- U.S., China Close In on Trade Deal (Wall Street Journal)

- Elon Musk, Tesla to unveil next vehicle, the Model Y crossover, on March 14 (USA Today)

- The US just officially hit the debt ceiling (Business Insider)

- Boeing could bring the Dow to a hard landing (MarketWatch)

- Strange Bedfellows: Office Depot and Alibaba team up to tap small and medium businesses (Reuters)

- Billionaires Are On the Hunt for New Underground Cobalt (Bloomberg)

- 5 Stocks to Buy Now That Low-Turnover Hedge Funds Love (24/7 Wall Street)

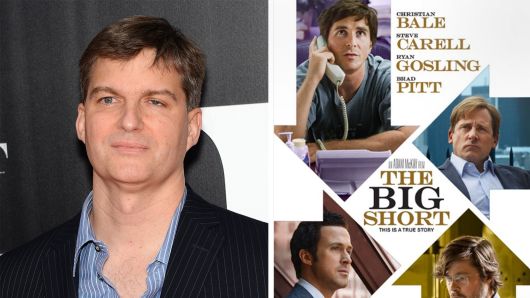

- The Bomb That Blew Up in 2008? We’re Planting Another One (Bloomberg)

- Kinder Morgan Co-Founder Is on a Stock-Buying Spree (Barron’s)

- Ray Dalio (Bridgewater) financing amazing underwater discoveries (YouTube)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.