1. What’s Next for Retail After a Great Week (Barron’s)

2. Powell Needs to Side With Markets at Jackson Hole (Barron’s)

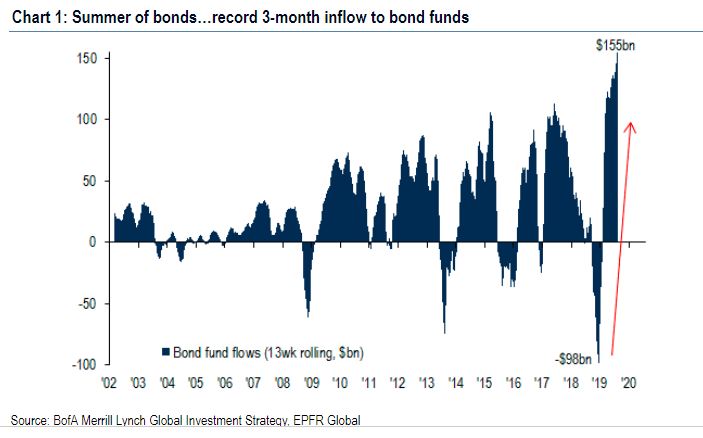

3. Investors are so bearish, it’s almost time to start buying stocks again, says Bank of America (MarketWatch)

4. Trump may still unveil tax cuts before 2020 election, Kudlow says (MarketWatch)

5. 25 dividend stocks selected for value by an outperforming money manager (MarketWatch)

6. These five U.S. stocks are most vulnerable to an activist attack (MarketWatch)

7. Health Insurers Set to Expand Offerings Under the ACA (Health Insurers Set to Expand Offerings Under the ACA (Wall Street Journal)

8. ECB Minutes Back Up Signals of Broad Stimulus Package (Wall Street Journal)

9. Watch CNBC’s full interview with St. Louis Fed President James… (CNBC)

10. China Hits Back at U.S. With Tariffs on $75 Billion of Imports (Bloomberg)

Category: What I’m Reading Today

Be in the know. 10 key reads for Thursday…

1. OPEC’s market share sinks – and no sign of wavering on supply cuts (Reuters)

2. Lumber Liquidators’ (LL) Founder Sullivan Seen Pushing for CEO Ouster – Sources (Street Insider)

3. Why This Jackson Hole Meeting Looks Like One of Best (Bloomberg)

4. Bianco: Powell Needs to Side With Markets at Jackson Hole (Bloomberg)

5. Uber’s Long Road to Profits (Wall Street Journal)

6. Costco Is the Most ‘Woke’ Company Out There (Barron’s)

7. Bank of America’s CEO has one simple reason why he doesn’t see a recession looming (MarketWatch)

8. Why Some Firms Say to Hold Out for an Emerging-Market Rebound (Wall Street Journal)

9. Mortgage Market Reopens to Risky Borrowers (Wall Street Journal)

10. Opinion: Milton Friedman on the Morality of the Free Market (Wall Street Journal)

Be in the know. 10 key reads for Wednesday…

1. Germany sells nearly $1 billion of 30-year negative yielding bonds (MarketWatch)

2. Opinion: The Fed needs to radically change policy and start printing money (MarketWatch)

3. Fed’s Kashkari says U.S. central bank should use forward guidance now: FT (Street Insider)

4. The US and Japan are holding trade talks, and a deal could settle shaky markets. (Business Insider)

5. Muni-Bond Buyers Are Desperate. Risky Borrowers Are Cashing In (Bloomberg)

6. Lamborghini debuts hyper-exclusive Aventador SVJ 63 Roadster, Huracán EVO GT Celebration (USA Today)

7. It’s Not a Bad Time for the Right Kind of Tax Cut (Barrons)

8. GE Power Is on a ‘Positive Trajectory’ (Barrons)

9. Milton Friedman on CEOs (Wall Street Journal)

10. Traders Bet on Falling Volatility (Wall Street Journal)

Be in the know. 10 key reads for Tuesday…

1. Wall Street Poised to Get Long-Sought Changes to Volcker Limits (Bloomberg)

2. ‘Tesla Killers’ Are Having A Really Hard Time Killing Tesla (Bloomberg)

3. Baidu.com (BIDU) Tops Q2 EPS by 60c (Street Insider)

4. Senior White House officials eye tax cut to avert slowdown: Washington Post (Street Insider)

5. These New Cars Have the Most Powerful Engines (24/7 Wall Street)

6. Baker Hughes Stock Slumped on GE Allegations, and Insiders Bought Up Shares (Barron’s)

7. Bank Regulator Pitches Low-Income Lending Rule Changes on U.S. Road Trip (Wall Street Journal)

8. Trump Administration Delays Ban on Huawei Working With U.S. Firms (Wall Street Journal)

9. The tide may be turning for the worst-performing S&P sector this year (CNBC)

10. Howard Marks: there’s sanity in stocks (MoneyWeek)

Be in the know. 5 key reads for Monday…

1. Apple CEO warns Trump about China tariffs, Samsung competition (Reuters)

2. This Year’s Tech IPOs Face a New Test (Barrons)

3. Euro zone bond yields rise from record lows, 30-year leads way (Reuters)

4. Powell Likely to Use Jackson Hole to Suggest Fed Ready to Cut (Bloomberg)

5. Tesla reboots its solar-panel business by offering rentals (MarketWatch)

Be in the know. 10 key reads for Sunday…

1. Where Hedge Funds Made Big Bets: Buying Uber, Selling Microsoft (Bloomberg)

2. The life rule Ray Dalio taught his son about success (CNBC)

3. A Century of Weird, Wonderful Concept Cars ()

4. AbbVie Stock Jumps After Rheumatoid Arthritis Treatment Gains OK; Rivaling Lilly, Pfizer (Investor’s Business Daily)

5. Hedge Fund Fees Continue To Shrink, But That’s Not The Whole Story (ValueWalk)

6. Apple CEO Tim Cook has met Trump at least 5 times in a year in a desperate bid to keep him on-side amid the trade war (Business Insider)

7. David Tepper Invests in 2 Managed Care Companies in 2nd Quarter (Guru Focus)

8. What I Learned at Camp Kotok (Advisor Perspectives)

9. 5 Reasons to Consider Buying Berkshire Hathaway (Morningstar)

10. Charles Koch — CEO of Koch Industries (Tim Ferriss Podcast)

Be in the know. 20 key reads for Saturday…

1. Wall Street Has Abandoned Oil and Gas Stocks. You Shouldn’t. (Barron’s)

2. American Eagle Stock Will Soar Despite the Trade War (Barron’s)

3. Copper prices could take off as supply tightens (Barron’s)

4. Strong consumer spending points away from a recession (Barron’s)

5. How to Avoid Recession? Cut Rates Like It’s 1995. (Barron’s)

6. Ackman Calls Berkshire a ‘Misunderstood’ Cash Machine (Barron’s)

7. Alibaba ADRs Are Rising Because of Strong Earnings. Here’s What Wall Street Thinks. (Barron’s)

8. Deere Stock Is Up Because All the Bad News Was Known (Barron’s)

9. Why The Co-Founder of Allbirds Always Exercises Before His Flight (Wall Street Journal)

10. Silicon Valley Goes to Congress in First Trailer for the Final Season (Vanity Fair)

11. Here’s what Powell could say at Jackson Hole to soothe the roller coaster markets

(CNBC)

12. BofA’s CEO Says the Biggest Recession Risk Is the Fear of Recession (Bloomberg)

13. Bugatti Channels Early ’90s Supercar Swag in New $8.9 Million Auto (Bloomberg)

14. Why the ECB Will Stuff Free Money Into Bank Pockets Again (Bloomberg)

15. Fed’s Kashkari Backs More Policy Support as Recession Risks Rise (Bloomberg)

16. These are the 15 hottest destinations billionaires are traveling to in 2019 (Business Insider)

17. More and More Public Companies Are Going Private (Institutional Investor)

18. ‘The Worst That Activist Short Selling Has to Offer’ (Institutional Investor)

19. Comedian Jim Gaffigan Rakes In $30 Million By Ditching Netflix And Betting On Himself (Forbes)

20. Tencent and other Chinese tech firms are reporting decent results (Economist)

Be in the know. 10 key reads for Friday…

- The flat-out silly Markopolos GE report (Bronte Capital)

- GE CEO Larry Culp bought nearly $2 million worth of the company’s stock after fraud accusation (CNBC)

- Hedge Fund and Insider Trading News: Stanley Druckenmiller, Bill Ackman, Engine Capital, ViewRay, Inc. (VRAY), NiSource Inc. (NI), and More (Insider Monkey)

- Energy Could Be a Surprise Beneficiary of an Inverted Yield Curve (Barron’s)

- Buffett, Loeb, and Paulson Reveal Second-Quarter Holdings (Barron’s)

- A Guide to Investing From the Richest Family on the Planet (Bloomberg)

- Alibaba just keeps growing (Business Insider)

- Instagram’s Changes Could Leave Influencers Heartbroken (Wall Street Journal)

- President Trump Eyes a New Real-Estate Purchase: Greenland (Wall Street Journal)

- Once Asking $1 Billion, America’s Priciest Listing Is Scheduled for Auction (Wall Street Journal)

Be in the know. 10 key reads for Thursday…

- Someone’s Betting Big on an S&P 500 Rebound as Sell-Off Worsens (Bloomberg)

- Worried? History Says Don’t Be — Yet (Barron’s)

- Bill Ackman Is Betting Big on Berkshire Hathaway (Barron’s)

- The case for higher oil prices (Barron’s)

- President Donald Trump tweeted on Wednesday that his Chinese counterpart Xi Jinping was a “great leader” and posed setting up a “personal meeting” to solve escalating protests in Hong Kong. (Business Insider)

- After the yield curve inverts — here’s how the stock market tends to perform since 1978 (MarketWatch)

- Lumber Liquidators: Get in on the Ground Floor (Wall Street Journal)

- U.S. retail sales surge in July in boost to economy (Reuters)

- Stocks set for strong open after China says it hopes to meet halfway on trade issues (CNBC)

- Warren Buffett Is a Huge Backer of U.S. Banks (Wall Street Journal)

Be in the know. 7 key reads for Wednesday…

- Hedge Fund and Insider Trading News: Dmitry Balyasny, Jim Chanos, Tom Steyer, Third Point LLC, General Electric Company (GE), Ames National Corporation (ATLO), and More (Insider Monkey)

- Falling Bond Yields Make Equities Hard to Ignore (Wall Street Journal)

- Drudge Headline Indicator Highs and Lows (Bespoke)

- Caterpillar and GE See Power Markets Improving. That’s Good News for the Stocks. (Barron’s)

- When Will Boeing 737 Max Fly Again and More Questions (Bloomberg)

- Fannie, Freddie to Consider Alternatives to FICO Scores (Wall Street Journal)

- Regeneron Announces Positive Topline Results from Phase 3 Trial of Evinacumab in Patients with Severe, Inherited Form of High Cholesterol (Yahoo Finance)