Skip to content

HSI Co.: BABA-W To be Added to Hang Seng Stock Connect Hong Kong Index, Hang Seng SCHK China Technology Index (aastocks )

Boeing Stock Is Rising. More Cash Means a Stronger Balance Sheet. (barrons )

Exclusive: China May Add 6 Trillion Yuan ($843B USD) in Treasury Bonds to Buttress Economy (caixinglobal )

Boeing Stock Fell. Why Analysts Are Still Backing Shares. (barrons )

Brendan Ahern, CIO at KraneShares, highlights China’s recent stimulus efforts, noting the need for more details, especially on boosting domestic consumption. (cnbc )

Starbucks scales back discounts as new CEO seeks turnaround (foxbusiness )

Charles Payne: As the market rises you will hear more bubble warnings (foxbusiness )

Alibaba, JD.com, Pinduoduo launch campaigns for Singles’ Day shopping festival on same day (scmp )

Hedge-fund manager who could be Trump Treasury secretary says tariffs can be negotiated lower (marketwatcch )

Google orders small modular nuclear reactors for its data centres (ft )

Stuart Varney: Elon Musk ‘opens the door to a new era in space exploration’ (foxbusiness )

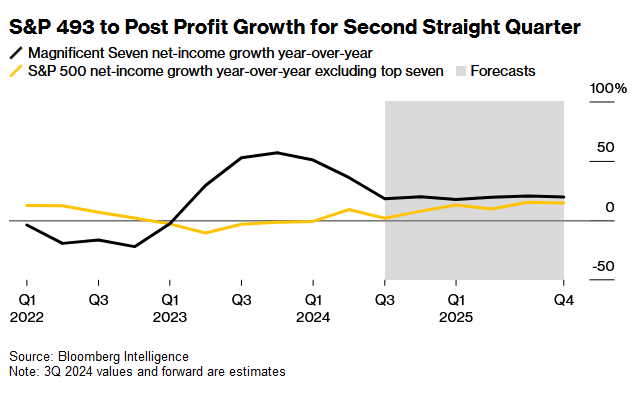

CEOs and Analysts Are at Odds About S&P 500’s Earnings Outlook (bloomberg )

Smaller-Cap Stocks Can Fill the Mag 7 Market Void. 4 to Play. (barrons )

Is BABA Stock A Buy Now? (investors )

Boeing Stock Is Rising. More Cash Means a Stronger Balance Sheet. (barrons )

More Bank Earnings Are Here. The Results Are Impressive. (barrons )

The bull market is entering its 3rd year. Here’s what history says will happen next. (marketwatch )

Uncertainty around the elusive ‘neutral’ interest rate could pose a real risk for markets (marketwatch

What Really Happens on the Ground When the US Slaps Tariffs on China (bloomberg )

China Says It Has a Big Stimulus Coming—But Still Won’t Say How Big (wsj )

What if Warren Buffett had faced Kamala Harris’s unrealized-capital-gains tax from the outset? Here are the numbers. (marketwatch )

6 Dividend Stocks to Buy—Once Tax-Loss Season Is Over (barrons )

Nike tries to get back in the race as sneaker sales gather pace (ft )

Alibaba’s Lazada courts Armani, D&G to fend off Shopee, TikTok (scmp )

CSRC Chairman Wu Qing will give a speech at the 2024 Financial Street Forum Annual meeting on October 18th in Beijing. He is expected to speak to the “Nine National Measures” supporting corporate governance, including Chinese companies paying dividends and buying back stock. (chinalastnight )

The Bull Market Has Lasted 2 Years. Is It Just Getting Started? (barrons )

China unveils fiscal stimulus measures to revive growth (reuters )

Auto Incentive Spending Increases for Third Straight Month (coxauto )

China Shores Up Property Sector, Signals More Spending Is Coming (bloomberg )

From Cartier To Kay, These Jewelry Brands All Buy From This Billionaire (forbes )

Inflation Guy’s CPI Summary (September 2024) (inflationguy )

Ford Bronco Goes Retro With Sunset-Inspired ‘Free Wheeling’ Package (maxim )

They Came to Florida for a Slice of Paradise. Now They Are Packing Their Bags. (wsj )

The Family That Went Against the Grain—and Built a Billion-Dollar Company (wsj )

Big US banks say consumers are still strong, despite economy fears (reuters )

Five Themes for Traders to Watch as Earnings Season Kicks Off (bloomberg )

Boeing to cut 17,000 jobs (reuters )

Boeing files unfair labor practice charges against union (bloomberg )

Why Chinese stocks will climb another 50% from current levels, research CEO says (businessinsider )

Nvidia Stock’s Overhang: Insiders Are Free to Sell a Lot More Shares (barrons )

China’s stock-market rally may ride on Beijing’s weekend stimulus announcement (marketwatch )

Boeing’s bonds again show more confidence in the troubled aerospace giant than the stock (marketwatch )

Fed’s Goolsbee Says Rates Are ‘Way Above’ Normal. Expect More Cuts. (barrons )

JPMorgan’s Dimon Says Economy ‘Remains Resilient’ (barrons )

As Conflict Spreads, Will Defense Stocks Regain Their Cold War Allure? (wsj )

The Federal Reserve may have pretty much just hit its 2% inflation target (cnbc )

China Investors Expect $283 Billion of New Stimulus This Weekend (bloomberg )

GXO Logistics could see $85/share in potential takeover – analyst (seekingalpha )

Donald Trump Calls for Making Car-Loan Interest Tax Deductible (wsj )

5 Numbers That Explain Why Boeing Won’t Go Bankrupt (barrons )

The big question hanging over banks as earnings season starts (yahoofinance )

Ministry of Finance Announces Ultra-Long Bond Issuance Before Weekend Meeting (chinalastnight )

Inflation Continues Its Bumpy Decline With Mixed September Reading (wsj )

Mets Postseason Run Pushes Steve Cohen Toward Baseball Glory (bloomberg )

XPO-Spinoff GXO Logistics Is Said to Explore Potential Sale (bloomberg )

Copper Rebounds From Two-Week Low With Eye on China Briefing (bloomberg )

PBOC Starts $71 Billion Liquidity Tool for China Stock Investors (bloomberg )

Hurricane Milton Makes Landfall Near Tampa as Category 3 (bloomberg )

These Are America’s Most Popular Cars (By Generation) (zerohedge )

Alphabet Might Get Broken Up. It Could Be Good for the Stock. (barrons )

Lululemon and Nike Are Less Popular Among Teens. Why That’s a Problem. (barrons )

Fed officials were divided on whether to cut rates by half a point in September, minutes show (cnbc )

The Dow is running hot. History says that’s usually a good sign. (marketwatch )

‘I’m Not Satoshi,’ Says Man Who HBO Suggests Created Bitcoin (bloomberg )

Why Breaking Up Google Would Be Hard to Do (nytimes )

Why a CPI surprise could trip up the Fed’s rate-cutting plans (marketwatch )

JPMorgan’s strategists are starting to sound less bearish on stocks (marketwatch )

Activists Want Pfizer, CVS. Healthcare Could Rebound. (barrons )

September Fed Minutes to Shed Light on Rate-Cut Debate (barrons )

UPS, FedEx Stocks are Ripe for Buying. The Case for a Shipping Upturn. (barrons )

When Cell Service Is Down, You Can Send iPhone Texts via Satellite (wsj )

Boeing Withdraws Contract Offer as Union Talks Break Down (bloomberg )

Disneyland hikes ticket prices for its highest-demand days (cnbc )

China’s property stimulus raises optimism — but more steps are needed for a sectoral turnaround (cnbc )

Generac CEO says pressure on the power grid ‘is only going to get worse’ from weather and technology (cnbc )

China state planner lays out further actions to boost economy but no new plans for major stimulus (cnbc )

GLP-1 drug demand rising, but not all packaged food companies in the crosshairs (streetinsider )

Pfizer CEO’s Job Is at Risk. A Shot of Discipline Could Help. (wsj )

Nobel Prize in Physics Awarded to Duo for Machine Learning (wsj )

The Great Florida Migration Is Coming Undone (wsj )

MicroRNA Pioneers Win Nobel Prize in Medicine (wsj )

Hurricane Milton Churns Toward Florida as Category 4 Storm (wsj )

China Markets Warn Xi More Stimulus Is Needed to Fuel Rally (bloomberg )

China confident to achieve full-year growth target: economic planner (people )

Chinese tech giants from ByteDance to Meituan see surge in ‘golden week’ consumer spending (scmp )

China’s rally still has ‘more legs,’ Goldman Sachs says (marketwatch )

“Whatever It Takes” Is On The Table (chinalastnight )

Pfizer Stock Rises After It Gets an Activist. What Starboard’s Track Record With Pharma Tells Us. (barrons )

Emerging Market Stocks Are Beating the U.S. Why They’ll Keep Winning. (barrons )

Tech Stocks Usually Rise in October. This Month, Not So Much. (barrons )

Why Goldman Sachs has bumped up its S&P 500 target for the third time this year (marketwatch )

Stock market’s soft-landing rally faces CPI inflation test. Here’s what investors should do. (marketwatch )

Google’s Grip on Search Slips as TikTok and AI Startup Mount Challenge (wsj )

US Yields Back at 4% for First Time Since August on Fed Rethink (bloomberg )

Boeing-Lockheed Venture Launches New Rocket in Key Test (bloomberg )

Hurricane Milton Nears Category 5 Strength as It Menaces Florida (bloomberg )

Goldman Says Surging Chinese Stocks May Advance Another 20% (bloomberg )

China Is Making Investor Calls So Awkward (bloomberg )

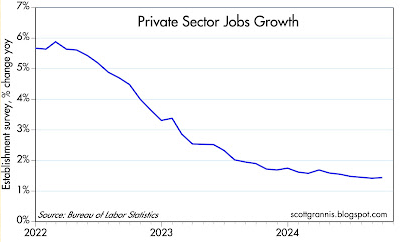

This wasn’t a monster employment number (scottgranis )

Nike tries to rip off the band-aid for investors. Its stock price is feeling the sting (marketwatch )

33 Undervalued Stocks (morningstar )

This Ex-Shoe Salesman Built A $5.5 Billion Fortune In Aging Apartment Buildings (forbes )

5 Questions For The Fed’s Austan Goolsbee—Including: Did They Move Fast Enough On Inflation? (forbes )

Saying No: How Successful People Protect Their Time And Focus (forbes )

China home sales rise after stimulus measures, state media says (reuters )