Skip to content

2 Stocks That Could Score on Taxes Whether or Not Trump Wins in 2020 (Barron’s )

Investors Try Stock Picking as Volatility Rises (Wall Street Journal )

This $72 Billion Fund is Shorting the Dollar in a Contrarian Bet (Bloomberg )

How stock-market bulls are adjusting to a much messier U.S.-China trade war (MarketWatch )

Huawei’s CEO said he would ‘be the first to protest’ if China banned Apple (Business Insider )

Modi’s Thumping Mandate—but for What? (Council on Foreign Relations )

Jeff Bezos: Big Things Start Small (Farnam Street )

Income Stagnation Is a Progressive Myth (Yardeni )

THE HARDEST POST TO WRITE (The Macro Tourist )

Invest in Your Relationships. The Payoff Is Immense. (New York Times )

Memorial Day (History )

Saving an American Icon: How IndyCar’s CEO Ended Its 20-Year Skid (Forbes )

How Much Oil is in an Electric Vehicle? (Visual Capitalist )

New Graham & Doddsville Issue: John Hempton, Yen Liow, Bill Stewart (Market Folly )

Omega Advisors’ Latest Moves (Insider Monkey )

Why eBay Is Jan Brady To Amazon’s Marcia (Value Walk )

HEALTHCARE IS GETTING BETTER (John Murphy – Stock Charts )

10 of the Best Waterfront Homes on the Market to Ring in Summer (Robb Report )

Trade beef aside, Trump and Abe bond over burgers, sumo and golf (Reuters )

Aston Martin Pays Tribute to James Bond with a (Very) Limited-Edition DBS Superleggera (Robb Report )

Step Inside Jessica Alba’s Haven in Los Angeles (Architectural Digest )

The Case for Eating More Caprese Salad (Men’s Journal )

How to Make a Mouthwatering ‘Magic Burger’ From a Texas Steakhouse Legend (Maxim )

Where is a millisecond worth a million dollars? The New York Stock Exchange. (Michael Lewis Podcast )

Is the Worst Over for Apple? (24/7 Wall St. )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Blackstone’s Schwarzman Recalls the Advice That Changed His Life (Bloomberg )

Daniel Loeb’s Hedge Fund Wants Centene to Consider Selling Itself (Wall Street Journal )

The House Always Wins. Unless It’s MGM Stock. (Barron’s )

Jim Grant: The World Created by Upside-Down Interest Rates (Barron’s )

JPMorgan’s Kolanovic Sees a ‘Trump Collar’ on S. Stock Market (Bloomberg )

An Updated Look At Memorial Week Historical $SPX Performance (QuantifiableEdges )

Studying the Sun’s Atmosphere Could Make Fusion Power a Reality (Futurism )

Trump says ‘dangerous’ Huawei could be included in U.S.-China trade deal (Reuters )

Theresa May announces her resignation as prime minister and Conservative leader (Business Insider )

Racing cars from the Indianapolis 500 Speedway, a gearhead’s dream (USA Today )

Chip Makers Are Punished as the Trade War Drags On (New York Times )

Trump’s Point Man on China Trade Is Still Trying to Close the Deal (Wall Street Journal )

Colony Capital Aims to Invest $5 Billion in Latin America (Wall Street Journal )

Josh Brown: The power of compounding can help you double your money, again and again (CNBC )

Panthers’ owner David Tepper is returning investors’ cash to focus on team (New York Post )

The Roar, the Riches, the Race: Previewing the Monaco Grand Prix (Bloomberg )

China just tested its ‘nuclear option’ in the trade war (Business Insider )

More active managers are beating the stock market again thanks to the trade war: Goldman Sachs (MarketWatch )

Why These 4 Semiconductor Stocks May Be the Absolute Best 5G Play (24/7 Wall Street )

Fed may cut rates if inflation keeps disappointing: Bullard (Reuters )

China would see ‘blue skies ahead’ if it accepts all US demands, Fed’s Bullard says (CNBC )

Southwest Airlines Mechanics Approve Contract, Ending Long Impasse (New York Times )

Fed Might Shed Clues on Debate Around Rate Cut: Minutes Preview (Bloomberg )

George Soros made 8 predictions about politics, financial markets, and Facebook – here’s how they turned out (Business Insider )

Eli Lilly’s Insulin Lispro Injection available at half the list price of Humalog (MarketWatch )

‘Door is still open’ for trade talks with U.S., Chinese ambassador says (MarketWatch )

Don’t Take the Dow’s Bull Market for Granted (Barron’s )

A Tale of Two Yield Curves (Wall Street Journal )

Coca-Cola is bringing back New Coke in honor of ‘Stranger Things’ (CNN Business )

Beyond Meat Wipeout Seen by Kazakh Who Nailed Facebook (Bloomberg )

Piper, confident in Street-high Dupixent estimates, says buy Regeneron (TheFly )

What’s Wrong With DowDuPont Stock? It’s Complicated (Barron’s )

DuPont plans $2 billion share buyback after spin off (Reuters )

Everyone Hates Health-Care Stocks. Buy Them Anyway. (Wall Street Journal )

The Market Thinks CVS Investor Day Will Be a Snooze. What If It’s Wrong? (Barron’s )

Trade war’s ‘wall of worry’ will spark a year-end rally, Wall Street bull Jim Paulsen says (CNBC )

Google reverses decision to cut ties with Huawei after US eases trade restrictions (CNBC )

Opinion: Reports of an overheated IPO market are greatly exaggerated (MarketWatch )

Home Depot (HD) Tops Q1 EPS by 8c, U.S. Comps Rise 3%; Reaffirms FY19 (Street Insider )

The trade war could be losing its power to frighten this battle-tested stock market (CNBC )

Japan’s economy surprised everyone by growing last quarter (Business Insider )

JPMorgan’s quant guru explains why stocks could surge. (Business Insider )

Stock futures drop on concerns over spiraling fallout of Huawei crackdown (Reuters )

Deere’s Trouble in the Fields Won’t Last (Wall Street Journal )

Dollar holds firm as market awaits Fed minutes; Aussie shines (Street Insider )

Which states have the highest and lowest property taxes? (USA Today )

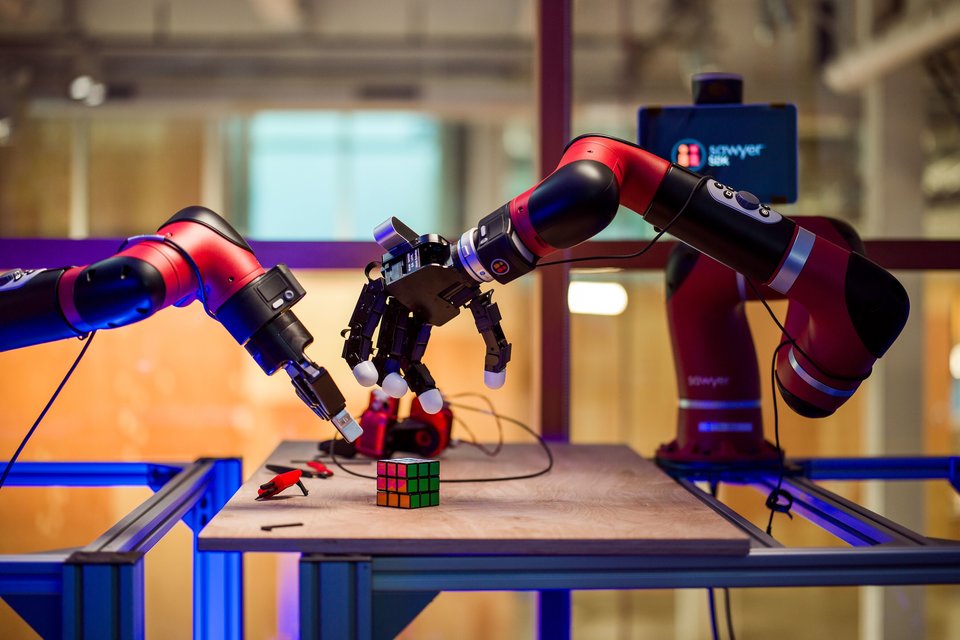

Facebook finally revealed what its secretive robotics division is working on, and it could spark new competition with rivals like Google and Apple (Business Insider )

Billionaire Mark Cuban says these 2 sentences are the best advice he’s ever gotten (Business Insider )

A lot of Fed activity this week – with two speeches today (including Powell): (Federal Reserve )

Joel Greenblatt Interview – Value Investing Will Never Go Out of Favor (Insider Monkey )

Hedge Fund Investor Letters 2019 Q1 (Insider Monkey )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Exclusive: Saudi’s Falih says sees no oil shortage, but OPEC to act if needed (Reuters )

The Best-Designed Building in Every U.S. State (Architectural Digest )

Meet Lamborghini Urus, the Ultraluxe SUV of Your Dreams (Men’s Journal )

The 33 People, Places and Things You Need to Know Now (Robb Report )

American life is improving for the lowest paid (The Economist )

CVS Wants to Make Your Drugstore Your Doctor (Fortune )

The Formula For A Happy Life (Forbes )

On Again/Off Again Tariffs & It’s a Pre-Election Year (Almanac Trader )

Episode 407: A Mathematician, The Last Supper, And The Birth Of Accounting (NPR Planet Money )

Resonance: How to Open Doors For Other People (Farnam Street )

2020 McLaren 600LT Spider first drive review: Drop-top track star (CNET )

40 Entrepreneurs Share Their Secrets to Staying Focused (Entrepreneur )

The Best James Bond Movie Cars—Ranked (Reader’s Digest )

The Fund Industry in Charts (A Wealth of Common Sense )

How Aldi’s frugal, reclusive founders turned a corner grocery store into a $38 billion fortune (CNBC )

Novak Says too Soon to Discuss Oil-Cut Options: OPEC+ Update (Bloomberg )

Australian Dollar to Strengthen After Morrison Clings to Power (Bloomberg )