Skip to content

Souring Bets on Apocalypse Were at Center of Quant Stock Storm (Bloomberg )

Ken Burns — A Master Filmmaker on Creative Process, the Long Game, and the Noumenal (#386) (Tim Ferriss Show )

The Faulty Metric at the Center of Private Equity’s Value Proposition (Institutional Investor )

The Power of Questions (Farnam Street )

The Great Rotation Continues (Quantifiable Edges )

Citigroup’s Stock Bear Acquiesces With S&P 500 on Cusp of Record (Bloomberg )

Billionaire Ken Fisher Wants to Knock Out Wall Street (Bloomberg )

Value Finally Replaces Growth. But Will This Hate Rotation Last? (Barron’s )

LEGO Unveils 2,573-Piece Model of New Land Rover Defender (Maxim )

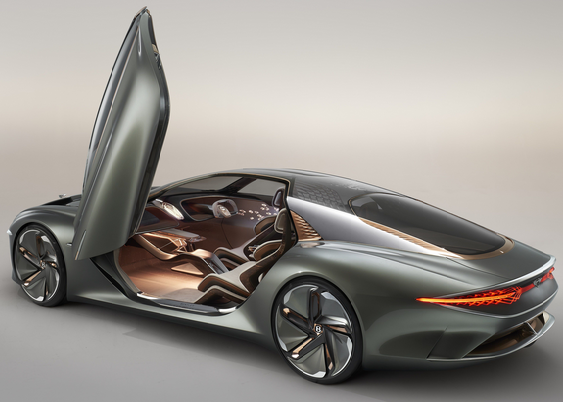

These Are the Next Wave of Ultra-Luxury Electric Cars Entering the Market—and They Don’t Disappoint (Architectural Digest )

S&P 500 up 13 of last 16 September option expiration weeks (Almanac Trader )

Kara Swisher Discusses the Tech Industry (Podcast) (Bloomberg )

Euro surges as investors see ECB done with stimulus (StreetInsider )

China adds US agricultural products to tariff exemptions ahead of trade talks (CNBC )

Trump says he would consider an interim trade deal with China (CNBC )

Transformative? New Device Harvests Energy in Darkness (New York Times )

America’s Billionaire Playgrounds: Rockets, Ranches and Rivers (Bloomberg )

Shares, bond yields perch at six-week highs (Reuters )

Pound climbs to nearly two-month high on Brexit report (MarketWatch )

Old Navy Plans to Open 800 More Stores (Wall Street Journal )

Walmart rolls out unlimited grocery delivery subscription ()

ECB cuts key rate, to restart bond purchases (Reuters )

Treasury Secretary Mnuchin says there’s no plan for Trump to meet Iran’s Rouhani at this time (CNBC )

Trump says China will be buying ‘large amounts’ of US agricultural products (CNBC )

Nearly half of stock pickers beat their passive peers over the last year (CNBC )

T. Boone Pickens, the ‘Oracle of Oil,’ corporate raider and billionaire philanthropist, dies at 91 (CNBC )

Here’s What We Know About How Drugs Are Priced — And What We Don’t ()

Dividends Are Now Part of the Oil-Stock Playbook (Barron’s )

Major Biotechs Scare Off Short Sellers (24/7 Wall Street )

How David Swensen Made Yale Fabulously Rich (Bloomberg )

Biotech EPS UP 8.58%, Price DOWN 9.52% (Hedge Fund Tips )

Shift into value stocks could fuel a solid rally, says J.P. Morgan (MarketWatch )

Never Mind Yield Curves. What’s Negative Convexity? (Bloomberg )

The Frankfurt Auto Show’s Heaviest-Hitting Debuts ()

Trump calls for zero, negative interest rates to refinance debt (Reuters )

The economic numbers are continuing to defy the recession hype (CNBC )

Oil prices gain after U.S. inventories fall (StreetInsider )

Deere’s Largest Investor, Bill Gates, Bought Up More Stock (Barron’s )

A Giant Bet Against Natural Gas Is Blowing Up (Wall Street Journal )

Buy DuPont Stock Because It Could Break Up Again, Citigroup Says (Barron’s )

Global growth may soar and investors aren’t ready, says Morgan Stanley (MarketWatch )

Boris Johnson to Work for Brexit Deal After Losing Six Key Votes (Bloomberg )

He Paid $1.50 an Acre for Barren Texas Land Now Worth $7 Billion (Bloomberg )

State Street stock has crumbled. The CEO scooped up shares. (Barron’s )

Land Rover unveils the all new Defender at Frankfurt Motor Show after 22-year hiatus in US (CNBC )

Exclusive: Waning confidence over global recovery may nudge BOJ closer to easing – sources (Reuters )

What Kraft Heinz Can Learn From General Electric’s Quick Actions (Barron’s )

Hedge Funds Getting Burned as Growth Stocks Trounced by Value (Bloomberg )

‘Big Short’ investor Steve Eisman says Trump ‘basically has to give in’ to end the US-China trade war (Business Insider )

Fracking Buzzwords Evolve, From ‘Ramp Up’ to ‘Capital Discipline’ (Wall Street Journal )

The 10-year yield hasn’t done this in 20 years, and it could be a bullish sign (CNBC )

Bullish for banks: Bank regulatory revisions pose dangers and could lead to financial crisis: say critics (New York Post )

‘Super Mario’ Draghi Set to Ride Again: Global Economy Week (Bloomberg )

Pound Hits Highest Since July as Johnson Strikes Softer Tone (Bloomberg )

From CLOs to ‘Ozark,’ Ex-Guggenheim President Builds an Empire (Bloomberg )

Big thanks to MarketWatch.com for picking up our article this week: Investor pessimism declines but remains elevated, AAII survey shows (MarketWatch )

Hedge Fund and Insider Trading News: Bill Ackman, David Tepper, Ray Dalio, Organogenesis Holdings Inc (ORGO), Silicon Laboratories (SLAB), and More (Insider Monkey )

Why Box is one of the most underappreciated companies (TechCrunch )

ECRI Weekly Leading Index Update (AdvisorPerspectives )

Huw van Steenis On What Central Banks Will Do Next (Podcast) (Bloomberg )

Episode 371: Where Dollar Bills Come From (NPR Planet Money )

Natural Gas Bulls End Week in Style as ‘Classic Short-Covering Rally’ Continues (Natural Gas Intelligence )

What a Character: The Inimitable Career of Sacha Baron Cohen (The Ringer )

Amgen’s Gene-Targeting Drug Shrank 54% of Lung Tumors in Study (Bloomberg )

Special chart suggests the market is starting a hot streak (CNBC )

The Big Picture: Calm Settles Over Stock Market, Buying Time For Bulls (Investor’s Business Daily )

This Single Variable Explains What Drives Managed Futures Performance (Institutional Investor )

September Macro Update: Rising Possibility of a Recession in 2020 (The Fat Pitch )

Permian Basin natural gas prices up as a new pipeline nears completion (EIA )

“Where Did I Find This Guy Jerome?” Trump Asks of Hand-Selected Fed Chief (Vanity Fair )

The Eternal Pursuit of Unhappiness (Farnam Street )

Powell Says Fed Will Sustain Expansion, Reinforcing Rate-Cut Bet (Bloomberg )

The 2020 Evora GT Is the Best Lotus We’ve Seen in Decades (Bloomberg )

Investors flocked to bonds and away from stocks in August at the fastest pace on record, says TrimTabs (MarketWatch )

Opinion: Gold’s big drop is just the beginning of a longer slide (MarketWatch )

U.S.-China trade conflict could take years to resolve: Kudlow (Reuters )

Small-cap stocks could jump if a trade deal is signed (Barron’s )

Stock dividends are Japan’s latest export (Barron’s )

Mallinckrodt Bankruptcy Fear May Be Premature (Barron’s )

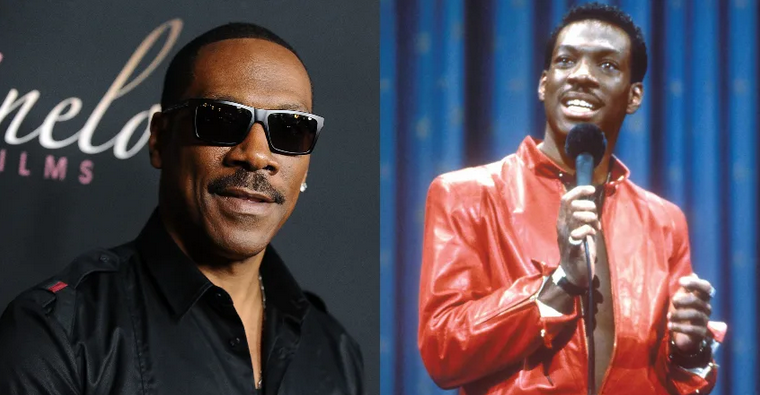

Eddie Murphy Says He’s Doing A Stand-Up Comedy Tour in 2020 (Maxim )

Stocks will ‘rally into the end of the year’ after upside earnings surprise, says J.P. Morgan’s Matejka (MarketWatch )

The explosion of ‘alternative’ data gives regular investors access to tools previously employed only by hedge funds (MarketWatch )

China cuts banks’ reserve ratios, frees up $126 billion for loans as economy slows (Reuters )

New Schlumberger CEO Outlines Strategic About-Face (24/7 Wall Street )

Christine Lagarde and the Case for More QE (Bloomberg )

Buy-the-Dip Bond Traders Are Scared of Momentum (Bloomberg )

Trump Moves to Send Mortgage Giants Back to Private Sector (New York Times )

Seth Klarman’s 3 Secrets to Value Investing (Yahoo! Finance )

Don’t Be Afraid of Stocks Now. Next Year Is Another Story. (Barron’s )

Apple’s growing opportunity in India (Barron’s )

The Fed will cut rates by a quarter point this month, not a half point, WSJ says (CNBC )

China, U.S. to hold trade talks in October; Beijing says phone call went well (Reuters )

U.S. Fed to further simplify ‘stress capital buffer’ plan: Quarles (Reuters )

After 32 Rate Cuts in 2019, Traders Say Many More Are Coming (Bloomberg )

Fed Beige Book Shows Wide Tariff Anxiety, Varied Impact So Far (Bloomberg )

Nicklaus: `Tiger’s Going to Win a Lot More Tournaments’ (Bloomberg )

A Recession Isn’t Inevitable: The Case for Economic Optimism (New York Times )

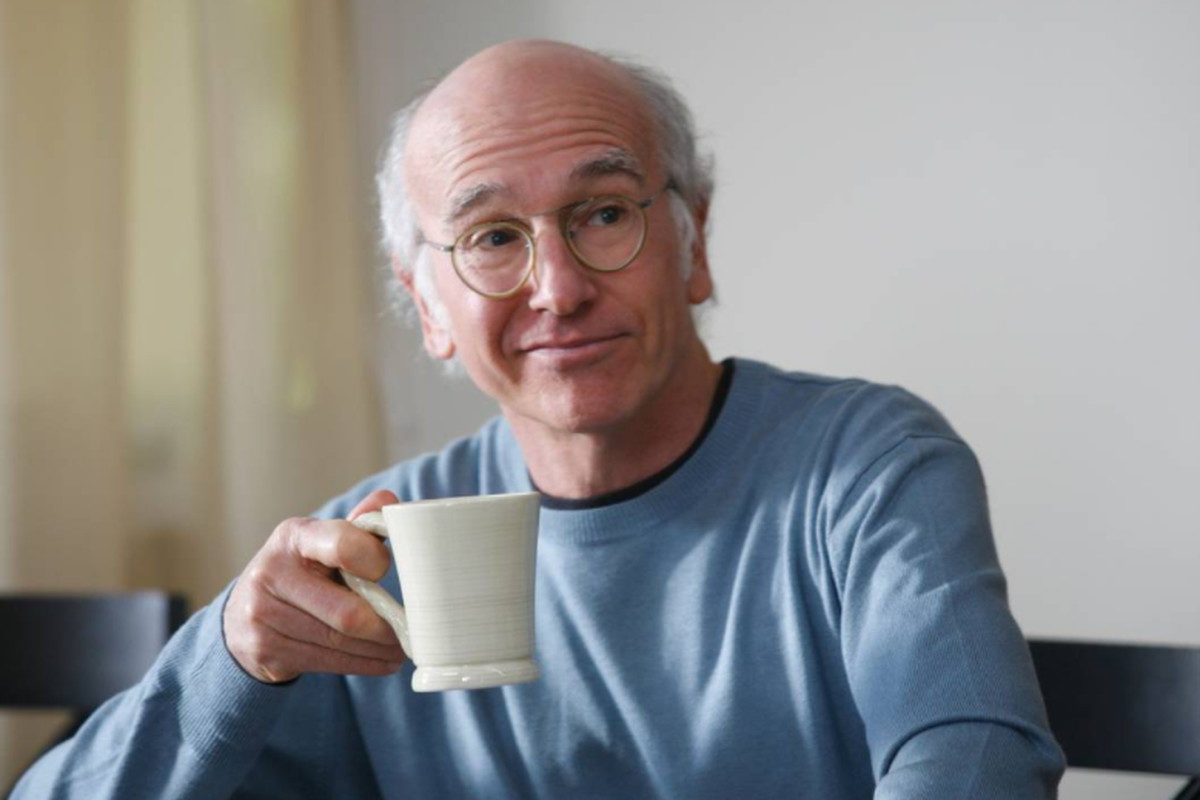

Curb Your Enthusiasm: What AI Can’t Do (Forbes )