Skip to content

Intel Bulls Have Given Up. Why There May Still Be Hope for The Stock. (barrons )

‘The Claman Countdown’ panelists Thomas Hayes and Nick Timiraos evaluate the state of the U.S. economy. (foxbusiness )

‘I’m really desperate now’: Temu sellers revolt against fines and withheld pay (cnn )

The government—either a Harris or Trump administration—will need Intel to thrive if the U.S. has any hope of achieving chip making independence. (barrons )

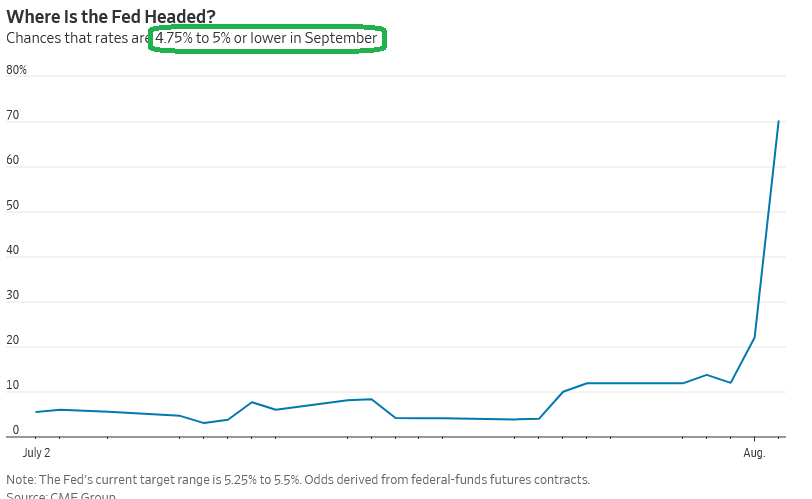

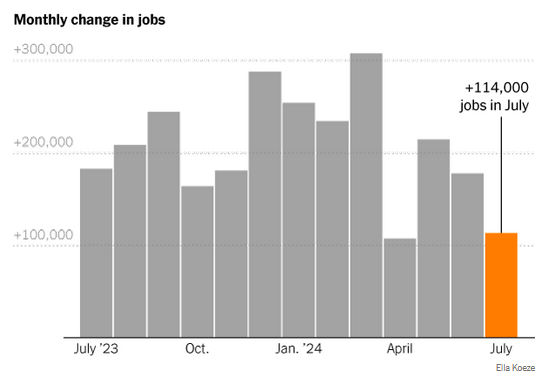

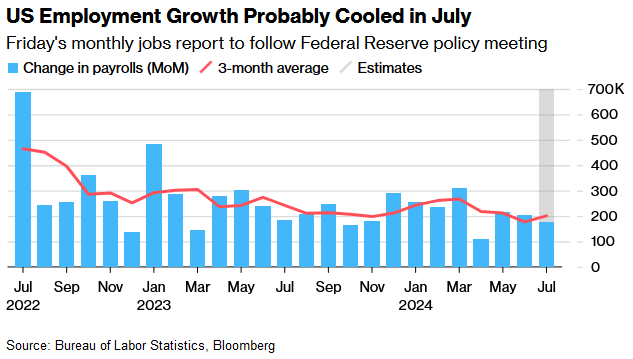

Job Slowdown Will Ignite Debate Over Larger Half-Point Rate Reduction (wsj )

How a Jobs Report Sent the Fed From a Soft Landing to Behind the Curve (barrons )

What 100 Years of Rate Cuts Says Happens Next (barrons )

Amazon’s Jeff Bezos Stopped Selling Stock When It Dipped Below $200 (barrons )

Pump Up the Value. Fed Rate Cuts Will Boost These Stocks. (barrons )

Wall Street’s Year of Calm Snaps as Most Reliable Trades Flop (bloomberg )

Dollar Eyes Worst Day This Year as Jobs Data Boosts Expectations for Fed Cuts (barrons )

Mortgage rates plunge to lowest level in more than a year after weak jobs report (cnbc )

Tech companies show no signs of slowing spending on artificial intelligence, even though a payoff looks a long way away. (nytimes )

Japan stocks plunge by nearly 6% in biggest drop since start of pandemic (cnn )

The 10 Best Companies to Invest in Now (morningstar )

PBOC to Step Up Support for Economy, Shifts Focus to Consumption (bloomberg )

BofA’s Hartnett Says Sell Stocks at the Fed’s First Rate Cut (bloomberg )

Automobile sales in the U.S. rebound after crippling cyberattack (marketwatch )

US job growth misses expectations in July; unemployment rate rises to 4.3% (reuters )

The July jobs report is likely to raise concerns that the Fed has waited too long to begin cutting rates. (nytimes )

Nvidia being probed by Justice Department, two separate reports say (marketwatch )

Japanese Stocks Suffer Biggest Fall Since 2020 on Economic Concerns (wsj )

Japanese stocks fell 6 percent as a long-running surge faltered. (nytimes )

Temu’s office besieged by Chinese suppliers protesting refund policy (businessinsider )

“Intel’s second-quarter earnings report on Thursday wasn’t all bad. CEO Pat Gelsinger continued to reiterate that the company’s ambitious plan for “5 nodes in 4 years” to enable its foundry business (for both internal and external customers) to catch up to Taiwan Semiconductor Manufacturing is still on track and executing as planned. Intel has shipped more than 15 million of its first “AI PC” chips, codenamed Meteor Lake, and is confident it will have 40 million units shipped by the end of 2024. That’s a huge milestone and dwarfs what AMD or Qualcomm could hope to do in the same time frame.” (marketwatch )

Cooper Standard Second Quarter Gross Profit Ramps Higher; Further Margin Expansion Expected in Second Half of the Year (cps )

Here’s the dividend-paying stock playbook for Fed rate cuts (marketwatch )

Intel to Cut Jobs and Suspend Dividend in Cost-Saving Push (wsj )

Why the Fed Risks Falling Behind (wsj )

Recession Triggered: Payrolls Miss Huge, Up Just 114K As Soaring Unemployment Rate Activates “Sahm Rule” Recession (zerohedge )

NDRC Reiterates Ministry of Finance Policy Support (chinalaastnight )

GM Chief Financial Officer Paul Jacobson Buys the Stock Dip (barrons )

Small caps and value stocks dominated in July by the widest margin in decades. Can the ‘great rotation’ continue? (marketwatch )

Katie Ledecky drops major 2028 Olympics hint after 1500-meter freestyle gold (nypost )

Interview: China revs up fiscal policy support to spur economic recovery (cn )

Since 1995, value stocks have always outperformed when they’re this cheap — and by a big margin (marketwatch )

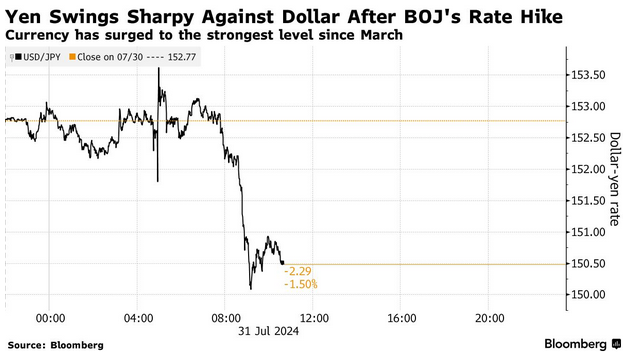

Japanese stocks fall as investors fear effects of stronger yen (ft )

Japan Raises Interest Rates for Second Time Since 2007 (nytimes )

China’s Politburo meeting sends positive vibes to investors after Third Plenum disappoints (scmp )

US Initial Jobless Claims Rise to One-Year High as Hiring Slows (bloomberg )

“This Is Unjust!” Female Boxer Quits Olympic Match, Melts Down In Tears After Biological Male Brutalizes Her In 46 Seconds (zerohedge )

China to improve market access system: top economic planner (cn )

Wall Street says buy stocks that pay dividends with $6 trillion of cash ready to be deployed (businessinsider )

CEOs Are Discussing the Fed on Earnings Calls at a Record Pace (bloomberg )

K. Cuts Rates (barrons )

Intel Wants to Sell More AI Chips. It Reports Earnings Thursday. (barrons )

September Rate Cut Would Thrust Fed Into Brutal Election Campaign (wsj )

Katie Ledecky wins gold in 1500m freestyle with new Olympic record (nbc )

In new CEO, Boeing gets ‘the kind of person who gives a damn’ (ft )

China’s ‘basic self-sufficiency’ in chip-making tools could come this summer, veteran says (scmp )

Macau casino group MGM China reports best-ever June quarter as tourists return, winning odds improve (scmp )

Bears flee China stock markets as regulatory curbs squash short positions to a 4-year low (scmp )

Tech war: China narrows AI gap with US despite chip restrictions (scmp )

Discount shopping giant Temu’s supply chain faces scrutiny as mainland sellers protest (scmp )

Boeing’s new CEO already seems to have given a major indication of where his priorities lie (businessinsider )

S. productivity rebounds sharply in second quarter, which could help a soft landing (marketwatch )

Fed should’ve cut today, says DoubleLine’s Jeffrey Gundlach (cnbc )

France’s ‘shallow’ Olympics pool could be slowing swimmers down (nypost )

What an August election-year rally for stocks could mean for Wall Street’s ‘Great Rotation’ (marketwatch )

XPO Earnings Show U.S. Manufacturing Improved. Shares Rise. (barrons )

Fed Clears Path for September Interest Rate Cut (wsj )

The Haves and Have-Nots at the Center of America’s Inflation Fight (wsj )

Yen Soars to Strongest Since March as BOJ Reignites Rally (bloomberg )

Alibaba to deploy AI-powered sourcing engine to boost trade for global merchants (scmp )

Japan’s Central Bank Hikes Key Rate Hours Before the Fed (bloomberg )

Japan Spent $36.6 Billion to Prop Up Yen in Past Month (bloomberg )

Intel to Cut Thousands of Jobs to Reduce Costs, Fund Rebound (bloomberg )

PayPal Shares Surge on Higher Forecast for Profit, Buybacks (bloomberg )

Boeing’s stock jumps after company names industry veteran Robert K. Ortberg CEO (marketwatch )

Opinion: Microsoft and AMD earnings show that AI remains a game of optics (marketwatch )

Disney Bets on Deadpool, Wolverine and Dirty Jokes to Save Marvel (bloomberg )

ADP says 122,000 jobs added in July. Smallest gain in six months points to weaker labor market. (marketwatch )

AMD Raises AI Chip Guidance Again. The Stock Jumps. (barrons )

TSMC, Broadcom, Intel Stocks Rise. 3 Reasons the Chip Companies Are Moving. (barrons )

Job quitting falls to nearly 4-year low and job openings dip in sign labor market is cooling (marketwatch )

We’re raising our Stanley Black & Decker price target on the stock’s earnings rally (cnbc )

Jobs Are Now a Big Focus for the Fed. 6 Charts That Tell the Story. (marketwatch )

Norwegian Cruise Line Stock Sails Higher. Earnings Were That Good. (barrons )

Starbucks CEO Said the Company Is Making “Real Progress” Amid Sales Decline in U.S. and China (barrons )

The U.S. Wanted to Knock Down Huawei. It’s Only Getting Stronger. (wsj )

Higher, Stronger…Slower? Why the Paris Olympic Pool Has a Problem (wsj )

Investors on Alert for Fed Signals of September Rate Cut (wsj )

US Labor Costs Rise Less Than Forecast as Inflation Eases (bloomberg )

US Will Host Chinese Officials for New Talks on Curbing Fentanyl (bloomberg )

This strategist is predicting a big rally after the Fed decision. He’s been more right than wrong this year. (marketwatch )

ASML shares jump on U.S. exemption from China chip export restrictions – Reuters (streetinsider )

Politburo Release Review (chinalastnight )

PayPal Stock Rises Sharply After Beat-and-Raise Quarter (barrons )

China’s Xi calls for faster measures to boost domestic consumption (ft )

Alibaba’s Taobao and ByteDance’s Douyin seek e-commerce price war detente with new policies (scmp )

PayPal’s stock gains as earnings bring big positive surprise on this key number (marketwatch )

Pfizer beats earnings estimates, hikes full-year outlook as drugmaker cuts costs (cnbc )

‘Fed Whisperer’ Nick Timiraos: Fed May Signal Sep’s Rate Cut (aastocks )

Alibaba Shares Jump on Plans to Boost Service Fee for Merchants (bloomberg )

In the 1,500, There’s Katie Ledecky and Then There’s Everyone Else (nytimes )

Japan Wanted Higher Inflation. It’s Here, and It Hurts. (nytimes )

Alibaba Cloud raises prices for domain name auctions amid AI compute price war (scmp )

Nvidia Stock Swoon Didn’t Slow CEO Jensen Huang’s Sales (barrons )

Alibaba’s Monetization Moves The Stock, Domestic Investors Plead “Jia You” (chinalastnight )

Boeing Has a New CEO Candidate. (barrons )

The Olympics Are Here. Take Gold With These 3 Stocks. (barrons )

Why 3M Stock Rose 23% on Friday (and Why Investors Should Have Seen It Coming) (barrons )

Guinness a bright spot as Johnnie Walker-maker Diageo drops on full-year sales decline (cnbc )

Don’t Count on a Fed Rate Cut to Boost Stocks (barrons )

Newell Stock Got a Boost From Earnings. CEO Says Stressed Consumers Won’t Hold It Back. (barrons )

Investors on Alert for September Rate Cut Signals (wsj )

Traders are focused on a central bank this week. But it may not be the Fed. (marketwatch )

What to look for in Friday’s jobs report (marketwatch )

Surge in Commercial-Property Foreclosures Suggests Bottom Is Near (wsj )

In a Troubled Box Office, Premium Still Sells (wsj )

Why Global Investors Are Watching What Japan Does Next (nytimes )

The Science Behind Olympic Greatness, Revealed Through Motion (nytimes )

Starbucks CEO Gets Cover for a Belated Overhaul (bloomberg )

Inside The Berkshire Hathaway Inc. Annual General Meeting

Houston Cofield/Bloomberg

Buffett Cuts BofA Stake, Unloading $3 Billion This Month (bloomberg )

Inside the race to make the world’s fastest running shoes (ft )

Hartnett: The World’s Most Crowded Trades Are Getting Liquidated (zerohedge )

The Zombie Mall King Doesn’t Want to Be a Bottom-Feeder Forever (bloomberg )

Hedge Funds Post Biggest Retreat on Bearish Yen Bets Since 2011 (bloomberg )

Traders Fret as 32-Hour Central Banking Spree Hangs Over Markets (bloomberg )

Canada Goose boss avoided printing ‘CEO’ on business cards for years after taking over at 27 (fortune )

Even September may be too late for a rate cut to swing the U.S. economy out of a recession, warns former Fed president (fortune )

Alibaba Cloud and OBS Unveil AI-powered OBS Cloud 3.0 at Paris 2024 (alizila )

Alibaba International’s Aidge AI Toolkit Hits Half a Million Merchant Adoptions (alizila )

‘Deadpool & Wolverine’ smashes R-rated record with $205 million debut (ap )

Fed’s next moves could seal the fate of tech stocks and small-caps (marketwatch )

China Backs Markets for Decisive Role as Grip Tightens (bloomberg )

China’s Industrial Profits Climb, Showing Manufacturing Strength (bloomberg )

A Fed Rate Cut Is Finally Within View (wsj )

Katie Ledecky Is Finally Vanquished by the Rivals She Helped Create (wsj )

Fed Is About to Nod at a Rate Cut as Job Growth Moderates (bloomberg )

3M Stock Had Its Best Day Ever. The New CEO Started With a Bang. (barrons )

What Gives Poor Kids a Shot at Better Lives? Economists Find an Unexpected Answer (wsj )

John Malone Has Hit a Rough Patch. How to Play His Liberty Empire Now (barrons )

Disney Bets on Deadpool, Wolverine and Dirty Jokes to Save Marvel (bloomberg )

The Private Equity Staffer With a Shot at Olympic Glory (bloomberg )

Some of the most popular trades of 2024 are coming undone after reaching ‘stupid’ levels (marketwatch )

Short-run U.S. inflation trend points down, down, down (marketwatch )

10 Best Cheap Stocks to Buy Under $10 (morningstar )

#34 Getting The Odds On Your Side: Legendary Investor Howard Marks (youtube )

A massive race to start the Olympics: Get ready for the women’s 400-meter freestyle (nytimes )

Nike Stock Is at Its Cheapest in a Decade. It Will Make a Comeback. (barrons )

Buy the dip on Nvidia and other chip stocks? Not quite yet, says this analyst. (marketwatch )

Disney+, Hulu, Max launch their new streaming bundle — at a 38% discount (marketwatch )

20 value stocks scoring highest for long term returns on invested capital (marketwatch )

Royal Caribbean Raises Its Outlook. Cruise Demand Is Strong. (barrons )

Auto Stocks Were Crushed. Everything Is Fine. Really. (barrons )

3M Earnings Are Coming. Investors Want Growth. (barrons )

Economic Growth Quickens, Rising at 2.8% Rate in Second Quarter (wsj )

Real Estate Crisis? Small Banks Say Their Loans Are Fine. (nytimes )

Cracker Barrel CEO gives progress update on the chain’s turnaround plan (cnbc )

GM reveals new Chevy Corvette with 1,000-plus horsepower and record top speed (cnbc )

Alibaba, Tencent quickly adopt Meta’s Llama 3.1 AI model amid excitement (scmp )

Yen Surges as Traders Bet the Big Turning Point Is Finally Near (bloomberg )

Japanese Population Falls at Fastest Pace in Demographic Crisis (bloomberg )

Japan Business Service Prices Jump, Backing Case for Rate Hike (bloomberg )

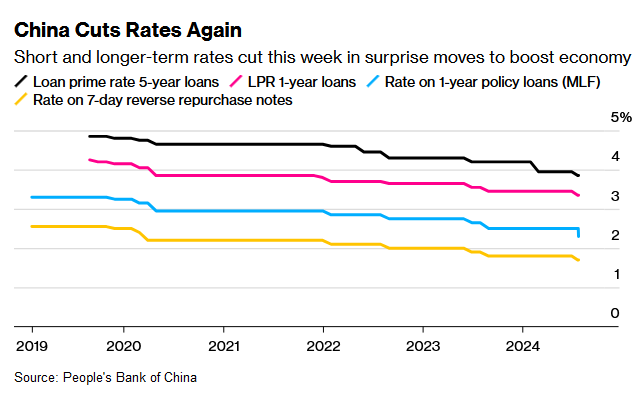

China Unexpectedly Cuts One-Year Policy Rate by Most Since 2020 (bloomberg )

‘Magnificent Seven’ stocks see worst drop since launch of ChatGPT — with $1.7 trillion in value erased in 2 weeks (marketwatch )