- Biotech Value Stocks Climb Out of Their Sick Bed (Wall Street Journal)

- Trump to Name Texas Cancer Doctor Stephen Hahn to Run FDA (Bloomberg)

- Ferrari’s Portofino, Superfast sales turbo-charge 2019 outlook (Reuters)

- Investors may start looking at GE with bull case becoming clearer, says Barclays (The Fly)

- Macy’s, GameStop, and 15 Other Stocks That Could Be End-of-Year Bargains (Barron’s)

- U.S., China Signal Progress Toward Initial Trump-Xi Trade Deal (Bloomberg)

- How Much Oil Does The U.S. Really Own? (Yahoo! Finance)

- Barron’s Picks And Pans: AbbVie, Alibaba, Fiat Chrysler, Garmin And More (Yahoo! Finance)

- Earnings Tide Lifts Most Stocks (Wall Street Journal)

- Hedge Fund Tips – VideoCast Weekly Recap (Hedge Fund Tips)

Category: What I’m Reading Today

Be in the know. 12 key reads for Sunday…

- MIB: WSJ’s Greg Zuckerman on Renaissance Technologies (The Big Picture)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Martin Scorsese’s Epic Funeral for the Gangster Genre (The Atlantic)

- What’s so super about super foods? (The Economist)

- How Jim Simons Built the Best Hedge Fund Ever (Bloomberg)

- Warren Buffett’s Berkshire Hathaway posts big jump in profit (FoxBusiness)

- How Iran Can Hold the World Oil Market Hostage (CFR)

- A new study shows that even the poorest immigrants lift themselves up within a generation (VOX)

- Evaluating lower-for-longer policies: Temporary price-level targeting (Ben Bernanke)

- The 10 Most Powerful Hedge Fund Managers This Year (Worth)

- Banksy’s Gross Domestic Product – Croydon, London (Luxuo)

- Continued Earnings Improvement: Q3 EPS Results (ZeroHedge)

Be in the know. 20 key reads for Saturday…

- What Trade War? Meet The Brilliant Quant Who’s Bullish On China (Forbes)

- Hedge Fund and Insider Trading News: Jim Simons, Nelson Peltz, Baker Bros. Advisors, Facebook Inc (FB), Covenant Transportation Group, Inc. (CVTI), and More (Insider Monkey)

- Edward Norton — On Creative Process, Creative Struggle, and Motherless Brooklyn (#393) (Tim Ferriss)

- U.S. net natural gas exports in first-half 2019 doubles year-ago levels for second year (EIA)

- How to Bet on China — and Manage the Risks (Barron’s)

- This ‘Perfect’ Jobs Report Looks Like a Game-Changer (Barron’s)

- Qorvo Stock Soars After Its 5G Chip Gains Wow the Street (Barron’s)

- Health-Insurance Stocks Rise as Elizabeth Warren Details Plan for Medicare for All (Barron’s)

- Investors to Big Oil: Make It Rain (Wall Street Journal)

- China says it’s reached a consensus in principle with the US during this week’s trade talks (CNBC)

- Saudi Crown Prince Gives Green Light for Aramco IPO (Bloomberg)

- How Jim Simons Built the World’s Most Lucrative Black Box (Bloomberg)

- How to Use Occam’s Razor Without Getting Cut (Farnam Street)

- The Most Bullish Signal in the World (The Irrelevant Investor)

- There’s Never Been a Better Time to Be an Individual Investor. Here’s Why (Fortune)

- Selling Early Is Not The Problem For Legends (Howard Lindzon)

- The Cirrus Vision Jet Can Now Land Itself With the Push of a Button (Robb Report)

- Google’s Fitbit purchase could reshape its healthcare ambitions (TechCrunch)

- SHoP architects tops out slender central park skyscraper, 111 west 57th street (DesignBoom)

- Merrill Lynch Says 4 Broken 2019 IPOs May Have Huge Potential Upside (24/7 Wall Street)

TOP ARTICLE OF THE WEEK:

Be in the know. 12 key reads for Friday…

- Hedge Funds’ Top Picks Killed The Market in October (Insider Monkey)

- U.S. adds 128,000 new jobs in October in stronger-than-expected employment report (MarketWatch)

- ‘Irishman’s’ Short Window From Big Screen to Small Has Theaters Fuming (New York Times)

- The “Three Tenors” Stock Market (and Sentiment Results)…(Hedge Fund Tips)

- Trump says U.S., China to announce new venue to ink trade deal soon (Reuters)

- Former Fed Chair Alan Greenspan doesn’t expect a recession to arrive anytime soon — and uses one stat to argue his position Business Insider)

- Kinder Morgan’s co-founder bought millions more in stock (Barron’s)

- Big Money Poll: Bears Rise to a Two-Decade-Plus High (Barron’s)

- Hedge Fund Investor Has Tense Flashback to Late 1990s Japan (Bloomberg)

- Better-Than-Expected Earnings Ease Growth Fears—for Now (Wall Street Journal)

- U.S. Consumers Stay on a Spending Streak (Wall Street Journal)

- Alibaba’s Revenue Beat Showcases Resilient Chinese Spending (Bloomberg)

Be in the know. 10 key reads for Thursday…

- How Jim Simons Built the Best Hedge Fund Ever (Bloomberg)

- The “Three Tenors” Stock Market (and Sentiment Results)…(ZeroHedge)

- Stocks Are Hitting New Highs. The Yield Curve Might Be the Reason. (Barron’s)

- Lyft Raises Guidance, Reports Increased Revenue (Wall Street Journal)

- Mnuchin Says China Deal Is Likely to Be Signed in November (New York Times)

- Kraft Heinz stock jumps on earnings beat (CNBC)

- U.S. consumer spending rises moderately, wages flat (Reuters)

- Exclusive: Beijing could ax extra tariffs on U.S. farm products to boost imports – China trade association chief (Reuters)

- Two Harvard Twins (No, Not Those Twins) Run One of the World’s Worst BDCs. They’re About to Get Rich. (Institutional Investor)

- Democrats Just Accidentally Sparked A Federal Fracking Boom (Yahoo! Finance)

Be in the know. 10 key reads for Wednesday…

- Stocks Hit Records. Bears Grow More Skeptical. History Says This Is a Good Combo. (Barron’s)

- Incoming ECB President Lagarde says big European countries aren’t spending enough: report (MarketWatch)

- Experts Talk Hot Biotech Stocks at Barron’s Breakfast (Barron’s)

- Big Money Poll: Bears Rise to a Two-Decade-Plus High (Barron’s)

- RPT-Ex-FDA chief Gottlieb sees investment opportunity in ‘unloved’ antibiotics (Reuters)

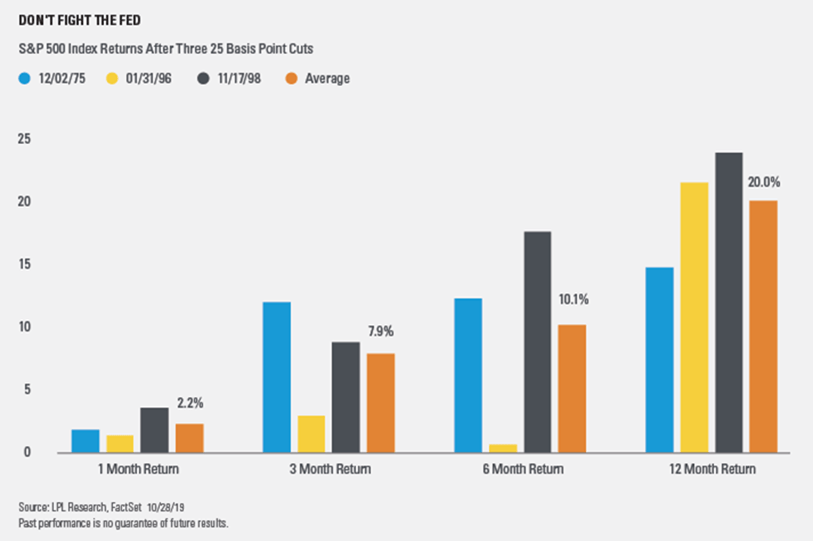

- Here’s how the stock market tends to perform after the Fed cuts interest rates 3 times in a row (MarketWatch)

- Amazon Turns to More Free Grocery Delivery to Lift Food Sales (New York Times)

- Chasing Unlimited Energy With the World’s Largest Fusion Reactor (Bloomberg)

- General Electric (GE) Tops Q3 EPS by 4c, Offers FY Guidance (StreetInsider)

- Natural-Gas Prices Jump as Producers Promise Restraint (Wall Street Journal)

Be in the know. 10 key reads for Tuesday…

- Stock Market Record Surprises Skeptics Yet Again (New York Times)

- The Always Exhilarating, Sometimes Lucrative Lives of Brexit Currency Traders (Bloomberg)

- 5,000 Tesla Model 3 Owners Tell Us What Elon Musk Got Right and Wrong (Bloomberg)

- ConocoPhillips Profit Beats Estimates as Shale Oil Output Gains (Bloomberg)

- The market will drop 25% if Warren wins the election, says hedge fund legend Paul Tudor Jones (CNBC)

- Are Electric Cars Good for the Environment? (ZeroHedge)

- Pfizer (PFE) Tops Q3 EPS by 13c, Raises FY Guidance (StreetInsider)

- China’s factory activity seen contracting for sixth month on trade pressure: Reuters poll (Reuters)

- Kellogg profit beats on higher demand for snacks, frozen foods (Yahoo! Finance)

- A Wealth Tax Is Simply Un-American (Yahoo! Finance)

Be in the know. 5 key reads for Monday…

- What’s in a Deal? The Brexit Extension’s Key Points Summarized (Bloomberg)

- RBC Has 4 E&P Energy Stocks to Buy With at Least 50% Implied Upside (24/7 Wall Street)

- Eddie Murphy is Back and Oscar-Bound (hasn’t lost a step): (Vanity Fair)

- ISIS Leader al-Baghdadi Is Dead, Trump Says (New York Times)

- Tesla’s solar-roof sales will grow ‘like kelp on steroids,’ Musk vows (MarketWatch)

Be in the know. 12 key reads for Sunday…

- How Costco Succeeded By Doing The Opposite Of Amazon (Digg)

- This Hedge Fund Returns 22% Annually, Here Are Its Latest Picks (Insider Monkey)

- The ‘Alfa Romeo Montreal Vision GT’ Looks Like the Future of Italian Horsepower (Maxim)

- Barron’s Picks And Pans: Altria, Square, Walmart And More (Yahoo! Finance)

- Bishops Ask Pope to Approve Married Priests, and Open the Way to Women Deacons (Daily Beast)

- Aldi, Right Moves – The German Grocer Sending Shock Waves Throughout Walmart and Kroger (Forbes)

- French luxury group LVMH offers to buy U.S jeweler Tiffany: sources (Reuters)

- Episode 947: Some-of-the-Money Ball (NPR Planet Money)

- If gambling is all probability, why aren’t mathematicians the richest people? (Quora)

- The Definitive Nate Silver Candy Poll (FiveThirtyEight)

- New Gene-Editing Tool Could Fix Genetic Defects—with Fewer Unwanted Effects (Scientific American)

- The Best All-You-Can-Eat Buffet in Every State (Reader’s Digest)

Be in the know. 20 key reads for Saturday…

- Tesla starts selling China-made Model 3 with autopilot function (New York Post)

- Microsoft snags hotly contested $10 billion defense contract, beating out Amazon (CNBC)

- She lost her arm in a shark attack, but surfer Bethany Hamilton is living ‘an unstoppable life’ (CNN)

- Jeff Kagan: Walmart Health Wants to Disrupt Healthcare (Equities)

- Three things to watch when the Fed meets next week (MarketWatch)

- Margot Robbie Becomes Her Own Biggest Competition in the Oscar Race (Vanity Fair)

- The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market: (AAII Sentiment Survey) (ZeroHedge)

- GM Strike Ends After Almost Six Weeks At Cost Of $2 Billion (Investors)

- ‘They Were Like Gods’ (Institutional Investor)

- How did Mohnish Pabrai inspire Guy Spier? An interview in the Aquamarine Fund’s office in Zurich (YouTube)

- What Black Monday Taught Us (Morningstar)

- Ayn Rand on Why Philosophy Matters (Farnam Street)

- 5G Is a Lot of Hype, But There Are Still Real Opportunities for Investors (Barron’s)

- Great Escapes: France’s Enchanting Loire Valley (Barron’s)

- Oil prices clock strong weekly gains on trade hopes, crude supply (Street Insider)

- U.S., China say they are ‘close to finalizing’ part of a Phase One trade deal (Reuters)

- This unexpected trade-war outcome will send stocks soaring, says Jefferies analyst (MarketWatch)

- Blackstone’s Online-Shopping Play: 800 Million Square Feet of Warehouses (Wall Street Journal)

- Boris Johnson Wants a Brexit Election. He May Not Get It. (Wall Street Journal)

- The Drones Are Coming! How Amazon, Alphabet and Uber Are Taking to the Skies (Wall Street Journal)