Skip to content

5 COVID-19 Casualty Stocks to Buy With Big-Time Upside Potential (24/7 Wall Street )

Retest Possible, But Bottom Likely In as Jobless Claims Trend Lower (Almanac Trader )

Oil Futures Pricing in Tighter Supplies (Futures Mag )

Hedge Fund and Insider Trading News: Barry Rosenstein, Jim Simons, Marshall Wace LLP, Selwood Asset Management, Pantera Capital, Vivint Smart Home Inc (VVNT), Penn National Gaming, Inc (PENN), and More (InsiderMonkey )

Space Force unveils flag; Trump touts ‘super-duper missile’ (AP )

President Trump unveils new vaccine effort ‘Operation Warp Speed’ (OANN )

This Art Installation Of A Giant Wave In South Korea Is Honestly Pretty Chill (digg )

Saudi wealth fund boosts U.S. holdings with stakes in Citi, Boeing, Facebook (OANN )

Brabham Automotive Unleashes BT62 Race Car (Maxim )

Seth Klarman: Top 10 Holdings (Q1 2020) (The Acquirers Multiple )

Rethinking Fear (Farnam Street )

2020 Ferrari F8 Tributo review: Somehow, it got better (cnet )

A Strategy for Reopening New York City’s Economy (Manhattan Institute )

Reopening Sports: Does MMA Point The Way? (NPR Planet Money )

Young Bulls and Old Bears (The Irrelevant Investor )

Major tax benefits for Tesla if Elon Musk moves production from California (Fox Business )

Maximilian Schneider Designs a 21st Century Batmobile Dubbed The Koenigsegg Konigsei Concept (Luxuo )

Your Ultimate Grill Buying Guide—Tested and Approved (Popular Mechanics )

“Poison Pills” Make Comeback at Hollywood Firms Bracing for Hostile Takeovers (Hollywood Reporter )

Stock Market Keeping Score in the Three-Front War Against the Virus (Yardeni )

Newly Flush PNC Could Kick Off the Next Round of Bank M&A (Barron’s )

Oil Market Dazzled With a Swift Delivery of Supply Cuts (Bloomberg )

Slash tax rate in half for corporations returning to US, White House adviser suggests (New York Post )

McConnell says next stimulus must have coronavirus liability protections (New York Post )

Appaloosa buys Twitter, Netflix stakes, exits Caesars, cuts Facebook position (TheFly )

TSA Preparing to Check Passenger Temperatures at Airports Amid Coronavirus Concerns (Wall Street Journal )

Wells Fargo Has Lost $220 Billion in Market Value Under Fed Cap (Bloomberg )

Inside the Science and Companies Racing to Develop a Covid-19 Vaccine (Barron’s )

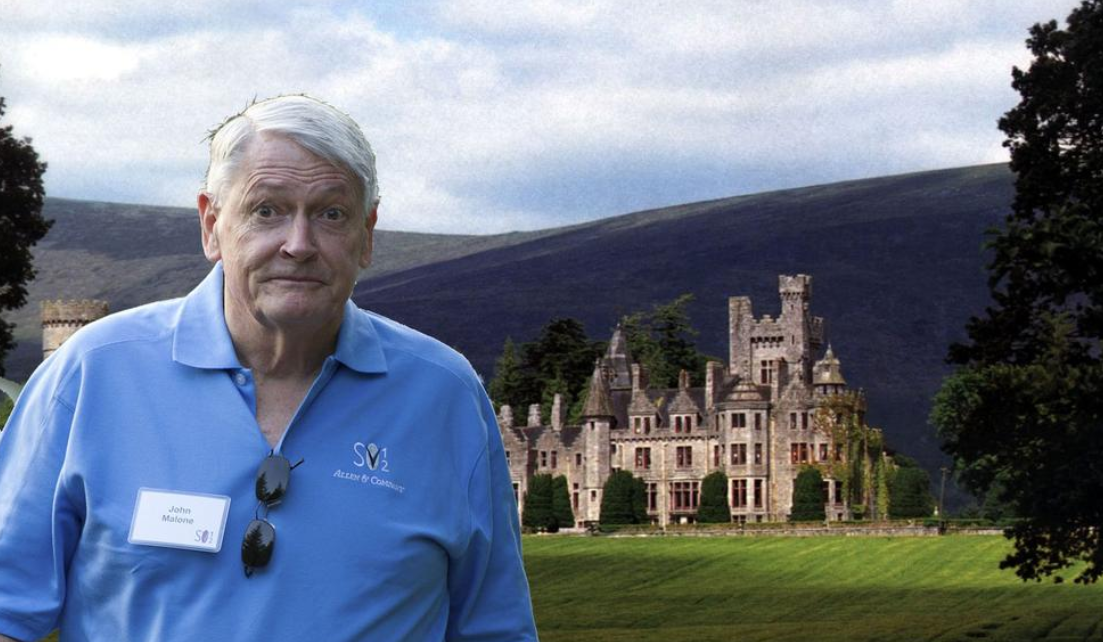

John Malone Has a Great Investing Record. Here’s How to Play Along. (Barron’s )

How Investors Should Evaluate Energy Bonds — And the Funds That Own Them (Barron’s )

This Economist Sees a ‘Regime Change’ Favoring Stockpickers (Barron’s )

Assessing the stock market after one of the fastest declines and subsequent comebacks in history (CNBC )

On Furlough From the Kingdom, Disney Workers Try to Keep the Magic Alive (Wall Street Journal )

Michael Jordan Didn’t Manage People, He Lit Them on Fire (Wall Street Journal )

Car Makers See Chinese Market Picking Up (Wall Street Journal )

Bill Murray drinks, jokes with Guy Fieri on Nacho Showdown: ‘Truth is, he’s a redhead’ (USA Today )

Google Antitrust Lawsuit Being Drafted by U.S Justice Department (Bloomberg )

Next coronavirus aid package expected to become reality ‘in June at the earliest,’ as House passes its bill (MarketWatch )

Is this the pullback you’ve been waiting for? (QuantifiableEdges )

JPMorgan Bets on a Dash for the Suburbs (Institutional Investor )

What Happens to Stocks After a Big Up Month? (A Wealth of Common Sense )

Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years (CNBC )

Loeb’s Third Point Builds Stake in Disney, Exits Campbell Soup (Bloomberg )

Saudi wealth fund snaps up $7.7bn of blue-chip stocks (Financial Times )

How bank hedging jolted investors into talk of negative rates (Financial Times )

Value Stocks Look Cheaper Than Ever. How to Play a Rebound. (Barron’s )

‘Stealth Bailout’ Shovels Millions of Dollars to Oil Companies (Bloomberg )

TikTok Raises Profile As Digital Ad Rival To Snap, Facebook, Google (Investor’s Business Daily )

The Oil Market Is Changing Its Tune (Barron’s )

GE Stock Dropped Again. Here’s What’s Going Right. (Barron’s )

Factory Output in China Surged in April (Barron’s )

NYSE Will Partially Reopen Its Trading Floor (Barron’s )

Meet the trikini, beach fashion’s answer to coronavirus (New York Post )

McDonald’s Details What Dining In Will Look Like (New York Times )

Elon Musk’s Boring Company completes second tunnel in Las Vegas (USA Today )

Wealthy Travelers Are Starting to Book Year-End Vacations (Bloomberg )

Are We Asking Too Much of Testing? (Bloomberg )

Drive-in theaters have become a safe haven for moviegoers. Here’s what it’s like to visit one (CNBC )

Who’s on The Hook for Skipped Mortgage Payments? (Wall Street Journal )

Economic Shock of Virus Hit Lower-Income Households Harder, Fed Finds (Wall Street Journal )

Time for GE to Bring Good Things Back to Life (Wall Street Journal )

Oil back at early April highs as demand shows signs of picking up (Street Insider )

PPP Loans Under $2 Million Get A Significant Waiver From SBA (Yahoo! Finance )

Ross to Bartiromo: Taiwan manufacturer hopes to bring supply chain to this state (Fox Business )

Investors warn Covid-19 crisis is paving the way for inflation (Financial Times )

13 Stock Ideas From Top Value Managers (Barron’s )

Gilead’s Remdesivir Is a Rare Example of Foresight in This Pandemic (Bloomberg )

What’s Good for Banks Isn’t Necessarily Good for Bankers (Wall Street Journal )

Deals Aren’t Dead. Here Are 12 Stocks That Could Become Buyout Targets (Barron’s )

Green Shoots for the Economy and 5 More Things to Know (Barron’s )

As Stock Buybacks Disappear, Dividends Stand to Gain (Barron’s )

As States Reopen, Home Purchase Applications Rise for the Fourth Week in a Row (Barron’s )

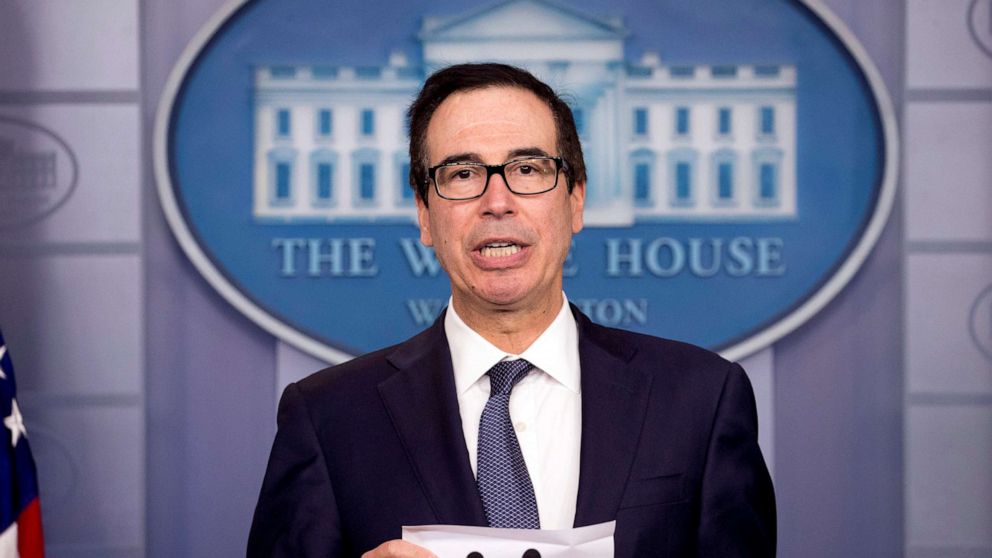

Mnuchin Seeks to Assuage Investors After Powell’s Gloomy Outlook (Bloomberg )

Trump Says He Disagrees With Fauci’s Concerns Over Reopening (Bloomberg )

Wisconsin Supreme Court strikes down state’s ‘stay-at-home’ order (CNBC )

A London-based trading house bought 250,000 barrels of oil during the historic plunge below $0, and likely made a fortune. (Business Insider )

U.S. weekly jobless benefits to stay elevated as coronavirus layoffs widen (Reuters )

AbbVie’s Potential Is ‘Underappreciated,’ Says Morgan Stanley Analyst (Benzinga )

The Swedish Model Trades More Disease for Less Economic Damage (Bloomberg )

Oil Price Crash Could Hurt Trump in Texas, Help in Pennsylvania (Bloomberg )

New York and New Jersey Start to Reopen Their Economies (Wall Street Journal )

Fed TALF Revision Could Help Clear CLO Logjam (Wall Street Journal )

Tesla Wins as County Blinks First in Standoff Over Plant (Barron’s )

Fed spells out terms of TALF rescue facility, potentially paving way to unleash funds in weeks (MarketWatch )

Hedge Funds, Go Home — Japan Is Closing the Door (Bloomberg )

Steve Cohen, Jeff Bezos Achieve Scroll Fame at Robin Hood Telethon (Bloomberg )

Hedge Fund That Never Loses Bets Big on South Africa Debt (Bloomberg )

House Democrats unveil new $3 trillion coronavirus relief bill (CNBC )

Gilead strikes deal to make remdesivir coronavirus treatment in 127 countries (CNBC )

What Doesn’t Kill Fast Food Makes It Stronger (Wall Street Journal )

The Emerging-Market Debt Trap (Wall Street Journal )

Live Nation to issue $800 million of bonds that mature in 2027 (MarketWatch )

Boyd Gaming is offering $500 million of senior notes that mature in 2025 (MarketWatch )

Royal Caribbean pledges 28 ships as collateral for $3.3 bln bond offering (Reuters )

CNBC’s Jim Cramer: Elon Musk may be a ‘zealot’ but he’s ‘dead right’ about his decision to break the rules (MarketWatch )

China will step up macro-economic adjustments to offset pandemic impact – state TV (Reuters )

Powell Says Washington Will Need to Spend More to Battle Downturn (Wall Street Journal )

Saudis to make further oil supply cut to ‘encourage’ peers (Financial Times )

Shanghai Disneyland Reopens With Strict Safety Procedures (New York Times )

Investors Are Terrified of Chinese Stocks. How to Profit From Their Fear. Barron’s )

Chinese investment in US drops to lowest level since 2009 (USA Today )

Trump orders federal retirement money invested in Chinese equities to be pulled (Fox Business )

China announces new tariff waivers for some U.S. imports (Reuters )

The Fed Is Buying E.T.F.s Today (New York Times )

Simon to reopen half of its malls within a week as states begin to reopen (New York Post )

Palm Beach is new escape for New Yorkers looking to dodge coronavirus (New York Post )

Boeing Plans to Resume Building the 737 MAX This Month (Barron’s )

A Movie Studio Could Buy AMC, Even if Amazon Isn’t Interested (Barron’s )

Why Investors Should Consider Companies That Are Repaying Their Credit-Line Debt (Barron’s )

‘Feels like we’re at the bottom’: Some executives see signs of recovery in April (CNBC )

Secret recipes for United Airlines’ stroopwafel, Disney’s beignets, more to make in quarantine (USA Today )

AbbVie Stock Is ‘Unsustainably Cheap’ After Allergan Acquisition (Yahoo! Finance )

PulteGroup (PHM) says recent sales trends have been more encouraging (Street Insider )

Is (Systematic) Value Investing Dead? (AQR )

Berkshire Hathaway Stock Has Rarely Been This Cheap (Barron’s )

Marriott, Cisco, DraftKings, and Other Stocks to Watch This Week (Barron’s )

9 Value Stocks Investors Are Buying While Buffett Waits (Barron’s )

Under virus pressure, Saudi Aramco may cut government payout (Reuters )

AMC Entertainment’s stock soars after report Amazon has expressed buyout interest (Yahoo! Finance )

One Sign That Outperforming Active Managers Will Continue to Outperform (Institutional Investor )

Coronavirus crisis: does value investing still make sense? (Financial Times )

America’s Smallest Stocks Are Staging a Comeback (Wall Street Journal )

Shanghai Disneyland tickets sell out as park prepares to reopen (Fox Business )

Southwest to raise $815 million through sale and leaseback of 20 planes (Reuters )

The 22 Most Expensive Homes in the World for Sale (Robb Report )

Order An Entire Meal From Texas Roadhouse And We’ll Guess How Old You Are (BuzzFeed ) (It said I was 19!)

R.I. teen creates non-profit org. to provide smart tech to patients isolated from loved ones (OANN )

Little Richard, Founding Father of Rock Who Broke Musical Barriers, Dead at 87 (RollingStone )

Why Ford Took The Bronco Off The Market – And Why It’s Bringing It Back (digg )

Automobili Pininfarina Is Speeding Into a New Era of Hypercars (Maxim )

This Weekend: NASCAR Makes Virtual Return to Historic North Wilkesboro Speedway (The Drive )

Episode 998: Journey To The Center Of The Fed (NPR Planet Money )

Bad Arguments and How to Avoid Them (Farnam Street )

7 Early Attempts at Self-Driving Cars (Mental Floss )

MiB: Jim Bianco of Bianco Research (Bloomberg )

Relocated UFC 249 could ‘bring sense of normalcy to people’ (Fox Business )

Epidemics in World History, With Frank M. Snowden (CFR )

Oil is the Comeback King (Futures Mag )

The One Factor That Will Determine The Size Of India’s LNG Boom (OilPrice )

Sam Zell: Nice Distressed Real Estate Bargains Are Ahead (Chief Investment Officer )

Lawmakers urge punishment for banks that won’t back drillers (Pensions & Investments )

Ferrari sales and other Luxury Cars beat Estimates as Global Car sales plummet (Luxuo )

Guy Fieri raised $20 million for restaurant workers amid pandemic (New York Post )

Battered Builder Stocks Could Be Hot Properties Again (Barron’s )

A Stock to Bet on a Recovery in Gambling (Barron’s )

9 Value Stocks Investors Are Buying While Buffett Waits (Barron’s )

Walmart and other superstores continue coronavirus-fueled hiring spree (New York Post )

Mad Dash for Small-Business Loans Slows Down to Glacial Pace (Bloomberg )

When United Pawned Old Jets, Bond Traders Sent a Stark Warning (Bloomberg )

Fresh Coronavirus Wave Won’t Require Shutdown, White House Says (Bloomberg )

‘Survival Mode’: How Billionaire Bosses Tackle the Pandemic (Bloomberg )

Bain Capital makes $1bn bet on Japan’s nursing homes (Financial Times )

‘We’ve seen the lows in March’ for stocks, says man who called Dow 20,000 in 2015, ‘and we will never see those lows again’ (MarketWatch )

New study claims vitamin D deficiency may impact coronavirus mortality rates (MarketWatch )

Royal Caribbean’s stock rallies after COVID-19-related business and liquidity update (MarketWatch )

Elon Musk Says He’ll Be Working on the Tesla Assembly Line Today (Futurism )

Leading Cause of Death in U.S.? Hint: It Isn’t Covid-19 (Wall Street Journal )

Rolls-Royce Cullinan: A Bid for Rich Millennial Buyers (Wall Street Journal )

If Charlie Munger Didn’t Quit When He Was Divorced, Broke, and Burying His 9 Year Old Son, You Have No Excuse (joshuakennon )

Ariel Investments Chairman John Rogers: We’re buying stocks, ‘leaning in looking for opportunities’ (Yahoo! Finance )

An Apology for Small-Cap Value (Verdad )

Warren Buffett Berkshire Hathaway Annual Meeting Transcript 2020 (Rev )

Global Equities Hold Gains as Jobs Figures Land (Barron’s )

Why China’s Tech Stocks Are Rallying (Barron’s )

Insurance Stocks Are Cheap. Lincoln Could Double, J.P. Morgan Says. (Barron’s )

Norwegian Cruise Line CEO: ‘We expect to sail sometime in 2020’ (CNBC )

Hertz Seeks Lender Leniency or Faces Bankruptcy Within Weeks (Bloomberg )

Turning Oil Wells Back on Is Trickier Than Shutting Them Off (Bloomberg )

‘Who am I to be bold?’: Warren Buffett’s lack of stock purchases worries billionaire investor Leon Cooperman (Business Insider )

The Defense Haven Isn’t Overcrowded Yet (Wall Street Journal )

Royal Caribbean Cruises (RCL) says booked position for 2021 within historical ranges (Street Insider )

What Americans Will Do With Their 11-Year-Old Cars (24/7 Wall Street )

Top U.S., China trade officials agree to strengthen cooperation (Reuters )

A Disney resort will partially reopen in America surprisingly soon (Fox Business )

Michigan governor says auto plants can reopen Monday (MarketWatch )

Chess Is the New King of the Pandemic (Wall Street Journal )

Liberty Global, Telefonica to Combine U.K. Units, Creating $39 Billion Giant (Wall Street Journal )

China’s Auto Market Rumbles Back to Growth (Wall Street Journal )

ViacomCBS Shares Rise on Earnings Beat, Despite Slumping Revenue (Wall Street Journal )