Skip to content

- The Next Round of Bailouts Will Name Names (New York Times)

- For charitable givers, CARES Act offers big tax breaks (InvestmertNews)

- Big Biotechs Make a Big Statement (StockCharts)

- Time to Consider Herd Immunity For New York City And The Rest Of The Country (Insider Monkey)

- ECRI Weekly Leading Index Update: WLIg Inches Up (Advisor Perspectives)

- John Cena Is Just Getting Started (Men’s Journal)

- Jerry Seinfeld Spoofs James Bond in Netflix Trailer for ’23 Hours To Kill’ (Maxim)

- Bugatti Divo Will Be Delivered This Year (TheDrive)

- Chris Whalen on PPP Loans (Podcast) (Bloomberg)

- Pennsylvania’s Comeback from Coronavirus Shutdowns Could Determine the Outcome of the 2020 Presidential Race (Manhattan Institute)

- When Is It Safe To Ease Social Distancing? Here’s What One Model Says For Each State (NPR)

- How The Fed Fights Coronavirus (NPR Planet Money)

- Explore the Fascinating History of Soul Food (Mental Floss)

- Why Exercise Is So Good For You (Scientific American)

- How The Crisis Pushed The Fed Into New Territory (Podcast) (Bloomberg)

- Trump: Apple CEO sees coronavirus V-shaped economic recovery (Fox Business)

- Sweden keeping open during coronavirus protects its economy (Fox Business)

- Apple and Google’s new contact tracing tool is almost ready. Just don’t call it a contact tracing tool. (recode)

- Phased Opening for NYSE Floor Talked (Traders Magazine)

- The New Koenigsegg Gemera: The World’s First, Four-Seater Mega-GT (JustLuxe)

- This respected market-timing model just flashed a bullish four-year outlook for stocks (MarketWatch)

- Kanye West Vaults From Broke to Billions With Yeezy in Demand ()

- It’s the Physical Market That’s Broken, Not the Futures (Futures)

- As States Reopen, Hold Your Breath (Investors Business Daily)

- Stocks Could Gain 15% in the Next Year, Experts Say (Barron’s)

- Yes, Stocks Have Rallied. Just Don’t Get Complacent. (Barron’s)

- Covid Is Changing How We Eat. These Food Stocks Are Benefiting the Most. (Barron’s)

- Is That Jerry Jones on a…Yacht? Riding the Seas of the NFL’s ‘Virtual’ Draft. (Wall Street Journal)

- 4 ‘Oily Industrial’ Stocks to Buy After Oil’s Collapse (Barron’s)

- The Shock of Subzero Oil Will Shake the U.S. Energy Industry. 4 Stocks Worth a Look. (Barron’s)

- The Oil Market Has Gotten Weird. Here’s How Investors Can Make Sense of It. (Barron’s)

- Mnuchin Says Federal Government Might Take Stakes in Energy Companies (Barron’s)

- Trump pulls punches and clings to his China trade deal as backlash against Beijing grows (CNBC)

- Some Oil Producers Have Secret Weapon in Hedging (Wall Street Journal)

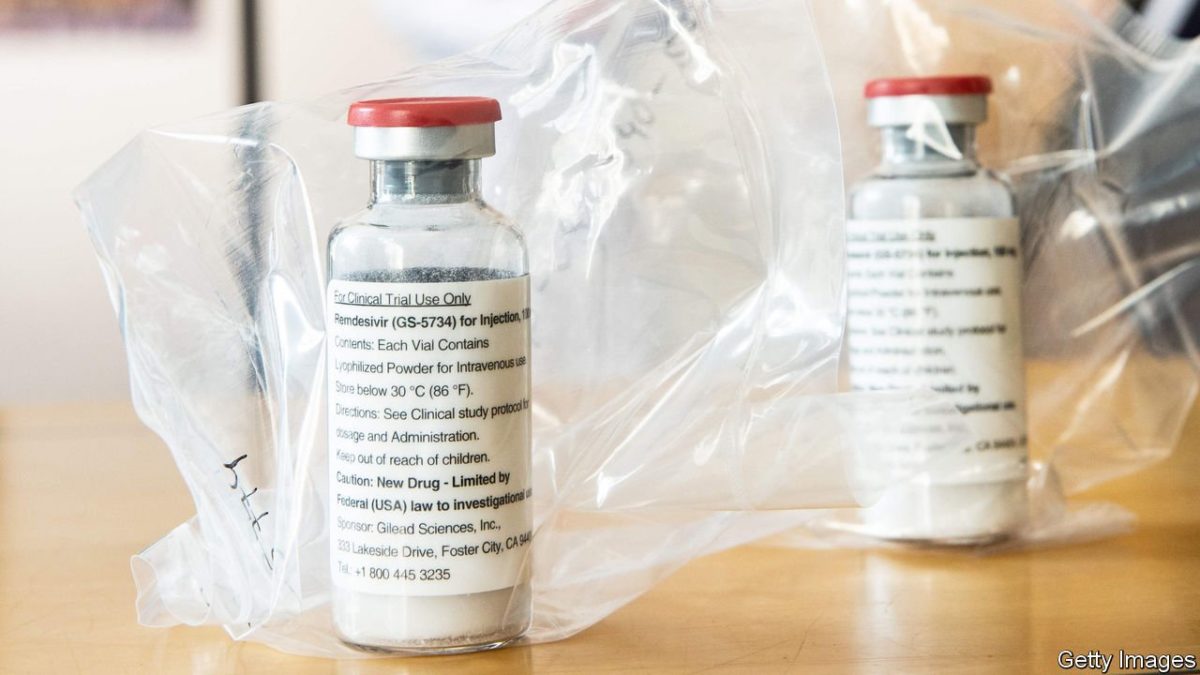

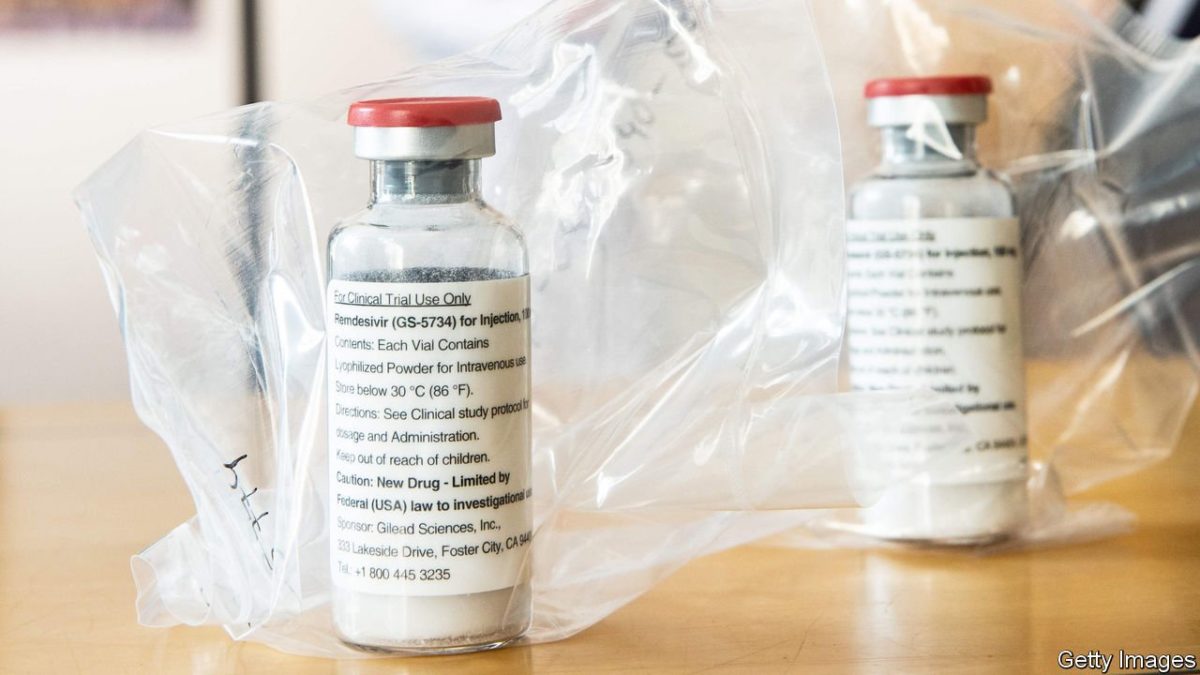

- Gilead Poised to Upend Market With Its First Covid-19 Study Data (Bloomberg)

- Mortgage bailout balloons by half a million more loans in one week (CNBC)

- Saudis Begin Curbing Oil Output Ahead of OPEC+ Start Date (Bloomberg)

- Famed ‘Big Short’ investor Steve Eisman explains why he’s betting big on major US banks (Business Insider)

- “Without Them, I Don’t Know What We’d Do†(Vanity Fair)

- Why stocks rebound before the economy (USA Today)

- ‘Capitalism as we know it will likely be changed forever’ and 9 other lasting implications of coronavirus, according to billionaire Leon Cooperman (MarketWatch)

- In the Coronavirus Era, the Force Is Still With Jack Dorsey (Vanity Fair)

- Why We Focus on Trivial Things: The Bikeshed Effect (Farnam Street)

- Apple Aims to Sell Macs With Its Own Chips Starting in 2021 (Bloomberg)

- Which Kind of Investor Could You Aspire to Be: Graham, Fisher, Lynch, Greenblatt, or Marks? (Focused Compounding)

- Bill Miller 1Q 2020 Market Letter (Miller Value)

- Facebook Announces Video Calls for Up to 50 People – Zoom Shares Tank (TheStreet)

- Autocrats see opportunity in disaster (The Economist)

- Will Coronavirus Wreck The Classic Car Market? (ZeroHedge)

- Change in Electricity Consumption (The Reformed Broker)

- U.S. Stock Futures Climb on More Coronavirus Aid (Barron’s)

- Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance)

- How Tanker Companies Like Teekay Are Profiting From the Oil Glut (Barron’s)

- This Famous Poker Player Can Help Investors Play a Tough Hand (Barron’s)

- Mustang Cobra Jet destroys quarter mile at 170 mph, all electric (USA Today)

- Don’t Try to Prepare for the Next Black Swan. You Can’t. (Wall Street Journal)

- Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance)

- Oil world zeroes in on Cushing, Oklahoma (Financial Times)

- Hedge Funds’ Favorite Stocks Were Hit Hardest in the Coronavirus Crash (Institutional Investor)

- Oxford scientists reveal coronavirus vaccine timeline as human trial begins (MarketWatch)

- The Kanye West, “Drive Slow†Stock Market (and Sentiment Results)… (ZeroHedge)

- Target says same-store sales rose more than 7% so far in first quarter as digital sales double (CNBC)

- Stocks Still Make Sense for The Long Term (Barron’s)

- The Next Coronavirus Package Might Not Pass Until June (Barron’s)

- Restaurant Chains Received Many of the Biggest Paycheck Protection Loans (Barron’s)

- Texas Instruments Bets Big on Shelf Life (Wall Street Journal)

- Private Equity to Get Squeezed Out of Another Stimulus Program (Bloomberg)

- Kuwait Cutting Oil Output Ahead of Schedule, Minister Says (Bloomberg)

- Germophobes Shunning Public Transit Give Carmakers a Bit of Hope (Bloomberg)

- Harvard Professor Reaps 17,000% Return on Early Moderna Bet (Bloomberg)

- Hot Pharma Stock Rallies After Strong Earnings (Investor’s Business Daily)

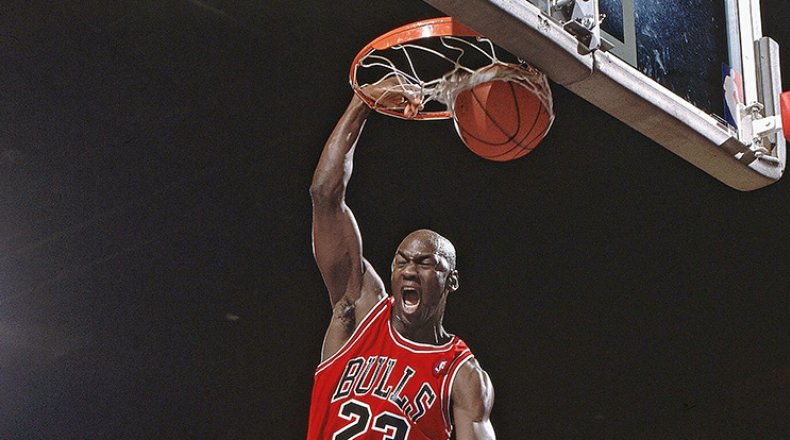

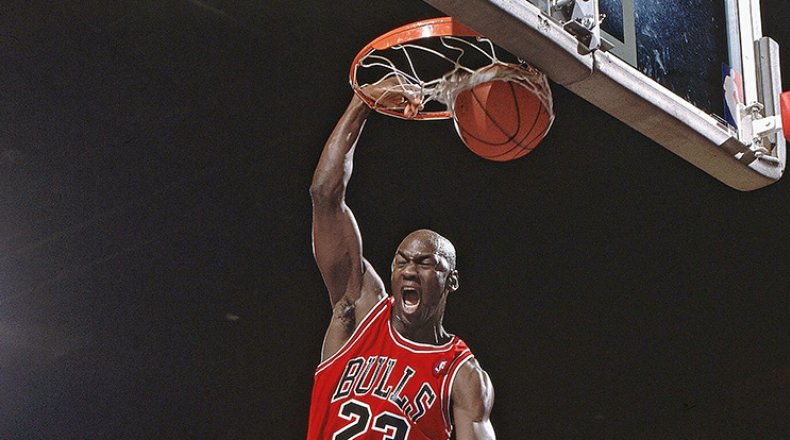

- What to Watch: The Return of Michael Jordan, the End of ‘Homeland’ (Wall Street Journal)

- 565 Americans Have Lost Their Job For Every Confirmed COVID-19 Death In The US (ZeroHedge)

- Las Vegas Sands predicts speedy recovery in Asia on pent-up gambling demand (StreetInsider)

- RBC Capital Handicaps Gilead Sciences (GILD) Upcoming Remdesivir Data (StreetInsider)

- 5 Buy-Rated Oil Stocks Trading Under $10 With Massive Upside Potential (24/7 Wall Street)

- Steve Forbes: How Trump can help our oil industry now and skip Pelosi’s stall tactics (Fox Business)

- The Curious Case of Dmitry Balyasny (Institutional Investor)

- The Chinese Trick That Could Save Oil (Yahoo! Finance)

- Oil jumps 25%, extending Wednesday’s rally as traders bet on US production cuts (CNBC)

- We’re Not Floating to Hell on an Oil Barrel (Bloomberg)

- Driving Data Tells the Story of Sheltering in Place (Barron’s)

- Record jump in Australian retail sales (MarketWatch)

- Texas Instruments Beats Earnings Expectations, Uses Financial Crisis to Set Guidance (Barron’s)

- Senate Passes Bill for More Small-Business Stimulus (Wall Street Journal)

- Escape from New York City (Wall Street Journal)

- Mortgage Firms Get a Reprieve on Paying Investors (New York Times)

- McDonald’s to give free ‘Thank You Meals’ for first responders, health care workers starting Wednesday (USA Today)

- Infect Everyone: How Herd Immunity Could Work for Poor Countries (Bloomberg)

- Lotus Is Gearing Up to Make a Car You Can Drive Every Day (Bloomberg)

- Larry Kudlow says oil should rebound as the economy starts to reopen (CNBC)

- Trump to US Navy: ‘Destroy’ Iranian gunboats that ‘harass our ships’ (Fox Business)

- AIMCo’s $3 Billion Volatility Trading Blunder (Institutional Investor)

- Expedia nearing deal to sell stake to Silver Lake and Apollo: WSJ (Street Insider)

- Kimberly-Clark shares rise after COVID-19 stockpiling drives earnings beat (MarketWatch)

- How a Mailman Still Carries On During Coronavirus (Wall Street Journal)

- Gucci’s Chinese Revenue up in April After Bruising First Quarter (Wall Street Journal)

- Peter Thiel’s Palantir Saw Coronavirus Coming. Now It Braces for the Impact. (Wall Street Journal)

- Oil price plunge below zero sends ‘oil tourists’ on wild ride (Reuters)

- Risk Parity Is Supposed to Be All Weather. That’s Not Happening. (Institutional Investor)

- No One: Absolutely No One: I Wonder What Phil Falcone Is Up To? (Institutional Investor)

- Georgia and South Carolina Will Begin To Reopen (Barron’s)

- Why Oil Turned Negative (Barron’s)

- Schumer says he believes Senate will pass small business relief bill Tuesday (CNBC)

- The Fed Is Buying $41 Billion of Assets Daily and It’s Not Alone (Bloomberg)

- Ferrari rolls out coronavirus testing to get staff ready for work. (Business Insider)

- Opinion: This is the one leading economic indicator stock investors should follow (MarketWatch)

- Less Than Zero: What Oil’s Crazy Day Means (Wall Street Journal)

- Online Gambling Is Booming Amid the Lockdown (Barron’s)

- RBC Capital Upgrades Abbvie (ABBV) to Outperform, Added to Offensive Positioning List (Street Insider)

- Twitter goes insane for ‘Last Dance’ premiere (USA Today)

- A $1.2 Trillion Fund Says Skip Earnings Season, Buy U.S. Stocks (Bloomberg)

- Mnuchin, Democrats Close on Virus Aid Deal Nearing $500 Billion (Bloomberg)

- 12 Stocks That Can Rocket Higher — but Aren’t For the Faint of Heart (Barron’s)

- Marc Andreessen asks why we don’t build things anymore – here are some possible answers (CNBC)

- Cuomo says New York will roll out antibody testing in ‘aggressive way’ this week (CNBC)

- Trump to use Defense Production Act to increase swab production amid coronavirus testing shortage (CNBC)

- Novartis, US drug regulator agree to malaria drug trial against Covid-19 (CNBC)

- Traders are using giant supertankers to store 160 million barrels of oil as the coronavirus torpedoes demand (Business Insider)

- ‘Warren Buffett created the template’: Mark Cuban said US officials should copy the investor’s past bailout deals (Business Insider)

- Here’s why the U.S. stock market rally has legs, strategist says (MarketWatch)

- Muzzled Activists Are Mixed Blessing for Companies (Wall Street Journal)

- Computers Were Going to Upend Home Buying. They Didn’t See the Coronavirus Coming. (Wall Street Journal)

- Inside Italy’s trials to find effective antibody tests for Covid-19 (CNN)

- Buy Stocks at Crisis ‘Epicenter’ as Lows Are In, Top Bull Says (Bloomberg)

- Barron’s Picks And Pans: Dropbox, Ford, Johnson & Johnson, Teladoc And More Yahoo! Finance)

- Annie Duke – Decision Making in a Crisis (Capital Allocators Podcast)

- EXCLUSIVE: Michael Milken lobbying Amazon to distribute free coronavirus tests (Fox Business)

- Inside $370B relief deal Mnuchin, Dems are very close to finalizing (Fox Business)

- DuPont Earnings Beat Estimates. That Could Help the Stock. (Barron’s)

- Governments Face Pressure to Ease Coronavirus Lockdowns (Wall Street Journal)

- Oil Plunges by Record to Below $11 With Storage Rapidly Filling (Bloomberg)

- Why Deflation Is Poison for Virus-Plagued Economies (Wall Street Journal)

- Typical April Trading: Strength from Start to Finish (Almanac Trader)

- ECRI Weekly Leading Index Update: WLIg At Lowest Levels (Advisor Perspectives)

- Starting to Think About Opening Day (FuturesMag)

- 5 Stock Picks from the Hedge Fund Manager Who Saw The Pandemic Coming (Insider Monkey)

- Doug Parker CEO Of American Airlines: US Treasury Has Been “Fair” Regarding Aid (ValueWalk)

- NY Fed Pres John Williams on coronavirus “We saw signs of concern and we acted promptly and decisively” (ValueWalk)

- Mark Cuban Calls for NBA Restart with No Fans, Says Owners Will Support (Breitbart)

- China now has more leading COVID-19 vaccine candidates than any other country (Fortune)

- Is remdesivir the drug that can kill the coronavirus? (The Economist)

- 16 Fascinating Facts About the Iconic Ferrari F40 (Robb Report)

- Real Estate Investors Are Set to Benefit from the Stimulus Bill (Architectural Digest)

- Hedge Fund and Insider Trading News: John Griffin, Jim Simons, Seth Klarman, Daniel Kamensky, Engaged Capital, JPMorgan Chase & Co. (JPM), Columbia Sportswear Company (COLM), and More (Insider Monkey)

- Severe truck driver shortage amid growing demand (OAN)

- Here’s What It Really Costs To Own Or Charter A Private Jet (TheDrive)

- Tom Hardy Goes Gangster In ‘Capone’ Trailer (Maxim)

- The US won’t run out of food during the coronavirus pandemic (Vox)

- Pennsylvania Is Place to Watch for Whether Post-Shutdown Recovery Works (Manhattan Institute)

- Episode 992: The Mask Mover (NPR Planet Money)

- Why Michael Jordan Was The Best (FiveThirtyEight)

- Boeing to restart operations at Philadelphia area plants next week (Fox Business)

- Chinese doctors using plasma therapy on coronavirus, WHO says ‘very valid’ approach (Reuters)

- A Feast for The Senses in Marrakech (justluxe)

- Drive-In Movie Theaters Thrive Despite Lack of New Titles: “People Just Want to Get Out” (Hollywood Reporter)

- Here’s How America Needs to ‘Reopen’ to Avoid Deeper Woes (Barron’s)

- Where Activist Investors Are Turning Their Focus to Now (Barron’s)

- Seoul’s Full Cafes, Apple Store Lines Show Mass Testing Success (Bloomberg)

- Bank Earnings Were Terrible. It’s Time to Buy the Banks. (Barron’s)

- Energy Hedge Fund That Shorted Oil Sees Chance for $100 a Barrel (Bloomberg)

- Charlie Munger: ‘The Phone Is Not Ringing Off the Hook’ (Wall Street Journal)

- Opinion: Vitamin D and Coronavirus Disparities (Wall Street Journal)

- Opening Up America Again (CDC/White House PDF Plan)

- Here’s why sauerkraut and kimchi sales have surged during the coronavirus (New York Post)

- Coronavirus Ushered in Medicine’s Digital Revolution (Barron’s)

- Big Pharma Sees Its Strengths Surface ()

- Reasons to Gobble Up Kraft Heinz’s Battered Shares (Barron’s)

- 3 Former United Technologies Stocks That Are Ready to Fly (Barron’s)

- Union Pacific Sees Biggest Insider Stock Buy in Years (Barron’s)

- Trump Announces $19 Billion Relief Program for Farmers (Wall Street Journal)

- Here Are the Companies Getting Federal Funds for Covid Relief (Bloomberg)

- ‘MacGyvering’: A Modern ‘Can-Do’ Approach To Bad Situations (Wall Street Journal)

- Wells Fargo, J.C. Penney, Amazon.com: Stocks That Defined the Week (Wall Street Journal)

- Procter & Gamble Posts Biggest U.S. Sales Gain in Decades (Wall Street Journal)

- Leaked Research: This Drug May Be Saving COVID Patients’ Lives (Futurism)

- Coronavirus latest: Hong Kong shows no need for total lockdown, says study (Financial Times)

- The Day of Reckoning for Private Equity (Institutional Investor)

- Warren Buffett’s financial crisis bailouts inspired the US government’s ‘big 4’ airline rescue deals (Business Insider)

- Pro golf plans to be the first major sport to return during the coronavirus pandemic (CNBC)

- Macy’s reportedly looking to use real estate to come up with cash during coronavirus pandemic (CNBC)

- Fed Says It Will Disclose Borrower Information in Crisis Lending (Bloomberg)

- These Are the Drugs and Vaccines That Might End the Coronavirus Pandemic (Bloomberg)

- Google seeks to launch a debit card with banks (USA Today)

- Standing on the Shoulders of Giants: The Key to Innovation (Farnam Street)

- A Primer On Reading Annual Reports (docdroid)

- Have Small Value Stocks Become a Bargain? (Morningstar)

- Gilead increases enrollment target for remdesivir trial in COVID-19 patients (Reuters)

- “Maybe He Doesn’t Want to Be the Hero”: In the COVID-19 Crisis, Warren Buffett is Lying Low (Vanity Fair)

- Virus Vaccine May Be Ready for Mass Production By Autumn, Oxford Professor Says (Bloomberg)

- Gilead Gains on Report Claiming Coronavirus Drug Working (Bloomberg)

- Covid Report: Gilead Pops On Promising Sneak Peek For Coronavirus Drug (Investor’s Business Daily)

- The Fear Gauge Is Sending False Signals (Barron’s)

- Why Emerging Market Currencies Are Cheap (Barron’s)

- Treasury yields follow stocks higher on hopes for coronavirus drug MarketWatch)

- AMC Entertainment’s stock rockets after liquidity update, private debt offering (MarketWatch)

- Schlumberger swings to large loss, misses revenue and cuts dividend by 75%; stock surges (MarketWatch)

- Trump administration working to ease drilling industry cash crunch (Reuters)

- Johnson & Johnson execs offer upbeat view of second-half recovery from COVID-19 pandemic (MarketWatch)

- Fed’s Bostic says watching closely for signs of ‘unbearable’ stress among mortgage servicers (MarketWatch)

- Boeing to Restart Jetliner Production (Wall Street Journal)

- Mnuchin Under Growing Pressure to Help Struggling Mortgage Companies (Wall Street Journal)

- Screening Rooms That Bring Hollywood Home (Wall Street Journal)