Skip to content

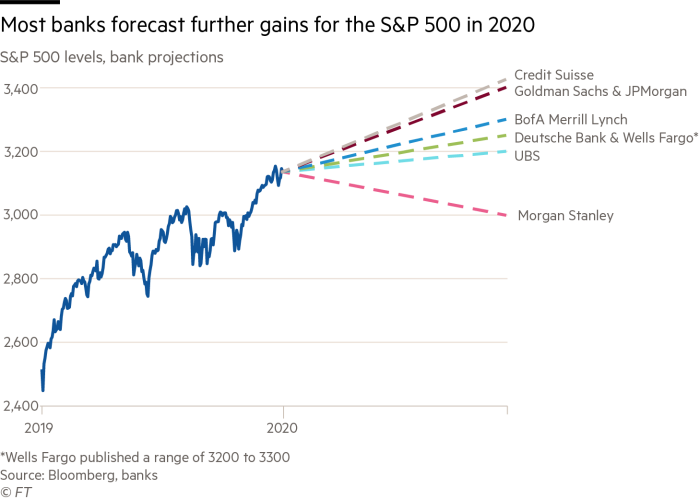

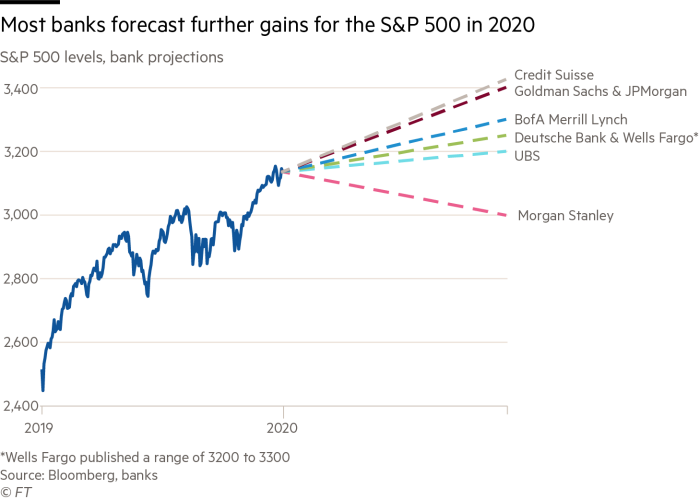

- Wall Street expects bull run to continue in 2020 (Financial Times)

- OPEC sees small 2020 oil deficit even before latest supply cut (Reuters)

- Industrial Stocks Could Rebound on Trade News, Analysts Say (Wall Street Journal)

- The 5 books Bill Gates recommends you read this holiday season (CNBC)

- Exxon Mobil prevails in New York climate change lawsuit (Reuters)

- The stock market will ‘breathe a sigh of relief’ if President Trump is re-elected in 2020, says billionaire Howard Marks (MarketWatch)

- Asleep No More, Traders Buy Hedges ‘Like World Is About to End’ (Bloomberg)

- Ray Dalio Is Now Mentoring Hip-Hop Mogul Sean ‘Diddy’ Combs (Bloomberg)

- Saudi Aramco shares jump 10% in oil group’s trading debut (Financial Times)

- Bank of America is becoming the Amazon of retail banking (Yahoo! Finance)

- Jobs surge boosts housing market (FoxBusiness)

- Brexit Stocks That Could Soar If Boris Johnson Wins the U.K. Election (Barron’s)

- The ‘Dividend Aristocrats’ have nearly matched the S&P’s return (Barron’s)

- The Federal Reserve Is Primed to Launch ‘QE4’, Strategist Says. Others Say That’s Not Likely. (Barron’s)

- Sicilian Homes Went Up for Auction Starting at €1. More Than 100,000 People Called. (Wall Street Journal)

- Ken Griffin Has Another Money Machine to Rival His Hedge Fund (Bloomberg)

- The Fed is expected to hold rates steady and vow to keep short-term lending markets stable (CNBC)

- ‘Gundlach ratio’ suggests bond yields may rise (MarketWatch)

- Christine Lagarde Needs to Be a Negotiator—But Also a Plumber (Wall Street Journal)

- Yuan Is Offering Interesting Entry Point at Current Levels: Pictet WM (Yahoo! Finance)

- 6 Strong Buy Oil and Gas Stocks Called to Surge in 2020 (24/7 Wall Street)

- Here’s What It’s Like To Drive a $210,000 McLaren (Barron’s)

- The Time to Buy Home Depot Stock Is Now, Analysts Say (Barron’s)

- JP Morgan is bullish on Vietnamese banks, says sector offers high growth and profitability (CNBC)

- The Federal Reserve’s Meeting Starts Today. Here’s What You Need to Know. (Barron’s)

- The Fed will stay in hibernation until at least summer: CNBC survey (CNBC)

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- Democrats and the Trump administration near a tentative North American trade deal (CNBC)

- There’s no better place to put your money than the U.S., says hedge-fund manager Kyle Bass (MarketWatch)

- Ross: US close to largest trade deal in history of the world, 170,000 jobs (Fox Business)

- US and Chinese trade negotiators planning for delay of December tariff Fox Business)

- Next Oil Rally May Be Made in Texas, Not Vienna (Wall Street Journal)

1. Hedge funds key in exacerbating repo market turmoil, says BIS (Financial Times)

2. RPT-U.S. banks’ reluctance to lend cash may have caused repo shock – BIS (Yahoo! Finance)

3. Now Repo Distortions Are Emerging in Europe’s $9 Trillion Market (Bloomberg)

4. Will sterling hold its gains through the UK general election? (Financial Times)

5. UK property investors pull cash at fastest rate this year (Financial Times)

6. Top DoubleLine investor sees opportunity in Brazil amid tariff threat (Yahoo! Finance)

7. Jeffrey Gundlach extended interview with Yahoo Finance [TRANSCRIPT] ()

8. The Taylor Swift “Bad Blood†Energy Market (and Sentiment Results) (ZeroHedge)

9. Big-name US investors take aim at beaten-up energy sector (Financial Times)

10. JPMorgan Sees $410 Billion Bump to Stocks’ Demand-Supply Balance (Bloomberg)

11. Japan’s economy expanded at a much faster-than-initially-reported pace in the third quarter. (Business Insider)

12. China says hopes it can reach trade agreement with US as soon as possible. (Business Insider)

13. Here’s the hard-money call for why the boom in the economy and stock market will continue (MarketWatch)

14. Not the sign of a Top: Investors Bail on Stock Market Rally, Fleeing Funds at Record Pace (Wall Street Journal)

15. Pound Rally Gets Nod From Signal That’s Been Right for a Decade (Bloomberg)

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results) (ZeroHedge)

- Sweet Success: WhIsBe Is Bringing His $60,000 Vandal Gummy Bears To Art Week Miami (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Politics Aside, what could happen to markets in the event of impeachment in the House? (Almanac Trader)

- Episode 773: Slot Flaw Scofflaws (NPR Planet Money)

- Making Sense of the Genome, at Last (Nautilus)

- Fed Adds $72.8 Billion to Markets, Balance Sheet Moves to $4.07 Trillion (Wall Street Journal)

- This wealth manager picked a home-run stock in 2019. Here’s what he likes for 2020 (MarketWatch)

- S&P 500 Melt-Up Is So Hot It’s Making Cheerleaders Into Skeptics (Bloomberg)

- Larry Kudlow: China deal ‘close’ as Beijing cuts some tariffs (New York Post)

- US unemployment rate falls to 3.5%, lowest in 50 years (New York Post)

- Golden Globe Nominations 2020 Predictions: All of Vanity Fair’s Picks (Vanity Fair)

- ‘The Irishman’ Is a Netflix Hit, Even If Few Make It to the End (Bloomberg)

- Repo-Market Minnows Say Fixing the Mess Means Going Beyond Big Banks (Bloomberg)

- FDA Approving Drugs at Breakneck Speed (Bloomberg)

- OPEC’s Oil Surprise Came as Skeptics Were Doubting Price Rise (Bloomberg)

- The Bloomberg 50: The People Who Defined Global Business in 2019 (Bloomberg)

- Trump Orders Toilet Rule Review, Saying People Flush 10 Times (Bloomberg)

- Here are 10 songs Warren Buffett has referenced over 2 decades of annual shareholder letters (Business Insider)

- Is Taylor Swift’s ‘Christmas Tree Farm’ a sign that millennials are boosting live tree sales? (MarketWatch)

- Why the Bull Market Is Only at Mid-Cycle (Jeff Staut) (Bloomberg)

- Inside Miami Art Week With Lenny Kravitz, Princess Eugenie, Rosario Dawson, and Dom Pérignon (Vanity Fair)

- MIT Says New Technique Lets You Hack Your Own Brain Waves (Futurism)

- Quant Mutual Funds Lag Stocks This Year, Bank of America Says (Institutional Investor)

- Survivorship Bias: The Tale of Forgotten Failures (Farnam Street)

- Why Warren Buffett Is The G.O.A.T, And Berkshire’s Secret Sauce (Greenbackd)

- ‘No Time To Die’: Watch the First Trailer for Daniel Craig’s Final Bond Movie (Maxim)

- Top 10 Best Things To Do In Las Vegas: What to check out (ValueWalk)

- Biased Algorithms, Biased World (The Big Picture)

- Saudi, Russia win over oil producers to deeper cuts (Reuters)

- Ulta Stock Is Soaring After Reporting Earnings That Were Much Better Than Last Quarter’s Disaster (Barron’s)

- China to Waive Trade War Tariffs for Some U.S. Soy, Pork Purchases (Bloomberg)

- Citi Tells Rich Clients Stop Being So Nervous About Stocks (Bloomberg)

- U.S. adds 266,000 jobs in November, unemployment dips to 3.5% (MarketWatch)

- BIS Wants Central Banks at Center of Digital Cash Revolution (Bloomberg)

- China offers official reassurance on trade talks with US (FoxBusiness)

- TikTok takes on Facebook in US advertising push (Financial Times)

- Europe First: taking on the dominance of the US dollar (Financial Times)

- Mnuchin Working Closely With Fed, Bank Regulators on Repo Market Issues (Wall Street Journal)

- Chesapeake Debt Deal Staves Off Bankruptcy (Yahoo! Finance)

- Chris Hogan: How to have the happiest Christmas ever (I dare you!) (Fox Business)

- Dollar General’s Earnings Show Retail Is Great as Long as You Sell at a Discount (Barron’s)

- Japan launches $122 billion stimulus to fight trade risks, post-Olympic slump (Business Insider)

- Steve Cohen Is in Talks to Buy the Mets. You Could Buy a Piece of Another Team. (Barron’s)

- Carl Icahn Says the HP-Xerox Merger Is a ‘No-Brainer’ (Barron’s)

- Oil rises as OPEC weighs deeper output cuts (Street Insider)

- Robert Shiller on the ‘Trump Narrative’ That’s Lifting Stocks, and Other Investor Enthusiasms (Barron’s)

- This Billionaire CEO’s Brilliant Idea Made Him Rich, Twice (Investor’s Business Daily)

- U.S. Jobless Claims Unexpectedly Drop to Lowest in Seven Months (Bloomberg)

- Soros CIO Puts Conservative Stamp on Fund Built With Bold Bets (Bloomberg)

- Math Whiz Trades Without Humans to Make $700 Million Fortune (Bloomberg)

- US Trade Deficit Shrinks To Smallest In 16 Months (ZeroHedge)

- How Steve Miller’s ‘Fly Like an Eagle’ Took Off (Wall Street Journal)

- Pound Hits Fresh High on Boris Johnson’s Election Prospects (Wall Street Journal)

- Exxon Mobil Stock Could Surge 47% as 2020 May Finally Be the Oil Giant’s Year, Analyst Says (Barron’s)

- The new Canada Goose Toronto store doesn’t have inventory, but it does have a daily snowstorm (CNBC)

- Blackstone’s Byron Wien says stocks have ‘room to move up’ and this is ‘nothing like 2006 or 1999’ (CNBC)

- Third Point Posts Strong November Gain (Institutional Investor)

- Growth stocks still have room to run before reaching previous bubble valuations, Credit Suisse strategist says (MarketWatch)

- A Big Question Looms Ahead of OPEC. What That Means for Oil Prices. (Barron’s)

- New study shows small businesses are the most optimistic on record, even as trade-war and recession fears swirl (Business Insider)

- Pound climbs to six-month high, leaving FTSE 100 to sit out a global equity rally (MarketWatch)

- Lil Nas X, Country Music’s Renegade Rapper (Bloomberg)

- Trump won’t ruin Christmas for Wall Street with China tariffs, investor Peter Boockvar predicts (CNBC)

- Faded Texas Oil Field Offers Austerity Lesson for U.S. Shale (Yahoo! Finance)

- Oil Trading in Sweet Spot Adds to Improving Economic Signals (Wall Street Journal)

- Here’s a full list of every book Warren Buffett has recommended this decade—in his annual letters (CNBC)

- Oil rises for a second day as Saudi Arabia pushes supply cut (Reuters)

- Japan’s Government Calls for Decisive Fiscal Action (Bloomberg)

- Fund managers deploy machines to decipher British election riddle (Reuters)

- Oil Trading in Sweet Spot Adds to Improving Economic Signals (Wall Street Journal)

- Dyal Capital Has a $9 Billion Fund to Deploy. Here’s Who Is Getting That Money. (Institutional Investor)

- OPEC+ Set to Debate Oil-Cut Cheating as Russia Seeks Rule Change (Bloomberg)

- Here’s everything investors need to know ahead of Britain’s election next week (MarketWatch)

- Is Boris Johnson heading for another Brexit crisis? (Financial Times)

- Who Will Rise at Art Basel Miami Beach? (Wall Street Journal)

- Brexit: Could the UK and EU sort a trade deal in months? (BBC)

- OPEC+ Gambles That U.S. Shale’s Golden Age Is Over (Bloomberg)

- China’s Nov factory activity unexpectedly expands at quickest pace in almost three years – Caixin PMI (Reuters)

- New ServiceNow CEO Bill McDermott Bought Up Stock (Barron’s)

- Oil jumps above $61 on talk of further OPEC+ supply curbs (Street Insider)

- Saudi Arabia wants OPEC+ to deepen oil cuts due to Aramco IPO (Reuters)

- World’s Most Famous Hedge Funds Get Cold Shoulder in China (Yahoo! Finance)

- These Ancient Funds Are Still Beating the Market (Barron’s)

- The Billionaire Hedge Fund Manager With Quantum Ambitions (Bloomberg)

- Oil-Sands Crude Could Get Even Heavier Amid Pipeline Shortage (Bloomberg)