Skip to content

The July CPI Clears a Low Hurdle for a September Rate Cut (wsj )

Home Depot’s stock bounces as home improvement demand may have just bottomed (marketwatch )

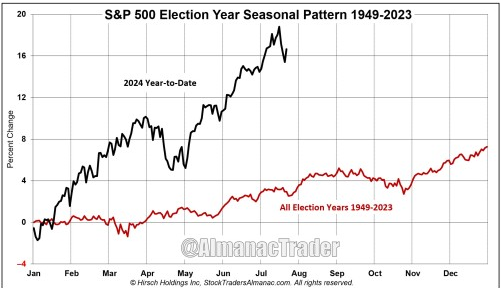

Why the bull market in stocks can continue despite a brutal start to August (marketwatch )

Wells Fargo strategist says investors may face 1995 rerun once Fed cuts rates (marketwatch )

Seth Klarman’s Baupost Group cuts stake in Alphabet and snaps up Humana (marketwatch )

Mortgage rates fall for a second week in a row — and refinances soar 117% (marketwatch )

Intel has sold its stake in Arm after a big rally for the chip-design stock (marketwatch )

BofA Survey Shows Optimism on Big Tech, Soft Landing Is Unbroken (bloomberg )

Starbucks Stock Soared After Naming a New CEO. What History Says Happens Next. (barrons )

Tencent profit jumps 82% on back of strong video gaming, ad growth (scmp )

Tencent Music Entertainment & HUYA Beat, MSCI Index Review (chinalastnight )

Southwest Activist Piles on Pressure. Why Elliott Smells Blood After Starbucks Win. (barrons )

China expects air travel to hit a record in 2024 (cnbc )

China Delivers Another Harsh Verbal Warning to Bond Buyers (bloomberg )

The ‘crazy’ fix for Google’s monopoly that investors are whispering about (businessinsider )

Alibaba Cloud: Paris 2024 Olympics’ Cloud Broadcast Surpasses Satellite Broadcasts (aastocks )

Alibaba’s Lazada posts first monthly profit as Southeast Asia rivalry heats up (scmp )

There’s a hidden risk lurking for AI stocks in 2025 (businessinsider )

Ratings & TPs on BABA-SW (Table) (aastocks )

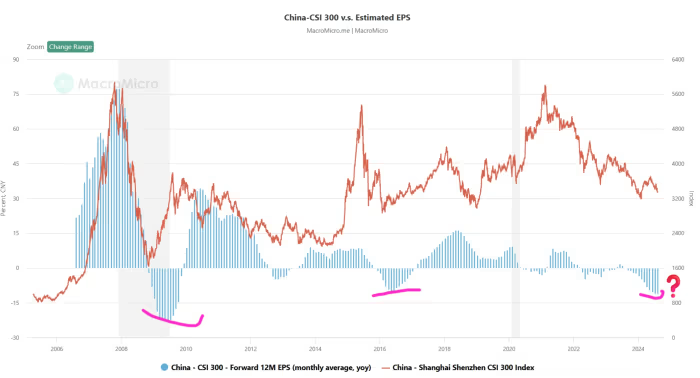

How China stocks could break out of the value trap (marketwatch )

Starbucks Ousts CEO, Taps Chipotle’s Niccol as Boss (bloomberg )

Producer Inflation Comes in Weak. How Fed Might Respond. (barrons )

Throughout History, Measuring Inflation Has Always Been Controversial (barrons )

Treasury yields turn lower after mild rise in U.S. July producer prices (marketwatch )

Real-estate stocks are bouncing back. Is the commercial property rout over? (marketwatch )

5 Big Takeaways From This Earnings Season (wsj )

China Goes to New Extreme in Crackdown on Bond-Market Frenzy (bloomberg )

US Small-Business Optimism Climbs to Highest Since February 2022 (bloomberg )

NYC’s Aging Midtown Buildings Lure Property Mogul Larry Silverstein (bloomberg )

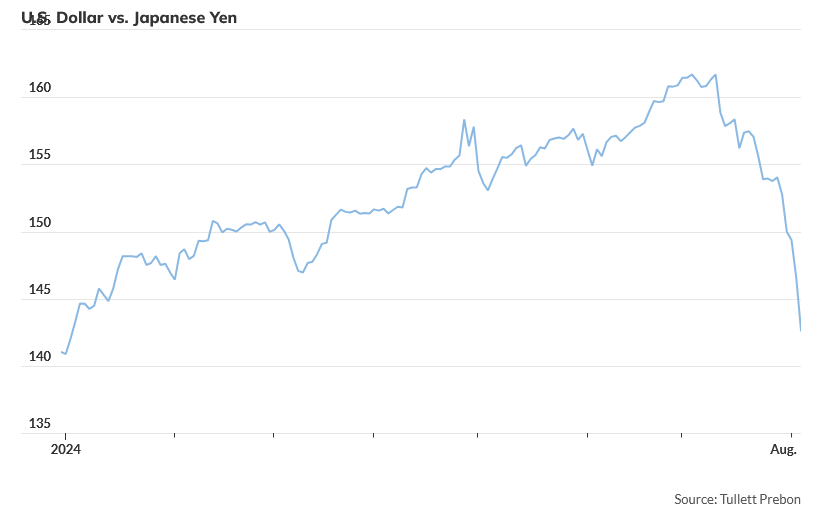

The big ‘carry trade’ unwind is far from over, strategists warn (cnbc )

Baxter to sell its kidney-care business in a $3.8 billion deal to Carlyle Group (marketwatch )

How the stock market can predict the outcome of the presidential election (businessinsider )

Down 54%, Is It Time to Buy the Dip on This Growth Stock? (fool )

Disney Details Vast Theme Park Expansion Projects (nytimes )

What are the biggest stock market baggers of all time? (ft )

KE Holdings Beats, China “Tech 8” Forms Bullish Pattern (chinalastnight )

Small US Inflation Pickup Won’t Derail a Fed Rate Cut in September (bloomberg )

Disney Plots Villains-Themed Land, New Ships in Big Resorts Push (bloomberg )

Disney Shows ‘Moana 2’ Clip, Says ‘Toy Story 5’ and ‘Incredibles 3’ Coming (bloomberg )

Disney Details Vast Theme Park Expansion Projects (nytimes )

Everything we learned at Disney’s parks panel at the 2024 D23 Expo (cnbc )

Intel Stock May Have Bottomed at Tangible Book Value (barrons )

Medals by Team (bloomberg )

Hedge funds sold Japanese stocks at fastest rate in five years during recent Nikkei crash (marketwatch )

Starbucks Stock Is Rising on Report Another Activist Has Taken a Stake (barrons )

Leveraged funds roll back bets against yen by widest margin in years as carry trade unwinds (marketwatch )

Boomers Buying Houses Had It Bad in the ’80s. Millennials Have It Worse. (wsj )

How Intel AI platforms can help identify untapped athletic talent (cnbc )

Shanghai Disney Resort adding Spider-Man-themed roller-coaster ride to its web of appeal (scmp )

Boeing’s Going, and Its CEO is Already Gone (fool )

Intel is also now trading below the company’s book value for the first time since at least 1981… Intel’s large role in what is now deemed an industry vital to national security also provides a floor of sorts (wsj )

China Inflation Rate Hits 5-Month Peak (tradingeconomics )

The Newport Mansions: Everything You Need to Know (ad )

Freshippo achieves four months of profitability after major restructuring: report (technode )

Ant Group adds lesser-known AI company MetaSota to its investment portfolio (technode )

Charlie Munger on Patience, Wisdom, and the Power of Changing Your Mind (safal )

The Charlie Munger Manifesto (safal )

How Ferruccio Lamborghini Built the Most Beautiful Car Ever Made (robbreport )

Non-heavyweight down products make up nearly half of Canada Goose’s revenue (fortune )

Sahm alternative measures (ft )

The 10 Most Expensive Cars (by Estimate) Heading to Auction at Monterey Car Week (rt )

Philippe Petit Marks the 50th Anniversary of His World Trade Center Walk With a New High Wire Act (smithsonianmag )

New Banksy Murals Appeared in London Every Day This Week. What Do They Mean? (smithsonian )

She wrote down the perfect quote. Now she’s leading the Olympics (golf )

Hedge Funds Most Bearish on Commodities Since at Least 2011 (bloomberg )

Intel Stock May Have Bottomed at Tangible Book Value (barrons )

How PayPal’s Growth Story Edged a New Bull Off the Sidelines (barrons )

Apple Is the Big Loser in Google’s Antitrust Battle (barrons )

Boeing’s New CEO Started His Job by Writing a Letter. It Reveals His Biggest Priorities. (barrons )

The Stock Market’s Wild Week Was a Wake-Up Call. What To Do Now. (barrons )

Target Stock Looks Attractive Heading Into Earnings, UBS Says (barrons )

Funds offering protection from volatility fail to deliver in sell-off (ft )

The great sell-off and why the Japanese market trades like a penny stock (ft )

Apple Investors Urged to Stay Calm After Buffett Slashes Stake (bloomberg )

Starboard Value reportedly becomes latest activist investor to take Starbucks stake (marketwatch )

Why Warren Buffett’s Berkshire Dumped 55.8% Of Its Apple Stock (forbes )

Behold Pininfarina’s First Batman-Inspired B95 Roadster (maxim )

Chinese stocks get upgraded as bear-market risks seen tempered by state buying support (scmp )

Bloomberg Intelligence Predicts BABA & Other CN Dotcom Giants to Announce More Shr Buybacks (aastocks )

Karnovsky lowered his price target on Disney stock to $125 from $135 but kept an Overweight rating. (barrons )

China’s consumer prices pick up more than expected in July, up by 0.5% (cnbc )

Fed is not doing the ‘right thing,’ but they’re ‘gonna get away with it’: Thomas Hayes (foxbusiness )

Yen carry tremors should become less pronounced in coming days: Macquarie (streetinsider )

Citi to Sell Trust Business Amid Turnaround Efforts (barrons )

Intel CEO Pat Gelsinger Buys Stock Near Multiyear Low (barrons )

Fed Official Sees Labor Market in Normal State not Recession (barrons )

Gilead Boosts Earnings Outlook as Stock Battles Back from Cancer Disappointment (barrons )

Mortgage Rates Fall to 15-Month Low (wsj )

Disney Posts First-Ever Streaming Profit (wsj )

Aerospace & Defense

Boeing’s new outsider CEO Ortberg takes the helm, this time from the factory floor (cnbc )

Jeremy Siegel backs off on calls for the Fed to do an emergency interest rate cut (cnbc )

Shenzhen’s Real Estate Policy Ignites Rally (chinalastnight )

BofA’s Hartnett Says Market Selloff Yet to Breach Key Levels (bloomberg )

New Bill Aims to Close E-Commerce Tariff ‘Loophole’ Benefiting Shein and Temu (barrons )

This strategist downgraded tech just before the summer swoon. Now he says buy and here’s why. (marketwatch )

The Economy Is Fine for Now, and the Market Will Be, Too, Says Torsten Sløk (barrons )

Mortgage Rates Drop to 15-Month Low (wsj )

China Restricts Fentanyl Chemicals After Years of U.S. Pressure (wsj )

Americans Are Skipping Theme Parks This Summer (wsj )

News Corp beats revenue estimates as digital subscriptions grow (nypost )

The New A.I. Deal: Buy Everything but the Company (wsj )

Retail investors haven’t been this pessimistic in nine months, AAII survey finds (marketwatch )

The Market Is in Summer Mode. Why Trading Volume Matters So Much. (barrons )

Stock market likely to retest lows in 4-step recovery process, history suggests (marketwatch )

Fast-Money Quants Are Hammered After ‘Everything Went Wrong’ (bloomberg )

China Is Rapidly Building Nuclear Power Plants as the Rest of the World Stalls (bloomberg )

Cramer looks at Disney’s post-earnings stock move to explain Wall Street dynamics (cnbc )

Unwinding of yen ‘carry trade’ still threatens markets, say analysts (ft )

KFC, Pizza Hut’s China owner beats estimates as low-price strategy draws diners (scmp )

Tech war: China’s chip imports surge as firms stockpile ahead of fresh US restrictions (scmp )

Does The Yen Signal Once-In-A-Decade Market Transformation? (chinalastnight )

Sahm Rule is picking up on something that’s ‘very worrisome’: Claudia Sahm (foxbusiness )

China Ramps Up Fight Against Record Bond Rally as Targets Widen (bloomberg )

Buffett’s Japan Holdings Become ‘Bargain’ After Stock Meltdown (bloomberg )

Fed Moving Aggressively on Rate Cuts May Spur PBOC to Ease More (bloomberg )

JPMorgan Says Three Quarters of Global Carry Trades Now Unwound (bloomberg )

PayPal Stock Rises. It’s on ‘Fast Track’ to Better Margins With New Guest Checkout System. (barrons )

It took 14 years and 86 days to make an Olympic champion in skateboarding. (nytimes )

This Bond Market Indicator Says the Stock Market Will Be Fine (barrons )

How Whole Foods Revolutionized the Way America Eats (barrons )

The Vix ‘fear gauge’ index is falling — but it hasn’t given stocks the all-clear yet (marketwatch )

Investors made a record number of option bets that equities would fall as markets dived on Monday (marketwatch )

BOJ Watchers Keep Rate Hike Views Unchanged Despite Market Chaos (bloomberg )

Disney raises streaming prices for Hulu, Disney+ and ESPN+ (cnbc )

Why the Fed is being blamed for the historic stock-market plunge (businessinsider )

This Doesn’t Look Like Recession. Here’s How One Could Happen. (wsj )

Japan Likely Sold Foreign Securities to Fund FX Intervention (bloomberg )

YUM China Gobbles Up Gains On Q2 Beat, State Council Prepares “Service Consumption” Policy (chinalastnight )

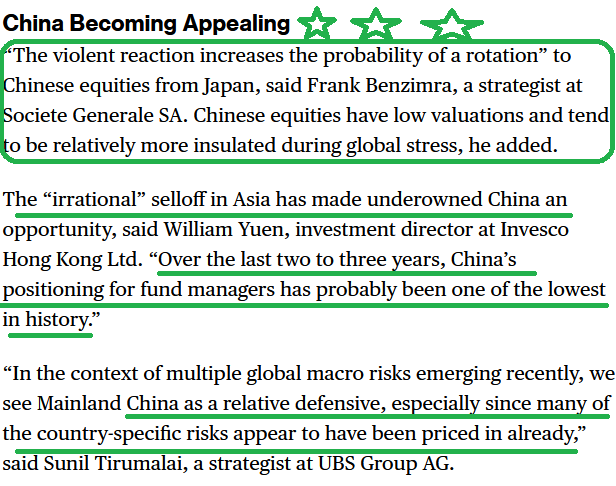

China, Defensive Sectors Win Favor as Asian Stocks Stage Rebound (bloomberg )

Market Selloff Upends Fed Rate-Cut Calculus (wsj )

Nvidia’s Huang Sold $323 Million of Stock in July Before Decline (bloomberg )

Google Monopolized Search Through Illegal Deals, Judge Rules (bloomberg )

Inside Alibaba’s New Global HQ: A Glimpse into China’s E-commerce Giant (chinalastnight )

Biggest Margin Debt Unwind Since 1999 Spurred Taiwan Stock Rout (bloomberg )

Chinese Brokerages Talk Up Local Stocks After Global Meltdown (bloomberg )

From Nvidia CEO To Warren Buffett: Insider Stock Selling Was An Ominous Warning Ahead Of Market Swoon (zerohedge )

Goldman Says Buying S&P 500 After 5% Drop Is Usually Profitable (bloomberg )

Apple Stock Slips, Microsoft Gains. What Google’s Antitrust Loss Means for Big Tech. (barrons )

What to Know About the Japanese Yen ‘Carry Trade’ That Is Blowing Up Markets (barrons )

The classic signs of a stock-market bottom aren’t yet in. Here’s what to watch, says JPMorgan (marketwatch )

Opinion: Your stocks now trade at the mercy of the Japanese yen (marketwatch )

S&P 500 put option volume hit record on Monday (marketwatch )

Is the stock-market meltdown due to the unwind of this popular hedge-fund trade? (marketwatch )

Fed’s Daly Isn’t Worried About the Jobs Report—or an Impending Recession (barrons )

Unraveling Trades Fuel Global Market Rout (wsj )

Not mincing words Michael Phelps didn’t hold back on how to handle doping controversy around Chinese swimming (nypost )

Traders Bet on Fed Emergency Rate Cuts, but Officials Need More to React (nytimes )

How Google’s antitrust defeat could change how you search the web (usatoday )

InterContinental CEO Says US Hotel Demand Defies Economy Fears (bloomberg )

San Francisco Fed President Daly sees interest rate cuts coming as labor market weakens (cnbc )

Uber says consumer spending ‘never been stronger’ as profits jump (ft )

Global hedge funds increased Chinese stocks exposure in July, Goldman says (scmp )

RMB rebound trend to continue (cn )

China’s yuan strengthens to 7-month high as yen gains, carry trade unwinds (scmp )

Carry Trade Unwind Extends as Peso Sinks, Yen and Yuan Surge (bloomberg )

Global hedge funds increased Chinese stocks exposure in July, Goldman says (scmp )

China’s services activity expands further, but external demand slows, Caixin PMI shows (reuters )

Tokyo’s Nikkei dives 12.4 per cent, suffers record points loss (scmp )

Why investors should buy the ongoing dip in stocks, Fundstrat says (businessinsider )

Market begins pricing possibility of intermeeting cut (marketwatch )

The U.S. government ‘cannot afford’ to let Intel struggle over the long term, one analyst says (marketwatch )

Hurricane Debby Slams Florida After Gaining Fury in Warm Waters (bnnbloomberg )

Nvidia Stock Dives. Here’s Why. (barrons )

The Fed needs to make an emergency cut, says Wharton’s Jeremy Siegel (cnbc )

Opinion: The Sahm Rule, carry trades and recession fear are more than the market can bear (marketwatch )

Corporate profit growth is on pace for its best quarter since just before 2022’s inflation spell (marketwatch )

Blame it on the yen? ‘Epic leverage’ in carry trade ‘beyond wildest market dreams’: Boockvar (marketwatch )

The Longest Inverted Yield Curve In U.S. History May End Soon. What It Means for Stocks. (barrons )

2024’s Most Popular Trades Are Unraveling (wsj )

The Sports Gambling Disaster (mi )

Scottie Scheffler wins Olympic gold in Paris after incredible final round (foxbusiness )