Skip to content

The Future of Power Still Means Fossil Fuels, for Now (Bloomberg Businessweek )

The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market (ZeroHedge )

Opinion: U.S. stock market has a good chance to record new highs (MarketWatch )

Opinion: Intel suggests the chip recovery is here, even as rivals are still waiting (MarketWatch )

Goldman Sachs predicts the Fed will make two big changes next week (CNBC )

Brexit Relief Fuels Biggest European Equity Inflows in 20 Months (Bloomberg )

Chipmaker Intel Crushes Third-Quarter Targets, Guides Higher (Investors )

Natural-Gas Prices Rise on Expectations for Cooler Fall Weather (Wall Street Journal )

A Biotech Giant Not Named Biogen Also Had a Good Week (Bloomberg )

Billionaire investor Ron Baron sees the Dow at 650,000 in 50 years (CNBC )

China Willing to Buy $20 Billion of U.S. Farm Goods in Year One (Bloomberg )

The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market: (AAII Sentiment Survey Results) (Hedge Fund Tips )

Health Care Gains as a Warren Victory Looks Less Certain (Barron’s )

Three Hedge Fund Titans Celebrated Over Dinner. Everything Was Fair Game Except Investing. (Institutional Investor )

ECB keeps money taps open as Draghi denied grand finale (Reuters )

British pound hovers around $1.29 as attention turns to EU and possible Brexit extension (MarketWatch )

How to Watch Scorsese on Broadway (and Why That’s Possible) (New York Times )

The Complete Berkshire Hathaway Portfolio (U.S. News )

6 Energy Stocks for Value Investors (U.S. News )

Texas Roadhouse CEO Kent Taylor Defies Convention — And Wins (Investor’s Business Daily )

Five Guys has the best french fries in fast food, according to our survey of more than 3,000 customers (Business Insider )

Elon Musk Makes Good on ‘Short Burn of the Century’, 18 Months Later (Bloomberg )

Hedge Fund and Insider Trading News: Carl Icahn, Paulson & Co., Corvex Management, Vertex One Asset Management, Northern Dynasty Minerals Ltd. (NAK), Moelis & Co. (MC), and More (Insider Monkey )

Death by Amazon’ Was a False Alarm for Walmart and Some Other Retailers (Barron’s )

Health Care Gains as a Warren Victory Looks Less Certain (Barron’s )

The Future of Technology: 16 Predictions (Barron’s ) and (196 Slides )

Tusk Tells Johnson He’ll Recommend Extension: Brexit Update (Bloomberg )

Opinion: Here’s the stock-market trade this hedge-fund star is most excited about right now (MarketWatch )

Here’s where hedge-fund shorts are at risk of getting burned (MarketWatch )

China’s premier says cooperation with the U.S. can create mutual benefit (Reuters )

Schlumberger- Shale and Deepwater (Yahoo! Finance )

Range Announces Asset Sales, Enhanced Financial Resources, and Initiation of Share Repurchase Program (Yahoo! Finance )

4 Fallen Angel Large-Cap Blue Chips May Have Massive 2020 Rebounds (24/7 Wall Street )

Google scientists have claimed a massive breakthrough in cutting-edge computing with ‘quantum supremacy’ — here’s what that means (Business Insider )

Biogen Stock Is Soaring as Hope Returns for Alzheimer’s Drug (MarketWatch )

$8 Billion Fund Manager Picks Battered Indian Auto Stocks (Bloomberg )

Biden Regains Lead, Warren Too Extreme (Mish Talk )

Chinese vice foreign minister says progress made in trade talks with U.S. (Reuters )

Pierre Delecto? Mitt Romney’s Secret Twitter Account Is Unveiled (Bloomberg )

FDA approves new breakthrough therapy for cystic fibrosis (Vertex Pharma) (FDA )

A Commodities Hedge Fund Titan Is Quitting After 50 Years (Hellenic Shipping News )

Foreign Stocks Are Looking Cheap. 5 Ways to Take Advantage. (Barron’s )

Last-Minute Opioid Deal Could Open Door to Bigger Settlement (Wall Street Journal )

SAP Extends Cloud Partnership With Microsoft (Wall Street Journal )

It’s Time to Stop Playing Defense in Stocks (Barron’s )

Johnson Prepares to Put Brexit Deal to Vote After Foiled First Try (Wall Street Journal )

Frackers Float ‘Shale Bonds’ as Traditional Investors Flee (Wall Street Journal )

Goldman Sachs says pound could hit $1.35 as risk of no-deal Brexit fades (MarketWatch )

Fed Poised to Cut, Goodbye to Draghi, Appropriate Yuan: Eco Day (Bloomberg )

ECB Restarting QE Will Need More Purchase of Private Debt (Bloomberg )

Robert Shiller: Recession likely years away due to bullish Trump effect (CNBC )

The Chip Industry Gets a Strong 5G Signal (Wall Street Journal )

The Week Ahead In Biotech: Earnings Trickle In, While Glaxo, Melinta, Foamix And Eton Await FDA Verdict (Yahoo Finance! )

China’s growth slumped to a record low last quarter — and it could drop even lower next year, the IMF warns (Business Insider )

How Private Sector Balance Sheets Changed Recessions (Podcast) (Bloomberg )

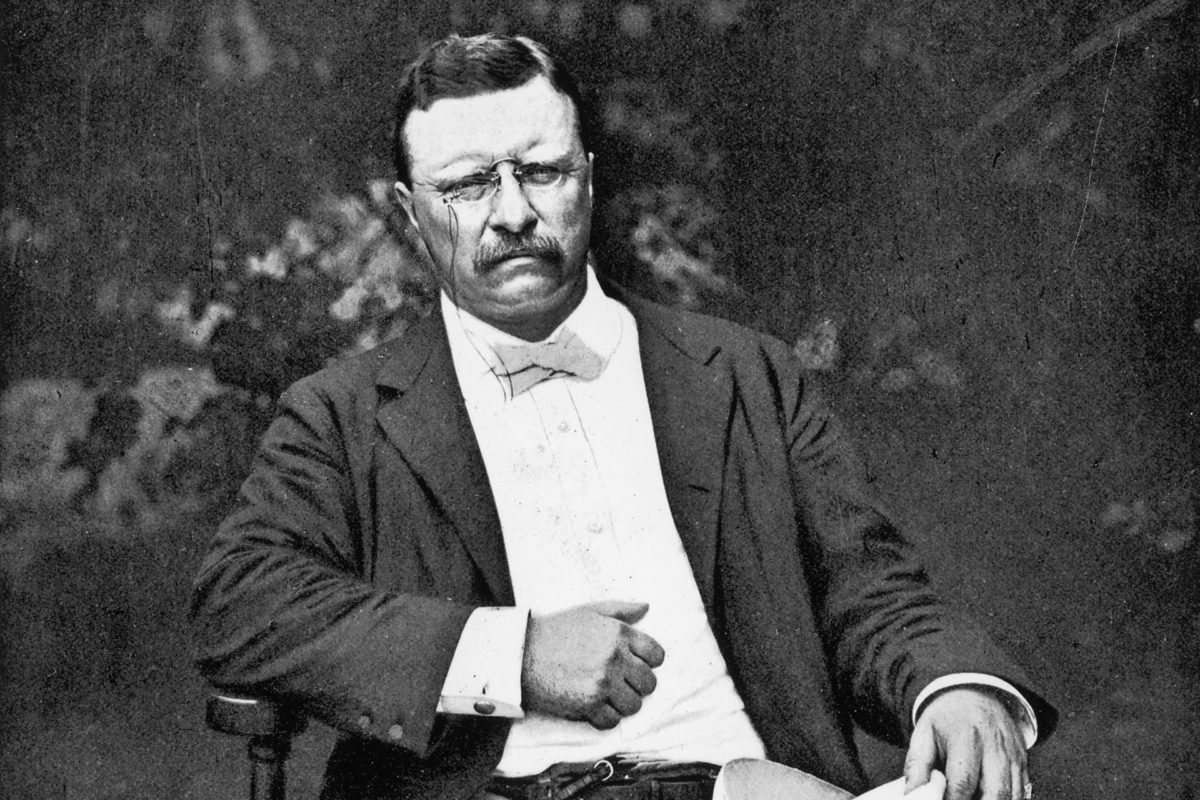

Theodore Roosevelt: A Timeline of the 26th President’s Life (Mental Floss )

How Biotech and Big Pharma Have Upside Heading Into Earnings ()

Stocks ‘no brainer’ over bonds (Fox Business )

How Non-Profit Hospitals Are Driving Up The Cost Of Health Care (NPR Planet Money )

How His Obscure Tax Break Became a $60B Venture Fund for Low-Income America (OZY )

ConocoPhillips Stock Looks Cheap After a Selloff (Barron’s )

What’s Next After the U.K. Parliament’s Non-Vote on Brexit (Barron’s )

Can ‘Modicare’ Save Sick Indians From Poverty? (OZY )

The Downside of Reusable Bags More People Need to Be Thinking About (Reader’s Digest )

Hedge Fund and Insider Trading News: James Dondero, Eddie Lampert, Chris Rokos, ExodusPoint Capital, SkyBridge Capital, Nektar Therapeutics Inc. (NKTR), Oshkosh Corp (OSK), and More (Insider Monkey )

Wealth Taxes Don’t Work. Here’s Why. (Barron’s )

How to pretend to understand the Brexit deal (Barron’s )

Meet the Buffett bot: quant fund tries to crack the ‘value’ code (Financial Times )

China’s GDP growth grinds to near 30-year low as tariffs hit production (New York Post )

Why Popular Investments Are Doomed to Underperform (Institutional Investor )

Howard Marks Latest Memo – Mysterious (OakTree )

Invest like Warren Buffett — Is this value’s time to finally shine? (CNN )

Wall Street’s top hedge fund managers reveal their best ideas (CNBC )

‘Feel the Force’: Gut Instinct, Not Data, Is the Thing (Wall Street Journal )

Bill Miller 3Q 2019 Market Letter (Miller Value )

Buy in October, and Get Yourself Sober (Almanac Trader )

Google affiliate begins drone deliveries in Virginia town (AP )

Mark Zuckerberg Takes Hard Stance Against China And Censorship In Georgetown University Speech (Forbes )

Trump hopes U.S.-China trade deal will be signed by middle of November (Reuters )

Empire State Manufacturing Survey: Slight Growth in October (Advisor Perspectives )

Norway Is a Green Leader. It’s Also Drilling More Oil Wells Than Ever (Fortune )

Lavender Fields, Bouillabaisse, and Calanques: The 4-Day Weekend in Marseille (Men’s Journal )

List Of Top 10 Best Beaches In The World (ValueWalk )

Here They Are: The 20 Best Places To Visit In 2020 (Forbes )

Why Mega-Cap Dividend Energy Stocks May Be the Best 2020 Bet (24/7 Wall Street )

4 Biotech Stocks That Are Set to Rally, Analyst Says (Barron’s )

Hedge Fund and Insider Trading News: Ken Fisher, D.E. Shaw, Dalton Investments, Safehold Inc (SAFE), ResMed Inc. (RMD), and More (Insider Monkey )

A Fed recession indicator has lit up. It’s not the only one to watch. (Barron’s )

Saudi Aramco Delays Launch of World’s Largest IPO (Wall Street Journal )

With Advice Like This, Gilead Can’t Go Wrong (Wall Street Journal )

Schlumberger profit beats as international gains offset weak North America (Reuters )

This Robotic Surgery Giant Just Crushed Third-Quarter Earnings Forecasts (Investors )

The Taylor Swift, “Shake It Off” Market…(AAII Sentiment Survey) (ZeroHedge )

Daniel Kahneman: Putting Your Intuition on Ice (Farnam Street )

Netflix Stock Rallies as Earnings Soar Past Guidance (Barron’s )

Britain, European Union reach new Brexit deal (New York Post )

FCC approves T-Mobile-Sprint merger (USA Today )

Morgan Stanley shares surge after bank beats expectations on trading, advisory results (CNBC )

10 Stock Picks Using Bernstein’s Quant-Aided Analysis (Barron’s )

UAW Reaches Tentative Labor Deal With GM (Wall Street Journal )

China says it hopes to reach phased trade pact with U.S. as soon as possible (Street Insider )

The Taylor Swift, “Shake It Off” Market…(AAII Sentiment Survey) (Hedge Fund Tips )

Value Finally Trumps Fear for Health Stocks (Wall Street Journal )

Bank of America Joins the Earnings Party. Strong Profits Push Up the Stock. (Barron’s )

Hedge Fund and Insider Trading News: Ken Fisher, D.E. Shaw, Dalton Investments, Safehold Inc (SAFE), ResMed Inc. (RMD), and More (Insider Monkey )

Jefferies Very Positive on 4 Top Internet Stocks in Front of Q3 Results (24/7 Wall Street )

British Tech Firms Bought Up by Foreign Buyers After the Vote to Leave (Bloomberg )

How Former Hollywood Mogul Barry Diller Built A $4.2 Billion Tech Fortune Out Of Underdog Assets (Forbes )

Leon Cooperman says there is ‘one more leg’ higher for the bull market before it ends (CNBC )

Long-Term Inflation Expectations Hit Record Low: N.Y. Fed (Wall Street Journal )

Mall Short Seller Shuts Down Before the Malls He Bet Against (Wall Street Journal )

Bullard Sees Trade Turmoil as ‘Pandora’s Box’ Risk to Economy (Bloomberg )