Skip to content

Retail Sales Surge as Shoppers Emerge From Lockdown (Barron’s )

Steroid dexamethasone reduces deaths among patients with severe COVID-19: trial shows (Street Insider )

10-year Treasury yield climbs above 0.75% on recovery in U.S. retail sales and report of $1 trillion infrastructure spending plan (MarketWatch )

European stocks rally on central bank action and U.S. data (MarketWatch )

A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch )

Oil prices rally as IEA report points to record appetite for crude next year (MarketWatch )

‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch )

U.K. and EU Want a Quick Brexit. They Just Disagree on Everything Else. (Barron’s )

Bluebird and Crispr Show Promise for Sickle-Cell Cures (Barron’s )

10 REITs With Strong Rent Collection and Lower Debt (Barron’s )

Dividend Stocks Set to Benefit From the Search for Yield (Barron’s )

Retail Traders Are Beating Hedge Funds (Barron’s )

Fed Will Amass Corporate Bond Portfolio Using Index Approach Wall Street Journal )

Airlines Are Losing Money. They Will Still Buy a Lot of Planes (Wall Street Journal )

iRobot Cleans Up (Wall Street Journal )

Apple price target raised to $400 from $310 at Cit (TheFly )

BofA boosts Disney target to $146, sees ‘compelling’ entry point (TheFly )

Lennar Corp. (LEN) Tops Q2 EPS by 51c, Offers Guidance (Street Insider )

Major US airlines may ban passengers who don’t wear face masks (New York Post )

Hedge fund coach claims ‘Billions’ trolling her by dressing character in favorite outfit (New York Post )

Trump to Sign Executive Order on Policing (Wall Street Journal )

Fannie, Freddie Tap Wall Street Banks to Advise on Recapitalization (Wall Street Journal )

The coronavirus pandemic can’t stop Americans from buying pickups USA Today )

BofA Survey Finds 78% of Investors See Market as ‘Overvalued’ (Bloomberg )

Supply Chains of 2020 Needing Repair Now Are the Banks of 2008 (Bloomberg )

Oil Rises Above $40 on U.S. Stimulus and Tighter Supplies (Bloomberg )

Light, Fast, and Powerful, the Porsche 718 Also Runs Under $100,000 (Bloomberg )

Ford unveils 2021 Mustang Mach 1 as new global ‘pinnacle’ of pony car lineup CNBC )

10 tech stocks left behind by the market’s furious rally (MarketWatch )

Investors Approaching Retirement Face Painful Decisions (Wall Street Journal )

Bank of Japan pledges $1tn in coronavirus loans (Financial Times )

More Market Makers To Be Allowed Back On The NYSE Floor Wednesday (Benzinga )

Tesla Says Model S Long Range Plus Finally Received 402 Miles Rating From EPA, Confirms $5,000 Price Cut (Benzinga )

How Tiger Funds Navigated the Market Volatility (Institutional Investor )

Fed’s Powell set to reiterate long U.S. economic recovery, call for more fiscal support (Reuters )

How the Pandemic Has Changed What Home Buyers Want. (Barron’s )

Goldman Says Mom-and-Pop’s Stock Picks Are Trouncing Wall Street (Bloomberg )

Why Investors Shouldn’t Worry About Last Week’s Fall (Barron’s )

Lilly Is Testing Its Arthritis Drug as a Coronavirus Treatment (Barron’s )

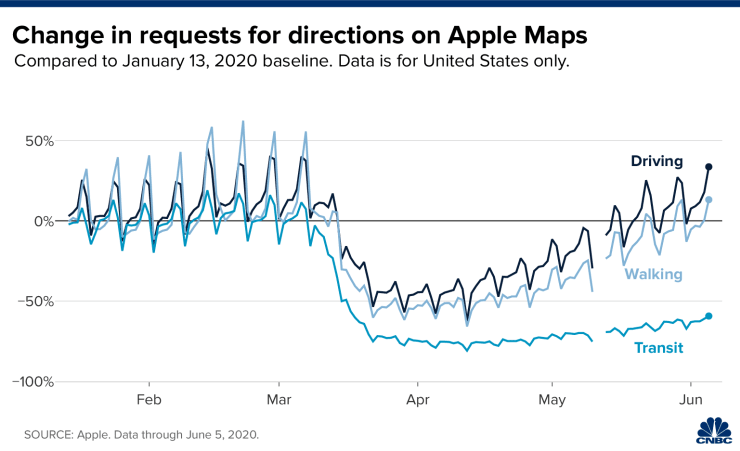

Americans Are Driving Again. What That Means for Auto Stocks. (Barron’s )

Get Ready for the ‘Mother of All Bidding-War Seasons’ (Barron’s )

Hedge fund Elliott Management shifts to elephant hunting as fund size balloons (CNBC )

Warren Buffett says this is ‘by far the best book on investing ever written’ (CNBC )

A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch )

China’s factory output perks up but consumers stay cautious (Reuters )

Big money may soon be chasing the ‘Robinhood’ investor (Yahoo! Finance )

Retail investors top Wall Street pros as stock market recovers from coronavirus selloff (Fox Business )

Barron’s Picks And Pans: Chevron, Goldman Sachs, Progressive And More (Benzinga )

AstraZeneca Strikes Deal With Four EU Countries Over 400M Coronavirus Vaccine Doses (Benzinga )

Source image: Unsplash.com

ByteDance Explores Partnership With Singapore’s Lee Business Family For Digital Banking License: Report (Benzinga )

Morgan Stanley Economists Double Down on V-Shape Global Recovery (Bloomberg )

Singapore to Ease Virus Curbs, Resume Most Activities Friday (Bloomberg )

China a Bright Spot for U.S. in Gloomy Global Trade Picture (Wall Street Journal )

Signs of a V-Shaped Early-Stage Economic Recovery Emerge (Wall Street Journal )

Kudlow Urges Replacing Unemployment-Benefit Boost With Return-to-Work ‘Bonus’ (Wall Street Journal )

‘Billions’ Recap, Season 5, Episode 7: Axe Capital on Drugs, a Scandal and a Firing (Wall Street Journal )

JPMorgan’s Kolanovic Drops Caution on Stocks, Says Buy the Dip (Bloomberg )

Second Wave Fears Won’t Crush Oil Demand (Futures Mag )

2 Energy Stocks to Buy in June 2020 (Insider Monkey )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Here’s Proof That the 2021 Ford Bronco Has a Seven-Speed Manual and Crawler Gear (The Drive )

The Cost Of Contact Tracing (NPR )

A Guy Named Craig May Soon Have Control Over a Large Swath of Utah (New Yorker )

Two Investors Search The Globe For An Investment Edge (Podcast) (Bloomberg )

Joe Rogan Got Ripped Off by Spotify? (Marker )

Why the Worst Is Over for Mortgage-Backed Securities, Maybe (Chief Invesment Officer )

Fresh OPEC+ cuts point to crude and condensate supply deficits through 2021 (Oil & Gas Journal )

Bond Moves Up (Variety )

Lasry: Hertz Debt Is an Opportunity (Barron’s )

Hedge Fund Tips – Who Was Really the Dumb Money? (Zero Hedge )

The Fed Is Optimistic—If Congress Does More Now (Barron’s )

Get Ready for ‘Mother of All Bidding-War Seasons,’ Says Real Estate CEO (Barron’s )

Why Regional Theme Parks Could Be the Place to Be This Summer (Barron’s )

Here’s how the stock market tends to trade after brutal selloffs like Thursday’s (MarketWatch )

Bank of America Stock Stands to Gain on Stress Test and Earnings (Barron’s )

10,000 Steps a Day Is a Myth. The Number to Stay Healthy Is Far Lower. (Wall Street Journal )

Before Catching Coronavirus, Some People’s Immune Systems Are Already Primed to Fight It (Wall Street Journal )

American Express Gets Nod to Start Operating Card Network in China (Wall Street Journal )

Steven Mnuchin Says White House Considering Second Round of Stimulus Payments (Wall Street Journal )

Twitter Restores Zero Hedge Account After Admitting Error (Bloomberg )

‘Economists make fortune-tellers look good’: This investment manager thinks the US is on course for a V-shaped recovery as markets ‘have already priced in’ a 2nd wave of coronavirus (Business Insider )

Global stocks could soar 47% from current levels as recent sell-off rejuvenates the bull market, JPMorgan says (Business Insider )

US consumer sentiment jumps the most since 2016 on renewed hiring efforts (Business Insider )

Cliff Asness, AQR Founder and Libertarian Firebrand, Tells Staff That ‘Black Lives Matter’ (Institutional Investor )

Donald Trump’s New Secret Weapon: Boats (Vanity Fair )

5 Signs This Might Be a New Bull Market (A Wealth of Common Sense )

Jeremy Siegel declares end to the 40-year bull market in bonds (CNBC )

CNBC’s full interview with Ron Baron (CNBC )

5 Stocks to Rotate to Now as Stock Market Melt-Up Rally Hits a Massive Wall (24/7 Wall Street )

A Tesla Fan Talks Down Nikola’s Highflying Stock (Barron’s )

NASA Needs to Find Ice on the Moon. This Rover Will Lead the Search. (New York Times )

Bankrupt Hertz wants to sell up to $1 billion in stock (MarketWatch )

More turning to RVs, motor homes to escape COVID-19 — and get away from it all (USA Today )

Defense contractor L3Harris CEO: Tech will ‘drive the future’ of warfare (CNBC )

Palantir Technologies close to stock market debut (Fox Business )

Is now the right time to buy a holiday home abroad? (Financial Times )

Stolen Banksy artwork honoring Bataclan victims found in Italy (USA Today )

Why TikTok’s Addison Rae Is More Than Just a “Pouty Face” (Wall Street Journal )

Bank of America Stock Stands to Gain on Stress Test and Earnings (Barron’s )

Fed Officials Project No Rate Increases Through 2022 (Wall Street Journal )

Bank of America’s top equity strategist is looking for these signals to get more bullish on stocks (MarketWatch )

Davey the Day Trader Deconstructed (Wall Street Journal )

Exclusive: Pershing Square’s Ackman eyes $1 billion-plus ‘blank-check’ company – sources (Reuters )

Suburban housing is a seller’s market now: Real estate agent (Fox Business )

Regeneron (REGN) announced initiation of first clinical trial of REGN-COV2, dual antibody cocktail for prevention and treatment of COVID-19 (Street Insider )

This Exclusive Dataset Shows Why Investor Optimism Is Surging (Institutional Investor )

Moderna Will Start Testing Vaccine on 30,000 People in July (Barron’s )

Jay Powell delivers dovish message to financial markets (Financial Times )

Mnuchin Backs More Aid to Hard-Hit Small Businesses (Wall Street Journal )

$130 Billion in Small-Business Aid Still Hasn’t Been Used (New York Times )

Pessimistic Pros Missed the Big Rally, and So Did Many Americans (Bloomberg )

Johnson & Johnson To Start Coronavirus Vaccine Human Trials Ahead Of Schedule In July (Benzinga )

Here are the biggest stock-market bets among institutional and retail investors, ranked MarketWatch )

Mortgage demand from homebuyers amazes again, now up 13% annually despite rising rates (CNBC )

The Rally in Cyclical Stocks Is Just Getting Started. Citi, Chevron, and 38 Other Stocks to Play the Rebound. (Barron’s )

AMC to reopen theaters globally in July (CNBC )

Six things to watch at the Federal Reserve meeting (Financial Times )

Why Occidental Stock May Have More Upside (Barron’s )

Hong Kong’s dollar peg faces new scrutiny as security law looms (Financial Times )

Value and growth investments gap at 25-year high (Financial Times )

BofA Securities Upgrades Occidental Petroleum (OXY) to Buy; ‘Moving up the risk curve’ (Street Insider )

Gundlach Warns Rising Rates May Lead Fed to Yield-Curve Control (Yahoo! Finance )

3 Ways to Play the Most Hated Stock Market Rally in History (Barron’s )

Coronavirus Obliterated Best African-American Job Market on Record (Wall Street Journal )

Hassett Sees Another Stimulus Bill From Congress Before August Recess (Wall Street Journal )

Fed Makes Small Business Loans Easier to Get (Barron’s )

This Is One Genre of Music That Isn’t Hurting Right Now (Bloomberg )

There’s a ‘disconnect’ with bank stocks and they should climb higher, top analyst says (CNBC )

Value Stocks Are Coming Back as Momentum Shares Lose Their Mojo (Barron’s )

‘People Are Getting in Planes’: The Travel Business Is Picking Up (New York Times )

US stocks erase all losses for the year (Financial Times )

Fed likely to signal near-zero rates for years (USA Today )

Brinker International says Chili’s is outpacing the competition as hundreds of dining rooms re-open for business (MarketWatch )

Consumers ‘More Optimistic’ About Economy’s Future in May, New York Fed Says (Wall Street Journal )

Once bitten, not shy: Investors again seek margin loans as stocks rally (Reuters )

US frackers to zero in on richest oil fields after coronavirus (Fox Business )

Germany’s ‘ka-boom’ stimulus marks a surprising change (Financial Times )

Tesla, Amazon Backer Baillie Gifford Invests $35M In Air Taxi Startup Lilium (Benzinga )

BofA Securities Upgrades Occidental Petroleum (OXY) to Buy; ‘Moving up the risk curve’ (Street Insider )

4 new vehicles could change Ford’s financial course (USA Today )

Here’s the only thing investors need to know about the stock market right now, says 50-year veteran (MarketWatch )

This Money Supply Metric Says Stocks Will Keep Rallying (Barron’s )

Party Like It’s 1983 (Wall Street Journal )

Five charts that track the U.S. economy amid reopening progress (CNBC )

Hospitals Got Bailouts and Furloughed Thousands While Paying C.E.O.s Millions (New York Times )

Chimerica Isn’t Dead, but the Pandemic Wounded It (Wall Street Journal )

Oil prices motor to levels not seen in months as OPEC+ extends historic cuts (Fox Business )

AstraZeneca contacted Gilead over potential megamerger: Bloomberg News (Street Insider )

Las Vegas Is Open for Business Again: 4 Top Gaming Stocks (24/7 Wall Street )

New York City reopens under Phase One on Monday (New York Post )

Bull, bear, bull, bear and now a new bull market — whatever’s next, these stocks will outperform, strategist says (MarketWatch )

Japan Bankruptcies Hit Lowest Since the 1960s: What Gives? (Bloomberg )

Fed Debates Whether to Reinforce Low-Rate Pledge With Yield Caps (Wall Street Journal )

Saudi Arabia’s Secret Plans to Unveil Its Hidden da Vinci—and Become an Art-World Heavyweight (Wall Street Journal )

U.S. Fed’s Main Street lending facility likely to start with a whimper (Reuters )

Stanley Druckenmiller says he’s been ‘humbled’ by market comeback, underestimated the Fed (CNBC )

New CEO Bought Stock in UPS (Barron’s )

Barron’s Daily: Travel Stocks Continue Their Rebound. Not Even a Tropical Storm Can Stop the Rally. (Barron’s )

HP Stock Is Slumping. The CEO and a Director Made the First Insider Buys in Years. (Barron’s )

Emerging-Market Rally Seen Unstoppable as Traders Turn to Powell (Bloomberg )

Move Over, Moderna: Why Pfizer May Be The Better Bet To Deliver A Vaccine By Fall (Forbes )

First CRISPR gene editing trial in cancer patients points to safety of technique in medical treatments (FirstPost )

CT: Indoor dining, gyms, movie theaters, small weddings and events to reopen June 17, three days early (News Times )

Hennessey Unleashes Fastest C8 Corvette Stingray Yet (Maxim )

The Business Of Antibody Tests (NPR Planet Money )

Ferrari 812 Superfast Review: One of the Best Engines of All Time (TheDrive )

Michael Jordan pledges $100M to promote racial equality (Fox Business )

California Gov. Gavin Newsom Reveals TV, Film Production Can Restart June 12 (Hollywood Reporter )

Ariel founder: ‘Black people are locked out’ (Pensions & Investments )

Baker Hughes: US rig count down 17 units to 284 (Oil & Gas journal )