Skip to content

China Unleashes Stimulus Blitz in Push to Hit Annual Growth Goal (bloomberg )

China’s Stimulus Is a Big Deal. What It Means for Markets and Stocks. (barrons )

China Mulls Stock Stability Fund, Unlocks $113 Billion From PBOC (bloomberg )

China Unveils Biggest Package Yet to Boost Property Market (bloomberg )

China Unleashes Stimulus Package to Revive Economy, Markets (bloomberg )

China’s central bank unveils most aggressive stimulus since pandemic (yahoo )

China Panics: Cuts Multiple Rates And Reserve Ratio Requirements, Goes All-In To Prop Up Stocks (zerohedge )

Chinese Stocks Rally Most in Seven Months on Stimulus Blitz (bloomberg )

China unveils raft of measures to boost economy (bbc )

HK Disneyland Resort Ticket Prices to Rise 5-7% From Tmr (aastocks )

Alibaba, JD.com, NIO Stocks Surge After China Interest Rate Cut and New Stimulus (barrons )

Cash Is Pouring Out of Money-Market Funds. What’s Hot Instead. (barrons )

Chicago Fed’s Goolsbee sees ‘a lot’ of interest-rate cuts coming over the next year (marketwatch )

Five Key Takeaways as China Unveils Stimulus to Boost Economy (bloomberg )

Fed’s jumbo interest rate cut puts the U.S. on track for a soft landing, Goldman CFO says (cnbc )

September consumer confidence falls the most in three years (cnbc )

Why stocks have a lot more room to rally before hitting a peak, according to a technical analyst (businessinsider )

Here’s What Happens to Markets When Interest Rates Fall, in Charts (wsj )

Boeing Makes New Offer to Union in Hopes of Ending Strike (wsj )

China’s big-bang stimulus boosts yuan; Aussie up after RBA (streetinsider )

Foreigners are piling into China’s free money trade. How long can it last? (ft )

Perplexity in talks with top brands on ads model as it challenges Google (ft )

Alibaba’s DingTalk launches new service bundled with AI features (scmp )

PBOC to set up US$71 billion swap facility to prop up stock market (scmp )

PBOC Cuts With More to Come, Buybacks Roll On (chinalastnight )

Intel Stock Rises on Report of Apollo Investment. Why It’s a Good Sign. (barrons )

China Stimulus Hopes Add to Fed Cues as EM Stocks Hit July Highs (bloomberg )

China stimulus calls are growing louder — inside and outside the country (cnbc )

China’s youth unemployment hits fresh high amid economic slowdown and restrictive hiring policies (cnbc )

Nvidia Stock Is Slumping. What What Tesla Can Tell Us. (barrons )

The Dow at 50,000. How It Could Happen—and When. (barrons )

These Restaurants Are Ordering Up CEOs. How It Goes Down With the Stocks. (barrons )

Fed’s Bostic Sees a U.S. Economy Ready for Neutral Interest Rates (barrons )

Wall Street’s most cautious voice says defensive stocks are now too rich. What alternatives are left? (marketwatch )

Boeing’s Defense Head Leaves. Starliner Wasn’t the Only Reason. (barrons )

‘Reagan’ Defies Negative Reviews And Holds Strong In Box Office Top 5 (forbes )

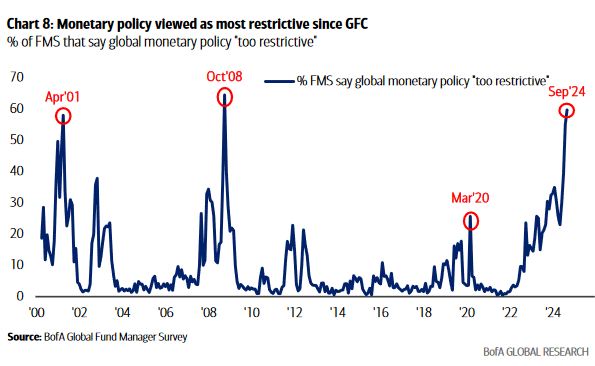

Investors cheer a soft landing scenario after Fed’s big rate cut. But they’re still keeping their guard up for a downturn. (marketwatch )

The Fed’s rate cut should make it easier to get a job — eventually. Here are the industries that could ramp up hiring first. (marketwatch )

How Bill Ackman Is Pursuing Howard Hughes’ Real Estate Empire (barrons )

Amazon Fell Behind in AI. An Alexa Creator Is Leading Its Push to Catch Up. (wsj )

The Rate Cut Happened. Not All Borrowing Costs Are Going Down. (wsj )

Elliott Hill Loved Nike and Left It. Now He’s Back as CEO (wsj )

How a Surfer Who Never Finished College Became a Biotech Billionaire (wsj )

Rather than taxing Americans on the money they earn at their jobs and on their investments, Mr. Trump instead suggested imposing a broad tax on the goods that Americans buy from abroad. In his view, such tariffs could replace income taxes as the main source of federal revenue. (nytimes )

Minneapolis Fed President Neel Kashkari: Fed is likely to make smaller rate moves going forward (youtube )

Bull Market Chance at 80% With Fed Cuts, Says Ed Yardeni (bloomberg )

How Foot Locker is waging a comeback after its breakup with Nike (cnbc )

S. business activity suffers small loss of momentum in September, PMI shows (marketwatch )

Alibaba Cloud unveils latest Qwen 2.5 LLM, CEO addresses speed of AI development (technode )

Alibaba, Nvidia collaborate on advanced autonomous-driving solution (scmp )

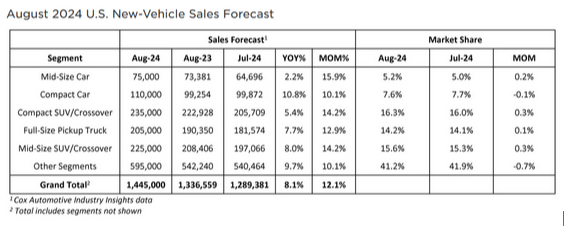

Cox Automotive Forecast: August U.S. Auto Sales Show Stability Amid Seasonal and Labor Day Boost (coxautoinc )

This Bulletproof Rezvani Vengeance SUV Has A Private Jet-Style Interior (maxim )

Qualcomm wants to buy Intel. Would that be enough to overtake Nvidia? (fastcompany )

AliViews: Eddie Wu Discusses AI, Alibaba Cloud and More at the 2024 Apsara Conference (alizila )

The Fed’s Jumbo Rate Cut Is a Sign of True Confidence (barrons )

Qualcomm Approached Intel About a Takeover in Recent Days (wsj )

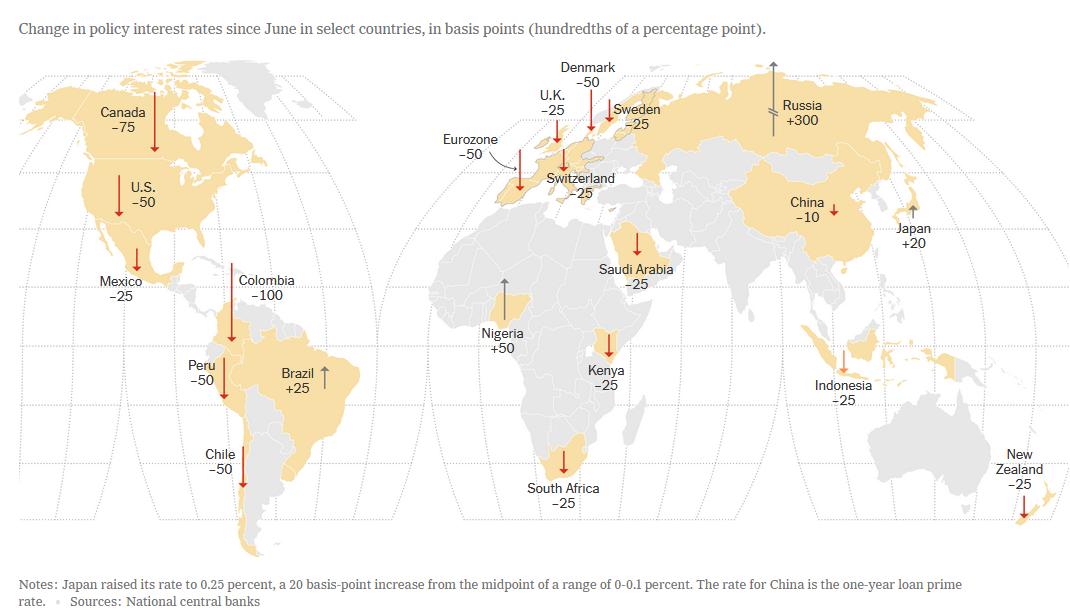

Interest Rates Fall, but Central Banks Are No Longer in Lock Step (nytimes )

Small-cap stocks post longest rally since 2021 after Fed rate cut. What’s next? (marketwatch )

Nike Has a New CEO. 4 Things to Know. (barrons )

The Price War in Weight-Loss Drugs Is Here (wsj )

The Work From Home Free-for-All Is Coming to an End (wsj )

Boeing ousts head of troubled space unit after astronauts left stranded, billions in losses (nypost )

Mobileye Jumps After Intel Says It Won’t Sell Majority Stake (bloomberg )

Why a top analyst just raised his year-end S&P 500 price target to the highest on Wall Street (businessinsider )

The mystery of Masayoshi Son, SoftBank’s great disrupter (ft )

Three Mile Island Plans to Reopen as Demand for Nuclear Power Grows (nytimes )

Lotus Unveils Wedge-Shaped ‘Theory 1’ Concept EV (maxim )

China Weighs Removing Major Homebuying Curbs to Boost Demand (bloomberg )

How Luxury Stocks Lost Their Shine. These Are the Ones That Will Get It Back. (barrons )

Small-Caps Are Outperforming. They Could Be the Stock Market’s Best Bet. (barrons )

Chinese Officials are also mulling measures to shore up stock market (bloomberg )

This Money Manager Likes Durable Businesses. 4 Industrial Stocks He’s Got His Eye On. (barrons )

Yen Weakens as Ueda Indicates BOJ Isn’t in Hurry to Hike Rates (bloomberg )

The Fed’s New R-Word Is ‘Recalibrate.’ Why Investors Love It. (barrons )

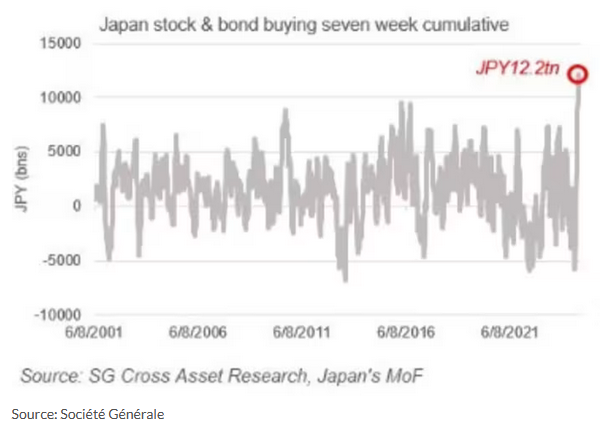

Analysts warned about the fallout from a surging yen. But then this happened. (marketwatch )

FedEx’s earnings miss may be more of a speed bump than a brick wall, analyst says (marketwatch )

This is what the Fed’s interest-rate cut means for distressed companies (marketwatch )

Hang Seng Index posts biggest weekly gain in 5 months (scmp )

Alibaba CEO eyes greater AI research and development, open sources 100 new LLMs (scmp )

Hong Kong cuts base rate by 50 basis points to reboot economy (scmp )

PayPal Stock Rises On Amazon Prime Checkout Partnership (investors )

PayPal, Amazon Team Up in ‘First Step’ of Branded Checkout Collaboration (barrons )

Central Bank Cuts Interest Rates in Half-Point Move (barrons )

Fed Officials See Cooler Inflation Ahead This Year (barrons )

Mortgage Rates Won’t Fall That Much. Don’t Be Too Disappointed. (barrons )

Fed’s Powell Isn’t Dovish or Hawkish. He’s Bullish. (barrons )

Small-cap stocks’ bullish ‘Fed day’ performance reflects investors’ confidence in the economy (marketwatch )

Bond market gets a Fed wake-up call after pricing in a recession (marketwatch )

Homeowners scramble to refinance with mortgage rates now at 2-year lows (marketwatch )

Here’s when falling interest rates will hit your mortgage, car loan, credit-card bills and savings accounts (marketwatch )

Starbucks should make this dramatic move to help its stock, BofA says (marketwatch )

Fed starts rate-cutting cycle with a bang — but wants it to be the only one (marketwatch )

Boeing Stock Is Steady Amid a Strike and Furloughs. Help Has Arrived. (barrons )

Big Rate Cut Forces Fed to Contend With New Obstacles (wsj )

The Fed Has Significantly Improved the Odds of a Soft Landing (wsj )

Fed Opts for Outsize Cut as Powell Seeks to Ensure Soft Landing (bloomberg )

Boeing starts furloughing tens of thousands of employees amid machinist strike (cnbc )

The Fed Isn’t First to Cut Rates, but It Is the Signal Other Central Banks Want (wsj )

Chinese chip stocks jump after claims of equipment breakthrough (finance.yahoo )

Apple iPhone 16 Pro Max review: Long battery life and great cameras. Apple Intelligence isn’t ready (cnbc )

Boeing Stock Is Steady as the Strike Continues. Help Has Arrived. (barrons )

3 ways the Fed interest-rate cut could jump-start buying and selling homes again (marketwatch )

Fed interest-rate cut boosts home builders confidence (marketwatch )

New-home construction posts biggest increase in 6 months (marketwatch )

A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch )

Chinese consumption edged up slightly during a major holiday this week from its pre-pandemic level (bloomberg )

Chinese Stocks Edge Up as Mainland Markets Reopen After Break (bloomberg )

Fed’s ‘Reverse Repo’ Balance Fell to Lowest Level in Over 3 Years. Why It Matters. (barrons )

Dollar Stores Expand Aggressively Even as Sales Shrink (wsj )

Intel stock jumps on plan to turn foundry business into subsidiary and allow for outside funding (cnbc )

Intel to Make Custom AI Chip for Amazon (bloomberg )

Big names like David Tepper and ‘Big Short’ investor Michael Burry are quietly upping their bets on the Chinese economy (cnbc )

Fed to cut rates by a quarter point with a soft landing expected, according to CNBC Fed Survey (cnbc )

China seeks a homegrown alternative to Nvidia — these are some of the companies to watch (cnbc )

Markets Hinge on Powell Emulating Greenspan’s Soft Landing (bloomberg )

A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch )

Intel, Aiming to Reverse Slump, Unveils New Contracts and Cost Cuts (nytimes )

Opinion: Why Intel’s latest move for its foundry business is so significant (marketwatch )

U.S. Officials Jet to Beijing Amid Flood of Cheap Chinese Exports (wsj )

Amazon Tells Workers to Return to Office Five Days a Week (wsj )

Boeing, union negotiators to meet as striking workers dig in (reuters )

This is the only Fed that eased while inflation surged all the way to its peak, says Jim Paulsen (cnbc )

Intel’s Turnaround Is Working. Buy the Dip. (barrons )

Intel made 3 big announcements since solvency concerns: Thomas Hayes (foxbusiness )

Life in the Fast Lane for PayPal? New Partnerships Could Boost the Stock. (barrons )

Markets should trade well into FOMC meeting, and for a few weeks after, says Fundstrat’s Tom Lee (cnbc )

Yen Strengthens Beyond 140 Per Dollar for First Time Since 2023 (bloomberg )

The Fed Should Go Big Now. I Think It Will. (bloomberg )

The 10 Best Hotels in North America, According to the Michelin Guide (bloomberg )

The Fed Meeting Isn’t the Only Rate Decision to Watch. Why Japan Could Matter More. (barrons )

Disney Deal With DirecTV Ends Blackout of ESPN, ABC (barrons )

13 times this has occurred, the S&P 500 has rallied 18% on average over the next 12 months (marketwatch )

Boeing labor issue likely to be a final milestone before news turns more constructive: Citi (streetinsider )

$2.1 Billion Net Flows To Alibaba In First Week of Connect, Week in Review (chinalastnight )

It’s Time to Start Wearing Vans Again (gq )

Vans’ Classic Skate Shoes Look Dapper as Preppy Brogues (highsnobiety )

Biden Targets Temu With Import Rule. Impact Could Go Beyond PDD Stock. (investors )

Schlumberger Stock Was Once as Hot as Nvidia. Why It’s a Buy. (barrons )

The Man Who Made Nike Uncool (bloomberg )

Peter Lynch on Big Winners and Patience (dgi )

Price is what you pay, value is what you get (dgi )

6-foot-8 Christo Lamprecht’s unique and fascinating golf swing, explained (golfdigest )