Skip to content

Cyclical Stocks Are Leading the Latest Leg of the Market’s Recovery (Wall Street Journal )

Goldman Boosts S&P 500 Target by 20% as Strategists Catch Up (Bloomberg )

Markets should be pricing in would-be Biden win already — they’re not (New York Post )

Home Depot Braced for Covid Pain—Then Americans Remodeled (Wall Street Journal )

Low Rates Push Homebuilder Optimism to Highest Since 1998 (Bloomberg )

PBOC Adds Cash to Ease Liquidity Stress With Rate Unchanged (Yahoo! Finance )

Oil Flows. The Energy Report (Price Group )

6 Stocks to Buy Now That Should Capitalize on the Economic Recovery (24/7 Wall Street )

Stock Rally Gives Commodities New Shine (Wall Street Journal )

Interior Secretary to Approve Oil Drilling Program in Alaska’s Arctic Refuge (Wall Street Journal )

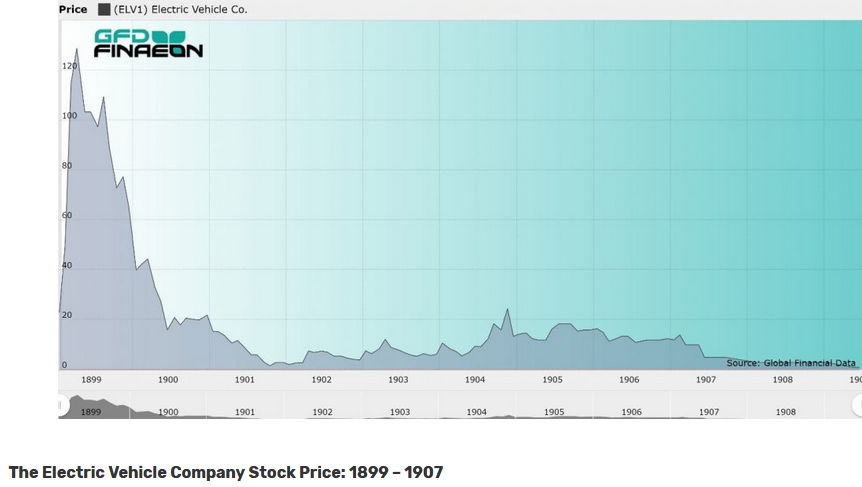

Speculation & Innovation: The long history of electric cars (Investor Amnesia via The Big Picture )

Top 10 Yachts Scheduled To Be At The Upcoming 2020 Cannes Yachting Festival (Forbes )

The Master and the Prodigy (Project Syndicate )

DOLLY PARTON Steers Her Empire Through the Pandemic — and Keeps It Growing (Billboard )

Hedge Fund and Insider Trading News: John Thaler, Jim Simons, Jeffery Smith, Ray Dalio, Red Rock Resorts Inc (RRR), Zoom Video Communications Inc (ZM), and More (Insider Monkey )

Another Roaring Twenties May Be Ahead (Yardeni )

ECRI Weekly Leading Index Update (Advisor Perspectives )

The 22 most expensive houses in the world (James Edition )

The 2020 Ferrari F8 Spider Is a 710-Horsepower Smile Generator (Men’s Journal )

Here’s How Well A 2021 Ford Bronco Sport Can Go Off-Road In The Toughest Terrain In America (Digg )

Principles for Building Better Health Insurance (Manhattan Institute )

The 1918 Flu Faded in Our Collective Memory: We Might ‘Forget’ the Coronavirus, Too (Scientific American )

In coronavirus housing market, ‘better to be seller than buyer’ (Fox Business )

The Economics of Gods and Mortals (NPR Planet Money )

Think the Founding Fathers Were a Bunch of Old Men? Think Again (How Stuff Works )

We Flattened the Curve. Our Kids Belong in School. (The Atlantic )

Over 100 AMC Movie Theaters Reopen Aug. 20 (PC Mag )

Yachting Vacations Are More Convenient and Affordable Than You Think (Just Luxe )

Here’s One Way to Make Fusion Reactors Much Better (Popular Mechanics )

“She Sticks Her Finger Right Into the Socket”: How ‘Ozark’ Star Julia Garner Became a Scene-Stealer and Emmy Favorite (Hollywood Reporter )

Warren Buffett Sold 26% of his Wells Fargo Position. Billionaire Hedge-Fund Manager David Tepper Was Buying It. (Barron’s )

Retail Spending in July Topped Pre-Pandemic Levels (Wall Street Journal )

The Bear Market Is Nearing an End. The Bubble Might Just Be Getting Started. (Barron’s )

Merck, Big Pharma’s Quiet Giant, Looks Like a Buy (Barron’s )

How the 2020 Election Could Affect Health-Care Stocks (Barron’s )

Tailwinds for Small-Cap Stocks (Barron’s )

How to Profit From the U.S.-China Cold War (Barron’s )

U.S. Seizes Iranian Fuel Cargo for First Time (Wall Street Journal )

Israel, U.A.E. Agree to Establish Formal Diplomatic Ties (Wall Street Journal )

The Treatment That Could Crush Covid (Wall Street Journal )

Goldman Sachs says the S&P 500 could climb another 7% from current levels if a ‘more optimistic US GDP forecast’ plays out (Business Insider )

The Race to Build an American Rare Earths Industry (New York Times )

Sia — The Alchemy of Blockbuster Songs, Billions of Views, and the Face You’ve Never Seen (#452) (Tim Ferriss )

New York A-listers in $2bn bidding war to buy the Mets (Financial Times )

Jeremy Siegel: I think we’re going to have a spending boom in 2021 (CNBC )

Ariel Investments’ John Rogers Shares Insight About Stocks, Racial Relations (Investor’s Business Daily )

Cyclical Recovery Coming? (upfina )

Value Does Not Have To Mean Cheap (Boyar Value )

Betting Against the Dollar Is More Popular Than Ever, BofA Says (Bloomberg )

Credit investors go ‘all in’ rather than fight central banks (Financial Times )

Goldman Sees Room for S&P to Surpass 3,600 (Bloomberg )

Interest Rates Are So Low, Buy Utility Stocks, Goldman Sachs Says (Barron’s )

Harley-Davidson CEO Jochen Zeitz Scoops Up Stock (Barron’s )

Bulls Still Like Lyft Stock After a Rotten Quarter and Negative Court Ruling (Barron’s )

Las Vegas Sands Stock Can Rally 45%: Analyst (Barron’s )

Intel Pushes Back on Concerns About Its Chip-Making Technology (Barron’s )

A Field Guide to Covid-19 Vaccines and Antivirals (Barron’s )

Yale Discriminated by Race in Undergraduate Admissions, Justice Department Says (Wall Street Journal )

Bryant Park’s Piano Series Offers Hopeful Note to New Yorkers (Wall Street Journal )

Electronics Spending Sends US Retail Sales Soaring (ZeroHedge )

The U.S. has already invested billions on potential coronavirus vaccines. Here’s where the deals stand (CNBC )

Locked Down and Loaded. The Energy Report (Price Group )

An Analysis of “Testing Benjamin Graham’s net current asset value model” (Global Investing Insight )

Cash Handouts Boost Bolsonaro’s Popularity Despite Virus Toll (Bloomberg )

Brainard Says Fed Is Conducting E-Money Tests for Research (Bloomberg )

Gundlach, who called Trump’s 2016 election, predicts he’ll win again (Yahoo! Finance )

The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)… (ZeroHedge )

The Drain Game. The Energy Report by Phil Flynn (Price Group )

Advisers Consider Whether Trump Can Cut Taxes Without Congress (New York Times )

Stock-market futures perk up after weekly jobless claims put in first reading below 1 million in the pandemic era (MarketWatch )

Inside the massive rotation rocking markets right now: Morning Brief (Yahoo! Finance )

Why Nio Has A Shot At Becoming The ‘Tesla Of China’ (Benzinga )

Stocks will soar 14% by the end of next year on unyielding optimism, long-standing bull Ed Yardeni says (Business Insider )

Value stocks, which trade lowest to growth stocks since 2001, look like a smart play as the economy rebounds (MarketWatch )

Trump wants stronger water flow in the shower — his Energy Department delivers (MarketWatch )

‘Cable Cowboy’ John Malone’s Liberty Global lassos Sunrise Communications in $7.4 billion deal (MarketWatch )

A virus vaccine will ‘bail out the bulls’, says fund manager (fn london )

Lightning outlast Blue Jackets in 5-OT NHL playoff thriller (New York Post )

The Phil Flynn Energy Report (Price Group )

Gold prices dive amid vaccine hopes and rising Treasury yields (CNBC )

Carl Icahn netted $1.3 billion from betting against brick-and-mortar shopping malls with an instrument that gained fame in the 2008 crisis. (Business Insider )

Mnuchin urges Dems to pass $1T stimulus deal, but won’t speculate on compromise (Fox Business )

CFOs Think They Know More Than They Do (Institutional Investor )

Dwayne ‘The Rock’ Johnson, Ryan Reynolds among top-paid Hollywood actors of 2020 (Fox Business )

U.S.-China trade deal in ‘fine’ shape, White House’s Kudlow says (Street Insider )

Warren Buffett may have bought back a record $7 billion of Berkshire Hathaway stock in the past 3 months. (Business Insider )

Small-Caps Are Playing Catch-Up (Barron’s )

Russia Registers a Coronavirus Vaccine (Barron’s )

Dow transports and Russell 2000 see ‘golden cross’ materializing (MarketWatch )

SoftBank swings to profit after record loss as Vision Fund recovers (CNBC )

5 BofA Securities Stocks to Rotate to Now Before the Tech Sell-Off (24/7 Wall Street )

How Goldman sees S&P 500 reacting to more U.S.-China tariffs and why November’s election result is key

Bolsonaro and the generals: will the military defend Brazil’s democracy? (Financial Times )

Trump’s $400 unemployment boost would give Americans $708 a week, on average (CNBC )

From Cocoa to Coffee and Sugar, Soft Commodities Stage Simultaneous Rally (Wall Street Journal )

Warren Buffett Signals Big Shift In Investing Stance As Berkshire Reports (Investor’s Business Daily )

Americans saving record cash trove. Will they spend it? (USA Today )

China’s factory deflation slows in July as recovery gains strength (Reuters )

Pelosi, Mnuchin open door to narrower COVID-19 aid through 2020 (Reuters )

Trump payroll tax executive order likely worth $1,200 per worker: Kudlow (Fox Business )

Seres Therapeutics stock rockets nearly fourfold after positive Phase 3 data on treatment for colon infections (MarketWatch )

Amazon and Mall Operator Look at Turning Sears, J.C. Penney Stores Into Fulfillment Centers (Wall Street Journal )

Buffett Shows Faith in Berkshire With Record Stock Buybacks (Bloomberg )

It has ‘never been easier to make money’ on small and midcaps, JPMorgan strategist says (CNBC )

Goldman Sachs lifts 2021 US GDP forecast to 6.2% and predicts a COVID-19 vaccine will be ‘widely distributed’ by mid-2021 (Business Insider )

Reopening stocks are set for a ‘monstrous rally’ next week, and these are the 6 stocks that could benefit, Fundstrat’s Tom Lee says (Business Insider )

Barron’s Picks And Pans: Berkshire Hathaway, Estee Lauder And More (Yahoo! Finance )

Trump Orders Extended Jobless Benefits, Payroll Tax Deferral (Bloomberg )

Warren Buffett’s Berkshire Shows Strong Investment Gains (Barron’s )

Nikola Tesla Proved It Was Possible. Now Wireless Electricity Is a Reality. (Popular Mechanics )

Buffett buys back record $5.1 billion in Berkshire stock as coronavirus hits operating earnings (CNBC )

Playing The Natural Gas Bull Market (All Star Charts )

‘Succession’ Showrunner Hopes to Start Shooting Season 3 in New York Before Christmas (EXCLUSIVE) (Variety )

From a $2.5 Million Ferrari to a $1.8 Million Porsche, These Coveted Collector Cars Are Heading to Auction (Robb Report )

The Burger: How to Perfect an American Classic (Men’s Journal )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Ben Affleck Writing, Directing Film About Making of ‘Chinatown’ (Variety )

NHL roundup: No. 12 seeds Montreal, Chicago advance (OANN )

2020 Land Rover Defender 110 Review: Still The Best 4X4 By Far? (Forbes )

Link between low Vitamin D levels, high COVID-19 infection risk established by Israeli researchers (FirstPost )

’80s Classic Knight Rider Will Ride Again With Help From James Wan (Gizmodo )

The terrible tradeoff of keeping schools closed (AEI )

What Is the Butterfly Effect and How Do We Misunderstand It? (How Stuff Works )

The 45 Best Movies on Netflix Right Now (MentalFloss )

Trump will require insurance companies to cover preexisting conditions (Fox Business )

Love Guy Fieri? Follow his new ‘Flavortown’ meme accounts. (Mashable )

Viking’s $50K World Cruise Takes You to 56 Ports and 27 Countries (JustLuxe )

This Is What the F-35 of the Future Will Look Like (Popular Mechanics )

The Ferrari F8 is the Example for Modern, Mid-Engine Supercars (Popular Mechanics )

How David Einhorn Is Betting on Higher Inflation (CIO )

Task force seeks tougher listing rules for Chinese companies (Pensions & Investments )

Blackstone, Brookfield Among Firms Eyeing Indian Malls, ET Says (Bloomberg )

Trump Says He’ll Order Unemployment Payments If Impasse Persists (Bloomberg )

Stock-market expert sees a ‘monstrous’ rally taking hold next week, if one recent trend holds (MarketWatch )

3 Potential 2020 Election Outcomes—and What They Could Mean for Investors (Barron’s )

Why Goldman Looks Golden (Barron’s )

Time for Thinking (Howard Marks )

The Ingredients For Innovation (Farnam Street )

Intel CEO Robert Swan Bought Shares After They Plunged (Barron’s )

Warren Buffett’s $50 Billion Decision (Forbes )

A Generational Opportunity In Commodities? (The Felder Report )

Corn Crops May Not Be Bountiful This Fall. Corn Prices Are Rising. (Barron’s )

New Chapter in U.S.-China Ties Marked by Confrontation (Wall Street Journal )

Dwayne ‘The Rock’ Johnson wants to tap the XFL’s reality-TV potential (New York Post )

Democrats challenge Kanye West’s bid to get on Wisconsin ballot (Financial Times )

President Plans Order to Require Pre-Existing Condition Coverage (Bloomberg )

Air Force One’s Successor Could Go 5x the Speed of Sound (Futurism )

Mike Novogratz on Bitcoin, Macro Trading, Ayahuasca, Redemption, and More (#451) (The Tim Ferriss Show )

Cult figure of investing one of few to grasp early promise of internet stocks (Financial Times )

Why Housing Could Be One of the Best-Performing Asset Classes of the 2020s (A Wealth of Common Sense )

Ben Graham’s 3 Secrets to Living A Good Life (Safal Niveshak )

An Analysis of “Testing Benjamin Graham’s Net Current Asset Value Strategy in London” (Global Investing Insight )