Skip to content

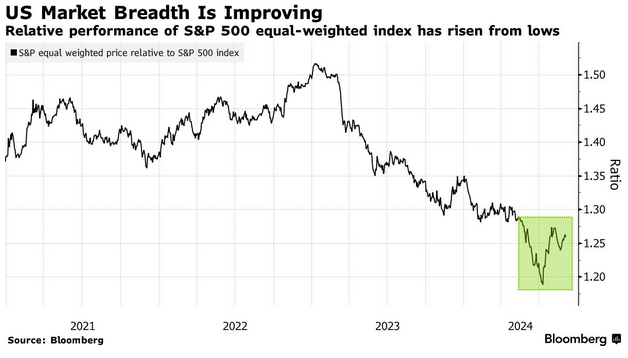

Stock Laggards Are Due a Catch Up (bloomberg )

Discretionary Stocks Are Set to Rally. Why Amazon and Tesla Hold the Key. (barrons )

Stocks Typically Suffer in September. Why Markets Face More Pain This Year. (barrons )

Biotech Stocks Are Showing Signs of Life. Why the Rally Could Continue. (barrons )

Septembers in presidential-election years aren’t so bad for the stock market. (marketwatch )

Treasury yields edge lower as traders await start of four-day data dump (marketwatch )

Boeing Investors Weigh Cost of a Strike as Clock Ticks on Contract (barrons )

Disney Narrows Search for the Next Bob Iger. How the Top 2 CEO Candidates Stack Up. (barrons )

Americans Are Really, Really Bullish on Stocks (wsj )

Americans’ Economic Mood Brightens—a Bit (wsj )

Shorts Are Circling Some of the AI Boom’s Biggest Question Marks (bloomberg )

Investors should be cautious for the next 8 weeks, says Fundstrat’s Tom Lee (cnbc )

Chinese e-commerce giant Pinduoduo updates rules to kick out sellers of shoddy products (scmp )

Alibaba-backed e-wallet operator buys Ant Bank Macao, eyes financial services for tourists (scmp )

Google, DOJ Trial Drama To Hit Earnings By Up To 10%, Says JPMorgan: ‘Status Quo Is No Longer Possible’ (benzinga )

New report offers more details into Intel’s possible plans to slash costs, sell units (marketwatch )

Banks May Think Twice Before Lowering Savings Account Rates in Lockstep with the Fed (barrons )

Chinese EV Makers Boost Deliveries by 30% in August (barrons )

China’s Sputtering Growth Engines Raise Urgency for Stimulus (bloomberg )

Yen Forecasters Chart Path Past 140 as Global Rate Tracks Emerge (bloomberg )

Ant Group’s blockchain arm Zan wants to be the Google or Microsoft of Web3 in Hong Kong (scmp )

Hong Kong property: cash-rich buyers make most of Peak distress amid 50% price slump (scmp )

U.S. stock-market rebound faces ‘huge’ jobs reports after Labor Day weekend (marketwatch )

Anil Kashyap on the Two Types of Fed Balance Sheet Operations (bloomberg )

Luscious Views, Perfect Pasta, and Secret Hideaways: 4-Day Weekend on the Amalfi Coast (mensjournal )

Retail Needs Some Therapy as Cautious Consumers Trade Down (wsj )

Airbnb Should Be a Sleeper Hit (wsj )

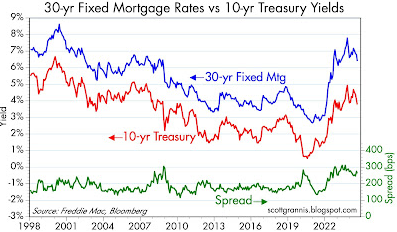

Why Interest Rate Cuts Won’t Fix a Global Housing Affordability Crisis (nytimes )

How to fix a housing shortage (npr )

Kamala’s tax proposals (scottgrannis )

Pagani Will Keep Making V-12 Hypercars Because Its Customers Don’t Want Hybrids or EVs (robbreport )

What to Watch For Next When the Fed Starts Cutting Rates (bloomberg )

Jeff Bezos’ new $80 million ride (foxbusiness )

Alibaba shares jump after it completes three-year regulatory overhaul (nbc )

Intel is trading at ‘tangible book’: Thomas Hayes (foxbusiness )

Biotech Stocks Are Showing Signs of Life. Why the Rally Could Continue. (barrons )

He Raised Disney Park Prices—and Fans Still Love Him. Now He’s on the CEO Shortlist. (wsj )

Intel working with bankers to present board with strategic options, sending shares up 10% (cnbc )

Consumer sentiment improves a bit more in late August (marketwatch )

Intel Weighs Options Including Foundry Split to Stem Losses (bloomberg )

The North Face/Vans Parent Sees Big Insider Stock Buy (barrons )

Dollar General Blamed the Economy for Poor Earnings, but This Was the Cause (barrons )

A population decline stemming from falling birthrates and tighter immigration policies could derail America’s prosperity. Politicians of both persuasions are promising to help families. (barrons )

Fed’s Preferred Inflation Gauge Stays on Cooling Trend (barrons )

Intel Considers a Radical Reform, Report Says. Why It Could Spell the End for CEO Pat Gelsinger. (barrons )

Eurozone Inflation Closes in on ECB Target (wsj )

The Threat to OpenAI Is Growing (wsj )

How a Corporate Tax Rate Change Could Impact Companies’ Growth, Investment (wsj )

Lululemon promises to crank out new styles after ‘Breezethrough’ fiasco, embarrassing reviews (nypost )

Chinese central bank’s $56bn debt purchase sparks talk of bond market intervention (ft )

How Nike Ran Into Trouble (bloomberg )

94 Investing Lessons from Warren Buffett (dgi )

Check Into These Classic Italian Luxury Hotels in Tuscany and Milan (maxim )

Alibaba wins Beijing’s approval in end to years-long scrutiny (finance.yahoo )

IBM Cloud to offer Intel’s Gaudi 3 AI chips next year (techcrunch )

Intel Weighs Options Including Foundry Split to Stem Losses (finance.yahoo )

Yuan Hits Strongest in Over a Year as Flows Offset Fundamentals (bloomberg )

Disney CEO Bob Iger says he’s ‘obsessed’ with finding his replacement. The clock is ticking. (finance.yahoo )

China PBOC Starts Bond Trading After Warning of Market Stampede (bloomberg )

Dell Stock Rises on Strong Earnings. AI Server Demand Is Booming. (barrons )

Lululemon’s diagnosis of its current woes? Not enough ‘newness.’ (marketwatch )

‘The Claman Countdown’ panelists Scott Bauer and Thomas Hayes react to Nvidia beating estimates. (foxbusiness )

Yen’s Rapid Advance Pressures Earnings Once Thought Easy to Beat (bloomberg )

Chinese central bank’s $56bn debt purchase sparks talk of bond market intervention (ft )

China’s internet users near 1.1 billion, driven by short videos and mobile payments (scmp )

How golfing — and putting in particular — can be applied to investing, according to one strategist (marketwatch )

Tool Up for Lower Rates With Stanley Black & Decker (wsj )

“Nguyen said that rivals, such as Intel, could “chip away” at Nvidia’s market share” (bbc )

Nvidia Tumbles After Disappointing Forecast, Blackwell Snags (bloomberg )

Nvidia’s earnings report shows the problem of being priced for perfection (cnbc )

Nvidia CEO Jensen Huang Sold $580 Million of Stock. How Much More He Can Sell. (barrons )

NVIDIA Earnings: Here’s What You Need to Know (247wallstreet )

Friday’s PCE inflation report: Here’s how financial markets may react (marketwatch )

Retail investors are bullish on stocks ahead of the Fed’s rate cut next month (marketwatch )

Retail investors loaded up on Nvidia ahead of the microchip maker’s poorly received results. (marketwatch )

This $100 Million Tournament Gives Scottie Scheffler a Head Start. It Also Gives Him Fits. (wsj )

Canada Goose, Known for Heavyweight Parkas, Leans Into T-Shirts and Shorts (wsj )

AI Is Learning to Predict the Weather (wsj )

Bosses Are Finding Ways to Pay Workers Less (wsj )

California lawmakers pass controversial AI bill opposed by most of tech industry (nypost )

Layoffs remain low as first-time jobless claims decline (marketwatch )

China’s international use of renminbi surges to record highs (ft )

Alibaba announced its conversion to a Hong Kong and New York dual primary listing, paving the way for a September inclusion in the Southbound Stock Connect. (chinalastnight )

Alibaba’s Connect Membership May Be a Boon for Overseas Stocks (bloomberg )

Fed’s annual Jackson Hole conference confirmed a regime change: Thomas Hayes (Fox Business )

Hayes points to seasonality factors at play as the next few months could see heightened volatility (^VIX) ahead of the election. (Yahoo! Finance )

New Boeing CEO’s engineer background ‘helpful’ to turnaround (Yahoo! Finance )

Protests in China on the Rise Amid Housing Crisis (bloomberg )

Warren Buffett’s Berkshire Hathaway Is Selling Bank of America Stock Again (barrons )

Chewy Stock Rises. Earnings Jump After Customers Spend More on Pets. (barrons )

Food Is Getting Cheaper. The ‘Price Gouging’ Fight Has Nothing to Do with It. (barrons )

Can a Closed Nuclear Power Plant From the ’70s Be Brought Back to Life? (wsj )

US Mortgage Rates Drop Again to Lowest Level Since April 2023 (bloomberg )

Reliance, Disney India’s $8.5 Billion Merger Wins Antitrust Nod (bloomberg )

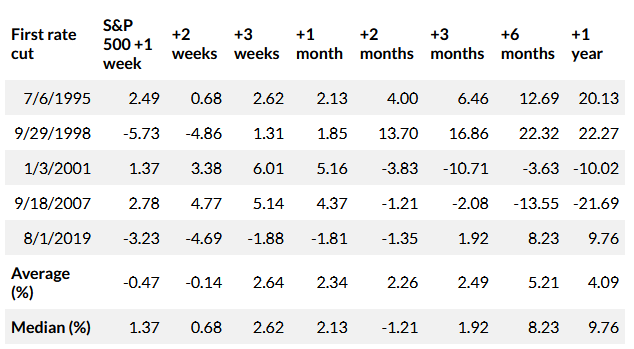

Will stocks rally or fade after the Fed cuts rates? Here’s what history tells us. (marketwatch )

There Are Opportunities in Beaten-Down Office Buildings. Where to Find Them. (barrons )

Boeing Says a Travel Boom in China Will Double Demand for Planes (barrons )

Fed Cut Could Lift Chinese Stocks. Here’s Who Could Benefit. (barrons )

China’s PDD (Temu) suffers $55 bln market cap wipeout (reuters )

Nvidia Earnings Arrive Tomorrow. What the Stock Needs to See. (barrons )

Ford Says Its Pulling Back on EVs. That’s Not the Whole Story. (barrons )

The Stock Market Rally Can Expand Beyond Big Tech. This Earnings Season Shows Why. (barrons )

6 Stocks That Look Like Buys for a Soft Landing (barrons )

‘FOMO’ returns to the options market as traders chase stocks higher (marketwatch )

Pound hits more than two-year high, dollar back under pressure (streetinsider )

Watch out for weaker seasonality in September, BofA says (streetinsider )

Elliott Investment Critiques Southwest Leadership, Overdue Changes (wsj )

Eli Lilly to sell half-price version of Zepbound weight loss drug (ft )

China’s export curbs on semiconductor materials stoke chip output fears (ft )

Temu’s global expansion now looks fraught with difficulty (ft )

Investors’ expectations for European inflation fall to lowest since 2022 (ft )

‘T-Bill and Chill’ Is a Hard Habit for Investors to Break (bloomberg )

JD.com Unveils $5 Billion Share Buyback as China Concerns Grow (bloomberg )

The starter home is making a comeback as the housing market thaws for first-time buyers (businessinsider )

Temu parent PDD’s stock tumbles after a revenue miss as competition intensified (marketwatch )

Alibaba Shareholders Approve Dual Primary Listing, Paving The Way For September Southbound Inclusion (chinalastnight )

The inside story of the secret backchannel between the US and China (ft )

How Banks Offload Risk From Their Balance Sheets (bloomberg )

Mortgage rate relief is coming (scottgrannis )

To Google or Not to Google? (ps )

Frank Lloyd Wright’s Only Skyscraper Is Heading to Auction (smithsonian )

“Black Myth: Wukong” Sparks Video Gaming Surge and Tourism Bookings in China (alizila )

Milton Friedman’s Shower Scene Is Back (bloomberg )

Why dividend stocks should be a hot play into fall (cnbc )

Hilton aims to add 100 new China hotels a year (scmp )

Nvidia Earnings Are Coming. Big Tech Needs Them to Be Good. (barrons )

China’s AI Engineers Are Secretly Accessing Banned Nvidia Chips (wsj )

Intel hiring Morgan Stanley, other advisors for activist defense (cnbc )

The Big Number: 818,000 (nytimes )

Ban on Doctor-Owned Hospitals Has Backfired: Opinion (bloomberg )

US Natural Gas Is America’s Clean Energy Standard (zerohedge )

The End of Fabulous Money Market Rates Is Near (nytimes )

Hedge funds are consciously uncoupling from the Mag7 (ft )

Inflation Usually Hits Harder for Poor Families. For a Couple of Years, It Didn’t. (wsj )

Lululemon ‘Dupes’ Are Just as Cool With the TikTok Crowd (wsj )

Legendary Investor Bill Miller (forbes )

Investors rush to money market funds before Fed rate cut, BofA says (reuters )

PayPal partners with crypto platform Anchorage Digital to offer stablecoin rewards (fortune )

Here’s What the Old Farmer’s Almanac Says to Expect for Winter 2025 (mensjournal )

Nelly Korda Proves She Is Not Simply a “Dome Golfer” (mensjournal )

Hennessey Performance Unveils ‘Stealth Series’ Carbon Fiber Hypercar (maxim )

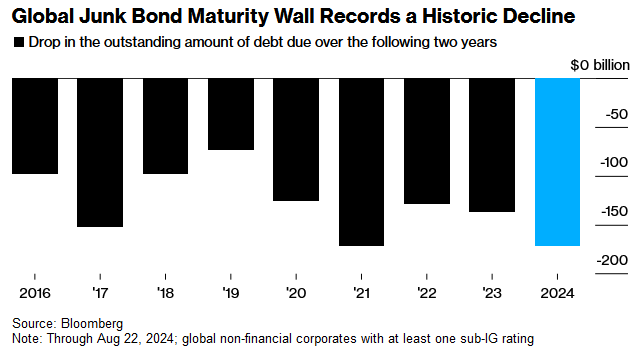

Junk Bond Maturity Wall Erodes as Money Managers Seek Yield (bloomberg )

Key Takeaways From the Fed’s Annual Jackson Hole Conference (bloomberg )