Skip to content

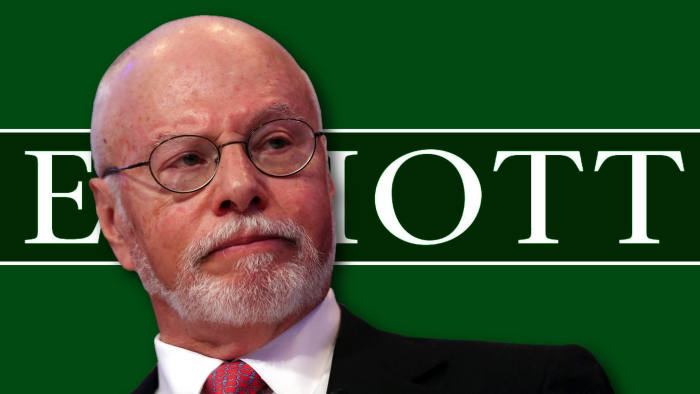

Hedge Fund and Insider Trading News: David Einhorn, Warren Buffet, Elliot Management, Tesla Inc (TSLA), Annaly Capital Management (NLY), and More (Insider Monkey )

SAP CEO welcomes ‘fantastic’ activist shareholder Elliott (Reuters )

An Old Tax Dodge for the Wealthy Is Making a Comeback (Barron’s )

Real Estate’s Latest Bid: Zillow Wants to Buy Your House (New York Times )

China Defaults Hit Record in 2018. 2019 Pace Is Triple That (Bloomberg )

‘Smart Beta’ Might Not Be So Smart After All (Bloomberg )

Why Amazon Is Gobbling Up Failed Malls (Wall Street Journal )

Exclusive: China backtracked on nearly all aspects of U.S. trade deal – sources (Reuters )

From Gundlach to Sundheim: Sohn Conference’s 2019 Trade Ideas (Bloomberg )

China vice premier going to U.S. for trade talks despite Trump threats (Reuters )

The Federal Reserve’s Misstep and How to Bet on It, According to Bond King Jeffrey Gundlach (Barron’s )

Federal Reserve Warns as Risky Corporate Debt Exceeds Peak Crisis Level (New York Times )

Walmart is opening dozens of veterinary clinics in its stores and launching an online pet pharmacy ()

German manufacturing orders miss forecasts (MarketWatch )

Humana (HUM) is Prepared to Explore Friendly Takeover of Centene (CNC) – Sources (StreetInsider )

Happy birthday, Gordon Gekko (MarketWatch )

Warren Buffett’s Case for Capitalism (DealBook )

Trump Threatens China With More Tariffs Ahead of Final Trade Talks (New York Times )

China trade team still preparing to go for talks after Trump cranks up pressure (Reuters )

Buffett says Berkshire plans to ‘put a lot of money’ into energy (MarketWatch )

Biogen Stock Is Near a Multiyear Low. The CEO and a Hedge Fund Bought Millions. (Barron’s )

Warren Buffett Talks Buybacks, Succession, Bitcoin, and 5G at the Berkshire Annual Meeting ()

How A Professional Poker Player ‘Reads’ Competitors (Podcast) (Bloomberg )

Stanley Kubrick showed that perfectionism pays off (The Economist )

The Ruthless, Secretive, and Sometimes Seedy World of Hedge Fund Private Investigators (Institutional Investor )

12 Habits Of Genuine People (Forbes )

Hedge Fund and Insider Trading News: Carl Icahn, Anthony Scaramucci, Paul Singer, Glenview Capital, BlueMountain Capital, Hasbro Inc (HAS), Steelcase Inc. (SCS), and More (Insider Monkey )

American Riviera: A Summer Guide to Santa Barbara and Beyond (Robb Report )

This Man Built a $64 Million Chateau in the South of France. Now, He Has to Tear It Down (Robb Report )

Silicon Valley (unverified) Rumors: Apple Project Titan Staff Spotted At NIO (TheLastDriverLicenseHolder )

T. Rowe Price: Chapter 9 – The Growth Stock Theory (Value Walk )

ECRI Weekly Leading Index Update: (Advisor Perspectives )

Why Tom Brady Is Absolutely the Greatest Quarterback of All Time (Maxim )

Why Do People Drink Mint Juleps at the Kentucky Derby? (Mental Floss )

7 big thoughts from Warren Buffett during annual Berkshire Hathaway meeting (USA Today )

‘SNL’: Adam Sandler Returns With Songs (NBC )

The No. 1 job billionaires and multimillionaires held before they got rich MarketWatch

Futuristic Robot Farm Begins Selling Its First Produce (Futurism )

Worried About the Economy? These CEOs Aren’t (Bloomberg )

Warren Buffett wants to invest in Britain. Is that a good idea? (CNN )

Charlize Theron and Seth Rogen Are Charming Enough in Long Shot (Vanity Fair )

Job Growth Underscores Economy’s Vigor; Unemployment at Half-Century Low (New York Times )

Charlie Munger is Warren Buffett’s right-hand man — here are 18 of his most brilliant quotes (Business Insider )

3 Takeover Scenarios That Could Boost Occidental’s Stock (Barron’s )

Carl Icahn Has Built a Small Position in Occidental (Bloomberg )

North Korea launched ‘several unidentified short-range projectiles,’ South Korean military says (CNBC )

The MyRaceHorse app makes it possible to buy a minority stake in race horses (New York Post )

Why Wages Are Finally Rising, 10 Years After the Recession (New York Times )

‘We would like to get to yes:’ Lawmakers signal growing concern on Trump’s Mexico-Canada trade deal (USA Today )

Euro-Area Inflation Accelerates After String of Upbeat Data (Bloomberg )

Buffett Finally Embraces Amazon as Berkshire Acquires Stake (Bloomberg )

At Milken, investors place their late-cycle bets (Financial News )

Bristol-Myers upgraded to Overweight from Equal Weight at Barclays. (TheFly )

Highest Paid CEOs at America’s Largest Companies (24/7 Wall Street )

Amazon Keeps Hitting Trucking Stocks. But It’s Not Actually a Threat. (Barron’s )

Buffett’s 2,472,627% Return Fueled Berkshire Billionaire Families (Bloomberg )

Allianz’s Mohamed El-Erian: When central banks don’t understand the markets, watch out (MarketWatch )

Berkshire Hathaway shares are trailing the S&P 500 over the last one, five, 10 and 15 years (CNBC )

Dalio Says Something Like MMT Is Coming, Whether We Like It Or Not (Bloomberg )

Get ready for an IPO bonanza. These 16 companies are set to go public in the next 9 days. (Business Insider )

U.S. Fed sees no strong case for hiking or cutting rates (Reuters )

Here’s what New Yorkers think about the Impossible Burger (New York Post )

3 Health-Care Stocks With Growing Dividends (Barron’s )

These 2 Drug Giants Just Topped Earnings Views (Investor’s Business Daily )

CVS Shares Are on the Mend (Wall Street Journal )

Tesla offers $650M of shares, $1.35B of notes to ‘strengthen’ balance sheet (TheFly )

Third Point’s Q1 2019 Investor Letter (Insider Monkey )

Bridgewater Associates’s Research Report – Peak Profit Margins? – A US Perspective (Insider Monkey )

Americans Are Shopping Again, and That’s Good News for the Economy (Barron’s )

Vitamin B-12 Deficiency: The Serious Health Problem That’s Easy To Miss (Wall Street Journal )

Warren Buffett Backs Occidental’s Bid for Anadarko With $10 Billion Investment (New York Times )

Trump pushes Fed to lower interest rates in series of tweets (USA Today )

Trump, Democrats agree to spend $2 trillion on U.S. infrastructure (Reuters )

‘Long Shot’ Creators Wonder: Would ‘Pretty Woman’ Be Made Today? (Wall Street Journal )

The Milken Conference Trades Rainbows for Clouds (Bloomberg )

Apple is finally moving beyond the iPhone as the smartphone industry stalls out (CNBC )

Pfizer, Merck Earnings Top; Eli Lilly Falls On Revenue (Investor’s Business Daily )

Lotus Evora GT4 concept is ready to rock a racetrack (Motor Authority )

The Rich List: What the world’s richest hedge fund managers made in 2018 — and how they made it. (Institutional Investor )

Mnuchin hopes for ‘substantial progress’ in China trade talks (Reuters )

How to Spot a Bear Market (Barron’s )

Yum China Sales Beat as Pizza Hut Finally Breaks From Its Slump (Bloomberg )

Want to Fly Private? Here’s Every Way to Do It (Bloomberg )

Anadarko to Resume Occidental Talks About $38 Billion Takeover (Bloomberg )

US-China trade talks are in the ‘final laps,’ Treasury Secretary Mnuchin says (CNBC )

Cloud Gathers Over Chip Makers (Wall Street Journal )

‘Avengers: Endgame’ smashes box-office records with $1.2 billion weekend (MarketWatch )

Consumer spending jumps in March while core inflation moderates (MarketWatch )

Traders Brace for Big Moves After GE Earnings This Week (Wall Street Journal )

Chinese electric car maker BYD’s Q1 profit up 632% (Irish Times )