Skip to content

China’s stock rally for the ages shows power of crowds (ft )

China home sales rise after stimulus measures, state media says (reuters )

Time to Get Out of Money-Market Funds? Why It May Already Be Too Late. (barrons )

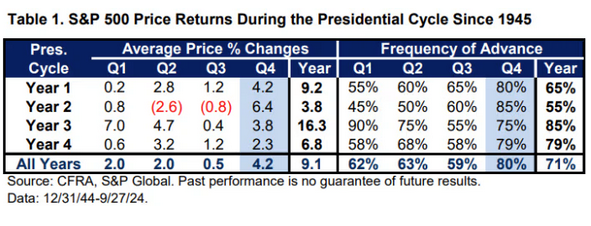

S. stocks’ remarkable 2024 run is likely to continue during the fourth quarter, history shows (marketwatch )

S. Hiring Accelerated in September, Blowing Past Expectations (wsj )

The Mets’ Season Looked Over. Then the Polar Bear Roared. (wsj )

Investors grab European equities to gain cheap US exposure (ft )

Angelina Jolie Is Selling Her Ferrari 250 GT in Paris (bloomberg )

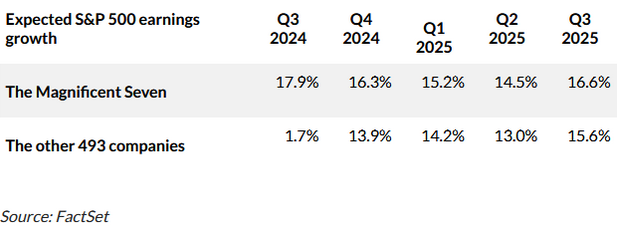

3 bullish catalysts could keep the bull rally alive and boost stocks 13% in the coming year, research firm says (businessinsider )

How China’s stimulus could provide a boost to new CEOs at Nike and Starbucks down the line (cnbc )

BofA’s Hartnett Sees Risk-On Rally If Jobs Are as Expected (bloomberg )

Unemployment rate falls to 4.1% as U.S. economy adds 254,000 jobs in September (marketwatch )

Hong Kong stocks add to 3-week rally as Alibaba, Tencent lead tech gainers (scmp )

FedEx, Shipping and Rail Stocks in Focus as Port Strike Nears End (barrons )

CEOs Are on the Hunt for More M&A. Where the Next Deals Are. (barrons )

Citi’s Turnaround Plan Is Stained by Warren’s Call for Growth Limits (barrons )

China Stocks Rally Reignites as Alibaba, JD.com, Tencent Shares Rise. What’s Driving It. (barrons )

Dividend and China Funds Come Roaring Back as Nvidia Stalls (barrons )

Oil Surges After Biden Says U.S. Discussing Israel Attack on Iran Facilities (wsj )

How to connect your iPhone to a satellite to send important messages (usatoday )

TSA PreCheck vs. Global Entry vs. CLEAR: Which is better? (cnbc )

Dockworkers union agrees to suspend port strike until Jan. 15 after tentative deal (marketwatch )

Medicare mess sends Humana shares on worst fall since financial crisis (yahoo )

The tailwinds for a European consumer recovery are building (ft )

Beijing is trying to put a ‘floor’ on the economy with its stimulus measures: China Beige Book CEO (cnbc )

Fundstrat’s Tom Lee on 6,000 S&P 500 year-end target: Setup into year-end has a lot of tailwinds (cnbc )

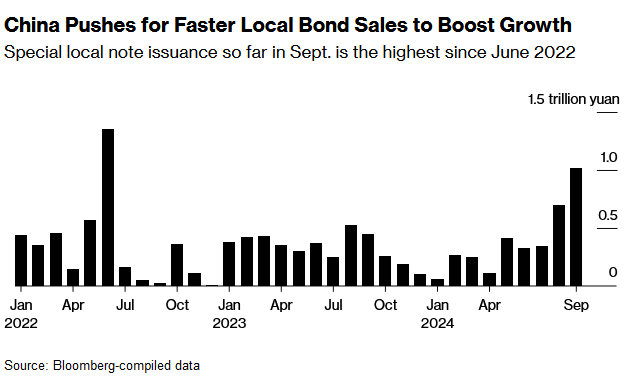

China Ready for $1.4 Trillion Fiscal Support, Top Economist Says (bloomberg )

Hong Kong Takes Breather as Fiscal Policy Bazooka Awaits (chinalastnight )

PayPal Completes Its First Business Transaction Using Stablecoin (bloomberg )

Nike Stock Dives. Why More Losses Wouldn’t Be a Surprise. (barrons )

17 Ways to Play U.S. and China Dividend Stocks With Growth Appeal (barrons )

Investors fearing a scary start to October should focus instead on Friday’s jobs report (marketwatch )

Turns out, the stock market can succeed without the Magnificent Seven (marketwatch )

Weight-Loss Drugs Are Everywhere Now. How the GLP-1 Copycats Took Over. (barrons )

LVMH Took Over the Paris Olympics. Now It’s Snagged Formula One. (wsj )

MIT economist says AI can only handle 5% of jobs, fears stock crash (nypost )

Mortgage Rates Near 6% Are Enough to Start Up a Refinancing Wave (bloomberg )

US Jobless Claims Remain Subdued, Consistent With Low Layoffs (bloomberg )

Natural Gas Higher as Temperatures Slowly Back Down (wsj )

Auto sales rebound and point to strong third-quarter GDP (marketwatch )

China Rally Spurs $7 Billion Loss for Shorts of US-Listed Stocks (bloomberg )

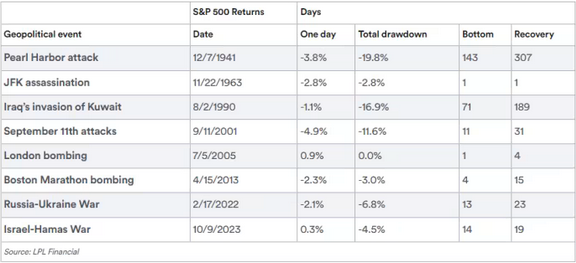

From Pearl Harbor to Sept. 11, here’s how stocks typically react to the outbreak of wars (marketwatch )

China Back to Dominating Emerging Markets as MSCI Weight Soars (bloomberg )

Chinese Homebuyers Scout Showrooms at Midnight After Stimulus (bloomberg )

The $459,000 Ferrari 12Cilindri Sports Car Will Be a New Classic (bloomberg )

Nike Seeks to Wipe Slate Clean for New CEO, Withdraws Guidance (bloomberg )

Xi’s Stimulus Blitz Adds $130 Billion to Coffers of China’s Rich (bloomberg )

Dockworkers Make $150,000. Why They’re on Strike. (barrons )

Boeing Stock Rose Despite Report Saying A Share Offering Is Coming (barrons )

How Will the Port Strike Affect the Price of Gasoline, Food, and Other Products? (barrons )

Port Strike Could Benefit Container Shippers Even as It Hits Retailers, Manufacturers (barrons )

Port Strikes Mean Trucking Rail, Stocks Are Set for a Boost. Check Out These 3. (barrons )

Port Strikes Aren’t About Pay. This Is the Real Issue. (barrons )

Israel Vows To Make Iran Pay For Missile Attack (barrons )

Emerging Market Stocks Have Popped. Expect More Outperformance. (barrons )

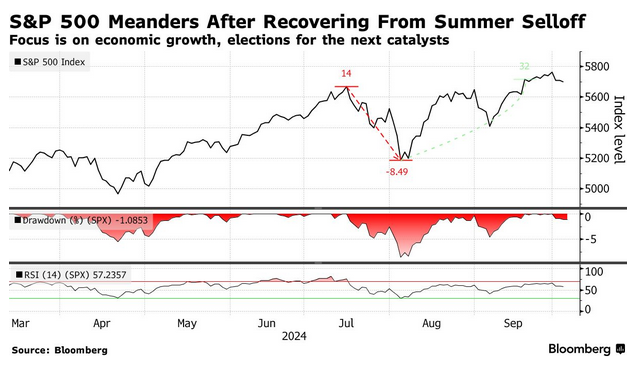

October tends to be a positive month for stocks — unless a presidential election is looming (marketwatch )

Hong Kong stocks surge to 20-month high as China-stimulus rally continues apace (marketwatch )

Nike Stock Drops as Doubts on Outlook Outweigh Strong Earnings (barrons )

Port Strike Puts Pressure on Harris, Biden Ahead of Election (wsj )

A CVS Breakup Is No Easy Fix for Its Problems (wsj )

Biden to Sign Bill Allowing Chip Projects to Skirt Key Environmental Review (nytimes )

Chinese Stocks Soar More Than 7% in Hong Kong on Stimulus Bets (bloomberg )

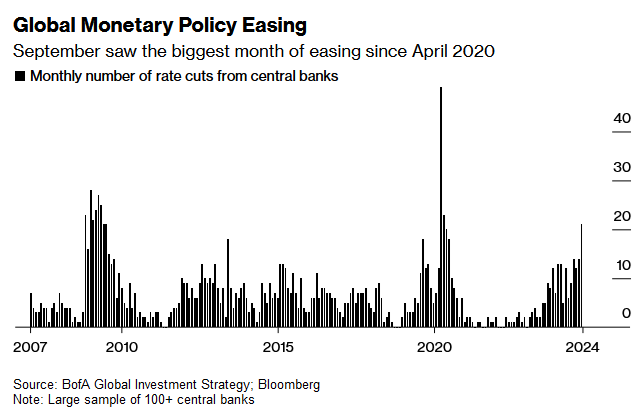

3 cheap areas of the stock market to buy as the Fed unveils a ‘rare double whammy’ of stimulus, BofA says (businessinsider )

How ‘Big Short’ became ‘Big Squeeze’ as Wall Street misread China’s stock market (scmp )

China stock market surge: investors rush to buy shares amid policy easing hopes (scmp )

ADP jobs report shows 143,000 gain. Cooling U.S. labor market leads to slower wage increases. (marketwatch )

China’s foreign investors hope stimulus will end ‘deep winter’ (ft )

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock (ft )

Israel Plans to Bomb Iranian Oil Facilities in Retaliation or Even Attack Nuclear Facilities: Report (aastocks )

Disney Stock Gets an Upgrade. (barrons )

Hedge fund mogul Larry Robbins seeks overhaul at struggling CVS: report (nypost )

The stock market is entering the most volatile month of an election year — but the rally may be here to stay (marketwatch )

Chamber of Commerce calls on Biden to stop dockworkers strike, citing inflation fears (marketwatch )

Into Lebanon Ahead of Expected Ground Incursion (wsj )

US Deploys a ‘Few Thousand’ More Troops to Middle East (bloomberg )

Employers Boost Dockworker Wage Offer in Bid to Keep Ports Open (bloomberg )

Ports strike could have $4 billion daily impact, but these container stocks are well positioned (marketwatch )

A port strike would be ill-timed, but disruption could boost these companies (marketwatch )

A port strike could be an economic ‘tsunami’ affecting these sectors (marketwatch )

Port strike could come at a ‘high political cost’ for Harris campaign (marketwatch )

Powell Says Fed Not in a Hurry, Will Lower Rates ‘Over Time’ (bloomberg )

Michael Dell Unloads $1.2 Billion in Second Big Dell Stock Sale (bloomberg )

California Clampdown on Retail Theft, Drug Crimes Wins Backing of Over 70 Mayors (bloomberg )

China to Allow Home Buyers to Refinance Mortgages in Latest Easing Move (wsj )

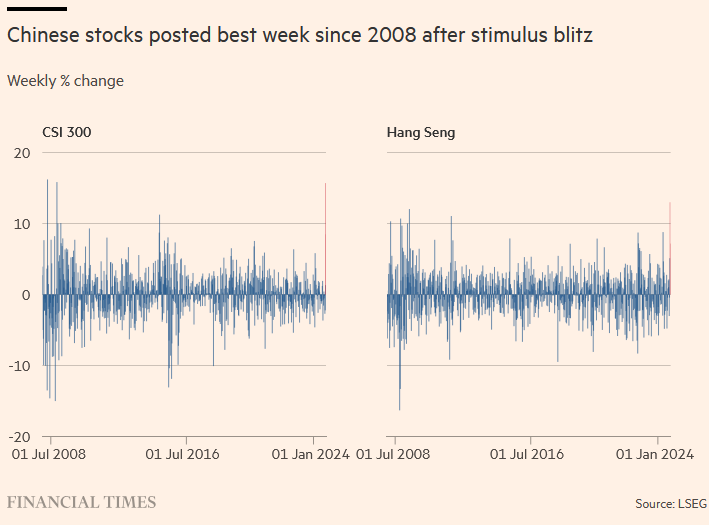

A Week of Shock and Awe Ignites China’s Stock Markets (wsj )

Many Dockworkers Make $150,000 or More. Why They’re About to Strike. (barrons )

Boeing, Union Stall on Strike Talks. Pensions Are a Problem. (barrons )

Alibaba, JD, and Baidu Stocks Rise. The China Trade Is Still Thriving. (barrons )

The Market Could Defy History in October. Where to Find Gains. (barrons )

This hedge-fund manager says it’s a ‘max-long’ moment for stocks (marketwatch )

Boeing Weighs Raising at Least $10 Billion Selling Stock (bloomberg )

Hang Seng & China Internet Outperforming S&P 500 Year to Date (chinalastnight )

Alibaba’s AI-Powered Cancer Detection Tool Recognized on Fortune’s 2024 Change the World List (alizila )

Is The Japanese Yen Reversing Upward? (seeitmarket )

Hedging Goes Out the Door With Burst of China Stocks Euphoria (bloomberg )

Japanese Stocks Plummet on Rate Hike Worries (bloomberg )

Boeing Union Says Talks Halted on Pensions, Pay Demands (bloomberg )

Xi Has Finally Realized What’s Ailing China (bloomberg )

China to cut existing mortgage rates by the end of October (reuters )

China Moves to Cut Mortgage Rates to Revive Housing Market (bloomberg )

Alibaba looks on course for a turnaround amid investor frenzy for Chinese stocks (scmp )

Billionaire investor David Tepper on China: Central bank comments ‘exceeded expectations’ (cnbc )

Those calling Intel a company in decline are missing the point entirely—it’s now a corporate actor on the geopolitical stage (fortune )

Helene Leaves US South Reeling From Flooding and Power Outages (bloomberg )

Nvidia Has ‘Two Glaring Holes’ In Its Data Center Offering (investors )

China Cries Uncle With Big Pledge on Property Crisis (bloomberg )

Chinese stocks post best week since 2008 after stimulus blitz (ft )

Sterling’s rally has further to run, say Wall Street banks (ft )

The case for a melt-up in markets (ft )

Sterling’s rally has further to run, say Wall Street banks (ft )

Masayoshi Son is the $100 billion gambler who went from dirt track to tech titan — and he isn’t done betting yet (businessinsider )

The Restaurant List (nytimes )

It was a September to remember for stocks — but October presents fresh challenges for the rally (marketwatch )

8 incredible golf courses in the US you can build a whole vacation around (usatoday )

10 Undervalued Wide-Moat Stocks (morningstar )

McLaren’s Next Supercar Is Coming Next Month (robbreport )

This Bulletproof Rezvani Vengeance SUV Has A Private Jet-Style Interior (maxim )

The World’s First Official James Bond Bar Just Opened in London—Here’s a Look Inside (robbreport )

Four Seasons Yachts Wants to Take You to the Caribbean for the Holidays (robbreport )

21 Stocks to Play a ‘Magical Moment’ in Healthcare (barrons )

Inflation Cooled in August. The Fed Looks Like It Made the Right Call. (barrons )

Wynn Stock Is Eyeing Its Best Week in 2 Years. China Isn’t the Only Reason. (barrons )

‘Sell in May’ was a costly mistake. Should you buy stocks now at record highs? (marketwatch )

Wall Street’s Risk Binge Expands to Even Unloved Assets After Global Policy Easing (bloomberg )

Hedge fund billionaire David Tepper says he’s loading up on Chinese stocks after the nation’s stimulus bazooka (businessinsider )

China’s biggest stock buying frenzy in years overwhelms exchange (yahoo )

Intel and US race to finalise $8.5bn in chips funding by year’s end (ft )

China stocks see best week since 2008 on stimulus impact as most Asia markets rise (cnbc )

Chinese stocks could surge higher as investors get ‘FOMO,’ Goldman Sachs says (marketwatch )

Arm Is Rebuffed by Intel After Inquiring About Buying Product Unit (bloomberg )

PayPal’s stock is having its best year since 2020, and this is a big reason why (marketwatch )

Alibaba, NIO and Other Chinese Stocks Rise Again. Stimulus Is a Gift That Keeps on Giving. (barrons )

Fed’s Rate Cut Is Jolting Small Businesses to Spend Again (wsj )

Fed’s Preferred Inflation Gauge Cooled in August (wsj )

Boeing’s Union Declines Vote on the Company’s ‘Best and Final’ Offer (barrons )

Wall Street Wants More Big Rate Cuts. Fed Officials Don’t Agree. (barrons )

Why Fed bets were so out of whack: Waller explains what put him ‘over the edge’ for a jumbo rate cut (marketwatch )

CPC Follows Up Monetary Stimulus With Fiscal Measures (chinalastnight )

China ETFs set for best week on record after Beijing fires policy ‘bazooka’ to boost economy. Is it time to jump in? (marketwatch )

Global stock-market capitalization is set to surpass its highest level in three years after the Federal Reserve cut interest rates and China began stimulating its economy this month. (marketwatch )

Why stock-market investors are freaking out over economic data they used to ignore (marketwatch )

Fed Gets a Boost From China Stimulus. How It Impacts U.S. Rate Cuts. (barrons )

PayPal CEO Marks a Year on the Job. The Race for Change at the Fintech Is a ‘Marathon.’ (barrons )

Don’t Wait for More Shoes to Drop. Nike Stock Is a Bargain. (barrons )

Spirits maker Diageo confirmed its outlook for the near and medium term (wsj )

Disney slashes 300 jobs this week as CEO Bob Iger continues belt-tightening (nypost )

Quant Hedge Funds Trapped in Short Squeeze After China Glitch (bloomberg )

Xi’s Big Stimulus Week Aims to Draw a Line Under China Slowdown (bloomberg )

China’s central bank, top political leaders appear to be abandoning a reluctance to act forcefully on the economy (wsj )

When Will Money-Market Funds Lose Their Allure? (wsj )

Why analysts are calling Cava the next Chipotle (cnbc )

Alibaba, Tencent rally as Beijing stimulus plans push China’s tech stocks to 13-month high (cnbc )

Yen bounces back as veteran lawmaker Ishiba wins PM contest (streetinsider )

Intel Has a Great Chip for the First Time In Years (barrons )

China’s Politburo Supercharges Stimulus With Housing, Rates Vows (bloomberg )

China pledges to ensure fiscal spending among steps signaling urgency (bloomberg )

Hedge Funds Snap Up Chinese Equities on Stimulus Optimism (bloomberg )

House, Senate Approve Spending Bill to Keep Government Open (barrons )

Alibaba’s Singles’ Day preparation includes US$5.7 billion in aid to merchants (scmp )

China Weighs Injecting $142 Billion of Capital Into Top Banks (bloomberg )

China Seeks to Resolve Structural Issues to Shore Up Employment (bloomberg )

Fed’s Kugler Sees Plenty More Rate Cuts Ahead (barrons )

Why now may be a good time to take ‘opportunistic’ profits in gold and silver (marketwatch )

The Policy Dragon Awakens As Mainland China & Hong Kong Rally (chinalastnight )

Visa Is in the Hot Seat. MasterCard and Others Could Benefit. (barrons )

Boeing, Union to Resume Pay Talks as Strike Nears Third Week (bloomberg )

Tracking Hurricane Helene’s Latest Path (bloomberg )

PayPal expands services to allow merchants to buy and sell crypto (cnbc )

Here are the most important days for the stock market between now and the November election, according to BofA (businessinsider )

Wall Street just got another sign that dealmaking is on its way back (finance.yahoo )

Dollar General asks shareholders to reject investment firm’s stock-purchase offer (marketwatch )

China’s yuan continues upward climb after Beijing’s stimulus roll-out (scmp )

Chinese homeowners cheer Beijing’s move to cut mortgage rates by a half point (scmp )