Skip to content

- 33 Stocks That Will See Strong Earnings Growth This Quarter (Barron’s)

- European stocks climb as investors eye bigger-than-expected EU stimulus plan (MarketWatch)

- Burger King debuts giant crowns to encourage social distancing (New York Post)

- Why Dollar Tree and Family Dollar Stock Are Buys Right Now (Barron’s)

- Fed should lift caps to buy as much corporate bond ETFs as it wants, says BofA (MarketWatch)

- 13 Deeply Discounted Dividend Stocks to Play in a Recovery (Barron’s)

- 15 Cheap Stocks Growing Fast Enough to Avoid Value Trap (Barron’s)

- Europe Is Subsidizing Millions of Paychecks. Companies Want to Keep It That Way, for Now. (Wall Street Journal)

- Distressed Real Estate Market Beckons Opportunistic Buyers (New York Times)

- KFC tests a new chicken sandwich (USA Today)

- Mortgage demand from homebuyers shows strong and unexpectedly quick recovery (CNBC)

- Jay Leno: What it’s like to drive the Tesla Cybertruck—from ‘instant acceleration’ to how the interior feels (CNBC)

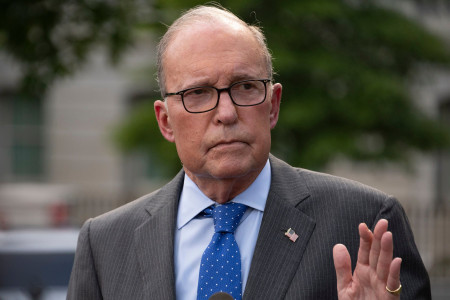

- A top Trump economic adviser says the White House is considering offering ‘back to work’ cash bonuses for unemployed Americans ) (Business Insider)

- Cuomo to press Trump on reviving U.S. economy with roads, bridges in White House meeting (Reuters)

- Ross to Bartiromo: Trump mulling ‘menu’ of action against China over Hong Kong (Fox Business)

- Top-rated companies raise $1tn to fill ‘war chests’ (Financial Times)

- Boeing and Airbus Study How Coronavirus Behaves During Air Travel Wall Street Journal)

- This is the time for active managers to shine, Goldman notes. How — and what — are they doing? (MarketWatch)

- Airline stocks soared as much as 16% Tuesday — here are Wall Street’s favorites (MarketWatch)

- Gilead Sciences Stock Is Moving Back Into Favor (MarketWatch)

- Wall Street’s 6 Favorite Defense Stocks for Memorial Day (Barron’s)

- Small caps outperform after recessions, so ‘you have history on your side,’ money manager says (CNBC)

- Global Stocks Rally on Recovery Hopes and Vaccine News (Barron’s)

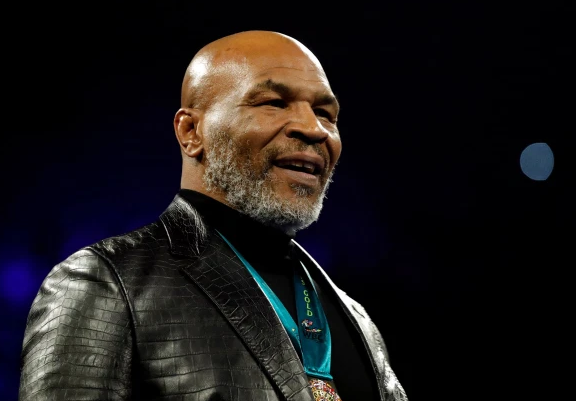

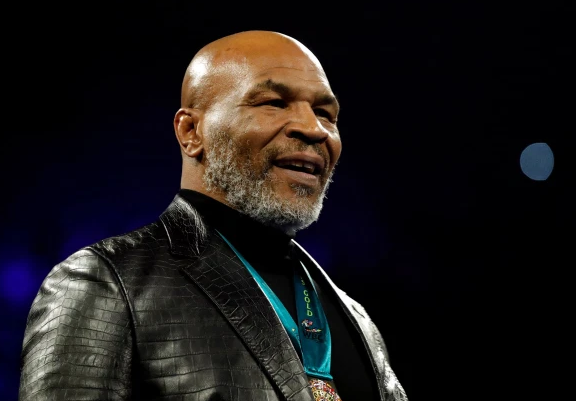

- Mike Tyson nears boxing return as another $20 million opportunity emerges (New Yoork Post)

- Classic Car Auctions Upended by Coronavirus (New York Times)

- Oil Gains on Optimism Market May Balance in Coming Weeks (Bloomberg)

- Six Flags’ stock surges after plan to reopen first theme park on June 5 (MarketWatch)

- What Hedge Funds Own – and What It Says About the Market (Barron’s)

- Stanley Ho, ‘King of Gambling’ Who Built Macau, Dies at 98 (Bloomberg)

- Square’s Co-Founder: A Recession Is a Great Time to Start a Company (Wall Street Journal)

- James Bond’s Car Comes to Life With Oil-Slick Sprayer, but No Ejector Seat (New York Times)

- NYSE’s Floor to Reopen With Masks, Waivers and Handshake Ban Wall Street Journal)

- Cyclical Stocks Are Staging Comeback (Wall Street Journal)

- The Secret to Searing a Bistro-Quality Steak (Wall Street Journal)

- As Passengers Disappeared, Airlines Filled Planes With Cargo (New York Times)

- Global Oil Demand Has Yet to Peak, Energy Watchdog Predicts (Bloomberg)

- Germany’s Ifo Index rises above forecasts in May (MarketWatch)

- Covid-19 Patients Not Infectious After 11 Days: Singapore Study (Bloomberg)

- China warns audit plans will drive companies from US exchanges (Financial Times)

- ‘Never waste a crisis’: inside Saudi Arabia’s shopping spree (Financial Times)

- Election-Year June: Candidate Clarity Boosts Performance (Almanac Trader)

- Disneyland to feature ‘modified’ experience for guests upon reopening amid pandemic (OAN)

- Triumph Celebrates James Bond With Special Edition Scrambler 1200 (Maxim)

- Southeastern: The Exceptional Opportunity in Small-Cap Value (Advisor Perspectives)

- Stocks Are Up But The Economy’s Down (NPR Planet Money)

- The Coronavirus Vaccine Is on Track to Be the Fastest Ever Developed (The New Yorker)

- Gut Microbes May Be Key to Solving Food Allergies (Scientific American)

- The Billionaire, an African Mine and a Spy Network (Bloomberg)

- The Sprint to Raise a $1.75 Billion Credit Fund During a ‘Maelstrom’ (InstitutionalInvestor)

- The top 9 shows on Netflix and other streaming services this week (BusinessInsider)

- Fauci warns overextending coronavirus lockdowns could cause ‘irreparable damage’ (New York Post)

- Two Stocks Nelson Peltz May Be Buying Now (Barron’s)

- China stands by pledge to implement US trade deal despite tensions (New York Post)

- ‘My Head Is About to Explode’: Virus Jargon Is Schooling Traders (Bloomberg)

- Scientists Say That Yes, You Can Have Fun This Summer. Just Do It Outside (Bloomberg)

- Alibaba sees China retail volume growing near pre-pandemic level (MarketWatch)

- China’s Hard Line on Hong Kong Could Mean Big Changes for Investors (Barron’s)

- Lockdowns Are Costing Us. It’s Time to Be Smart. (Barron’s)

- Clorox and Netflix Shares Have Prospered in the Pandemic. But the Risk Is Rising. (Barron’s)

- Hospitals Are Rationing Remdesivir (Wall Street Journal)

- Nevada Aims to Reopen Casinos June 4 (Wall Street Journal)

- U.S. Rig Count Collapse Continues Despite Soaring Oil Prices (OilPrice)

- Cooped-up Americans race to book vacations in reopened states (Financial Times)

- The fall and rise of Pierre Andurand, oil’s comeback kid (Financial Times)

- Spain’s Soccer League to Resume June 8 After Halt for Virus (Bloomberg)

- Why Delisting Chinese Firms Has Gained Traction in Washington (Bloomberg)

- Why the U.S. Has Shunned Negative Interest Rates (Bloomberg)

- ‘Big Short’ investor Michael Burry added these 5 new stocks to his portfolio in the first quarter (Business Insider)

- Trump administration warms up to sending out more virus relief money (CNBC)

- NHL Players’ Association approves going forward with 24-team playoff talks (CNBC)

- Gilead’s remdesivir improves time to recovery for COVID-19 patients in peer-reviewed results, NIAID says (MarketWatch)

- Kevin Hart — Life Lessons from a Comedic Powerhouse (#435) (Tim Ferriss)

- Three things you can’t do in this world (The Reformed Broker)

- Bill Miller’s Takeaways From Recent Market Volatility (YouTube)

- Dazed and Confused (CompoundAdvisors)

- Disney Eyes Key Step To Reopen Florida Parks As Rival Gets OK (Investor’s Business Daily)

- Deere Crushed Earnings Estimates. Its Stock Is Flying. (Barron’s)

- Scoring tickets to NYC drive-in movies is now a competitive sport (New York Post)

- Americans use their stimulus checks to splurge at Walmart, Target and Best Buy (New York Post)

- Rise of S.U.V.s: Leaving Cars in Their Dust, With No Signs of Slowing (New York Times)

- U.S.-China tensions are flaring on a new front: the financial markets (CNBC)

- Why one strategist says these hard-hit stocks will rebound — even if there’s a second wave to the pandemic (MarketWatch)

- States reopen after coronavirus lockdowns: More beaches, casinos open ahead of Memorial Day holiday weekend (MarketWatch)

- Opinion: As the economy reopens, these three indicators will show the strength of the recovery (MarketWatch)

- A Few Big Stocks Are Driving Market Gains. That’s an Opportunity. (Barron’s)

- Western Digital Stock Has Fallen Far Enough. ‘Risks Are to the Upside.’ (Barron’s)

- Why one analyst thinks now is the time to buy cruise stocks (Yahoo! Finance)

- 10 Forces Driving the Stock Market Gains and the Economic Recovery (24/7 Wall Street)

- Elon Musk Is the Hero America Deserves (Bloomberg)

- China vows to push ahead with ‘phase one’ US trade deal amid renewed tensions (CNBC)

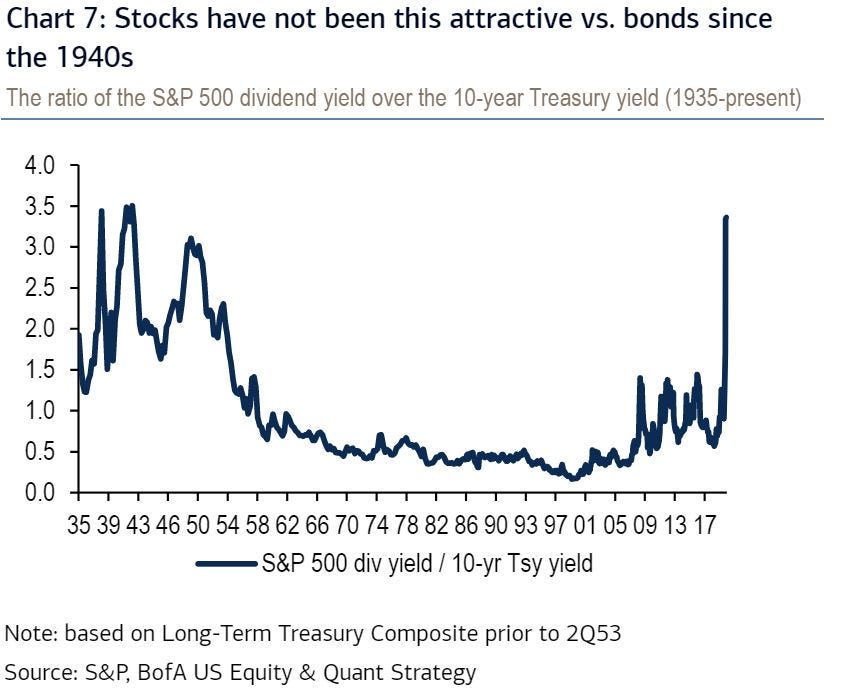

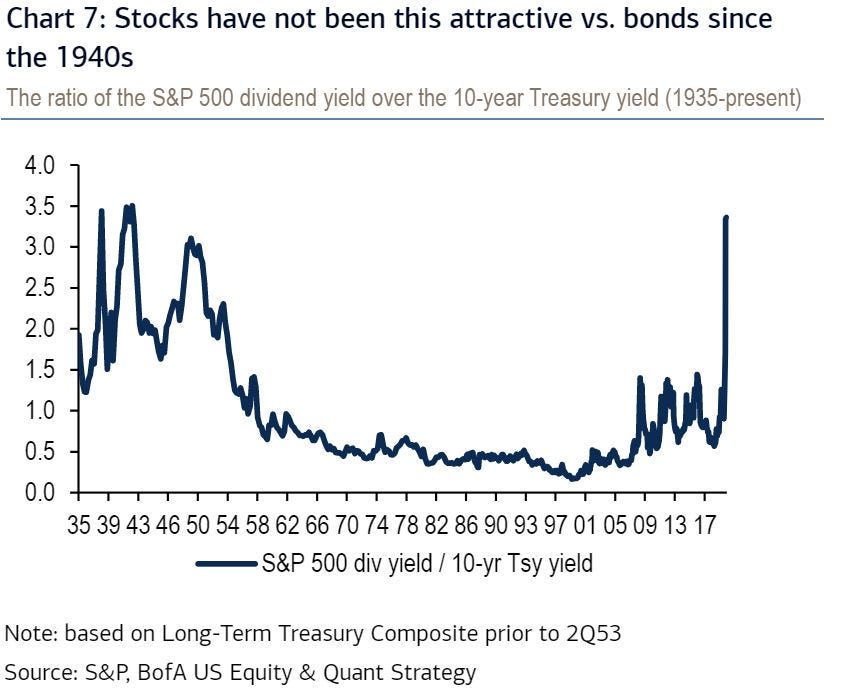

- BANK OF AMERICA: Stocks haven’t been this attractive relative to bonds in 70 years, suggesting further gains are coming (Business Insider)

- Fauci Calls Moderna’s Coronavirus Vaccine Candidate ‘Quite Promising’ (Benzinga)

- Royal Caribbean hopes to resume cruises as soon as August, but the CEO says only if it’s safe (CNBC)

- Michael Burry Could Profit on Selloff Bets (Yahoo! Finance)

- China promises more spending to help revive economy, won’t set growth target (MarketWatch)

- All 50 States Have Now Taken Steps to Reopen (Wall Street Journal)

- Shopping Malls Are Reopening, but Visits Are Still Way Down (Barron’s)

- “Leave My Mom Out Of It”: Virtual Debate Between Caruso-Cabrera And AOC Turns Ugly (ZeroHedge)

- Coronavirus live updates: Italian PM says ‘worst is behind us;’ Elvis Presley’s Graceland to reopen (CNBC)

- Boeing Stock Will Rebound. Look Beyond Covid-19. (Barron’s)

- The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)… (ZeroHedge)

- Lowe’s Did What Home Depot Couldn’t (Barron’s)

- Oil prices extend climb toward highest level since March as demand and supply seen taking steps toward recovery (MarketWatch)

- This could be the next signal for the S&P 500 to climb past 3,000, says Standard Chartered (MarketWatch)

- Airline Stocks Rally as Carriers Plan June Restart and State Bailouts Ease Fears (Barron’s)

- Fed Minutes Outline Potential Next Steps to Fight Crisis (Barron’s)

- 5 Restaurant Stocks That Are Still Worth Buying (Barron’s)

- More Analysts See Oil Demand Exceeding Supply Later This Year. That’s a Bullish Sign for Oil. (Barron’s)

- Contact Tracing Takes a High-Tech Step Forward (Barron’s)

- The Dow Is Up — and the Number of Stocks In Up Trends Is Too (Barron’s)

- Can You Get Covid-19 Twice? (Wall Street Journal)

- TikTok parent company valued at over $110B (New York Post)

- Coronavirus Shut Down the ‘Experience Economy.’ Can It Come Back? (New York Times)

- China’s Xi Seeks to Portray Unity and Pivot to Economy Under Coronavirus Shadow (Wall Street Journal)

- When Will Big Concerts Finally Return After Covid? (Think 2021) (Wall Street Journal)

- Andrea Bocelli Wants to Get Back to Work (Wall Street Journal)

- U.S. Raises Ante in Vaccine Race With $1.2 Billion for Astra (Bloomberg)

- Trump Points Finger at China’s Xi, Escalating Fight Over Virus (Bloomberg)

- Disney and Universal to Begin Submitting Florida Reopening Plans (Bloomberg)

- Young Join the Rich Fleeing America’s Big Cities for Suburbs (Bloomberg)

- Starbucks U.S. same-store sales have recovered more than 60% from last year, summer menu announced (MarketWatch)

- 2.4 million more file for unemployment, but weekly number steadily decreasing (Fox Business)

- Why Texas Roadhouse Could Be A Big Post-Shutdown Winner (Yahoo! Finance)

- Trump admin. gives energy companies temporary breaks on royalty rates, rent (Fox Business)

- Why Magic Johnson, Mark Cuban Are Connecting Minority-Owned Businesses With Millions In PPP Loans (Benzinga)

- Target Stock Is Up After Earnings. Walmart Wasn’t a Tough Act to Follow After All. (Barron’s)

- Why states can’t go bankrupt (CNBC)

- Homebuilding stocks rise despite April slowdown — how to play the move (CNBC)

- Weekly mortgage applications point to a remarkable recovery in homebuying (CNBC)

- The Metropolitan Museum of Art plans to reopen in mid-August (New York Post)

- Thousands of sports fans who can’t gamble on their favorite teams are reportedly flocking to the stock market instead. (Business Insider)

- Chinese smartphone maker Xiaomi reports 13.6% rise in first-quarter revenue. (Business Insider)

- Lowe’s stock surges after profit, sales rise well above expectations (MarketWatch)

- ‘Main Street’ lending program will start at end of May, Fed officials say (MarketWatch)

- Here come the TALF funds (MarketWatch)

- For Home Builders, a Better Kind of Recession (Wall Street Journal)

- ‘The Joe Rogan Experience’ Launches Exclusive Partnership with Spotify (SPOT) (Street Insider)

- JetBlue, United Airlines take more steps to counter coronavirus spread (Street Insider)

- Northrop Grumman (NOC) Raises Quarterly Dividend 9.8% to $1.45; 1.8% Yield (Street Insider)

- 5 Dividend Aristocrat Stocks to Buy That Could Weather Another Brutal Sell-Off (24/7 Wall Street)

- Delta CEO to Bartiromo: No US airlines will go out of business thanks to Trump (Feox Business)

- Venetian Las Vegas reveals coronavirus safety measures, charity (Fox Business)

- U.S. bank regulator finalizes new community lending rule (Reuters)

- Is the U.S. on the Path to Recovery? 14 Charts to Watch. (Bloomberg)

- Return of Car Traffic Fuels Surge in Oil (Wall Street Journal)

- Did Angela Merkel Just Make a U-Turn in Her European Policy? (Bloomberg)

- Live Sports Will Return to TV in June, ViacomCBS Says (Barron’s)

- Value Stocks Look Cheaper Than Ever (Barron’s)

- President Trump Can Choose Which States Get Coronavirus Payback From FEMA (Wall Street Journal)

- At Least 30 Public Companies Say They Will Keep PPP Loans (Wall Street Journal)

- Value Managers Fight Back (Institutional Investor)

- Southwest says bookings outpace cancellations in May (Reuters)

- 4 Energy Stocks to Buy Now as Massive Oil Rally Continues (24/7 Wall Street)

- TikTok nabs Disney’s streaming boss to be its new CEO (CNBC)

- Some signs children may not transmit COVID-19, two UK epidemiologists say (Reuters)

- The U.S. Space Force Is Starting to Launch Rockets. These Stocks Should Benefit. (Barron’s)

- Regions Financial funds 37,000 PPP loans totaling $4.7B (TheFly)

- Walmart earnings soar as e-commerce sales jump, shoppers flock to stores (CNBC)

- Home Depot (HD) Misses Q1 EPS by 18c, Revenues Beat; Suspending FY20 Guidance, ‘Sales Were Strong at End of 1Q’ (StreetInsider)

- JPMorgan hands out $30 billion in loans to small businesses: memo (StreetInsider)

- U.S. housing starts drop more than expected (Reuters)

- Kohl’s online sales surge amid lockdown, reopens about half of its stores (StreetInsider)

- 47% of people will visit restaurants ‘as soon as they reopen:’ Piper Sandler (Yahoo! Finance)

- Covid Patients Testing Positive After Recovery Aren’t Infectious, Study Shows (Bloomberg)

- Loaded With Cash, Real Estate Buyers Wait for Sellers to Crack (Bloomberg)

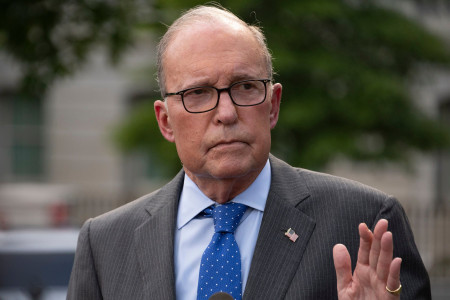

- Kudlow to Bartiromo: Why Beijing won’t sell US debt despite coronavirus feud (FoxBusiness)

- 3 factors why this economic bounceback won’t mirror 2008: Commerce Secretary Wilbur Ross (FoxBusiness)

- Olive Garden parent plans to reopen more than 65% of dining rooms by end of May (CNBC)

- Liability protections are top GOP priority in next coronavirus bill, McCarthy says (CNBC)

- The Auto Market Is Improving Faster Than Expected (Barron’s)

- President Trump says he is taking hydroxychloroquine (Reuters)

- Fed Chair Powell’s Comments Spark Rally in Bank Stocks Barron’s)

- 21 Cheap Stocks With Above-Average Growth Prospects (Barron’s)

- Global Stocks Advance on Signs of Slowing Virus as Powell Interview Adds Cheer (Barron’s)

- Moderna Reports Positive Vaccine News (Barron’s)

- Fed’s Powell tells ‘60 Minutes’ he’s not out of ammunition to fight the recession (MarketWatch)

- Work-from-home productivity pickup has tech CEOs predicting many employees will never come back to the office (MarketWatch)

- Barron’s Picks And Pans: Cisco, Gilead, Netflix, Wayfair And More (Yahoo! Finance)

- Hertz appoints new CEO to lead car rental giant (Fox Business)

- Dwayne ‘The Rock’ Johnson ‘very proud’ of his daughter joining WWE New York Post)

- Dan Bilzerian Pushes Party Brand From a Social Distance (Bloomberg)

- Brent at one-month high, U.S. oil tops $31 as restrictions ease (Street Insider)