Skip to content

China Discusses Accelerating Stimulus to Counter Trump Tariffs ( bloomberg ) Yuan Devaluation Market Chatter Grows as Trade War Worsens ( bloomberg ) China sovereign fund steps in to support stocks plunging on trade war ( reuters ) Goldman Sachs expects significant Chinese fiscal easing to offset tariffs ( reuters ) Vietnam Offers to Remove Tariffs on US After Trump’s Action ( bloomberg ) India Seeks US Trade Talks, Signaling No Retaliatory Tariffs ( bloomberg ) Trump says he can’t say what will happen to markets as his team claims 50 countries are seeking tariff deals ( marketwatch ) South Korea’s Trade Minister Heads to US After Hit by 25% Tariff ( bloomberg ) Philippines Mulls Cutting Tariffs on US Products, Its Trade Chief Says ( bloomberg ) Ishiba to Talk With Trump as Japan’s Nikkei Enters Bear Market ( bloomberg ) Hedge funds capitulate, investors brace for margin calls in market rout ( reuters ) Americans Are Sitting on a Cash Pile as Stocks Reel ( wsj ) The Stock Market’s Fear Gauges Point to a Bounce, Not a Bottom ( wsj ) Treasury Yields Fall. Why They Could Have Further to Drop. ( barrons ) Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs ( cnbc ) Trump’s Trade War Raises Bar for Fed Rate Cuts ( nytimes ) Wall Street Starts to Speak Out Against Trump’s Tariffs ( wsj ) How Global Trade Could Survive Trump’s Tariffs ( wsj ) Warren’s Winning ( zerohedge ) Hisense Partners with GXO to Manage its Logistics Operations in Spain (investing )

As Donald Trump’s trade war heats up, China is surprisingly confident ( economist ) China and America are racing to develop the best AI. But who is ahead in using it? ( economist ) Alibaba’s Qwen2.5-Omni tops Hugging Face’s open-source Ai model list ( technode ) Employee Pricing Returns at Stellantis and Ford Amid Customer Uncertainty ( thedrive ) Automakers jump on Tesla’s brand woes with discount EV offers ( techcrunch ) New Auto Tariffs Are Now in Place, Driving the Industry into Uncharted Territory ( coxautomotive ) Are there any business winners in Trump 2? ( economist ) Cautious Optimism for Building Products Distribution Rising as Sustained Demand for New Residential Construction Expected ( morningstar ) More homes are finally hitting the spring market. Will buyers take the plunge? ( npr ) How Investing Will Change if the Dollar No Longer Rules the World ( wsj ) The Complicated Relationship Between Consumer Sentiment and Stocks ( wsj ) ‘Keep Your Head When All About You Are Losing Theirs’: Here’s Warren Buffett’s Classic Advice As Stock Market Plunges on Tariff Announcement ( entrepreneur ) Alex Ovechkin has tied Wayne Gretzky’s all-time NHL goals record ( npr ) The Launch of the Torpedo Bat ( newyorker ) 5 collector cars to put into your garage this week ( classicdriver ) 5 holes that will decide the Masters (hint: not on the back 9) (golf )

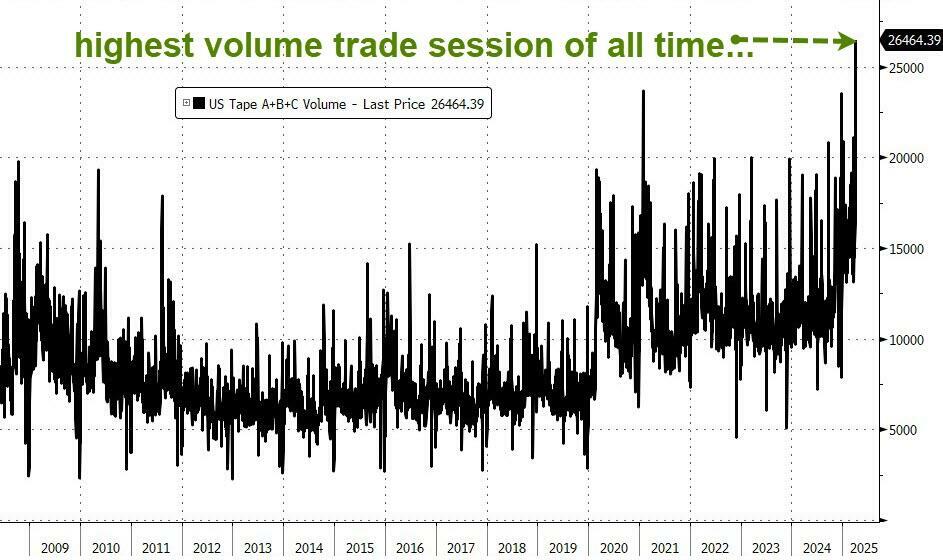

Dalio Sees US, China Push for Yuan Deal as Part of Trade Relief ( bloomberg ) How Alibaba is transforming into a catalyst for China’s AI boom ( scmp ) Nike, Lululemon Rebound as Trump Touts Call With Vietnam Leader ( bloomberg ) Mortgage Rates Are Heading Lower. Is It a Good Time to Buy a Home? ( barrons ) The Fed Is In ‘No Hurry’ to Lower Interest Rates. Don’t Be Surprised by Multiple Cuts. ( barrons ) The Big Losers in Trump’s Tariff Chaos—and a Couple of Survivors ( wsj ) Energy Tanked on Trump’s Tariffs. Natural-Gas Stocks Could Still Fire Back Up. ( barrons ) U.S. natural gas consumption set new winter and summer monthly records in 2024 ( eia ) Stellantis gives employee discount to US buyers as tariffs take effect ( nypost ) General Motors, Nissan to boost production at US plants due to Trump tariffs ( nypost ) Hedge funds hit with steepest margin calls since 2020 Covid crisis ( ft ) Goldman: Biggest. Selling. Ever! ( zerohedge ) With value investing back in vogue, I’m taking a leaf out of Warren Buffett’s playbook ( yahoo ) Trump is calling for a rate cut to rescue markets. Why he might be right. ( marketwatch ) A weaker dollar and lower rates are part of Trump’s plan. Don’t say you weren’t warned. ( marketwatch ) Flight to safety pushes 10-year Treasury yield below 4% ( ft ) The Stock Market Had Its Worst Week Since the Pandemic. Keep Hope Alive. ( barrons ) Tariff impact manageable for commercial aero; Boeing exposure limited: Wells Fargo ( investing ) Something’s Gone Wrong With Microsoft’s Huge AI Data Center Investments (futurism )

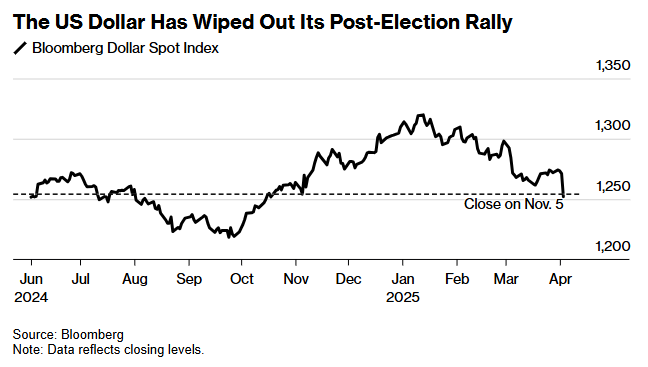

Why This Is China’s Year in Markets ( bloomberg ) China Retaliates Against Trump Tariffs With 34% Levy on U.S. Goods ( barrons ) Cheap Shein and Temu Finds Are History. This Import Loophole Is Now Closed. ( barrons ) Gold and Foreign Stocks Are Winning. Here Are the Losers. ( barrons ) Donald Trump triggers race to offer US concessions before tariffs hit ( ft ) A Market-Rattling Attempt to Make the American Economy Trump Always Wanted ( wsj ) Ford rolls out discounts — and Volvo, Mercedes eye upping US production as Trump’s auto tariffs rev up ( nypost ) Volvo Cars’ new CEO vows to produce more cars in US ( reuters ) Fed to cut rates five times in 2025 to shore up economy amid tariff storm: Citi ( streetinsider ) Fed to go big with June start to interest-rate cuts, traders bet ( yahoo ) Euro Emerges as Unlikely Winner From Trump’s Trade Shock ( bloomberg ) Dollar Weakens as Investors Seek Safety Elsewhere ( wsj ) Mortgage Rates in US Slip for a Second Week, Dropping to 6.64% ( bloomberg ) Hiring Defied Expectations in March, With 228,000 New Jobs ( wsj ) Intel Gains on Report of Joint Venture Deal With TSMC ( bloomberg ) Alcohol Industry Dodges Worst of Trump’s Tariffs — For Now ( bloomberg ) Consumer Staples Gain on Rush to Safety After Tariffs Spark Market Rout ( wsj ) Exempt or Not, the Chip Industry Won’t Escape Tariffs ( wsj ) Lululemon stock falls as Trump’s tariffs put it in the ‘bullseye.’ This analyst still says buy. ( marketwatch ) The ‘Magnificent Seven’ saw a record $1 trillion wipeout — and Apple led the way ( marketwatch ) Mizuho maintains PayPal stock Outperform rating, $96 target ( investing ) Retail Traders Step In to Buy as Others Flee in Tariff Rout ( bloomberg ) US Energy Chief Plans to Use Federal Land to Build Data Centers ( bloomberg ) These Are Scary Times. Market Downturns Can Be a Buying Opportunity. ( barrons ) Why You Should Ignore Everything Going On in the Market Right Now (barrons )

Traders Bet on More Fed Cuts With 10-Year Yield Headed Toward 4% ( bloomberg ) What to Know About the U.S. Trade Imbalance, in Charts ( wsj ) Trump’s ‘Reciprocal’ Tariff Formula Is All About Trade Deficits ( bloomberg ) Trump’s Tariffs Were Supposed to Boost the Dollar. Why the Opposite Happened. ( wsj ) 10-year Treasury yield falls to lowest level since October after Trump unveils sweeping tariffs ( cnbc ) Dollar Drops by Most Since 2022 as Traders Brace for More Pain ( bloomberg ) Will Today Go Down In History As The Beginning Of A New Era? ( zerohedge ) Chinese Stock Investors Flock to Hong Kong to Bargain Hunt ( bloomberg ) China Stocks Post Modest Losses as US Tariffs Spur Stimulus Bets ( bloomberg ) Alibaba Steps Up AI Game With Qwen 3, Challenging DeepSeek’s Low-Cost AI Success ( yahoo ) China Services Gauge Shows Acceleration in Activity Expansion ( wsj ) Tariff Loophole That Helped Temu, Shein Will Close May 2 ( bloomberg ) Xiaomi delivers record cars in March as winners emerge in China’s EV race ( cnbc ) Ford Motor Company will offer employee pricing to all US shoppers: ‘Handshake deal with every American’ ( foxbusiness ) Hyundai Motor says no plan for price hikes in US for now ( reuters ) Auto giants surprisingly resilient as sweeping U.S. tariffs spare Canada and Mexico for now ( cnbc ) Euro jumps over 2% against dollar after hefty US tariffs announced ( streetinsider ) Europe LNG Demand Is So Hot That Cargoes Land at Wider Discounts ( bloomberg ) Intel Stock Has Broken Its Winning Streak. This Could Help It Rally Again. ( barrons ) Intel’s new CEO Lip-Bu Tan makes his case for a revived Intel ( yahoo ) Boeing Has Made ‘Drastic’ Changes to Root Out Defects, CEO Says ( bloomberg ) Is Apple Pay really a problem for PayPal? Wall Street analyst weighs in ( streetinsider ) Growing Recession Worries Are Hitting Fintechs. 2 Bargain Stocks to Consider. ( barrons ) This Ultracheap Stock to Buy Is a Compelling Value Investment ( morningstar ) GXO Logistics, Inc. renews multi-year contract with Grupa Żywiec in Poland ( investing ) Retailers Are Dreading Tariffs. 8 Companies That Could Weather the Storm. ( barrons ) Want to Bring Factories Back? This Is What It Takes. ( barrons ) In shaky times, investors should hold their nerve (ft )

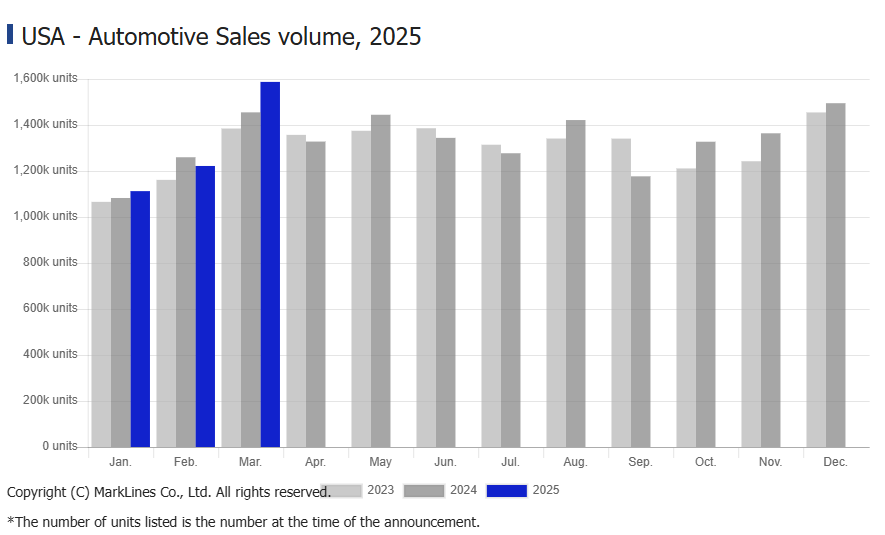

U.S. auto sales up 8.8% in March as pre-tariff rush boosts new car sales ( marklines ) Trump Tariff Threat Mobilizes Car Shoppers ( wsj ) Is Trump’s Plan Working? ADP Shows Biggest Jump In US Manufacturing Jobs Since Oct 2022 ( zerohedge ) US construction spending beats expectations in February ( reuters ) US LNG exports soar in March on ramp up of Plaquemines plant ( reuters ) Alibaba’s Qwen3 AI model coming this month, sources say, in bid to cement industry lead ( scmp ) How Alibaba.com is betting on AI to transform e-commerce ( scmp ) Joe Tsai Is Becoming AI’s Voice of Reason ( bloomberg ) China’s Improving Profits May Help Soften Tariff Blow for Stocks ( bloomberg ) EMJ’s Eric Jackson says Alibaba is a better AI play than Nvidia right now ( youtube ) March Economic Data Stronger Than Expected Despite Lack of Media Coverage ( chinalastnight ) Intel’s new CEO is known to ‘underpromise and overdeliver.’ Can he do it again? ( marketwatch ) Intel analyst says this is the ‘best ever messaging’ from the new CEO, management ( streetinsider ) Diageo Divests From Third African Brewer in Less Than a Year ( bloomberg ) Boeing CEO to Tout Culture, Safety Reforms Prompted by Missteps ( bloomberg ) PayPal set to launch ad platform in the UK ( investing ) 33 Undervalued Stocks to Buy for 2025 ( morningstar ) How Caution and Contrarianism Paid Off for Investors During Q1 ( morningstar ) Investors are turning bearish on the U.S. dollar as Trump tariffs loom ( cnbc ) No need to wait: Goldman slashes 10-year yield forecast ( marketwatch ) Germany Offers the Global Economy a Glimmer of Hope ( barrons ) A Big Coal Plant Was Just Imploded to Make Way for an AI Data Center (wsj )

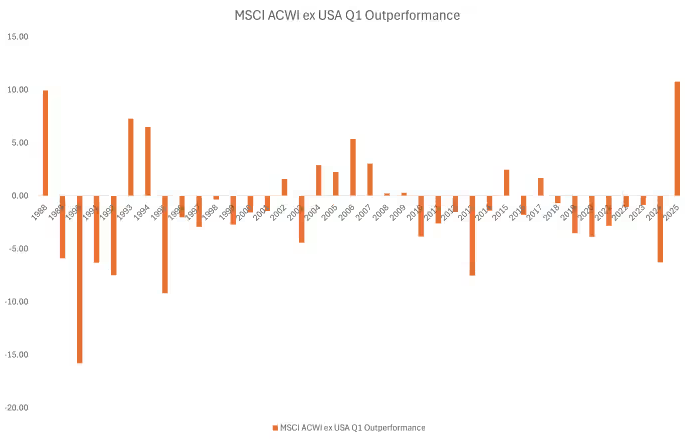

Intel’s new chief promises ‘cultural change’ at chipmaker ( ft ) Intel’s New CEO Plots Turnaround; ‘We Need to Improve’ ( wsj ) Intel CEO Lip-Bu Tan Says Company Will Spin Off Non-Core Units ( bloomberg ) The Clock Is Ticking Loudly for Intel’s New Boss ( wsj ) Alibaba woos back DingTalk founder to lead office app’s AI push ( scmp ) Chinese stocks get ‘shot in the arm’ from stimulus moves, HSBC survey says ( scmp ) Global stocks trounced the U.S. during the first quarter. Is ‘American exceptionalism’ in trouble? ( marketwatch ) China Manufacturing Activity Gauge Shows Continued Expansion ( wsj ) Boeing stock is a new Top Pick at JPMorgan ( yahoo ) Boeing awarded $2.46 billion contract modification for C-17 sustainment ( investing ) Boeing denies fluctuations in 737 MAX jet production ( reuters ) Car Sales Poised for Boost as Buyers Beat Tariff Price Hikes ( bloomberg ) US Automakers Make Mad Dash to Persuade Trump to Temper Tariffs ( bloomberg ) Mizuho maintains PayPal stock Outperform rating, $96 target ( investing ) The 1 Scenario That Would Send the Stock Market Soaring ( barrons ) Energy Stocks Defy Market Turmoil in Hunt for Inflation Hedge ( bloomberg ) 3 Long-Term Stocks to Buy That We Still Believe In ( morningstar ) The 10 Best Companies to Invest in Now ( morningstar ) U.S. Natural Gas Gains With Help From Weather ( wsj ) CVS Health and Deckers Are the S&P 500’s Best and Worst for the Quarter. Here’s Why. ( barrons ) Meta Stock Slumps the Least in a Bad Quarter for the Mag 7. Tesla Is Set to See Its Worst First Quarter Ever. ( barrons ) Nasdaq 100’s Worst Quarter in Years Sealed by AI Bubble Fears ( bloomberg ) Palantir Stock Is Dropping. 3 Reasons It’s in the Selling Crosshairs. (barrons )

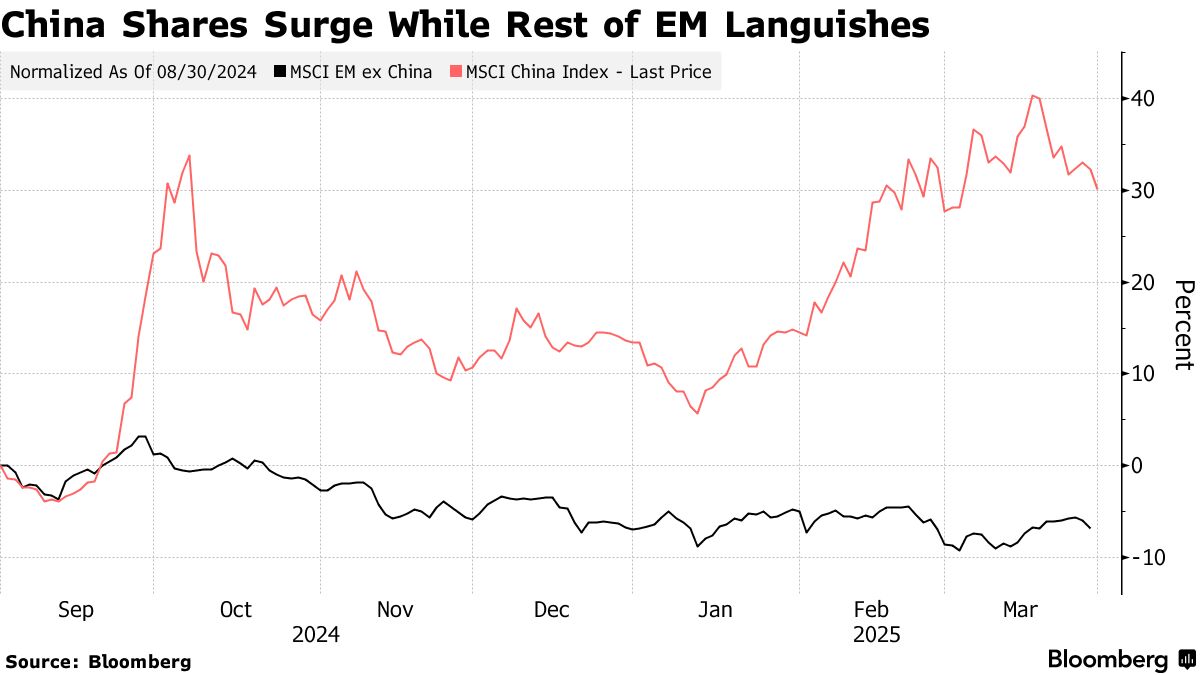

Chinese Stocks Power Ahead of Emerging Peers Amid AI Frenzy ( bloomberg ) China’s factory activity growth at 1-year high, official survey shows, as stimulus measures kick in ( cnbc ) A Wild Quarter for U.S. Stocks Sends Investors Abroad ( wsj ) This Investing Trend Is Your Friend—Until It Isn’t ( wsj ) Consumers Are Worried About the Economy. Why It Isn’t all Gloom and Doom. ( barrons ) Car Shoppers Outracing Trump Tariffs Poised to Lift Auto Sales ( bloomberg ) The Housing Market Will Have Some Bargains This Spring ( bloomberg ) The M&A Boom Wall Street Wanted Is Here, if You Know Where to Look ( wsj ) BOC Aviation Buys 120 Single-Aisle Jets From Airbus, Boeing ( bloomberg ) Last Week Saw The 2nd Largest Selling Of Tech Stock By Hedge Funds In 5 Years ( zerohedge ) Goldman Sees More Fed Cuts This Year as Tariffs Dent Growth ( bloomberg ) China’s Big State Banks to Get $71.6 Billion Capital Injection ( wsj ) Make Europe Great Again trades are gaining traction ( reuters ) Alibaba.com Records Double-Digit Order Growth in the USA During March Expo ( morningstar ) Disney is raising the stakes with bold new menu in bid to lure more customers ( nypost ) Markets could have the ‘right pieces’ for a bottom this week, says Fundstrat’s Tom Lee (youtube )

How Diageo CEO Debra Crew’s time in military intelligence shaped her leadership style at the Johnnie Walker and Guinness maker ( fortune ) How Disney creates a ‘Disney Bubble’ around its theme parks ( fastcompany ) BofA maintains Walt Disney stock Buy rating, $140 target ( investing ) Ducks Team Up with Vans for Exclusive Player-Designed Sneakers on Sale Sunday, March 30 ( nhl ) Ducks and Vans Join Forces for Special Shoes Collaboration ( thehockeynews ) Can foreign investors learn to love China again? ( economist ) Tmall Doubles Down on Brand Growth with Expanded Resources ( alizila ) How PayPal, Sam’s Club, and Nordstrom Plan to Grow Their Ad Businesses ( adweek ) Altra President Jen McLaren Shares Go-Forward Plan ( shopeatsurf ) Advance Auto Parts to open 30 new stores in 2025; 100 through 2027 ( foxbusiness ) Used Cars Love Tariffs. So Do Auto Parts Stocks. ( ibd ) The AI Data-Center Boom Is Coming to America’s Heartland ( wsj ) Homebuilder inventory hits 2009 levels: These are the housing markets where you can find deals ( fastcompany ) Europe’s Stock Surge Outpaces Wall Street in Historic Run ( bloomberg ) Maserati Just Unveiled a Program That Lets You Design Your Own One-of-a-Kind Sports Car ( robbreport ) Aston Martin’s Vanquish Volante Is The World’s Fastest Front Engine Convertible ( maxim ) 8 simple tips for improving your golf game (golf )

Car Buyers Who Fear Tariff Price Hikes Are Rushing to Dealers ( bloomberg ) Selling Your House This Spring? You Might Need to Cut the Price ( wsj ) AI Agents Are a Moment of Truth for Tech ( wsj ) Americans Feel Bad About the Economy. Whether They Act on It Is What Really Matters. ( wsj ) How the Reversal of the ‘American Exceptionalism’ Trade Is Rippling Around the Globe ( wsj ) Forget the Mag 7. The ‘Terrific 10’ Are the Tech Bet for 2025. ( barrons ) Intel Board Members Leaving as Chipmaker Looks to Add Expertise ( bloomberg ) Intel Received $1.9 Billion From Final Close of SK Hynix Deal ( barrons ) Exclusive: Buyout, aerospace firms close in on $8 billion-plus Boeing navigation unit, sources say ( reuters ) Wall Street Analysts Adore Amazon, Microsoft, and Nvidia. Here’s Why That’s Problematic. ( barrons ) Disney Stock Is Under Pressure. Why Wall Street Is Singing Hakuna Matata. ( barrons ) Can ESPN and Major League Baseball Still Play Ball? ( vanityfair ) The United States remained the world’s largest liquefied natural gas exporter in 2024 ( eia.gov ) Xi Jinping pitches China to global CEOs as protector of trade ( ft ) US car tariffs help Chinese EVs to race ahead ( ft ) Nvidia Stock Falls. It Has Problems at Home and Abroad. (barrons )