Skip to content

What the Stock Market Did Under Every President in the Last 100 Years ( 24/7 Wall Street )  The Grinch is Dead! ( YouTube )  Berkshire Hathaway Is a Top Stock for 2020. Here’s Why. ( Barron’s )  7 Internet Stocks To Buy For 2020, According to a Veteran Tech Analyst ( Barron’s )  The Top Biopharma Calendar Events to Watch Going Into 2020 ( )  Why Boris Johnson will not go for a ‘hard’ Brexit, but a slow Brexit ( FN London )  China to take measures to support jobs amid economic slowdown ( Reuters )  Funding Secured for Tesla Shareholders ( Wasll Street Journal) Bet on These 16 Value Stocks in 2020, Goldman Sachs Says ( Yahoo! Finance )  Warren Buffett’s likely successor will be Geico’s next CEO — here’s how he prepared Todd Combs for the role ( Business Insider ) Â

Banks Get Tough on Shale Loans as Fracking Forecasts Flop ( Wall Street Journal ) This strategist picked two blockbuster stocks in 2019 — here’s what he likes for 2020 ( MarketWatch ) China to Cut Tariffs on Range of Goods Amid Push for Trade Deal ( Wall Street Journal ) What is the Santa Claus Rally? ( USA Today ) China Vows More Support for Private Sector to Stabilize Growth ( Bloomberg ) Robert Shiller: A Trump effect could drive the record market rally through 2020 ( CNBC ) No. 1 Stock Market in Americas Forecast to Climb 15% Next Year ( Yahoo! Finance ) Oil billionaire schools Elizabeth Warren on energy industry ( Fox Business )

Peter Lynch Draws on 50 Years of Stock-Picking to Find Growth Opportunities in (Barron’s )

Warren Buffett’s favorite Christmas gifts include See’s Candies, dresses, and $10,000 in cash (Business Insider )

Today’s MarketWe Buy A Junk Bond! (NPR Planet Money )

China Mobile Dominates the World’s Biggest Market. Its Stock Is Cheap. (Barron’s )

Episode 958: When Reagan Broke the Unions (NPR Planet Money )

How Artificial Intelligence Is Totally Changing Everything (howstuffworks )

History’s Largest Mining Operation Is About to Begin (The Atlantic )

Warren Buffett Says Anyone Can Achieve Success by Following This 1 Personal Rule He Lives By (Inc. )

Space Force will start small but let Trump claim a big win (Fox Business )

Natural Gas Futures Gain as Bulls Look to Early January for Colder Temps (naturalgasintel )

Almost No One’s Starting New Hedge Funds Anymore (Institutional Investor )

10 of the Best Energy Stocks to Buy for 2020 (Yahoo! Finance )

Barron’s Picks And Pans: Alibaba, Biogen, China Mobile, Peter Lynch Picks And More (Yahoo! Finance )

Xi Jinping says ‘phase one’ trade deal benefits both US and China, seeks to sign as soon as possible (CNBC )

DuPont Gets Better End of Deal (Morningstar )

Lowest-rated US bonds end the year with a bang (Financial Times )

Boris Johnson’s Biggest Problem: What to Do Next (Bloomberg )

‘Put all your eggs in one basket and watch the basket very carefully’: Here are 13 brilliant quotes from billionaire investor Stanley Druckenmiller (Business Insider )

The 2010s Were the Upside-Down Decade (Barron’s )

This CRISPR Stock Is A 2020 Top Pick — But Will Gene Editing Succeed? (Investor’s Business Daily )

The Oil Situation (ValuePlays )

The Beginning of a New Bull Market In Stocks? (All Star Charts )

Consumer sentiment rises for December despite Trump’s impeachment (CNBC )

How the Icahn-Ackman ‘Battle of the Billionaires’ on CNBC became a defining moment of the decade (CNBC )

When Warren Buffett Thanks You for “Client Alpha” (Validea )

How Vevo’s Artistic and Scientific Approach to Music Videos Is Paying Off After 10 Years (Fortune )

Jim Cramer Says Democratic Debates Show How Badly China’s Xi Needs a Deal (TheStreet )

Amazon Blocked Sellers From Using FedEx And Now We Know Why (Forbes )

2019 Market Strength Could Give Election-Year 2020 A Boost (Almanac Trader )

The Forbes Investigation: Inside the Secret Bank Behind the Fintech Boom (Forbes )

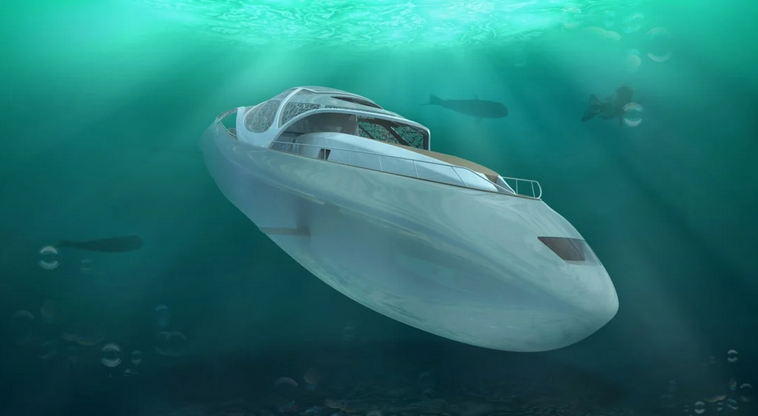

This 256-Foot Superyacht Transforms Into An Actual Submarine (Maxim )

ECRI Weekly Leading Index Update (Advisor Perspectives )

iPhone maker reportedly building secret satellite team as 5G race speeds up (FoxBusiness )

Florida SBA’s Strategic InvestmentTeam Has It Eye on Energy (Institutional Investor )

Fidelity mutual fund guru Peter Lynch: Market will be higher in 10 years (FoxBusiness )

These 10 S&P 500 stocks were lousy in 2019, but they could return 40% or more in 2020 (MarketWatch )

China can fulfil $40 billion U.S. farm purchase pledge: consultancy (Reuters )

3 Top Retail Picks for Stronger Than Expected Gains in 2020, With Runners-Up (24/7 Wall Street )

The Secure Act Has Passed. 2 Insurance Stocks That Could Benefit. (Barron’s )

There’s Still More Upside to Squeeze Out of My On-Fire Energy Picks (TheStreet )

U.K. Picks Safe Hands to Lead Central Bank (Barron’s )

10 Undervalued Energy Stocks for 2020 (24/7 Wall Street )

Biotech Stocks Are In a Position to Break Out in 2020, Analysts Say (MarketWatch )

Opinion: Takeaway from Abu Dhabi money conference: So much money is looking to find a home (MarketWatch )

BOJ to begin lending ETFs to prop up market liquidity (Reuters )

The J. Paul Getty (Energy) Stock Market (and Sentiment Results) (ZeroHedge )

Oil Stocks To Buy As Prices Rebound: Here Are U.S. Shale, Market Cap Leaders (Yahoo! Finance )

Think the Dow Is OId-Fashioned? It Beat the S&P 500 Over 5 Years. (Barron’s )

The Best Cars—Including Two Electric Vehicles—I Drove in 2019 ()

Tesla shares close at a record high. Next stop $420? (CNBC )

‘I couldn’t have been more wrong’: Legendary investor Stanley Druckenmiller reveals a mistake he made that cost him major market returns (Business Insider )

The ‘ultimate smart money indicator’ is signalling a big move in the stock market by the end of the week (MarketWatch )

China says in touch with U.S. on signing of Phase 1 trade deal (Reuters )

Biotech Analysts See Deals, Drug Data Carrying 2020 Performance (Yahoo! Finance )

Investors Pony Up More Than $2B for Distressed Fund (Institutional Investor )

US House poised to approve USMCA trade deal (Financial Times )

DuPont Has Narrowed Its Focus. Analyst Sees a Winner for 2020. (Barron’s )

8 Oil Stocks Goldman Sachs Says to Buy in 2020 (Barron’s )

Stanley Druckenmiller Is Embracing Risk Again, Just ‘Timidly’ (Bloomberg )

U.S. Energy Chief Shrugs Off Permian Oil Slowdown as a ‘Pause’ (Barron’s )

Saturday before Christmas expected to be the biggest U.S. shopping day of 2019 (Reuters )

Why Fund Managers Are Cranking Up the Risk (Institutional Investor )

Trump adviser hints at next big trade deal (Fox Business )

The U.S. housing market is taking off: Morning Brief (Yahoo! Finance )

A Berkshire Hathaway decade in review: Here are the biggest takeaways from Warren Buffett’s annual shareholder letters (Business Insider )

Dollar Is Poised to Weaken Just in Time (Bloomberg )

The Two Countries Dictating Oil Prices In 2020 (Yahoo! Finance )

The Trade Deal Doesn’t Fix Everything. The Market Doesn’t Care. (Barron’s )

Animal-Care Provider Zoetis and 6 More Companies Are Raising Dividends (Barron’s )

Global Economy Shows Signs of Regained Footing (Wall Street Journal )

Upbeat Chinese Economic Data Buoy Commodities (Wall Street Journal )

This year’s really big rally doesn’t mean 2020 needs to be a down year, history shows (CNBC )

UK unemployment falls to lowest level since 1975 (BBC )

US Single-Family Building Permits Reach 12-Year High (Zero Hedge )

Worst to First in 2020 (Oil Stocks)? (Yahoo! Finance )

7 Greatly Undervalued Dow Stocks for Upside and Dividends in 2020 (24/7 Wall Street )

Embattled Oil Stocks Occidental and Chesapeake See Large Insider Buys (Barron’s )

Lighthizer Scores a Trifecta of Wins for Trump’s Trade Agenda (Bloomberg )

A Warren Buffett Protégé on the Most Critical Thing She’s Learned About Turning Companies Around (Fortune )

Opinion: There’s more upside for biotech even after 24% gains in two months (MarketWatch )

Villains or visionaries? Hedge funds short companies they say ‘greenwash’ (Reuters )

Fresh off election win, Boris Johnson seeks new Brexit legislation ‘before Christmas’ (MarketWatch )

Stock market ‘melt-up’ coming soon: Bank of America (FoxBusiness )

Bond funds revel in white-hot year for fixed income (Financial Times )

Analysts: 9 Stocks Will Grow Sales The Most Next Year (Investor’s Business Daily )

Barron’s Picks And Pans: Charles Schwab, Disney, Sprint, Netflix And More (Yahoo! Finance )

Biotech Stocks Are Poised to Rise in 2020, Analyst Says. Here Is His Top Pick. (Barron’s )

The Pound Is Only Heading in One Direction (Bloomberg )

Where Can Investors Find Value in a Long Bull Market? Here Are Our 10 Stock Picks for 2020. (Barron’s )

Lachlan Murdoch Purchases ‘Beverly Hillbillies’ Mansion for Record Price (Fortune )

Here’s What Every Michelin 3-Star Restaurant in the US Is Serving on New Year’s Eve (Robb Report )

We Have a Trade Deal and Brexit Clarity. That’s Good News for Stocks. (Barron’s )

TOP 10 concept cars of 2019 (designboom )

This Mind-Blowing Mojave Desert Compound Will Train Astronauts For Life on Mars (Maxim )

Fed’s Clarida Dismisses Weak Retail Sales, Says Outlook Solid (Bloomberg )

Artificial Intelligence And Machine Learning Lead Charts: 2020 Tech Trends (ValueWalk )

The Top 20 Destinations For 2020 (Forbes )

ECRI Weekly Leading Index Update (Advisor Perspectives )

China to target around 6% growth in 2020, step up state spending: sources (Reuters )

U.S. Mnuchin says trade deal with China to boost global economy (Reuters )

Warren Buffett said an 89-year-old carpet seller would ‘run rings around’ Fortune 500 CEOs. Here’s the remarkable story of Mrs B (Business Insider )