Skip to content

What The %!&# Is The Repo Market? (NPR Planet Money )

‘El Camino: A Breaking Bad Movie’ Review: Fan Service Firing on All Cylinders (Rolling Stone )

ECRI Weekly Leading Index Update (Advisor Perspectives )

The Best of Goethe’s Aphorisms (Farnam Street )

Is Amazon Unstoppable? (New Yorker )

How Florida Georgia Line Helped Country Music Reinvigorate Itself (GQ )

Wells Fargo report: A.I. will cut 200,000 American bank jobs over next decade (Big Think )

Why Governments Haven’t Learned The Lessons Of Japan (Podcast) (Bloomberg )

Mini Trade Deal Could Be Huge Catalyst For Oil (Oil Price )

GE and 4 More Favorite Stocks From a Fan of Disruption (Barron’s )

Federal Reserve Gives Large Banks a Break on Postcrisis Rules (Wall Street Journal )

New Cocoa-Pricing Method Makes for a Hot Commodity (Wall Street Journal )

U.S. Steel Boosts Revenue Outlook (Wall Street Journal )

Millennials Are Making Babies. These Stocks Could Bounce. (Barron’s )

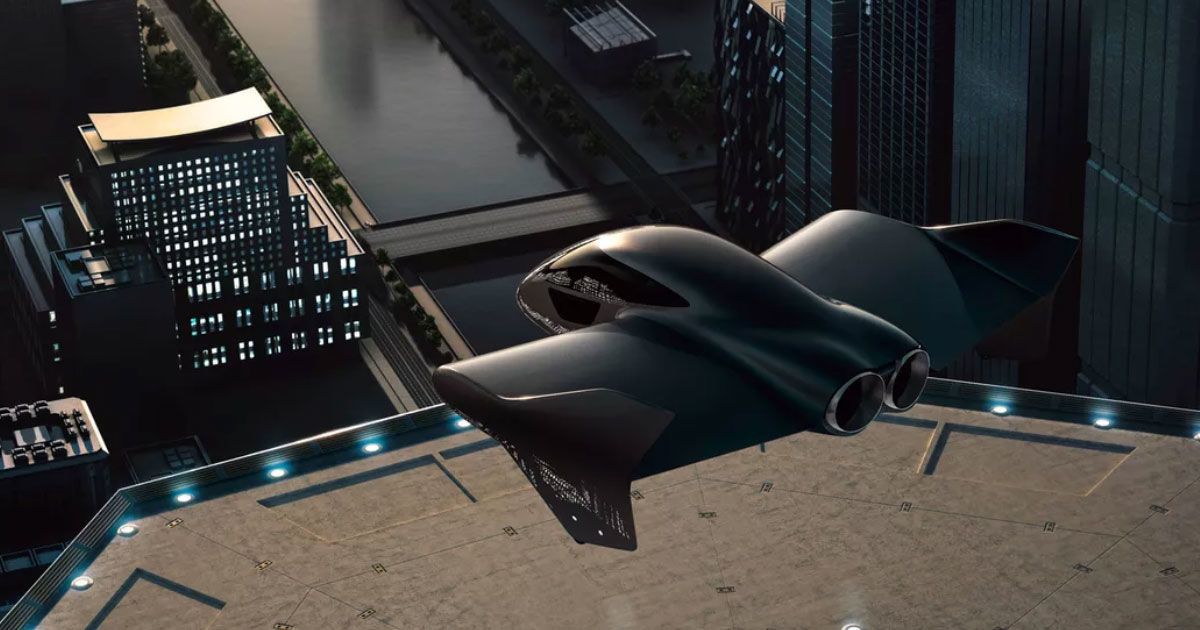

Porsche and Boeing Want to Build This Sexy Flying Car Together (Futurism )

When EBITDA Is Just BS (Institutional Investor )

U.S. and China Reach a Truce on Trade (Wall Street Journal )

Fed’s Plan to Buy Treasury Bills ($60B/month) (Bloomberg )

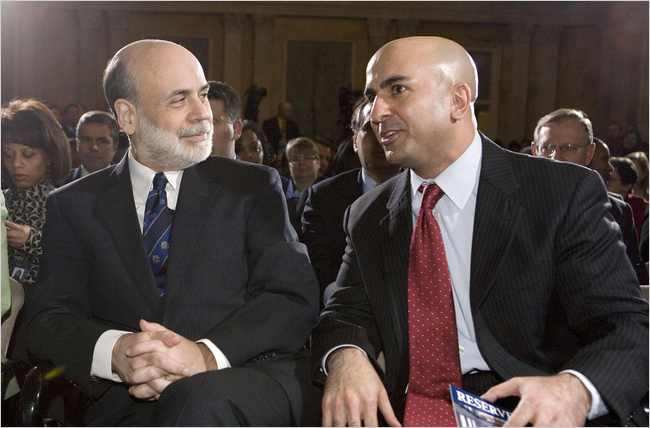

Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results) (Hedge Fund Tips )

No, SoftBank Won’t Go Down in Flames: Term Sheet (Fortune )

Opinion: These battered biotech stocks are now buying opportunities as Elizabeth Warren climbs in the polls (MarketWatch )

What May Have Driven David Tepper’s Big Decision (Institutional Investor )

Hedge Fund and Insider Trading News: Kyle Bass, Warren Buffett, Silver Point Capital, Kraft Heinz Co (KHC), and More (Insider Monkey )

Jeff Bezos’s Master Plan (The Atlantic )

SAP Stock Jumps After Strong Earnings Pre-Announcement, CEO Succession (Barron’s )

Aussie dollar up on hopes of U.S.-China trade deal, sterling surges on Brexit deal hopes (Street Insider )

For hedge funds, software-as-a-service stocks are the new FAANG (MarketWatch )

5 Raymond James Analyst Favorite Picks With Huge Implied Upside (24/7 Wall Street )

Here’s how the Fed’s balance sheet expansion that’s got the market excited is going to work (CNBC )

Trump just joined Amazon’s video game streaming site Twitch, even though he has major beef with Jeff Bezos (Business Insider )

U.S. Weighs Currency Pact With China as Part of Partial Deal (Bloomberg )

Fed’s Kaplan has ‘open mind’ on rate cuts, watching U.S. yield curve (Reuters )

Hedge Fund and Insider Trading News: Boaz Weinstein, Eddie Lampert, Ray Dalio, AQR Capital Management, Monolithic Power Systems, Inc. (MPWR), Catalent Inc (CTLT), and More (Insider Monkey )

No Inflation: US consumer prices were unchanged in September, the weakest reading since January (CNBC )

How people vote in 2020 will come down to the economy (New York Post )

The Fed chose ‘ounce of prevention’ with rate cut. Expect more. (Barron’s )

Fed Officials Voice Concern About Slowdown’s Effect on Hiring (New York Times )

Stock Traders Pay Biggest Premium to Shun Volatility in 41 Years (Bloomberg )

From summer janitor to CEO of Disney: What fueled Bob Iger’s rise to the top (CNBC )

Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results) (Hedge Fund Tips )

Fox Stock Has Sold Off Since the Disney Deal. How It Can Bounce Back. (Barron’s )

Hedge Fund and Insider Trading News: David Tepper, Joel Greenblatt, Seth Klarman, Bain Capital, Dollar Tree, Inc. (DLTR), Carnival PLC (CUK), and More (Insider Monkey )

A Hard Lesson in Silicon Valley: Profits Matter (New York Times )

Fed Chair Powell Signals Balance Sheet Will Grow Soon After Recent Market Turmoil (New York Times )

Weekly mortgage refinances jump 10% as rates drop to the lowest level since August (CNBC )

China ready to discuss a partial trade deal and will increase US agricultural purchases, reports say (CNBC )

Small-Cap Tech Stocks Are Cheap And Might Be Ready to Rally (Barron’s )

Want to Sit in This Ultra-Rare Ferrari? Just Ask. (Wall Street Journal )

Fed’s Kashkari says more easing needed, not sure how much (Reuters )

Three Key Recession Indicators Are Sending Mixed Signals. Here’s What to Watch. (Barron’s )

Cisco Systems Could Finally Rally Back to Its Bubble-Era Highs. One Analyst Explains How. (Barron’s )

Elizabeth Warren Overtakes Joe Biden In Democratic Presidential Race: IBD/TIPP Poll (Investor’s )

ETFs Get All the Buzz, but Mutual Funds Still Dominate. There’s a Reason. (Wall Street Journal )

An Investment Tip From Mr. ZIP: Spot a coming trend and buy something close. No one knows exactly what’ll take off. (Wall Street Journal )

Tepper’s Appaloosa Has Large S&P Call Option Position (Market Realist )

GE to freeze pensions for about 20,000 employees, stock surges (MarketWatch )

Barron’s Picks And Pans: Netflix, Raytheon, Spotify, Taiwan Semi And More (Yahoo! Finance )

Review: The Dodge Challenger SRT Hellcat Redeye is a big, brash, intoxicating supercar (CNBC )

Netflix has focused on India as a key area for growth. Exclusive data tells the story of its progress. (Business Insider )

People Who Work from Home Earn $2,000 More a Year (Bloomberg )

Goldman Says It’s Too Early to Call End to Equity Bull Market (Bloomberg )

JPMorgan Says Euro Area to Be Key Equities Winner in Brexit Deal (Bloomberg )

It’s ‘Too Early to Turn Cautious’ on Stocks (Barron’s )

Fed Confronts Balance-Sheet Decisions to Curb Money-Market Volatility (Wall Street Journal )

There’s No Recession Coming. The Fed Will Make Sure of That. (Barron’s )

ECRI Weekly Leading Index Update (Advisor Perspectives )

How Iceland’s Tourism Bubble Deflated (NPR Planet Money )

Externalities: Why We Can Never Do “One Thing” (Farnam Street )

The Coming Crisis of China’s One-Party Regime (Project Syndicate )

The Negative Effects of Chinese Financial Repression (Podcast) (Bloomberg )

10 Walt Disney Quotes That Could Boost Your Small Business (Entrepreneur )

Buy Delta stock or sell it? Your time horizon is the key. (Barron’s )

Odds Apple Buys Netflix Advance (24/7 Wall Street )

How to Succeed in Business? Major in Liberal Arts (Bloomberg )

Charles Schwab, Lennar, Johnson & Johnson: Stocks That Defined the Week (Wall Street Journal )

Fed Officials Signal Openness to More Easing After Jobs Report (Bloomberg )

The 2019 S&P 500 Sector Quilt (awealthofcommonsense )

LEAPS (focusedcompounding )

Stephen Schwarzman Hung Out a Shingle. Then He Waited (Institutional Investor )

Google in talks to acquire TikTok rival Firework (New York Post )

The Fed Will Give the Market What It Wants. Again (Bloomberg )

Powell Says Economy Faces Some Risks But Still in Good Place (Bloomberg )

JPMorgan, BlackRock Say Investors Too Cautious on Repeat of 2008 (Bloomberg )

Banksy’s ‘Devolved Parliament’ painting showing monkeys in House of Commons sold for $12 million (Luxuo )

I spent the day with a New Jersey commuter who rides a Jet Ski to work, and it changed the way I think about my week (Business Insider )

The Fed says it will continue overnight repos of at least $75 billion through November 4 (Business Insider )

Shipping Fuel Is About to Get Cleaner. What It Means for Investors. (Barron’s )

A GE Stock Bear Trashed the Aviation Unit. Here’s Why Investors Shouldn’t Worry. (Barron’s )

Banks Expected to Get Break on Postcrisis Rules (Wall Street Journal )

Opportunity Zones Aren’t a Program—They’re a Market (Fortune )

Hedge Fund and Insider Trading News: Glenn Dubin, Tiger Global Management, Arrowgrass Capital Partners, Darsana Capital Partners, Apple Inc. (AAPL), PROS Holdings, Inc. (PRO), and More (Insider Monkey )

Top 20 Best Warren Buffett Quotes On Money, Life And Success (ValueWalk )

Zuckerberg misunderstands the huge threat of TikTok (TechCrunch)

The Cheating Scandal Rocking the Poker World (The Ringer )

U.S. adds 136,000 jobs in September, unemployment rate hits 50-year low (MarketWatch )

The Dow Could Rebound in ‘a Matter of Days.’ One Way to Play the Comeback (Barron’s )

Apple to Increase iPhone 11 Output by Up to 10%, Nikkei Reports (Bloomberg )

Alphabet (GOOGL) PT Raised to ‘Street High’ $1,600 at Deutsche Bank; ‘Bullish on Google Cloud’ (Street Insider )

‘Sahm Rule’ enters Fed lexicon as fast, real-time recession flag (Reuters )

Eddie Murphy says ‘Dolemite Is My Name’ (and Obama’s urging) spurred his return to stand-up (USA Today )

The McRib is returning to McDonald’s menus at more than 10,000 locations across America (Business Insider )

Soybean Futures Bounce Back After China Restarts Purchases (Wall Street Journal )

The EU signaled it won’t retaliate after Trump said he’d slap Europe with $7.5 billion in tariffs (Business Insider )

Ray Dalio: ‘I’m going to go quiet in about a year’ (Yahoo! Finance )