- Here’s a full list of every book Warren Buffett has recommended this decade—in his annual letters (CNBC)

- Oil rises for a second day as Saudi Arabia pushes supply cut (Reuters)

- Japan’s Government Calls for Decisive Fiscal Action (Bloomberg)

- Fund managers deploy machines to decipher British election riddle (Reuters)

- Oil Trading in Sweet Spot Adds to Improving Economic Signals (Wall Street Journal)

- Dyal Capital Has a $9 Billion Fund to Deploy. Here’s Who Is Getting That Money. (Institutional Investor)

- OPEC+ Set to Debate Oil-Cut Cheating as Russia Seeks Rule Change (Bloomberg)

- Here’s everything investors need to know ahead of Britain’s election next week (MarketWatch)

- Is Boris Johnson heading for another Brexit crisis? (Financial Times)

- Who Will Rise at Art Basel Miami Beach? (Wall Street Journal)

Category: What I’m Reading Today

Be in the know. 10 key reads for Monday…

- Brexit: Could the UK and EU sort a trade deal in months? (BBC)

- OPEC+ Gambles That U.S. Shale’s Golden Age Is Over (Bloomberg)

- China’s Nov factory activity unexpectedly expands at quickest pace in almost three years – Caixin PMI (Reuters)

- New ServiceNow CEO Bill McDermott Bought Up Stock (Barron’s)

- Oil jumps above $61 on talk of further OPEC+ supply curbs (Street Insider)

- Saudi Arabia wants OPEC+ to deepen oil cuts due to Aramco IPO (Reuters)

- World’s Most Famous Hedge Funds Get Cold Shoulder in China (Yahoo! Finance)

- These Ancient Funds Are Still Beating the Market (Barron’s)

- The Billionaire Hedge Fund Manager With Quantum Ambitions (Bloomberg)

- Oil-Sands Crude Could Get Even Heavier Amid Pipeline Shortage (Bloomberg)

Be in the know. 15 key reads for Sunday…

- Al Pacino made ‘Irishman’ so he could finally work with Scorsese (and eat free ice cream) (USA Today)

- Hedge Fund Tips – Episode 5 – VideoCast. Stock Market Commentary. (ZeroHedge)

- Tesla Model Y vs Ford Mustang Mach-E [COMPARISON] (ValueWalk)

- Hedge Fund and Insider Trading News: Marshall Wace LLP, Millennium Management, Cognex Corporation (CGNX), Post Holdings Inc (POST), and More (Insider Monkey)

- The Secret to Getting Anything You Want in Life (Forbes)

- Joe Ricketts Discusses Trade and Deregulation (Podcast) (Bloomberg)

- The Sahm Rule With The Eponymous Economist (NPR Planet Money)

- Animal Spirits: The Nastiest, Hardest Problem in Finance (The Irrelevant Investor)

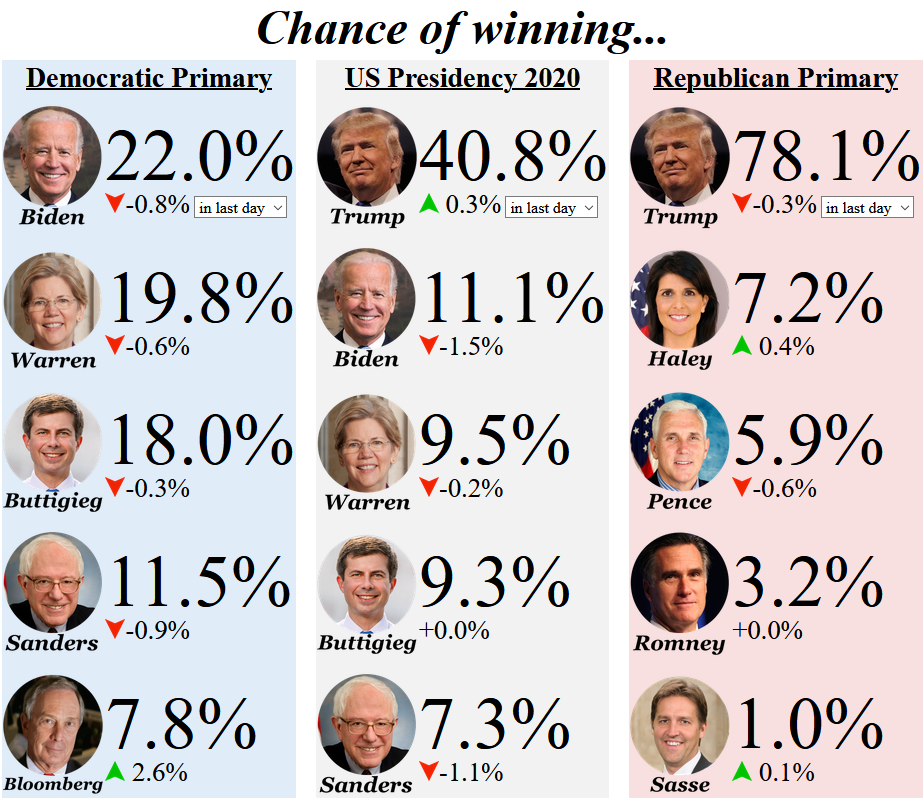

- Chance of winning… (Election Betting Odds )

- Is the Global Slowdown Over? (OZY)

- All-Time Highs Are Both Scary & Normal (A Wealth of Common Sense)

- WWII veteran who credited longevity to daily Coors Light turns 102 (Fox News)

- Icahn Is Said to Push Ahead With Bid to Control Occidental Board (Yahoo! Finance)

- Iraq Says OPEC+ to Mull More Cuts, Jarring With Group’s Stance (Bloomberg)

- As NHL expands, private equity could boost hockey’s financial boom (Fox Business)

Be in the know. 15 key reads for Saturday…

- US merger rush stirs debate over equities bull market (Financial Times)

- The Greatest Value Investor You’ve Never Heard Of (Macro Ops)

- US-China trade talks are at a critical juncture. Here’s a timeline of everything that’s happened so far. (Business Insider)

- Is There New Life in Legacy Tech? (Barron’s)

- Oil-Sands Stock Suncor Offers a Pipeline of Cash (Barron’s)

- Don’t write off energy stocks just yet (Barron’s)

- Dividend-Paying Stocks Could Be the Best Long-Term Growth Play (Barron’s)

- Even Low Earners Have Money to Spend (Bloomberg)

- Yes, You Can Get Free Trading. But There’s Often a Catch. (New York Times)

- Aramco IPO Draws Bids of $44.3 Billion, Though Global Investors Balk (Wall Street Journal)

- The Irishman Finally Hit Netflix and With It the Memes (Vanity Fair)

- Dubai is Adding Tesla Cybertrucks to its Police Car Fleet (Futurism)

- Why We Don’t Own Tesla stock (and no, we’re not bears) (Contrarian Edge)

- Saudi Aramco IPO May Hinge on Something Called the Greenshoe. What’s a Greenshoe? (Fortune)

- Watch the Tense New ‘Better Call Saul’ Season 5 Teaser Trailer (Maxim)

Be in the know. 12 key reads for Black Friday…

- Cowboys Owner Jerry Jones Says He’s Hunting for More Gas Assets (BNNBloomberg)

- The Stealers Wheel, “Stuck in the Middle with You” Stock Market (and Sentiment Results) (Hedge Fund Tips)

- Teaching Your Child the Value of a Dollar (Barron’s)

- Franco-German Rift Clouds EU (Wall Street Journal)

- America’s Cattle Ranchers Are Fighting Back Against Fake Meat (Wall Street Journal)

- The CEO of Twitter and Square says he’s moving to Africa for at least 3 months next year because the continent will ‘define the future’ (Business Insider)

- Netflix’s ‘The Irishman’ could inject some much-needed momentum into the streaming giant’s stock, analyst says (Business Insider)

- The World Doesn’t Have Enough Pigs to Fill China’s Pork Deficit (Bloomberg)

- Soros’s Dawn Fitzpatrick Likes Hemingway, College Hoops, Spain (Bloomberg)

- Wall Street Wades Into Sports Gambling as Legalization Spreads (Bloomberg)

- U.S. third-quarter GDP growth revised up to 2.1% (StreetInsider)

- Markets Will Grind Higher on `Skinny’ U.S., China Trade Deal: BlueBay (Yahoo! Finance)

Be in the know. 13 key reads for Thanksgiving Day…

- 11 Stocks to Be Thankful for This Thanksgiving (Barron’s)

- The Stealers Wheel, “Stuck in the Middle with You” Stock Market (and Sentiment Results) (ZeroHedge)

- Treasuries’ Appeal Will Fade Next Year as the Economy Strengthens, J.P. Morgan Says (Barron’s)

- NYSE Wants to Let Companies Raise Capital Through Direct Listings (Wall Street Journal)

- New York Fed Adds $108.95 Billion to Markets (Wall Street Journal)

- China Criticizes U.S. Support for Protests, Signals Trade Hope (Wall Street Journal)

- The Underground Way to Earn a 10% Yield in Oil Stocks (Wall Street Journal)

- Elon Musk says Tesla has 250K Cybertruck orders (New York Post)

- A $1.8 Trillion Fund Manager Explains Why It’s Plowing More Money Into China (Bloomberg)

- This is the No. 1 thing to buy on Black Friday if you want great deals (MarketWatch)

- The Great Hedge Fund Retreat (Institutional Investor)

- Beware Footnote Mischief (Institutional Investor)

- Trish Regan: Thanksgiving is a chance to be truly grateful for our families, our health and our country (Fox Business)

Be in the know. 13 key reads for Wednesday…

- Will A ‘Bored Billionaire’ Compete Against Boeing, Lockheed Martin? (Investor’s Business Daily)

- Tesla Easily Beat a Ford F-150 in a Tug of War. It Should Try an F-450 Instead. (Barron’s)

- Activist investor Starboard Value takes stake in CVS a year after Aetna merger (New York Post)

- Toys R Us comeback: The new company’s first toy store opens Wednesday (USA Today)

- Trump Says China Deal in ‘Final Throes’ as Top Officials Speak (Bloomberg)

- Emmanuel Macron Has an Algorithm for Taking Control of Europe (Bloomberg)

- 16 brilliant quotes from Bill Gross, the legendary ‘Bond King’ who retired earlier this year (Business Insider)

- Opinion: 4 reasons why this bull market in stocks will keep going in 2020 (MarketWatch)

- Hedge Fund Rules That Keep Out Not-So-Rich Poised for SEC Revamp (Bloomberg)

- China front-loads $142 billion in 2020 local government bonds to spur growth (Reuters)

- White Castle gets its ugly sweater on (Fox Business)

- Jim Cramer: Here’s Why the Market Hasn’t Stopped Rallying (TheStreet)

- Balance sheet relief could come sooner than expected for Chesapeake – Scotiabank (Financial Post)

Be in the know. 13 key reads for Tuesday…

- Powell says the Fed is ‘strongly committed’ to 2% inflation goal (CNBC)

- What to Do When You’re a Distressed-Asset Investor (and Nothing’s in Distress) (Institutional Investor)

- The Bias That Pays Off in the Hedge Fund Industry (Institutional Investor)

- Are Index Funds Headed for a Reckoning? (Institutional Investor)

- China’s top negotiators say US talks going strong, Phase 1 soon (Fox Business)

- It’s not just trade hopes fueling the U.S. stocks rally (Reuters)

- Investors Could Do Much Worse Than ‘Japanification’ (Wall Street Journal)

- CNBC’s Jim Cramer, a longtime Tesla critic, says he might be about to buy a Model X (MarketWatch)

- Disney+ averaging almost a million new subscribers a day (New York Post)

- Dallas Fed President Robert Kaplan says the fourth-quarter economy is ‘weak’ (CNBC)

- It’s 2019, But It Sure Feels a Lot Like 1998 for Stocks (Bloomberg)

- Fed Chair Powell Says a Solid Labor Market Could Get Even Stronger (New York Times)

- Teva, Drugmakers in Talks With U.S. to End Generics Probes (Bloomberg)

Be in the know. 15 key reads for Monday…

Source: Election Betting Odds

- Election Betting Odds (Biden Leads Dems again) (Election Betting Odds)

- Hedge Fund Tips – Episode 4 – VideoCast. Stock Market Commentary. (Hedge Fund Tips)

- The ‘great rotation’ will arrive in 2020 and bring another strong year for stocks, JP Morgan says (MarketWatch)

- Carl Icahn to Seek Control of Occidental’s Board (Yahoo! Finance)

- French Luxury Giant LVMH Nears Deal to Buy Tiffany (New York Times)

- Who owns the most land in America? Jeff Bezos and John Malone are among them (USA Today)

- Star Stock-Picker Moves On From U.S. and China (Bloomberg)

- How the Steel Industry Made Millions From the Climate Crisis (Bloomberg)

- Schwab and TD Ameritrade Announced a $26 Billion Merger. What You Need to Know. (Barron’s)

- HP Again Rejects Xerox Takeover Bid, Raises Prospect for Big Stock Buyback (Barron’s)

- Pfizer Has 5 Drugs in Its Pipeline That Could Turn Its Stock Around (Barron’s)

- Novartis to Buy Cholesterol-Drugmaker Medicines Co. (Wall Street Journal)

- Elon Musk Says Cybertruck Orders Have Climbed to 200,000 (Bloomberg)

- Paul Singer Has Been Called a ‘Doomsday Investor.’ Now He’s Hoping for Calm Waters. (Institutional Investor)

- Hong Kong elections a slap to Beijing’s face — Here’s what could happen (Fox Business)

Be in the know. 16 key reads for Sunday…

- The Greatest Investor of All Time? (The Irrelevant Investor)

- Is Oil Glut Trading Regime Starting To Falling Apart? (Futures Mag)

- Tom Hanks Plays Mister Rogers: Sharing Joy Is ‘The Natural State Of Things’ (NPR)

- How Does The Economy Influence Voters? (NPR Planet Money)

- How Michael Bloomberg’s Late Bid For The Democratic Nomination Could Go (FiveThirtyEight)

- Elastic: Flexible Thinking in a Constantly Changing World (Farnam Street)

- 25 Fascinating Facts About John F. Kennedy (Mental Floss)

- Millennials finally get housing market break (Fox Business)

- The U.S. Trade Deficit: How Much Does It Matter? (CFR)

- 2019 Wriston Lecture: The End of the Computer Age (Manhattan Institute)

- Why Asset Managers Are Eyeing Millennial Wallets (OZY)

- Box Office: ‘Frozen 2’ Ends November Cold Snap, Heads for Record $110M-$120M U.S. Debut (Hollywood Reporter)

- 99 Oil Rigs Gone And Counting: Rig Count Falls Again (Oil Price)

- Early December Pattern Sparks Natural Gas Futures Rally; SoCal, Sumas Basis Soar (Natural Gas Intel)

- The 5 Types of Market Crash Predictions (A Wealth of Common Sense)

- Hedge Fund Tips – Episode 4 – VideoCast. Stock Market Commentary. (ZeroHedge)