- Tesla Batteries Are Keeping Zimbabwe’s Economy Running (Bloomberg)

- Kinder Morgan Co-Founder Richard Kinder Bought Up Millions in Stock (MarketWatch)

- Would Warren Buffett Buy Greenland? (Wall Street Journal)

- Gut Check Time for Treasuries After Biggest Rally Since 2008 (Bloomberg)

- JPMorgan Says It’s Finally Time to Buy Stocks Despite Trade Woes (Bloomberg)

- A ‘fear bubble’ is creating a huge buying opportunity, long-time market bull Jim Paulsen says (CNBC)

- China’s factory activity unexpectedly expands in August, a private survey shows (CNBC)

Category: What I’m Reading Today

Be in the know. 10 key reads for Sunday…

- 9 questions about the Hong Kong protests you were too embarrassed to ask (Vox)

- Episode 937: Moving To Opportunity? (NPR Planet Money)

- Life of Brian: the comedian telling China where to go (Economist)

- Why Value Investing Has Been Doing Terribly (Podcast) (Bloomberg)

- What You Need To Know About U.S. Election Security And Voting Machines (NPR)

- Out of Gas: New York’s Blocked Pipelines Will Hurt Northeast Consumers (Manhattan Institute)

- Brain-reading tech is coming. The law is not ready to protect us. (VOX)

- President Trump Formally Establishes US Space Command (PC Mag)

- The Four Tools of Discipline (Farnam Street)

- Why Energy Master Limited Partnerships May Be the Best Contrarian Bet Ever (24/7 Wall Street)

Be in the know. 10 key reads for Saturday…

- Good Writers Make Better Hedge Fund Managers (Institutional Investor)

- Kirsten Dunst Season Is Now in Full Swing (Vanity Fair)

- “Super Cathartic”: Why Peak-TV Hollywood Is Obsessed With Ping-Pong (Vanity Fair)

- Opinion: Lotus rises from the dead with a 2,000-horsepower electric sports car (MarketWatch)

- Week in Review: How Trump’s policies moved stocks (TheFly)

- Hedge Fund Titans’ Struggles in Insurance Offer a Value Play (Barron’s)

- 2 Tech Stocks to Ride the 5G Wireless Trend, According to an Analyst (Barron’s)

- Hedge Fund and Insider Trading News: David Harding, Warren Buffett, Ray Dalio, Jana Partners, GAMCO Investors, Anterix Inc (ATEX), County Bancorp Inc (ICBK), and More (Insider Monkey)

- Ron Williams Discusses the Health-Care Business (Podcast) (Bloomberg)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

Be in the know. 8 key reads for Friday…

-

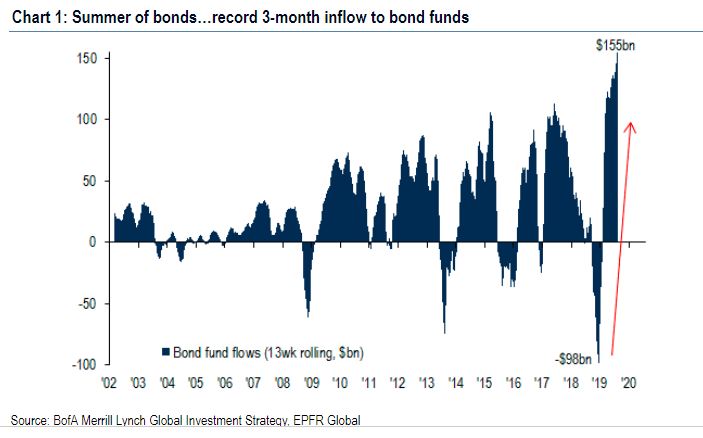

- BAML: Buy risky assets as sentiment gets extremely bearish (Street Insider)

- Dell, Inc. (DELL) Tops Q2 EPS by 68c (Street Insider)

- Every Mid-Engined Sports Car You Can Buy in 2019 (Car and Driver)

- Walmart tests dentistry and mental care as it moves deeper into primary health (CNBC)

- Adobe’s CEO on Disruption, the Cloud, and Big Buys (Barron’s)

- Taylor Swift Album Hits 1 Million in China Sales, Beating U.S. (Bloomberg)

- Stocks are rallying after China touted that it’s having ‘effective communication’ with the US on the trade war (Business Insider)

- Fears of a World Domination by a Handful of Asset Managers Are Overblown (Institutional Investor)

Be in the know. 7 key reads for Thursday…

- The Big Short’s Michael Burry Sees a Bubble in Passive Investing (Bloomberg)

- China says it’s willing to resolve trade war with a ‘calm attitude,’ hints it won’t retaliate for now (CNBC)

- JC Penney (JCP) Sees Several Insider Buys, Including CEO’s 500K Shares (StreetInsider)

- Don’t worry about the ‘monsters’ as production is about to boom, says this fund manager (MarketWatch)

- Mnuchin says U.S. weighs ultra-long bond issuance, no plans ‘at this time’ to intervene in dollar (MarketWatch)

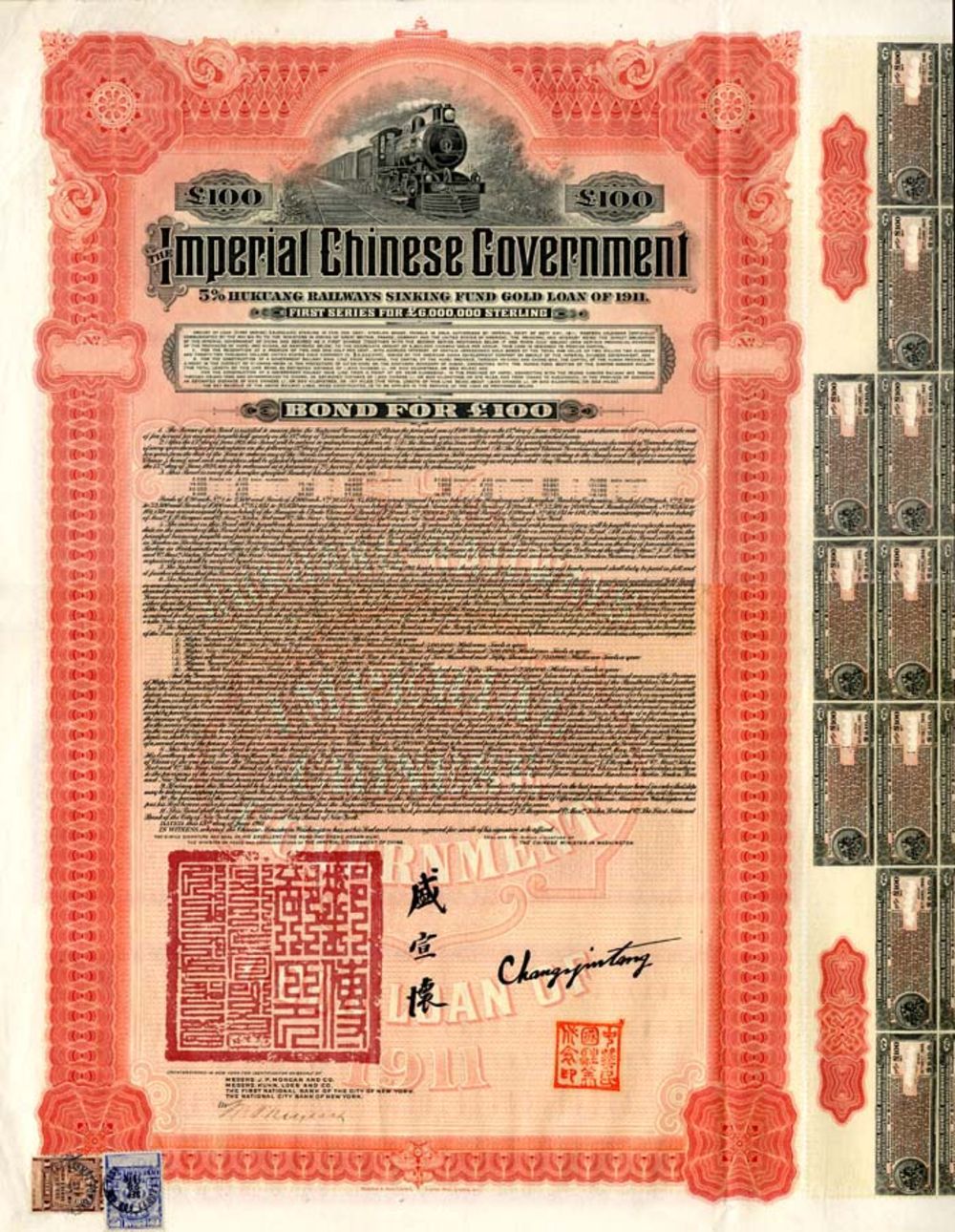

- Trump’s New Trade War Tool Might Just Be Antique China Debt (Bloomberg)

- Energy Companies Set to Get Reprieve on Methane Rules (Wall Street Journal)

Be in the know. 5 key reads for Wednesday…

- Saudi Aramco’s Path to the World’s Largest IPO (Wall Street Journal)

- Fossil Group Executives Bought Up Shares After the Stock Slid (Barron’s)

- What Trade War? China’s First Costco Draws Crowds of Shoppers (Wall Street Journal)

- Can Steve Schwarzman Be Replicated? (Institutional Investor)

- Martin Scorsese’s ‘The Irishman’ Reveals Incredibly Long Running Time (Maxim)

Be in the know. 5 key reads for Tuesday…

- Top Baird Health Care and Biotech Picks Have Massive Upside Potential (24/7 Wall Street)

- Amgen Shows Price Is Still Right for Blockbuster Drug Deals (Wall Street Journal)

- China says it hopes U.S. can create conditions for trade talks (Reuters)

- Why Jefferies Top Value Picks Include Some of the Biggest US Banks (24/7 Wall Street)

- This index is making a hidden bet on biotechs (MarketWatch)

Be in the know. 10 key reads for Sunday…

1. When Taking Risks Is the Best Strategy (Wall Street Journal)

2. Brexit Bargain Shoppers: Investors Snap Up Peppa Pig, Beer and Jet Technology (Wall Street Journal)

3. Not All Energy Stocks Are Depressed (Wall Street Journal)

4. Boeing 737 Max’s Certification Flight Likely to Occur in October (Bloomberg)

5. Michael Burry (from “The Big Short”) Urges GameStop to Buy Back $238 Million of Stock with Cash on Hand (Business Wire)

6. Value Stocks Haven’t Traded This Low Since the Dot-Com Bubble (Validea)

7. Stocks Haven’t Seen The Top Yet? (Tumblr)

8. ECRI Weekly Leading Index Update (Advisor Perspectives)

9. Finance Friday With Mary, Volume 3: Snack-Sized Questions (NPR Planet Money)

10. How to Become a Better Forecaster of the Future (Podcast) (Bloomberg Odd Lots)

Be in the know. 15 key reads for Saturday…

1. ‘Sustainably Fracked’: Shale Producers Seek a Green Label for Their Natural Gas (Wall Street Journal)

2. Why Is Joe Rogan So Popular? (The Atlantic)

3. Fed Chair Jerome Powell says he can’t fix trade war’s damage to the economy but he’s going to try his best (Vox)

4. Meet the Countess Who Lives at the Real-Life Downton Abbey (Architectural Digest)

5. Here Are the Best Cars From Every Season of Seinfeld’s ‘Comedians in Cars Getting Coffee’ (Robb Report)

6. Retailers in the Bargain Bin (Morningstar)

7. Grace Potter Announces New Album (Rolling Stone)

8. 2Q Corporate Results: 2% Earnings Growth Expected in 2019 (The Fat Pitch)

9. ‘They Were Like Gods’ (LTCM) (Institutional Investor)

10. Liquidity is bad even by August standards, JPMorgan shows (Bloomberg)

11. Using PMI to Trade Cyclicals vs Defensives (ThinkNewfound)

12. Natural gas deliveries to U.S. LNG export facilities set a record in July (EIA)

13. The Highest-Paid Actors 2019: Dwayne Johnson, Bradley Cooper And Chris Hemsworth (Forbes)

14. Hedge Fund Investor Letters 2019 Q2 (Insider Monkey)

15. Divided G-7 Leaders Headed for Clashes at Tense French Summit (Wall Street Journal)

Be in the know. 10 key reads for Friday…

1. What’s Next for Retail After a Great Week (Barron’s)

2. Powell Needs to Side With Markets at Jackson Hole (Barron’s)

3. Investors are so bearish, it’s almost time to start buying stocks again, says Bank of America (MarketWatch)

4. Trump may still unveil tax cuts before 2020 election, Kudlow says (MarketWatch)

5. 25 dividend stocks selected for value by an outperforming money manager (MarketWatch)

6. These five U.S. stocks are most vulnerable to an activist attack (MarketWatch)

7. Health Insurers Set to Expand Offerings Under the ACA (Health Insurers Set to Expand Offerings Under the ACA (Wall Street Journal)

8. ECB Minutes Back Up Signals of Broad Stimulus Package (Wall Street Journal)

9. Watch CNBC’s full interview with St. Louis Fed President James… (CNBC)

10. China Hits Back at U.S. With Tariffs on $75 Billion of Imports (Bloomberg)