- Fed Prepares to End Balance-Sheet Runoff Later This Year (Wall Street Journal)

- Trump Continues to Weigh EU Auto Tariffs (Wall Street Journal)

- Wall Street, Seeking Big Tax Breaks, Sets Sights on Distressed Main Streets (New York Times)

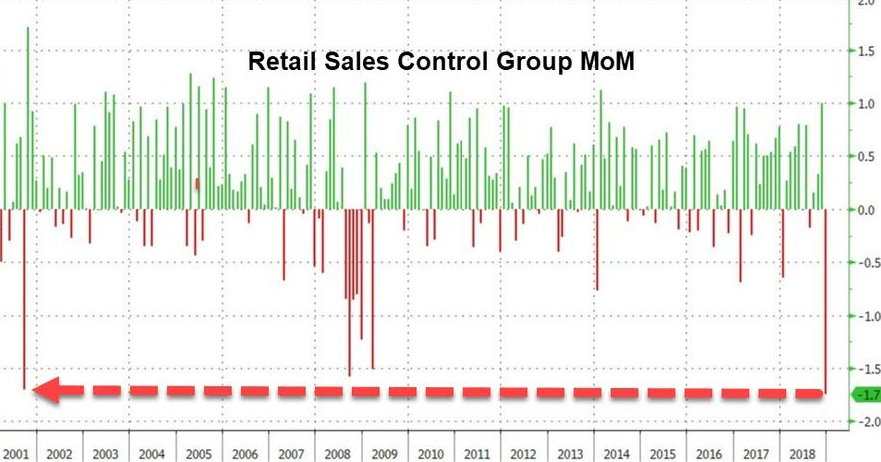

- Why the $9 Trillion Stock Rally Is Beginning to Look Tired (Bloomberg)

- EU’s Juncker ‘not very optimistic’ on Brexit deal after meeting with UK leader May (CNBC)

- US and China are sketching the outlines of a deal to end the trade war (CNBC)

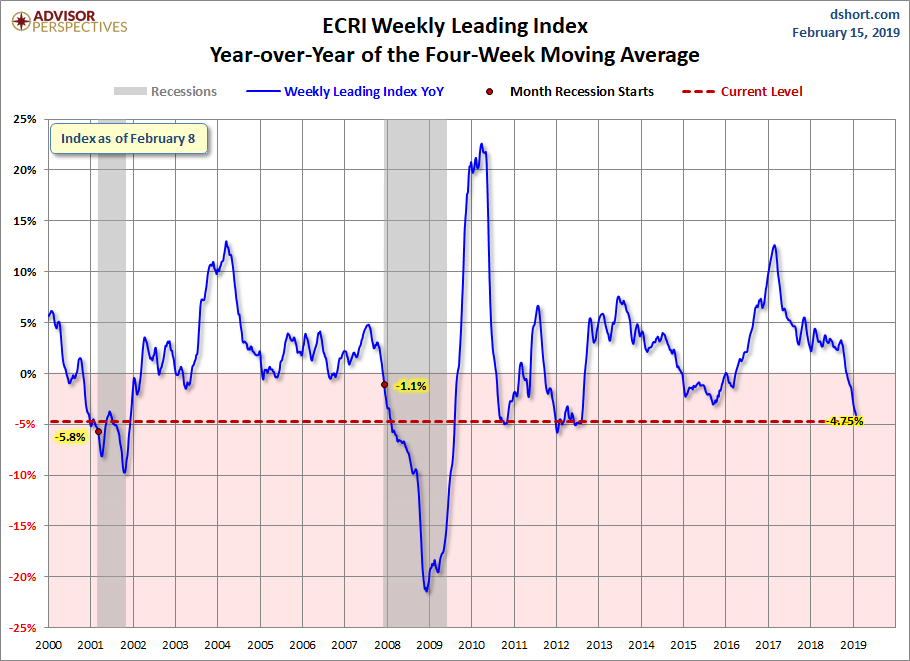

- BAML: Investors are freaking out about the rising prospect of a global recession (Business Insider)

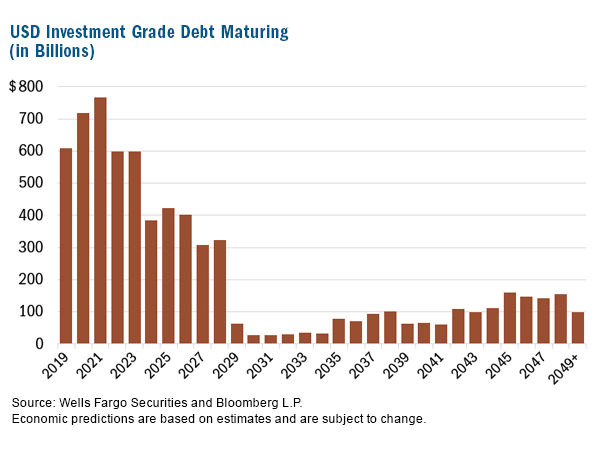

- A $3-trillion tsunami is about to flood the stock market, warns fund manager (MarketWatch)

- Stock Buybacks Are on Track for Another Record Year (MarketWatch)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.