Skip to content

An Obscure Post Office Fight Has High Stakes for UPS, Amazon, and Holiday Shoppers (Barron’s )

‘Money Honey’ Maria Bartiromo on Trump, AI and the future of work (USA Today )

Chinese Trade Delegation Called Off Farm Visits at U.S. Request (Bloomberg )

Arthur Cashin, wise to the ways of Wall Street (Washington Post )

U.K. companies for sale — at a 13% discount (MarketWatch )

The weight of evidence is on the side of the ECB’s doves (Financial Times )

How DJ Khaled Overcame His Fear Of Flying And Earned $67 Million In Two Years (Forbes )

Watch Brad Pitt and Jimmy Fallon Hilariously One-Up Each Other With Wild Orders (Men’s Journal )

Sarah Ketterer Discusses Investment Management (Podcast) (Bloomberg )

Blackstone CEO Steve Schwarzman Says Recession Is ‘Unlikely Now’ (Fortune )

New land rover defender makes its long-awaited debut (designboom )

ECRI Weekly Leading Index Update (AdvisorPerspectives )

Episode 940: Interest Rates… Why So Negative? (NPR )

Why Netflix’s Founding CEO Always Carries a Notebook (Inc. )

Google Says It’s Achieved Quantum Supremacy, a World-First: Report (Gizmodo )

Stitch Fix: Katrina Lake How I Built This with Guy Raz (NPR )

A Kelley Blue Book for Hospitals? He’s Got a Fix for Surprise Bills (Ozy )

The Rolling Stone Interview Taylor Swift (Rolling Stone )

Don’t Stop Believin’, Part 2 – E&Ps Boosting Production Despite Sharp Cuts to Capital Spending (RB Energy )

The Power 100 2019 (Worth )

Will Ferrell, Ryan Reynolds to Star in Musical Reimagining of ‘A Christmas Carol’ (Exclusive) (Hollywood Reporter )

Stocks will soar 17% through next year, market bull Ed Yardeni predicts (CNBC )

Hedge Fund and Insider Trading News: T. Boone Pickens, Carl Icahn, Glen Kacher, Camber Capital Management, Elliott Management, Abbvie Inc. (ABBV), Fidelity National Financial Inc (FNF), and More (Insider Monkey )

Fed officials are studying whether market plumbing issues contributed to a spike in short-term lending rates this week. (Wall Street Journal )

Paranoia Written All Over S&P 500 in Struggle to Get Back to Record Bloomberg )

Meet Goldman Sachs’ top quant, Bankers in Portland, Alt data may not be a gold mine (Business Insider )

The Pentagon will deploy U.S. forces to the Middle East on the heels of the attack on Saudi Arabian oil facilities (CNBC )

After the Fed’s Second Rate Cut, Hints of Another to Come (New York Times )

Week in Review: How Trump’s policies moved stocks (TheFly )

The Stocks Jim Chanos and Leon Cooperman Are Buying — And Shorting (Institutional Investor )

Why Value Investing Works (Safal Niveshak )

Why We Love to Call Everything a Bubble (Bloomberg )

The Evolutionary Benefit of Friendship (Farnam Street )

How to invest like Warren Buffett (CNBC )

A World Without Fossil Fuels Is Approaching. But You Might Not Live Long Enough to See It. (Barron’s )

McLaren GT: Introducing the World’s Most Civilized Supercar (Wall Street Journal )

How Lil Nas X Inspired a New Cowboy-Hat Craze (Wall Street Journal )

Fed’s Bullard on his rate cut dissent: US manufacturing appears to be ‘in recession’ (CNBC )

Larry Ellison on Uber, Tesla, AI, and More (Barron’s )

AbbVie Stock Is Falling Because Investors Hate the Allergan Deal. The Vice Chairman Bought Up Shares. (Barron’s )

China cuts new loan rate for second month but struggling economy likely needs more (Reuters )

Activist investor Peltz says GE CEO Culp is doing a good job (Yahoo! Finance )

U.S. bankers seize on repo-market stress to push for softer liquidity rules (Reuters )

Light Street’s Glen Kacher: ‘Multiples Should be Higher’ (Institutional Investor )

Jim Grant, “Nobody’s going to be right all the time. Our job was to make people stop and think.” (Institutional Investor )

Netflix chief says ‘The Crown’ will look a bargain after streaming explosion (Reuters )

Hold That Recession: U.S. Indicators Are Trouncing Forecasts (Bloomberg )

Fed Will Weigh Resuming Balance Sheet Growth at October Meeting (Wall Street Journal )

Tesla’s Model 3 earns insurance industry’s top safety rating (New York Post )

Hedge Fund and Insider Trading News: John Paulson, Daniel Loeb, Tom Steyer, GoldenTree Asset Management, Fox Factory Holding Corp (FOXF), Silicon Laboratories (SLAB), and More (Insider Monkey )

Investors and the Fed: I’m OK, You’re OK (Wall Street Journal )

U.S., Chinese trade deputies face off in Washington amid deep differences (Reuters )

10 Stable Growth Socks That Are Still Worth the Price, Analyst Says (Barron’s )

Buffett protégé Tracy Britt Cool leaving Berkshire Hathaway (New York Post )

U.S. Jobless Claims Increase Less Than Forecast to 208,000 (Bloomberg )

Microsoft to Buy Back Up to $40 Billion in Stock (Wall Street Journal )

Just Two Stocks Turned Pennies Into Billions (Investor’s Business Daily )

Were pessimistic manufacturing surveys wrong? (Barron’s )

Coachs parent flopped on fashion and lost its CEO. The case for a turnaround. (Barron’s )

ConocoPhillips Stock Is Nothing to be Afraid of, Analyst Says (Barron’s )

Explainer: The Fed has a repo problem. What’s that? (Reuters )

The Fed Needs to Give the Economy a Booster Shot (Bloomberg )

Wall Street May Get $40 Billion Reprieve From Trump Regulators (Bloomberg )

Banks Warm to Mortgage Bonds That Burned Them in 2008 (Wall Street Journal )

Global Fund Managers Favor US Stocks, But Not Yet Ready for Value Rotation –BAML (The Street )

Oil Prices Can’t Make or Break Emerging Markets Anymore (Barron’s )

Value Stocks Look Ready to ‘Take the Reins.’ Here’s Why. (Barron’s )

U.S. Tells Saudi Arabia Oil Attacks Were Launched From Iran (Wall Street Journal )

Former Oil CEO Aims to Change How the U.S. Exports Natural Gas (Wall Street Journal )

Saudis Face Lengthy Oil Halt With Few Options to Fill Gap (Bloomberg )

Opinion: Stock investors have overreacted to the Saudi oil attack (MarketWatch )

Former Cisco CEO John Chambers makes fast friends with anyone, including royalty — here’s how he does it (Business Insider )

Oil Spike, Auto Strike Won’t Derail U.S. Economy (Barron’s )

Chicago School Professor Fights ‘Chicago School’ Beliefs That Abet Big Tech (New York Times )

British Prime Minister Boris Johnson is set to explore a Brexit deal with the President of the European Commission Jean-Claude Juncker over lunch of snails and salmon. (Business Insider )

The 2019 McLaren 720S Spider is a $315,000 supercar with mind-bending performance (CNBC )

Strong U.S. Dollar Prompts Speculation of Trump Intervention (Wall Street Journal )

Global spare oil capacity in U.S. hands after Saudi outage (Reuters )

Uber and Lyft say they don’t plan to reclassify their drivers as employees (Vox )

The Debt That Never Dies: China’s Imperial Bonds (NPR Planet Money )

VIDEO: Short Selling Stocks Was Invented As Revenge (NPR Planet Money )

The Third Democratic Debate In 7 Charts (FiveThirtyEight )

This Guy Grew Up Knowing 2 Things: Hard Work and Hockey. Now He’s Combined Them Into a Hugely Successful Business (Inc. )

The Co-Founder of Shareholder Activism Is Dead, but His Cause Is Thriving (Cheif Investment Officer )

Coach Parent Tapestry Could See a Turnaround (Barron’s )

Saudi Oil Attack: This Is the Big One (Wall Street Journal )

Surge in Treasury Yields Highlights Easing Economic Worries (Wall Street Journal )

Stephen Schwarzman’s Lifelong Audacity (Wall Street Journal )

U.K. Steps Up Efforts Toward a Brexit Deal, Pushing Pound Higher (Wall Street Journal )

Souring Bets on Apocalypse Were at Center of Quant Stock Storm (Bloomberg )

Ken Burns — A Master Filmmaker on Creative Process, the Long Game, and the Noumenal (#386) (Tim Ferriss Show )

The Faulty Metric at the Center of Private Equity’s Value Proposition (Institutional Investor )

The Power of Questions (Farnam Street )

The Great Rotation Continues (Quantifiable Edges )

Citigroup’s Stock Bear Acquiesces With S&P 500 on Cusp of Record (Bloomberg )

Billionaire Ken Fisher Wants to Knock Out Wall Street (Bloomberg )

Value Finally Replaces Growth. But Will This Hate Rotation Last? (Barron’s )

LEGO Unveils 2,573-Piece Model of New Land Rover Defender (Maxim )

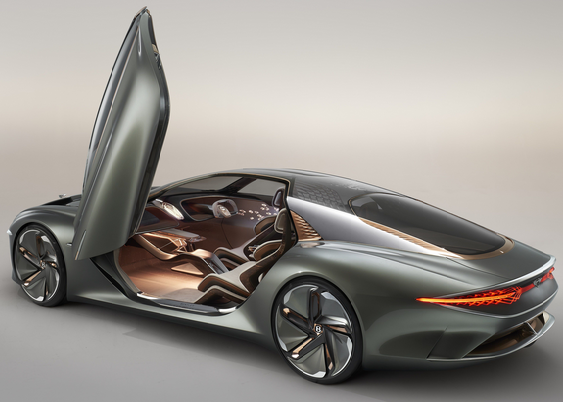

These Are the Next Wave of Ultra-Luxury Electric Cars Entering the Market—and They Don’t Disappoint (Architectural Digest )

S&P 500 up 13 of last 16 September option expiration weeks (Almanac Trader )

Kara Swisher Discusses the Tech Industry (Podcast) (Bloomberg )