1. What’s Next for Retail After a Great Week (Barron’s)

2. Powell Needs to Side With Markets at Jackson Hole (Barron’s)

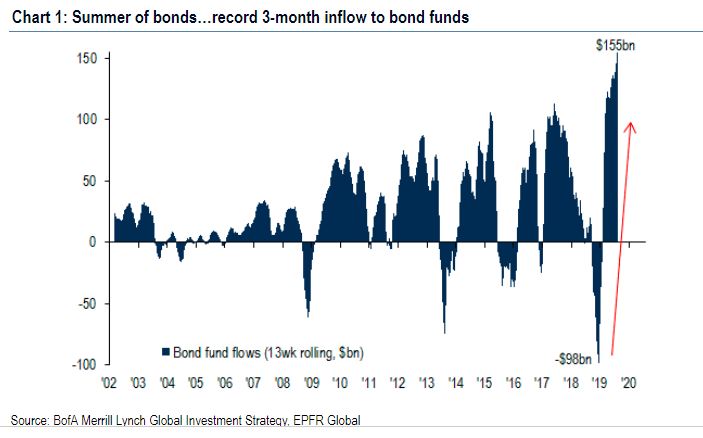

3. Investors are so bearish, it’s almost time to start buying stocks again, says Bank of America (MarketWatch)

4. Trump may still unveil tax cuts before 2020 election, Kudlow says (MarketWatch)

5. 25 dividend stocks selected for value by an outperforming money manager (MarketWatch)

6. These five U.S. stocks are most vulnerable to an activist attack (MarketWatch)

7. Health Insurers Set to Expand Offerings Under the ACA (Health Insurers Set to Expand Offerings Under the ACA (Wall Street Journal)

8. ECB Minutes Back Up Signals of Broad Stimulus Package (Wall Street Journal)

9. Watch CNBC’s full interview with St. Louis Fed President James… (CNBC)

10. China Hits Back at U.S. With Tariffs on $75 Billion of Imports (Bloomberg)