Skip to content

Warren Buffett may have found a stock he likes — his own (MarketWatch )

China’s Economy Rebounds From Coronavirus, but Shares Fall (New York Times )

U.S. housing starts accelerate in June (Reuters )

U.S. Retail Sales Rose 7.5% in June as Stores Reopened (Wall Street Journal )

How Banks Could Turn Covid Pain Into Eventual Gains (Wall Street Journal )

Robinhood Is Democratizing Markets, Not Disrupting Them (Bloomberg )

5 Biopharma Stocks That Are Affordable And Growing (Barron’s )

These Are Netflix’s 10 Most Popular Original Movies (Bloomberg )

In a Republican Presidential Sweep, These Stocks Would Win (Barron’s )

In a Democratic Presidential Sweep, These Stocks Would Win (Barron’s )

Pelosi says $1.3T ‘not enough’ for coronavirus relief as reopenings stall (Fox Business )

US 30-year mortgage rate falls below 3% for first time (Financial Times )

Johnson & Johnson Says Late-Stage Coronavirus Vaccine Trials Moved Ahead To September (Benzinga )

CEO of world’s biggest money manager says wearing masks will help economy avoid another shutdown (CNBC )

The last time this happened, homebuilding stocks rallied double digits: Analyst (CNBC )

Goldman Sachs Has 3 Top Aerospace and Defense Stocks to Buy Before Earnings (24/7 Wall Street )

7 Unpopular Value Stocks That Could Surge Into 2021 (24/7 Wall Street )

Warren Buffett Sees Natural Gas Sticking Around for a Long Time (Bloomberg )

Domino’s Earnings, Sales Beat As At-Home Dining Stays Strong (Investor’s Business Daily )

Morgan Stanley Crushes Views, BofA Beats, Capping Big Bank Results (Investor’s Business Daily )

How A Medical Brainiac CEO Turned Brilliance Into Billions (Investor’s Business Daily )

How Dell Can Spin off VMware (Barron’s )

Dividend Aristocrats Roar Back After Early-Year Stumbles. These 10 Recently Raised Their Payouts. (Barron’s )

OPEC+ move to taper output cuts may ‘keep a floor’ under prices (MarketWatch )

Wall Street Defends Delta Stock After Steep Loss (Barron’s )

Meet the man who’s been behind nearly every evolution of the fund industry for two decades (MarketWatch )

J&J to start Phase 1 trial for coronavirus vaccine candidate next week (MarketWatch )

All Walmarts, Sam’s Clubs to require shoppers wear masks (New York Post )

Traders Are Betting the Fed’s Bond-Buying Binge Has Just Begun (Bloomberg )

AstraZeneca Pressure Mounts as Investors Await Oxford Vaccine Data (Bloomberg )

Greenwich Mansions With Pools Are All the Rage in Pandemic Era (Bloomberg )

Billionaires Hunt Real Estate Bargains in Shadow of Pandemic (Bloomberg )

Goldman Puts Capital Fears to Bed for Now, With Help From Fed (Wall Street Journal )

China Is First Major Economy to Return to Growth Since Coronavirus Pandemic (Wall Street Journal )

Consumer Appetite for Cars, Homes Bolsters U.S. Economy (Wall Street Journal )

U.S. Industrial Production Picked Up Again in June (Wall Street Journal )

Coronavirus Has Americans Hooked on Canned Tuna, and Producers Are Playing Catch Up (Wall Street Journal )

The Billion-Dollar Broker Who Managed a Nation’s Oil Wealth (Bloomberg )

Fauci bullish on prospects for U.S. vaccine, not worried about China winning race (Street Insider )

China says will stick with U.S. trade deal (Reuters )

Influencers with Andy Serwer: David Rubenstein (Yahoo! Finance )

Six films to watch this week (Financial Times )

Here’s the Long-Awaited Data on Moderna’s Vaccine Trial. So Far, So Good. (Barron’s )

Value investing has been “broke” since 2007. BofA lists 7 reasons why it may finally be poised for a comeback (Business Insider )

JPMorgan’s Earnings Were Surprisingly Strong. It’s a Positive Sign for Other Banks. (Barron’s )

12 Stocks That Could Take Off—If You’re Willing to Bet Everyone Else Is Wrong (Barron’s )

JPMorgan, Citigroup and Wells Fargo opted to stow away a combined $28 billion (Wall Street Journal )

U.S. consumer prices climbed sharply in June (Wall Street Journal )

As Europe’s Economies Reopen, Consumers Go on a Spending Spree (New York Times )

Oxford Vaccine Emerges as Front-Runner (Bloomberg )

Goldman Sachs sees the Chinese yuan strengthening to 6.70 against the dollar in the next 12 months (CNBC )

Investing legend Bill Gross says investors should favor value over growth during the pandemic, and tipped these 4 stocks to flourish (Business Insider )

“Long Tech Stocks” Is The Most Crowded Trade Ever (Zero Hedge )

Banks Are Dirt Cheap: 5 Analyst Top Picks for the Rest of 2020 (24/7 Wall Street )

Value will trump highflying growth stocks if this bond-market indicator bounces back, says Bill Gross (MarketWatch )

JPMorgan’s Earnings Were Surprisingly Strong. It’s a Positive Sign for Other Banks. (Barron’s )

Coronavirus Spending Pushes U.S. Budget Deficit to $3 Trillion for 12 Months Through June (Wall Street Journal )

Ford Reveals New Bronco After 24 Years Off the Market (Wall Street Journal )

Hospitals Stock Up on Covid-19 Drugs to Prepare for Second Wave in Fall (Wall Street Journal )

12 Stocks That Could Take Off—If You’re Willing to Bet Everyone Else Is Wrong (Barron’s )

U.S. Consumer Prices Climb by Most Since 2012 on Higher Gasoline (Bloomberg )

BofA Clients Keep Tight Grip on Cash Amid Ebullient Stock Rally (Bloomberg )

JPMorgan’s Record Trading Helps Ease the Pandemic’s Toll (Bloomberg )

OPEC+ Risks Triggering Another Oil Price Slump (Bloomberg )

Wells Fargo reports $2.4 billion loss for the quarter, cutting dividend (CNBC )

Citigroup shares rise after bank reports better-than-expected earnings (CNBC )

Robert Shiller warns that urban home prices could decline (CNBC )

Opinion: The No. 1 market-timer of the 1980s and 1990s has this message for today’s buy-and-hold investors (MarketWatch )

Boeing awarded nearly $23B Air Force contract for F-15EX fighter jet program (Fox Business )

Warren Buffett may have bought back more than $5 billion in Berkshire Hathaway stock in recent weeks (Business Insider )

Barron’s Daily: Merger Monday Is Back (Barron’s )

Stocks are resilient because investors have been braced for much worse COVID-19 news, says strategist (MarketWatch )

Pfizer, BioNTech stocks surge after COVID-19 vaccine candidates get Fast Track designation (MarketWatch )

Income rates: How much you need to make to be in the top 1% in every state (USA Today )

Blank-Check Boom Gets Boost From Coronavirus (Wall Street Journal )

Wall Street’s Earnings Forecast: Cloudy With a Chance of Turbulence (Wall Street Journal )

Are Banks Afraid of Covid-19? Watch How Much They Set Aside for Loan Losses This Week (Wall Street Journal )

Bank Earnings: Main Street Blues vs. Wall Street Boom (Wall Street Journal )

Fed’s Support for Corporate Debt Has Been a Wall Street Bonanza (Bloomberg )

These ignored stocks may be poised to rebound (Yahoo! Finance )

Alibaba’s Jack Ma sells $9.6B worth of shares, stake dips to 4.8% (Fox Business )

Bill Miller on the Classical Value Portfolio (Podcast) (Bloomberg )

Connecticut Bet Big on the Suburbs. That Might Finally Pay Off. (Wall Street Journal )

Fed, Treasury Disagreements Slowed Start of Main Street Lending Program (Wall Street Journal )

People complain that going to the shore is a careless act during a pandemic, but the science so far suggests otherwise. (The Atlantic )

Should Value Investors Buy General Dynamics (GD) Stock? (Insider Monkey )

Kanye West’s Plans for Wyoming Mansion Approved (Architectural Digest )

Kanye West is not running for President…yet (Fortune )

President Trump to introduce executive order on immigration reform (OAN )

This Aston Martin DB5 Comes With a Rear Smoke Screen and Twin Front ‘Machine Guns’ (Maxim )

Mansory Unleashes Carbon Fiber-Bodied 710 HP Ford GT (Maxim )

2021 Ford Bronco Finally Leaks Ahead of Its Big TV Debut on Monday Night (TheDrive )

Flying Taxis Are Coming. Inside the Scramble to Find Them a Place to Land. (Robb Report )

Welcome to the Czech Republic – Incredible Culture and Stunning Beauty (thelifeofluxury )

How To Build a Treehouse (Popular Mechanics )

Investment banking activity witnessed robust quarter: Thomas B. Michaud (Fox Business )

Lichtenstein Nude Leads Christie’s $421 Million Live-Stream Auction (Bloomberg )

Wall Street Forges a New Relationship to Data in Coronavirus Age (Bloomberg )

What to expect as banks report earnings: more loan pain but plenty of fee income (MarketWatch )

Hedge Fund Tips Podcast/VideoCast: Cyclicals, The Election and Buffett (ZeroHedge )

Gilead Says New Analysis Suggests Remdesivir Reduces Covid-19 Deaths (Barron’s )

37 Stocks to Buy for the Second Half of 2020, According to Barron’s Roundtable Experts (Barron’s )

How Barron’s Roundtable Panelists’ 2020 Stock Picks Have Performed So Far This Year (Barron’s )

The Tanger Outlets CEO Thinks Online Shopping Is Overrated. Now He’s Betting on It. (Wall Street Journal )

How to Visit the National Parks Safely in the Summer of Covid-19 (Wall Street Journal )

German Biotech Sees Its Coronavirus Vaccine Ready for Approval by December (Wall Street Journal )

Jair Bolsonaro: The rightwing leader may emerge politically stronger from the pandemic (Financial Times )

Disney World to Reopen as Coronavirus Cases Surge in Florida (Bloomberg )

Goodbye, extra $600: Unemployment benefits won’t exceed former wages in next stimulus bill, Treasury’s Mnuchin says (MarketWatch )

Here’s what Trump’s back-to-work bonus could look like (Fox Business )

Hedge Funds Would Get to Keep Lots of Trades Secret in SEC Plan (Bloomberg )

The latest Corvette is great, but wait until you see what comes next (CNN Business )

Warren Buffett bets big with $10 billion Dominion Energy deal—What it means (CNBC )

Emerging Markets Rally as Economies Reopen in the Second Quarter (Advisor Perspectives )

A contrarian take on recovery prospects (Andreessen Horowitz )

Bill Miller: The Economy, What The Pandemic Has & Has Not Changed (YouTube )

Wells Fargo upgraded to Outperform from Neutral at Baird. (TheFly )Gilead says remdesivir coronavirus treatment reduces risk of death (CNBC )

Maryland man may be first person successfully vaccinated against COVID-19 (New York Post )

Trump says he’ll wear a mask on trip to Walter Reed medical center (New York Post )

Lumber Prices Rise Sharply Despite Covid-19 (Barron’s )

2 Bank Stocks Worth a Look Heading Into Earnings (Barron’s )

Wells Fargo Stock Has Potential, Because ‘a Broken Bank Can Be Fixed’ (Barron’s )

Mnuchin wants ‘another round’ of stimulus checks passed this month (New York Post )

68% Have Antibodies in This Clinic. Can Neighborhood Beat a Next Wave? (New York Times )

Wear a Mask — That’s How We Stop Covid-19 Together (Barron’s )

Walgreens to Cut 4,000 Jobs in U.K. Boots Stores (Wall Street Journal )

Oil Went Below $0. Some Think It Will Rebound to $150 One Day. (Wall Street Journal )

German Biotech Sees Covid-19 Vaccine Ready for Approval by December (Wall Street Journal )

Cruise Ships Still Have Their Fans, Even After Coronavirus (Wall Street Journal )

GM reveals price, features of 2021 Corvette Stingray, including two new colors (USA Today )

These ‘epicenter’ stocks could surge higher, says analyst who called March bottom (Yahoo! Finance )

Natural Gas Is Rebounding. 3 Stocks to Play the Move. (Barron’s )

Fed balance sheet below $7 trillion, repo drops to zero for first time since September (Street Insider )

Wells Fargo preparing to cut thousands of jobs: Bloomberg Law (Street Insider )

Mortgage bailout sees biggest one-week decline, but more borrowers are extending terms (CNBC )

Wells Fargo Has Potential, Because ‘a Broken Bank Can Be Fixed’ (Barron’s )

Gilead Is Testing an Inhaled Version of Its Covid-19 Drug (Barron’s )

Warren Buffett Gives Another $2.9 Billion to Charity (New York Times )

U.S. Initial Jobless Claims Fell Last Week by More Than Forecast (Bloomberg )

The coronavirus has given investors a ‘once-in-a-lifetime opportunity,’ says hedge-fund billionaire (MarketWatch )

Former Fox News Anchor Shepard Smith Joins CNBC to Host Evening Newscast (Wall Street Journal )

Costco (COST) June U.S. Comps Increase 11% (StreetInsider )

Walmart Forays Into Health Insurance In A Bid To Expand Health Care Offerings (Benzinga )

Fed withdraws from repo market after 10 months (Financial Times )

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…(ZeroHedge )

Walgreens stock rises on plans to open 700 primary care practices (MarketWatch )

Banks Could Get $24 Billion in Fees From PPP Loans (Wall Street Journal )

Can Biotechs Make it to the Finish in the Covid-19 Vaccine Race? (Barron’s )

Disney Stock Is Undervalued by Nearly 30%, Analyst Says (Barron’s )

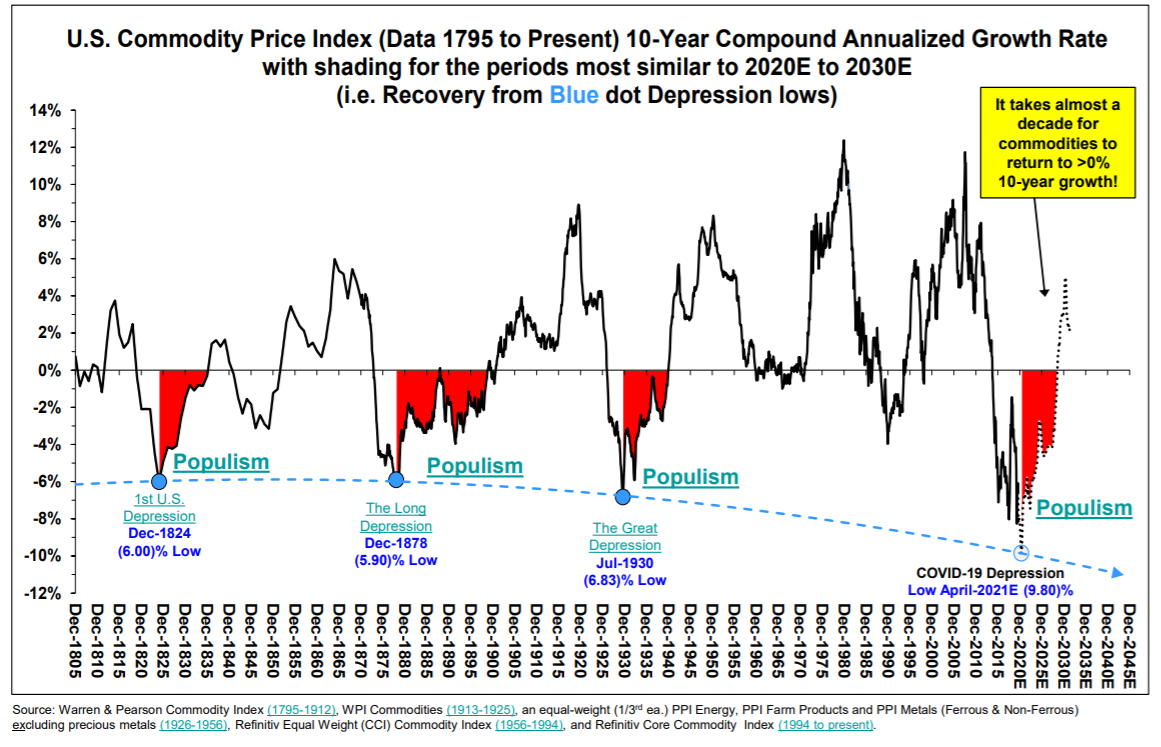

This fascinating chart shows the link between commodity prices and populism (MarketWatch )

Here’s how much money banks earned for distributing PPP funds (New York Post )

Walmart launching a subscription service for less than $100 a year (USA Today )

Chubb’s Pandemic Estimate Could Buffer Insurers (Wall Street Journal )

Homebuyer mortgage demand spikes 33% as rates set another record low (CNBC )

What Wall Street Pros Will Look for This Earnings Season (Bloomberg )

Taylor Morrison shares soar premarket after home builder says June was its best ever sales month (MarketWatch )

Morgan Stanley Sees Multiple COVID-19 Vaccine Makers with Pivotal Data Before Year End, Supporting ‘V’ Shaped Recovery (StreetInsider )

Biogen (BIIB) Completes Submission of BLA to FDA for Aducanumab as Treatment for Alzheimer’s Disease (StreetInsider )

Big economies face surging debt, have time to put house in order, Barclays says (Reuters )

Herd Immunity May Be Closer Than You Think (Wall Street Journal )