Skip to content

The S&P 500 Will Hit 3400 by 2020 Even If Earnings Are Lower, Goldman Sachs Says (Barron’s )

Powell Suggests Fed Embarking on 1990s-Style Mini Easing Cycle (Bloomberg )

China sees intensive contact with U.S. this month ahead of September trade talks (Reuters )

Powell is ‘confusing’ the markets about Fed intentions, but a new cut is expected (CNBC )

Merck Has a Good Problem and Plenty of Options (Wall Street Journal )

Nordstrom Family Prepares New Proposal to Increase Stake in Retailer (Wall Street Journal )

Dr. Michael Burry Of ‘Big Short’ Likes Asian Stocks (Forbes )

Gilead Sciences Is a ‘Top Pick.’ Analyst Says the Stock Can Rise 40%. (Barron’s )

Hedge Fund and Insider Trading News: Tom Steyer, Visium Asset Management, Cat Rock Capital, Central Pacific Financial Corp. (CPF), Comfort Systems USA, Inc. (FIX), and More (Insider Monkey )

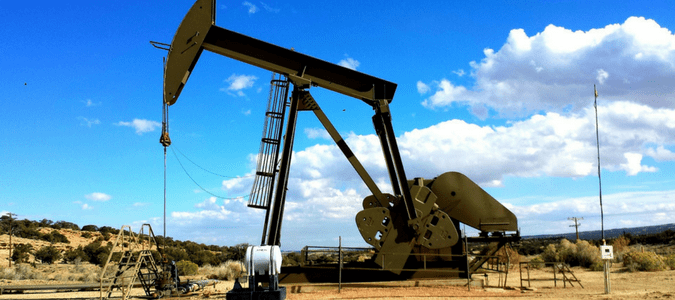

U.S. Crude Draws Should Continue Into Year-End (Seeking Alpha )

Weekly Market Summary (The Fat Pitch )

Gilead Sciences Beats Second-Quarter Earnings Expectations (Barron’s )

Wells Fargo Reaps a Windfall From Old Financial-Crisis Mortgages (Barron’s )

Apple Stock Rallies as Earnings Top Estimates, Boosted by AirPods and Apple Watch (Barron’s )

The Undeclared Currency War: How the ECB Is Forcing the Fed’s Hand (Wall Street Journal )

Warren Buffett: This is the No. 1 mistake parents make when teaching kids about money (CNBC )

China Says U.S. Trade Talks to Continue With September Meeting (Bloomberg )

The Best Ice Cream Parlor in Every State (24/7 Wall Street )

Humana Beats Q2 Earnings Forecast as Medicare Advantage Sign-Ups Accelerate (TheStreet )

Hedge Fund and Insider Trading News: Ray Dalio, Warlander Asset Management, Copper Street Capital, Avangrid Inc (AGR), Knowles Corp (KN), and More (InsiderMonkey )

Trump warns China not to wait for 2020 U.S. election to make trade deal (Reuters )

Uber Lays Off 400 as Profitability Doubts Linger After I.P.O. (New York Times )

Incyte Earnings Crush Views With 188% Gain (Investor’s Business Daily )

Dell’s Crown Jewel, With Thomas Lott (Podcast) (Seeking Alpha )

D.R. Horton profit beats as lower home prices boost demand (Reuters )

Goldman Sachs says S&P 500 bull-run has legs but cuts earnings outlook (StreetInsider )

Porsche’s Battery-Powered Taycan on Track to Overtake 911 (Bloomberg )

Merck shares climb 3.7% after earnings blow past estimates (MarketWatch )

Berkshire Hathaway’s Earnings Are Saturday. Watch the Stock Buyback Number. (Barron’s )

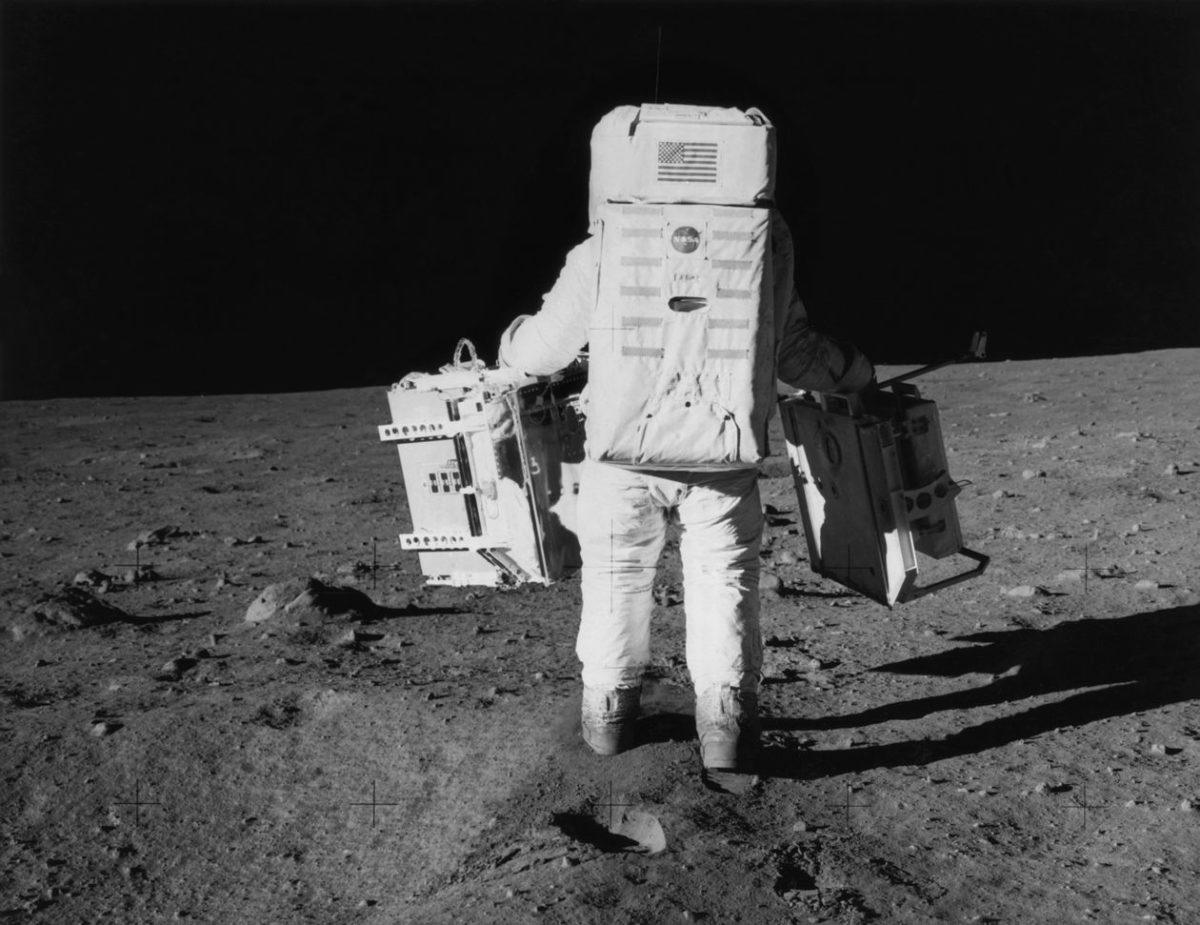

What Are The World’s Next ‘Moonshots?’ (Barron’s )

With Stocks at Fresh Highs, Investors’ Portfolios Look Alike (Wall Street Journal )

5G could change everything. Here’s what you need to know before you buy into the tech (USA Today )

Hedge Funds Chasing 400% Return Show Risk in China’s Wild Market (Bloomberg )

Quentin Tarantino nets his biggest opening weekend ever with $40.4 million take for ‘Once Upon a Time… in Hollywood’ (Business Insider )

Former Fed Chair Janet Yellen says she’s in favor of an interest rate cut (CNBC )

Bill Gates took solo ‘think weeks’ in a cabin in the woods—why it’s a great strategy (CNBC )

37-Year-Old Former School Teacher Is India’s Newest Billionaire (Bloomberg )

Animal Spirits: Pfizer May Buy Low and Smart in Generics Gambit (Wall Street Journal )

Financial Crisis Yields a Generation of Renters (Wall Street Journal )

Beijing says millions of tons of U.S. soy shipped to China in trade consensus (Reuters )

Jack Ma’s $290 Billion Loan Machine Is Changing Chinese Banking (Bloomberg )

How donuts fuelled the American Dream (Economist )

How Two Stanford Dropouts Built a $2.6 Billion Company In Just Two Years (Entrepreneur )

How Mary Ramos Brought 1969 to Life for Quentin Tarantino (GQ )

Chinese LNG Imports See Strong Growth This Summer (OilPrice )

Dyson: James Dyson How I Built This with Guy Raz (NPR )

Land of the Giants: Why You’ll Never Quit Amazon Prime (PodCast) (Vox )

Is CVS A Value Trap Or A Fallen Angel Ready To Rise Again? (Forbes )

Why KBW Sees BofA, Citi and Goldman Sachs Winning From Fed Rate Cuts (24/7 Wall Street )

Hedge Fund and Insider Trading News: David Einhorn, Caxton Associates, Crown Castle International Corp (CCI), Esperion Therapeutics Inc (ESPR), and More (Insider Monkey )

LBOs Make (More) Companies Go Bankrupt, Research Shows (Institutional Investor )

Chevron, Exxon earnings: Shale M&A is high on the list of investor concerns (MarketWatch )

Buffett buys more Bank of America stock, with stake’s value rising to $29 billion (MarketWatch )

Week in review: How Trump’s policies moved stocks (TheFly )

As electric vehicle production ramps up worldwide, a supply crunch for battery materials is looming (CNBC )

A TV Maverick Is Going All-In on a New Wireless Bet (Wall Street Journal )

Europe’s Bond Yields Race to the Bottom (Barron’s )

Is a Recession Coming? Economic Indicators Say Otherwise (Barron’s )

The 2020 Evora GT Is the Fastest, Most Powerful Lotus Ever Offered in the U.S. (DesignBoom )

Inside the Goodwood Festival of Speed, a High-Octane Supercar Celebration (Maxim )

SoftBank’s transformation into an investment powerhouse continues (The Economist )

ECRI Weekly Leading Index Update (AdvisorPerspectives )

Howard Marks new memo “On the Other Hand” (pdf) (Oaktree Capital )

Strong Alphabet, Intel earnings drive futures higher (Reuters )

Twitter stock rises after revenue, user numbers top expectations (MarketWatch )

Who Wins if the Fed Cuts Interest Rates? Try Oil Stocks. (Barron’s )

Need to Relocate? Bring the House, Too (Wall Street Journal )

GDP slows to 2.1% in second-quarter but beats expectations thanks to strong consumer (CNBC )

Oxford Economics sees the ECB cutting rates in September (CNBC )

Expect 15 More Years for the Bull Market if Demographics Are Destiny (Barron’s )

Managers reduce cash, increase risk in July – BofA survey (Pensions&Investments )

China and U.S. trade negotiators to meet in Shanghai July 30-31 (Reuters )

Fed to cut rates for first time in a decade this month: Reuters poll (Reuters )

3M’s stock surges after profit and sales fall less than expected, guidance maintained (MarketWatch )

Opinion: I’m betting Boris and Brexit won’t sink Britain and am buying stocks (MarketWatch )

Facebook price target raised to $250 from $230 at Jefferies (TheFly )

European Central Bank signals its ready to cut rates, opens door to renewed QE (MarketWatch )

Hedge Funds Help Fuel Southeast Asia Consumer Lending Boom (Bloomberg )

Bill Ackman’s Playbook Works Against Him (Wall Street Journal )

Global oil market in glut, but not a big enough one for OPEC (Reuters )

Four reasons why antitrust actions will likely fail to break up Big Tech (MarketWatch )

Trump Really Might Weaken the Dollar (Wall Street Journal )

Shopping Mall REIT Stocks Could Benefit Because Growth Expectations Are Low (Barron’s )

UPS Earnings Top On Strong U.S. Growth; Shipping Giant Raises Guidance (Investor’s Business Daily )

Value Stocks Haven’t Traded This Low Since the Dot-Com Bubble (Bloomberg )

Hedge Fund and Insider Trading News: Stanley Druckenmiller, Whitney Tilson, Perceptive Advisors, Bank of New York Mellon Corp (BK), Ionis Pharmaceuticals Inc (IONS), Schlumberger Limited. (SLB), and More ()

Biogen climbs as profits surge 72%, prompting the firm to boost 2019 guidance (BIIB) (Business Insider )

U.S. farmers look past trade fears to cash in on China’s hog crisis (Reuters )

United Technologies’ earnings crush Wall Street forecasts (MarketWatch )

Warren Buffett took Occidental CEO ‘to the cleaners’: Carl Icahn (New York Post )

Coca-Cola raises revenue forecast after earnings beat, sending shares higher (CNBC )

Oil Stocks Could Get a Boost From Lower Interest Rates. Here’s Why. (Barron’s )

The 35 celebrities and athletes who make the most money per Instagram post, ranked (Business Insider )