Skip to content

Daniel Craig Can’t Outrun His James Bond Fate (The Ringer )

Ford Announces Just How Insanely Powerful the 2020 Mustang Shelby ST500 Will Be (Maxim )

ECRI Weekly Leading Index Update (Advisor Perspectives )

12 Habits Of Genuine People (Forbes )

Interest Rates Could Bottoming After 35% Decline, Says Joe Friday (Kimble Charting Solutions )

Will it hold? (The Reformed Broker )

Chris Brightman Discusses the Investment Industry (Podcast) (Bloomberg )

‘My Whole Life Is a Bet.’ Inside President Trump’s Gamble on an Untested Re-Election Strategy (Time )

Box Office: ‘Toy Story 4’ Flies High Friday With $47.4 Million (Variety )

Pain Trade By Locals and Prop Groups In Eurodollar Options (Futures Mag )

How I Built This: Allbirds: Tim Brown & Joey Zwillinger (NPR )

Trump Says Didn’t Threaten to Demote Fed’s Powell But Has Right (Bloomberg )

Trump says US will impose ‘major additional sanctions’ against Iran on Monday (CNBC )

Billionaire Leon Cooperman Interview –“We Live in Abnormal Times”, But The Stock Market Is Still In Its “Zone of Fair Value” (Insider Monkey )

U.S. Existing-Home Sales Rose in May (Wall Street Journal )

Sunday Strategist: This $200,000 Grill Is a Masterpiece of Arbitrage (Bloomberg )

An Extreme In Investor Fear And Pessimism (The Fat Pitch )

Before Iran Shot It Down, the US’s $130M Drone Spied on the World (Futurism )

Hedge Funds Hold Out Hope for Kiwi Even as Second Rate Cut Looms (Bloomberg )

The No. 1 most reliable appliance brand in America, according to Consumer Reports (MarketWatch )

Opinion: Believing all this talk about a stock market bubble can land you in real trouble (MarketWatch )

OPEC readies for ‘critical’ meeting, decision on oil output cuts (MarketWatch )

Fed officials face weak inflation, but split over what it means (Reuters )

Soybeans Could Be Next Market to Surge as U.S. Showers Drag On (Bloomberg )

Kashkari Says He Wanted Half-Point Rate Cut at Fed Meeting (Bloomberg )

Star Athletes Become Trophies Banks Covet as Salaries Skyrocket (Bloomberg )

The ECB Is Talking Stimulus Again. Is It Bluffing? (Barron’s )

Big Banks Ace First Round of Federal Reserve’s Stress Tests (Wall Street Journal )

Taylor Swift’s Real-Estate Portfolio, Revisited (Architectural Digest )

Japanese Security Companies Benefit From U.S.’s China Concerns (Wall Street Journal )

Trump Ordered Military Strike on Iran, Then Called It Off (Bloomberg )

European central bankers claim oversight over Facebook’s cryptocurrency (Reuters )

Fed’s Bullard says he wanted interest-rate cut as insurance against slowing economy, weaker inflation (MarketWatch )

This Year’s G-20 Will Be a Faceoff Between Trump and Xi (Bloomberg )

The Federal Reserve Gets Ready to Reverse Course (Barron’s )

Verizon Is Remodeling for a 5G World. Here’s What That Looks Like. (Barron’s )

Apple Explores Moving Some Production Out of China (Wall Street Journal )

Fed sees case building for interest rate cuts this yearReuters )

China, U.S. to resume trade talks but China says demands must be met (Reuters )

Brazil Stocks Close at a Record High (Bloomberg )

Lagging Dell Stock Looks Like a Bargain (Barron’s )

How Chick-fil-A Got Big by Keeping Its Menu Small (Wall Street Journal )

Oil Surges After Iran Downs U.S. Drone and Fed Signals Rate Cut (Bloomberg )

One of the Most Powerful Women in Hedge Funds Doesn’t Run Money (Wall Street Journal )

Stock Market Pessimism Is at Financial Crisis Levels. Why That’s Good News. (Barron’s )

OPEC+ Sets Date for Meeting, Ending a Month of Bickering (Bloomberg )

China says history shows positive outcome from U.S. talks possible (Reuters )

A New Source of Stress for Banks (Wall Street Journal )

Applied Materials CEO Gary Dickerson on the Chip Slump and the Rise of Big Data (Barron’s )

Adobe Reports 25% Revenue Increase in Latest Quarter (Wall Street Journal )

Fed Seen Signaling Cut by Losing Patience: Decision-Day Guide (Bloomberg )

Opinion: What insider buying at tech companies says about stocks and the economy (MarketWatch )

Two ‘insurance’ rate cuts from Fed in ’90s produced no big shocks to corporate bonds, Goldman Sachs says (MarketWatch )

Growth Is Worth Paying Up for at Pfizer (Wall Street Journal )

Draghi puts further ECB easing firmly on the table (Reuters )

U.S. Treasuries ‘most crowded’ as investors flee risk: BAML survey (Reuters )

Fed Models Suddenly Call for Stronger Than Expected GDP Growth (24/7 Wall Street )

Contra-indicator?: Investors Haven’t Been This Bearish Since 2008 Financial Crisis (Bloomberg )

Boeing Drought Gives Way to Second-Day Slugfest: Air Show Update (Bloomberg )

A Wall Street investment chief overseeing $26 billion breaks down why recession fears are overblown, even as the market clamors for Fed relief (Business Insider )

Jefferies Analysts Are Out With Four Daring Summer Growth Stock Picks (24/7 Wall St. )

What I Have To Offer You (Ray Dalio )

Trials Near for Boeing 737 MAX Fix (Wall Street Journal )

Boeing Says Grounded 737 Max May Resume Service This Year (Bloomberg )

Pfizer to buy Array Biopharma for $10.64 billion ()

The World Cries Out for Onion Derivatives (Wall Street Journal )

The Fed is likely to drop ‘patient’ word this week, clearing way for July cut, economists say (CNBC )

Iran, Russia talks raise hopes of progress on OPEC+ meeting date (Reuters )

What the Fed Will Do This Week, and Why (Bloomberg )

Case for Cutting Rates Can Be Found in Close Calls of the 1990s (Wall Street Journal )

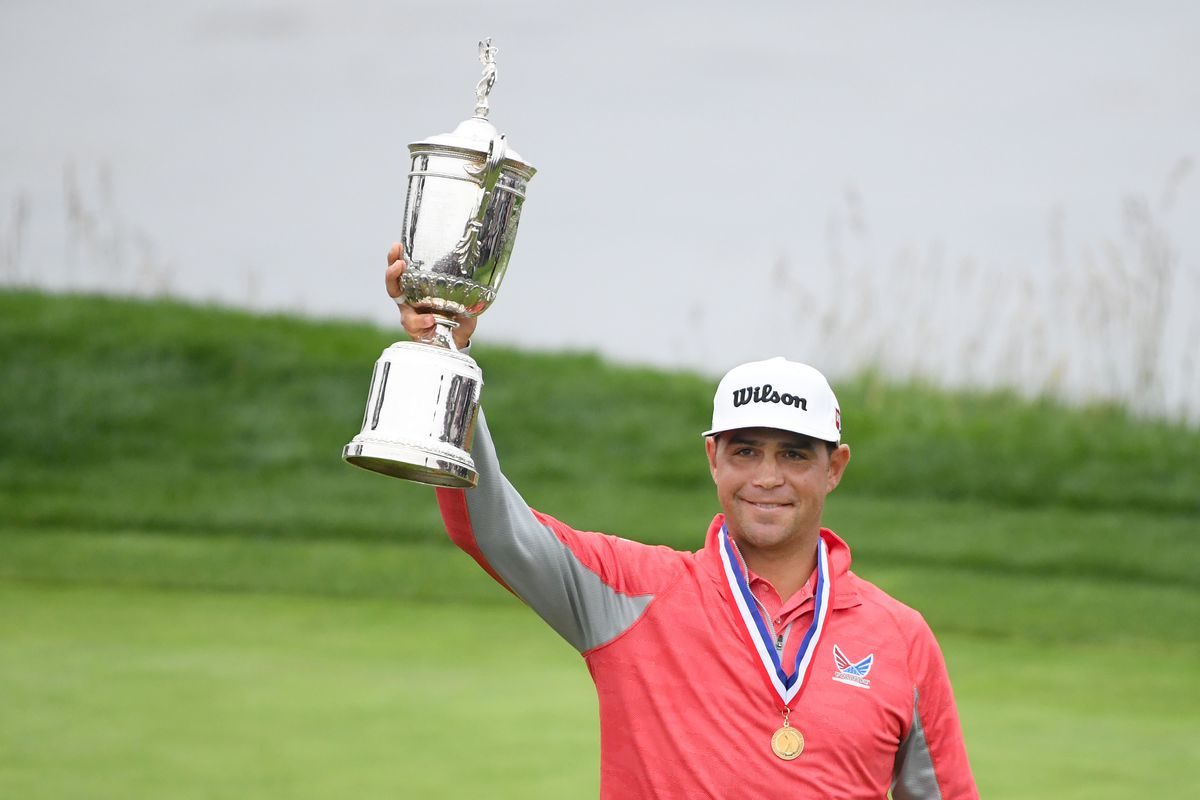

Gary Woodland Wins U.S. Open (Wall Street Journal )

Meet the Art World’s Rising Stars (Wall Street Journal )

The Richest Person In Every Country, Visualized (digg )

10 Great Rosé Wines Worth Sipping This Summer (Maxim )

Who are these people who write thousands of Amazon product reviews? (Vox )

Sega does the retro console right with the fantastic Genesis Mini (The Verge )

Pulse of the nation: How Beyond Meat could turn this humble pea into Canada’s new gold (Financial Post )

Animal Spirits (Planet Money )

Better Memory through Electrical Brain Ripples (Scientific American )

Jeff Bezos Says People With High Intelligence Do This 1 Thing Often. (Now, Amazon Just Proved His Point) (Inc. )

How ‘Shaft’ Brought the 1971 Chevy Chevelle SS Into 2019 (Popular Mechanics )

Oil Inches Higher On Falling Rig Count (OilPrice )

U.S. Navy official sees more orders for Boeing P-8A in coming months (Reuters )

JGB Bulls Look to Kuroda to Keep Rally Going as Inflation Wanes (Bloomberg )

Economy Breaks Record on Trump’s Watch. He Wants All the Credit (Bloomberg )

Five things to watch in the pivotal Fed meeting (MarketWatch )

Saudi Energy Minister hopes OPEC agrees to extend production cut ‘early July’ Reuters )

Saudi Arabia Seeks to Balance Global Crude Markets Before 2020 (Bloomberg )

Why Alzheimer’s Treatment Hopes Endure Despite High-Profile Drug Failures (Investor’s Business Daily )

Tips for Spotting a U.S. Recession Before It Becomes Official (Bloomberg )

Drugmakers Sue Trump Administration to Halt Advertising Rule (Bloomberg )

As Trump demands major concessions, Beijing wants the world to think that the US will blink first (CNBC )

Trump is threatening sanctions on Germany over its Russian gas pipeline, opening a new front in the trade war that the Kremlin calls ‘blackmail’ (Business Insider )

The automotive industry has not reached ‘peak car’ as some Wall Street analysts suggest. Here’s what’s really going on. (Business Insider )

As China exports slow, government might face growing labor unrest, researcher says (MarketWatch )

Here’s who keeps investors abreast of the opaque leveraged loan market and possible systemic risk (MarketWatch )

Boeing Makes Another Vertical Leap As It Looks For Fatter Profits (Investor’s Business Daily )

McLaren’s Customer Racing Program Gets Drivers on the Track (Barron’s )

Week in review: How Trump’s policies moved stocks (TheFly )

Boeing lands $6.5B contract with US Air Force (yesterday): (DoD )

Schlumberger: Has This Oil Services Giant Fallen Too Far? (TheStreet )

Hedge Fund and Insider Trading News: Anthony Scaramucci, Dan Loeb, Elliott Management, Kirkland’s, Inc. (KIRK), Sharps Compliance Corp. (SMED), and More (InsiderMonkey )

NBC Sports posts record NHL ratings (NewsTimes )

The New McLaren GT Is a Race Car Built for Road Tripping (Robb Report )

Why Attitude Is More Important Than IQ (Forbes )

Hip-Hop’s Next Billionaires: Richest Rappers 2019 (Forbes )

ECRI Weekly Leading Index Update (Advisor Perspectives )