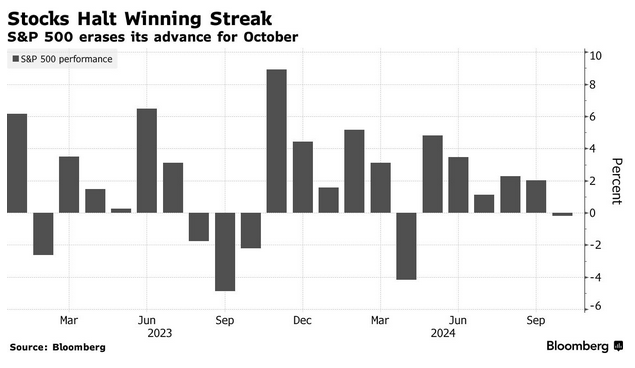

The incumbent party has historically won if stocks rally into an election. Here’s why this time could be different. (businessinsider )

Alibaba brings Singles’ Day to US with AliExpress, offering alternative to Black Friday (scmp )

China’s Singles Day shopping festival is more than halfway over. Here’s how consumers are spending (cnbc )

China Reviews Plan to Refinance Local Governments’ Hidden Debt (bloomberg )

Talen Stock Tumbles on Amazon Nuclear Power Deal Setback. Constellation, Vistra Down, Too. (barrons )

Market expert bullish on China’s Alibaba (foxbusiness )

The burrito king in coffee land: Starbucks CEO Brian Niccol’s most important job is fixing the bad vibes (fortune )

Nvidia’s stock performance has been ‘staggering.’ But recent buyers of the stock are taking a far greater risk than they realize (fortune )

ChatGPT releases a search engine, an opening salvo in a brewing war with Google for dominance of the AI-powered internet (fortune )

Why Kamala and Trump are turning to podcasts to woo uncertain voters (nypost )

Cool, cool, cooling jobs (npr )

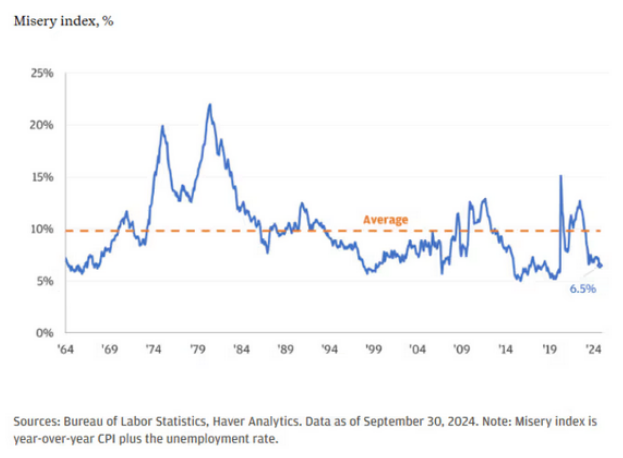

Abundant reserves enabled a soft landing (scottgrannis )

🔴 【LIVE BLOG】Alibaba’s 2024 11.11 Global Shopping Festival 🔥:Brands Surge, 88VIP Drives Growth 📈(Continuous Updating)(alizila )

Warren Buffett is sitting on over $325 billion cash as Berkshire Hathaway keeps selling Apple stock (apnews )

Tech Earnings Fail to Fire Up Traders With Sky-High Expectations (bloomberg )

Fed and Peers Will Go Ahead With Rate Cuts After This Week’s US Election (bloomberg )

Harnett: This Is The Most Contrarian Post-Election Trade (zerohedge )

Alibaba cuts ‘dozens of employees’ at metaverse unit as sector’s hype cools down (scmp )

China may have big opportunity to change household & consumer sentiment: Longview’s Dewardric McNeal (cnbc )

China Eases Curbs to Woo Global Investors Ahead of US Elections (bloomberg )

Berkshire Sold 25% of Its Apple Stock in the Third Quarter (barrons )

Berkshire Sold Bank of America Stock Again. Here’s Why. (barrons )

Wells Fargo, Capital One, and Other Value Picks From a Berkshire Board Member (barrons )

Intel Stock Needs an Nvidia-Like Run to Save the CEO’s Stock Awards (barrons )

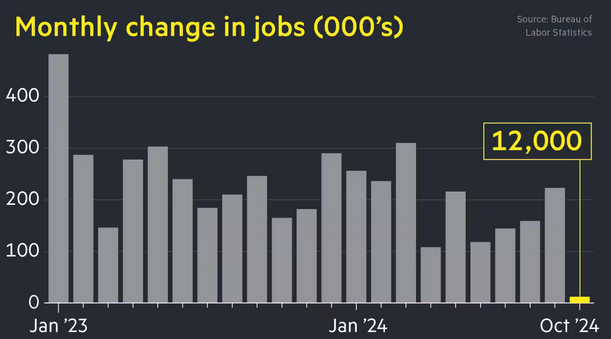

US adds just 12,000 jobs as storms and strikes hit labour market (ft )

Betting Markets Tend to Get Elections Right—With Some Notable Exceptions (wsj )

Ski Bums Love It. So Do Billionaires and History Buffs. How This Aspen Hotel Kept Its Gilded Age Appeal. (wsj )

Paralyzed people may soon be able to walk thanks to NYC innovation — and that’s only the beginning (nypost )

Wall Street frets over Big Tech’s $200bn AI spending splurge (ft )

Boeing Reaches New Deal With Union in Hopes of Ending Strike (nytimes )

Fed seen agreeing to quarter-point rate cut, while disputes flare about the road ahead (marketwatch )

This closely watched stock-market indicator hit a 2½-year high. What it says will happen next. (marketwatch )

AI Today and Tomorrow (bridgewater )

Mopar Unleashes All-Electric Plymouth GTX Muscle Car (maxim )

How John Hennessey Builds Some Of The World’s Fastest Supercars (maxim )

Cooper Standard Reports Third Quarter Results; Continuing Lean Initiatives Delivering Cost Savings as Planned (cooperstandard )

Intel CEO’s turnaround mirrors some moves by Steve Jobs. (marketwatch )

Boeing Dismantles DEI Team as Pressure Builds on New CEO (bloomberg )

U.S. Added Only 12,000 Jobs in October. Blame Strikes, Storms. (barrons )

Walmart Is on a Winning Streak. How the Walton Family Keeps the World’s Biggest Retailer on Track. (barrons )

Boeing Stock Rises After Offer to Pay $119,000 a Year. Vote Due Next Week as Strike Rolls On. (barrons )

Wayfair Stock Leaps on Earnings Beat. CEO Is Focused on ‘Healthy Profitability.’ (barrons )

Intel Says Sales Outlook Is Improving (wsj )

The Fed’s Preferred Inflation Gauge Cooled Overall in September (nytimes )

Boeing Gains After Union Endorses Sweetened Offer to End Strike (bloomberg )

Real Estate Prices & Transaction Volume Rebound In October, Week in Review (chinalastnight )

Intel books big charges for restructuring, but here’s why its stock is surging (marketwatch )

China’s Economy Shows Flashes of Stimulus Taking Hold (bloomberg )

China Home Sales Slump Eases as Stimulus Boosts Buyer Morale (bloomberg )

AliExpress Invites U.S. Retailers to Sell on the Platform (aliexpress )

Alibaba Stock Has Soared. It’s Still Cheap Enough to Buy. (barrons )

BABA-W’s AliExpess Sees Some Merchants’ Stocking Growth 8x+ (aastocks )

Meta Stock Falls Further After Facebook Parent’s Earnings Beat. Spending Is an Issue. (barrons )

Intel Reports Earnings Today. Analysts Are Worried About the Outlook. (barrons )

PCE Inflation Slips to 2.1% Annual Rise, Moves Closer to the Fed’s Target (barrons )

Boeing Stock Won’t Budge Despite All the Bad News. This Is Why. (barrons )

Estée Lauder Stock Is Dropping on Disappointing Guidance and Cut Dividend (barrons )

23 Stocks That Pay a Huge Dividend. Why They Should Be a Better Bet Than Treasuries. (barrons )

Temu’s debut in Vietnam faces scrutiny after Indonesian ban (scmp )

Boeing’s New 6% Convertible Preferred Stock Scores With Investors (barrons )

Microsoft Shares Slip as Forecast Sparks Concern About AI and Cloud Revenue (wsj )

Starbucks Is Bringing Back the Condiment Bar (wsj )

US Jobless Claims Fall to Five-Month Low as Storm Impact Fades (bloomberg )

American Airlines Busts Travelers Who Cut the Boarding Line (wsj )

China Central Bank Adds $70 Billion With New Liquidity Tool (bloomberg )

Boeing strike will dent last jobs report before election (cnbc )

How Hermès is bucking the global luxury slowdown (cnbc )

Why the bond market may have it entirely backwards on Trump and Harris (marketwatch )

Disney to Pay More Than $500 Million to Air the Grammys (wsj )

Can We Prevent Cancer With a Shot? (wsj )

Science Is Finding Ways to Regenerate Your Heart (wsj )

Eurozone inflation rises to 2% in October (ft )

Big Tech’s AI splurge worries investors about returns ahead of Amazon results (reuters )

PayPal’s Real Friends Will Have to Be Patient (wsj )

Boeing, Union Hold ‘Productive’ Talks in Attempt to End Strike (bloomberg )

Super Micro Stock in Free Fall After Accountant Resigns (barrons )

New retail car sales increased 2% in the latest week of data, and they are now up 10% over last year. (cox )

U.S. Economic Growth Extended Solid Streak in Third Quarter (wsj )

Eli Lilly Stock Plummets After Earnings Miss (barrons )

China Beige Book Sees Economy Perking Up. (barrons )

What the Election Means for Tesla and Other Car Stocks (barrons )

US Hiring in ADP Data Rises to Fastest Pace in More Than a Year (bloomberg )

Mortgage demand stalls as interest rates surge higher ahead of election (cnbc )

VF Stock Surges After Q2 Sales Beat, Profit Swing (footwearnews )

For fiscal 2024, PayPal now expects adjusted earnings per share to grow in the high teens, compared with an earlier forecast of low to mid-teens growth. (barrons )

China Weighs $1.4 Trillion Fiscal Stimulus Package, Reuters Says (bloomberg )

It Has Your Money—and Your Pants Size. Here’s What PayPal Is Doing With Them. (wsj )

Alphabet’s Search and Spending Is All Wall Street Cares About. (barrons )

3 Titans Spent Tens of Billions on AI. Will They Regret It? (barrons )

Pfizer Rises After Earnings Beat, Guidance Hike (barrons )

Boeing Moves to Raise $19 Billion in Equity (wsj )

Bosses Are Calling Workers Back to the Office. That’s Good News for Landlords. (wsj )

At Boeing and Starbucks, Different Problems but Similar CEO Messages (wsj )

Estée Lauder Succession Drama to End With Insider Pick (wsj )

The 25 Best Pizza Places in New York Right Now (nytimes )

Milei’s Revamp Offers CEOs a Glimmer of Optimism About Argentina (bloomberg )

China Investors Scour Protest Data for Clues to Next Stimulus Moves (bloomberg )

CEOs Are Saying This Is as Bad as It Gets for Their Earnings (bloomberg )

What’s Different Between 2016 Trump Trade and Now (bloomberg )

Fed goes quiet ahead of its Nov. 7 meeting, with quarter-point cut seen as likely (marketwatch )

Ministry Of Finance Hints At NPC Fiscal Policy, Reiterates 2024 GDP Goal (chinalastnight )

JPMorgan CEO Jamie Dimon says ‘it’s time to fight back’ on regulation (reuters )

Job openings fall to lowest level since January 2021 (yahoo )

PayPal Earnings Due. Wall Street Eyes 2025 Catalysts Amid Big Run. (investors )

Boeing Is Selling Stock—A Lot of It. The Shares Are Surprisingly Steady. (barrons )

There’s a ‘generational opportunity’ for investors in this sector, says JPMorgan (marketwatch )

Ford Earnings Are Coming. They Need to Be Better. (barrons )

Pfizer’s Activist Battle Might Fizzle—but Its Stock Probably Won’t (wsj )

Elliott Hunts Bigger Prey, Testing Limits in Barrage of Activism (bloomberg )

Palm Beach Is Having a Luxury Hotel Renaissance (bloomberg )

Cut or pause? 2 critical reports will determine what Fed does in November. (yahoo )

Musk predicts he could save taxpayers $2,000,000,000,000 if Trump wins (foxbusiness )

Intel invests US$300 million in China chip packaging and testing plant (scmp )

Alibaba Presents First Full-process AI Product (aastocks )

Intel and Samsung explore foundry alliance to challenge TSMC (technode )

China’s GenZers Are Into Stocks. They Are So Over the Housing Crisis. (barrons )

Intel Stock Needs an Nvidia-Like Run to Save the CEO’s Stock Awards (barrons )

Big Tech Stocks Lose Some of Their Aura as Earnings Growth Slows (bloomberg )

Savers Bid a Sad Farewell to Higher Yields (wsj )

It’s not just obesity. Drugs like Ozempic will change the world (economist )

Ferrari 296 GTB: Absurdly Potent, Outrageously Capable (roadandtrack )

Impact of CRISPR in cancer drug discovery (science )

Why pros like Rory McIlroy use this practice method to improve their golf swing (golfdigest )

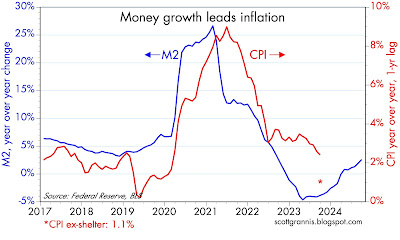

Slow M2 means low CPI (scottgrannis )

Consumer confidence seen as key driver for growth (cn )

China property: Sunac’s multimillion-yuan One Sino Park in Shanghai sells out in 3 hours (scmp )

This is why David Einhorn thinks Peloton could be worth five times what it is now (cnbc )

The A.I. Power Grab (nytimes )

China’s Stimulus Aims to Boost Consumption, Top Official Says (bloomberg )

These Are the Absolute Cheapest Stocks in the S&P 500 Right Now (barrons )

Where Will Rates End Up? Inside the Fed’s Chase for the Magic Number. (barrons )

Markets are moving in mysterious ways — and Wall Street is struggling to explain why (marketwatch )

Israel Strikes Back at Iran, Deepening a Cycle of Military Escalation (barrons )

What Is Behind the Rise in Bond Yields? Look to Powell, Not Trump. (barrons )

Boeing Explores Sale of Space Business (wsj )

America’s Newest Hit Candy Is Gummy, Crunchy and Printing Money (wsj )

Big Food Is Learning to Love Weight-Loss Drugs (wsj )

Joe Rogan Takes Center Stage in an Election Season Dominated by Podcasts (wsj )

How Boeing’s new CEO is tackling the ultimate management test (businessinsider )

S. shale natural gas production has declined so far in 2024 (eia )

Small-caps have better value and momentum than large, says Miller Value’s Bill Miller IV (cnbc )