Skip to content

Oil Companies Are Finally Pumping Out Cash. That’s Good News for Their Stocks. (Barron’s )

Buy Occidental Petroleum Stock, Morgan Stanley Says. Its Dividend Is ‘Best-In-Class.’ (Barron’s )

JPMorgan posts record profit in strong start to US earnings season (Financial Times )

Citigroup earnings beat expectations on 49% fixed-income trading surge (CNBC )

For Howard Marks, Investing Is Like a Game (Institutional Investor )

Hedge fund puts $550m into technology stock option financing (Financial Times )

EXCLUSIVE: JPMorgan CEO Jamie Dimon praises ‘phase one’ US-China trade deal (Fox Business )

2 GM engineers arrested after 100-mph Kentucky joyride in new Corvettes (USA Today )

Big Commitments for China Energy/Ag Buys in Phase 1 Trade Deal (Reuters )

Worry over ‘Japanification’ of the economy is overblown (Barron’s )

Warren Buffett Should Buy FedEx. It’s Cheap and Elephant-Sized. (Barron’s )

Xi Strikes Optimistic Tone After Riding Out Trade War With Trump (Bloomberg )

Stocks Continue to Rise. How Much Is Due to the ‘January Effect?’ (Barron’s )

Trump administration nears decision on LNG shipping by train (Financial Times )

Goldman Sachs says Europe’s stocks have a huge ‘cushion’ not seen since the financial crisis (Business Insider )

Commodities may not stay cheap forever (Financial Times )

History will repeat itself when it comes to stocks in 2020, Goldman Sachs says (MarketWatch )

Biotech Stocks Could Soar In 2020 On CRISPR Gene Editing And Precision Medicine (Investor’s Business Daily )

Time to Buy Long-Dated TIPS, Says Bank of America (MarketWatch )

Stock Picker Who Pummeled The Market By 76% Reveals His 2020 Bets (Investor’s Business Daily )

China’s yuan rallies, yen slides ahead of U.S. trade deal (Street Insider )

Photos of Yelp’s top 100 places to eat in 2020 (USA Today )

U.S.-China phase one trade deal: 7 things you need to know (FoxBusiness )

Barron’s Picks And Pans: Apple, Bank of America, Lockheed Martin And More (Yahoo! Finance )

January Expiration Week: Mixed Bag Last 21 Years (Almanac Trader )

The Man Who’s Spending $1 Billion to Own Every Pop Song (Medium )

U.S., China agree to have semi-annual talks aimed a reforms, resolving disputes: WSJ (Reuters )

Hedge Fund and Insider Trading News: Chase Coleman, Ray Dalio, Daniel Loeb, Ken Griffin, Salesforce.com, Inc. (CRM), Goldman Sachs Group Inc (GS), and More (Insider Monkey )

Where’s Your Flying Car? Hyundai and Uber Say They’re Working on It (New York Times )

The 8 Most Beautiful Castle Gardens in Europe (Architectural Digest )

Bloomberg Spent $200 Million and Isn’t on Track to Score a Single Delegate (The Daily Beast )

Nashville Goaltender Pekka Rinne Scores NHL’s First Goalie Goal In Six Years (digg )

avatar-inspired mercedes-benz VISION AVTR concept car lands at CES 2020 (designboom )

Matthew Benkendorf on Managing Equities (Podcast) (Bloomberg )

The 1970 Plymouth Superbird Won 18 NASCAR Races. Now You Can Buy a Street-Legal Version of Your Own. (Robb Report )

ECRI Weekly Leading Index Update (Advisor Perspectives )

This Custom 1970 Dodge Challenger Has 2,500 Horsepower Under the Hood (Maxim )

Will Northrop Grumman Stock Be a Top Performer Again in 2020? (24/7 Wall St. )

Trump called Iran’s bluff. And he won. (Washington Post )

The St. Louis Blues Are Finding New Ways To Beat The Odds (FiveThirtyEight )

The new tools of monetary policy (Ben Bernanke )

Issues 2020: A Fracking Ban Would Trigger Global Recession (Manhattan Institute )

What It’s Like to Be an Investor in Iran’s Market Now (Podcast) (Bloomberg )

How I Built This with Guy Raz Dell Computers: Michael Dell (Apple )

Biotech Looks for Fireworks in First Quarter to Regain Momentum (Bloomberg )

Bet on the Big Banks — and Bank of America (Barron’s )

Davos? Meet Me at Butternut Instead. (Barron’s )

A New Hot Spot for Oil Could Boost These 4 Companies (Barron’s )

Davos? Meet Me at Butternut Instead. (Barron’s )

Biogen Awaits a Decision on a Key Patent. At Risk Is Its Biggest Drug (Barron’s )

Trump Allies Explore Buyout of Conservative Channel Seeking to Compete With Fox News (Wall Street Journal )

New Sanctions Power Could Squeeze Remaining Iranian Trade Channels (Wall Street Journal )

The Internet of Things Is Changing the World (Wall Street Journal )

Trump Says Iran Had Planned to Attack Four U.S. Embassies (Bloomberg )

Hummer is back as GM revives name for electric pickup (USA Today )

S&P 5,000? Why one fund manager says that milestone may be reached sooner than you would expect (MarketWatch )

These were the most talked-about products at CES (CNN Business )

Mark Zuckerberg Says He Hunts Wild Boar With a Bow and Arrow (Futurism )

Penn Jillette on Magic, Losing 100+ Pounds, and Weaponizing Kindness (#405) (Podcast )

The Four Traits of Successful Asset Managers (Institutional Investor )

Gradual Improvements Redux (theirrelevantinvestor )

Client for Life (The Reformed Broker )

Is Vulnerability a Choice? (Farnam Street )

Eight lessons from market history (Evidence Investor )

The Stock Market Was Up the First 5 Days of 2020. Here’s What History Says Will Happen Next. (Barron’s )

After A Sizzling End To 2019, Biotech Stocks Could Soar In 2020 (Investor’s Business Daily )

Stocks More Than Doubled Over the Last Decade. Many Investors Missed Out. (Institutional Investor )

Facebook Says It Won’t Back Down From Allowing Lies in Political Ads (New York Times )

Warren Buffett calls this ‘indispensable’ life advice: ‘You can always tell someone to go to hell tomorrow’ (CNBC )

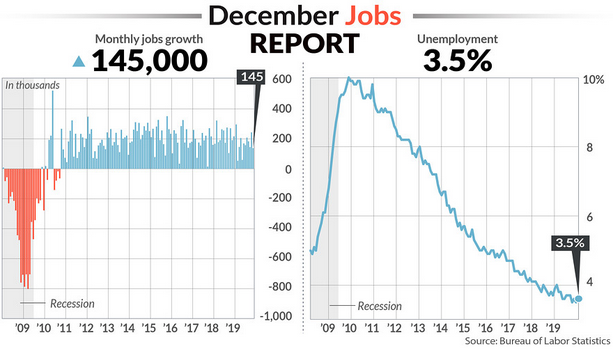

The U6 unemployment rate fell to 6.7% to mark the lowest level on record (MarketWatch )

Fed’s Bullard, Kashkari Favor Holding Interest Rates Steady (Wall Street Journal )

Top 2019 Stock Picker Spotted Under-the-Radar Tech (Bloomberg )

Red-Hot Biotech Stocks Brace For Key Meeting — Here’s What To Expect (Investor’s Business Daily )

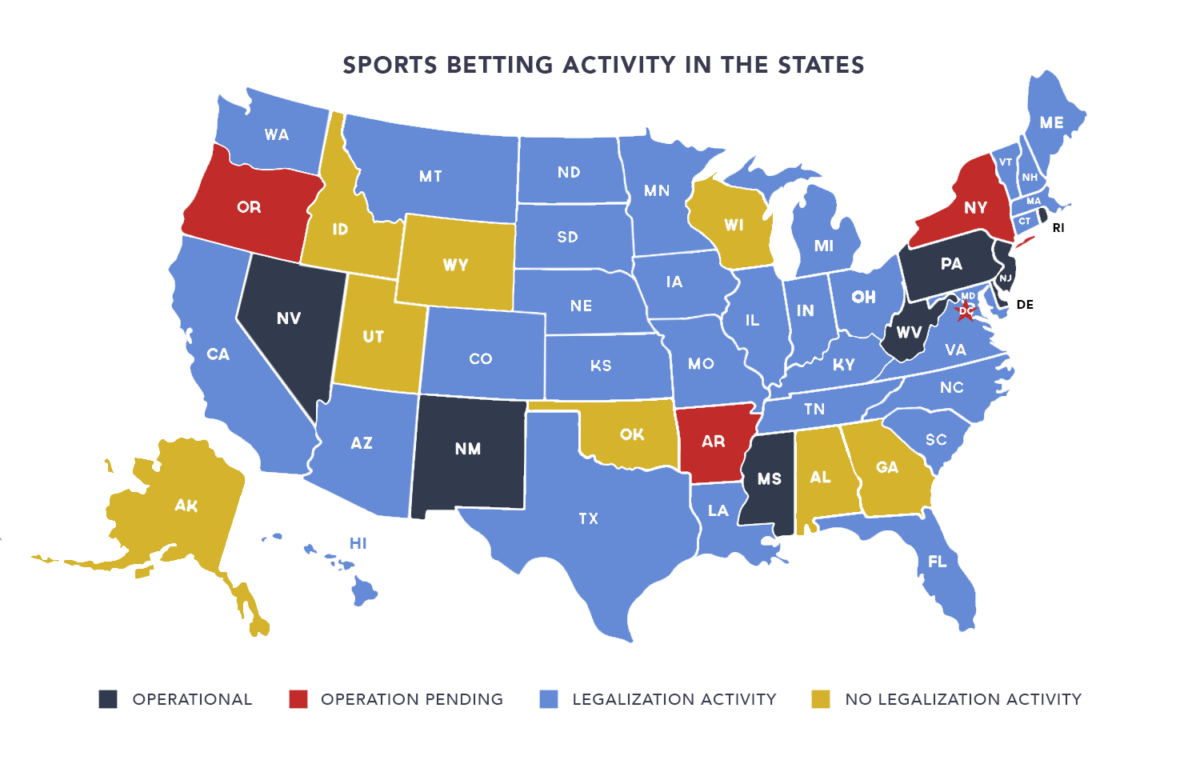

Legal sports betting: California among states set for 2020 push (Fox Business )

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results) (ZeroHedge )

Taco Bell Offering $100,000 Salary Amid Mounting Worker Shortage (Bloomberg )

Defense Stocks Have Climbed on Mideast Tension. The Run Isn’t Over. (Barron’s )

City bosses reveal their bargains and bubbles for 2020 (Financial News )

Divergent paths: Oil, natural gas going different directions (for now) (Reuters )

Pepperidge Farm releasing its first gluten-free products – Farmhouse Thin & Crispy cookies (USA Today )

XPO Logistics CEO Brad Jacobs Centers His Strategy Around Tech (Investor’s Business Daily )

To Save Avon, New Owner Comes Calling on Social Media (Wall Street Journal )

Nothing scares Jeffrey Gundlach more than Bernie Sanders (MarketWatch )

Starbucks, Lowe’s and 6 Other Consumer Stocks That Could Shine in 2020 (Barron’s )

3 Oil Stocks to Buy and 1 to Avoid in 2020, According to an Analyst (Barron’s )

Iran’s Forewarned Strikes Give Trump a Path to Avert All-Out War (Bloomberg )

Here’s What Could Take the Dow Up to 32,000 in 2020 (24/7 Wall Street )

For India’s Battered Small Caps, Patience Is Virtue, ICICI Says (Bloomberg )

US debt investors seek protection against inflation (Financial Times )

Expert: These Will Be The Biggest Hedge Funds Trends Of 2020 (Benzinga )

How 7-Eleven Struck Back Against an Owner Who Took a Day Off (New York Times )

New cars hit the LA Auto Show (USA Today )

Byron Wien makes some bold 2020 calls in his widely followed surprises list including 2 rate cuts (CNBC )

Bet on these big names to use their scale to squeeze out smaller rivals, says Jefferies (MarketWatch )

US trade deficit plunges to more than 3-year low (Fox Business )

RBC Capital Markets Out With First Top Picks Equity List for 2020 (24/7 Wall Street )

Oil tycoon Harold Hamm predicts 19% jump in U.S. oil prices within six months, ‘regardless of what happens’ in the Mideast (MarketWatch )

U.S. Consumer Tech Sales Projected to Increase 4% in 2020. These Trends Will Drive the Growth. (Barron’s )

‘Bad’ Manufacturing Data Contained Good News for Industrial Stocks. Here’s Why. (Barron’s )

UK economy boosted by ‘greater Brexit clarity’ after conservative win (Fox Business )

Barron’s Picks And Pans: Amazon, Dine Brands, Walgreens And More (Yahoo! Finance )

Top Energy Stocks for January 2020 (Investopedia )

Don’t laugh: Here’s why the ‘great rotation’ from bonds to stocks could finally happen in 2020 (MarketWatch )

Here’s how the Dow and S&P 500 perform in years after they ring up gains of 20% (MarketWatch )

The Tech That Will Invade Our Lives in 2020 (New York Times )

Inside the world of one of YouTube’s most popular food vloggers (Vox )

‘Points Guy’ Brian Kelly on Maximizing Travel Rewards (Podcast) (Bloomberg )

Typical January Trading: Volatile Last 20 Years (Almanac Trader )

The MMT backlash takes a new form (FT Alphaville )

Hedge Fund and Insider Trading News: Bill Ackman, Marshall Wace, Greenlight Capital, Becton Dickinson and Co (BDX), On Track Innovations Ltd (OTIVF), and More (Insider Monkey )

This Icelandic Retreat Is Reminiscent of a Bond Villain’s Lair (Fortune )

22 of the Most Expensive Homes in the World for Sale (Robb Report )

18 Travel Experiences To Add To Your Bucket List In 2020 (BuzzFeed )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Here’s What’s Coming To Netflix, Hulu, Amazon, HBO and Disney+ in January (Maxim )

Episode 216: How Four Drinking Buddies Saved Brazil (NPR Planet Money )

The Great British Bicycle Bubble (NPR Planet Money )

Salesforce CEO Marc Benioff Runs a $143 Billion Company From an iPhone. Here’s Why That Makes Perfect Sense (Inc. )

Why So Many Emerging Markets Are Blowing Up Right Now (Podcast) (Bloomberg )

Scientists Spot Addiction-Associated Circuit in Rats (Scientific American )

Issues 2020: A Fracking Ban Would Trigger Global Recession (Manhattan Institute )

Top 10 Tips to Meet Your New Year’s Resolution. (LiveLux )

20 Questions We Have for the 2020s (Popular Mechanics )

713: The Tipping Point Between Failure and Success (Harvard Business Review )