Skip to content

- First-Quarter US Labor Costs Marked Down on Weaker Output, Hours (bloomberg)

- ECB Cuts Rates, Raises Inflation Forecasts for 2024, 2025 (bloomberg)

- US Payroll Gains Not as Robust as Reported, BLS Data Suggest (bloomberg)

- Citi Wealth Says Equal-Opportunity S&P Is a Way to Play Rally (bloomberg)

- Nvidia CEO Jensen Huang to Sell Up to $735 Million in Stock (barrons)

- Country Garden sees home sales jump as Beijing’s rescue package gives developers a boost (scmp)

- Bond Traders Pile Into Fresh Bets on Faster Pace of Fed Cuts (bloomberg)

- Investing in China ‘desirable’ despite risks, says hedge fund giant Ray Dalio (scmp)

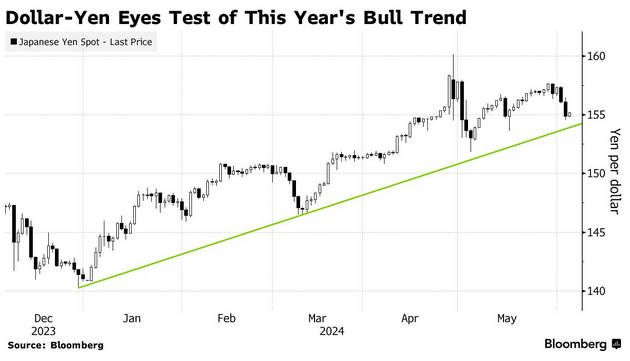

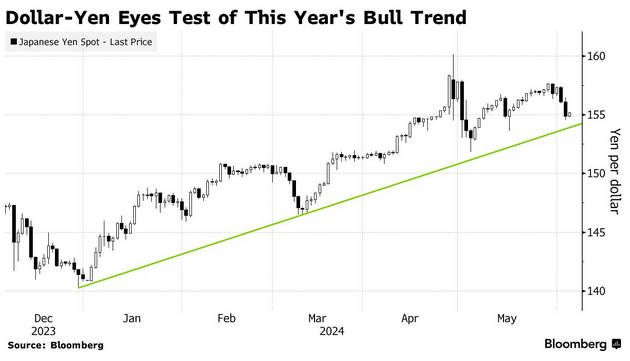

- Hedge Funds Flip Flop on Yen Option Trade as BOJ ‘Spooks’ Market (bloomberg)

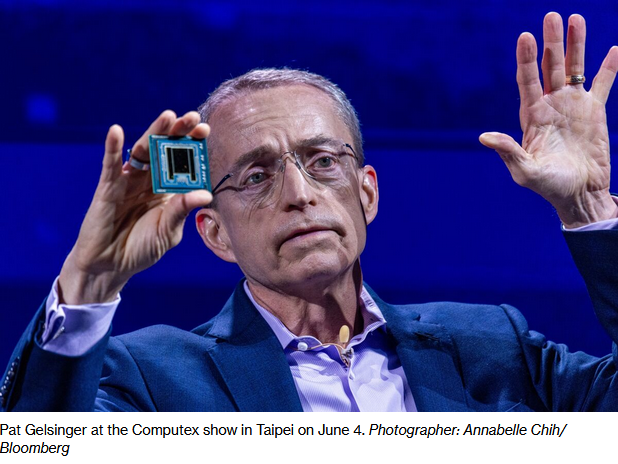

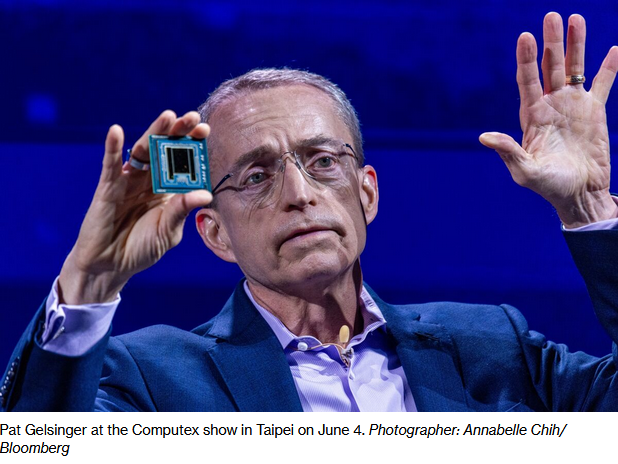

- ‘We want to build everybody’s AI chips’: Intel CEO talks of regaining market share (cnbc)

- Here’s what happened in 9 major bubbles in the last 100 years — and what’s going on now (marketwatch)

- Bank of Canada seen cutting rates (marketwatch)

- Traders expect a hawkish cut from the ECB. What it means for markets. (marketwatch)

- Intel, Apollo strike $11 billion deal over chip-manufacturing plant in Ireland (marketwatch)

- Citi Says ECB’s Interest Rate Path Hands European Stocks an Edge (bloomberg)

- These popular stock-market trades are unwinding as Fed bets shift. Here’s what happens next. (marketwatch)

- Margin Debt Is Rising. It’s a Sign Some Investors Are Amping Up Risk. (barrons)

- Americans Have More Investment Income Than Ever (wsj)

- The number of US homes for sale is slowly returning to normal: An ‘incredible trend,’ economists say (nypost)

- The Great Concert Ticket Bust (businessinsider)

- US dollar to weaken, but Fed rate cuts are required, say strategists (streetinsider)

- Alibaba shows strong momentum during 618 shopping festival, as chairman Joe Tsai eyes return to double-digit revenue growth (scmp)

- Ford US sales soar in May, powered by hybrids (yahoo)

- PayPal and Oracle are new top picks at Mizuho (streetinsider)

- Intel CEO Takes Aim at Nvidia in Fight for AI Chip Dominance (bloomberg)

- The Dollar Is at Its Strongest Since the 1980s. Can It Last? (wsj)

- Short Sellers in Danger of Extinction After Crushing Stock Gains (bloomberg)

- VF Corp. Replaces North Face President with Former Fashion Exec, Adds Two Board Members (outdoorretailer)

- China needs to inject US$276b into property market to stabilise prices: Goldman (scmp)

- Hong Kong stocks rise amid bets of stability in China property, US rate cut hopes (scmp)

- Chinese exporters anticipate strong performance on new growth drivers (cn)

- Fundstrat’s Tom Lee: S&P 500 will rise 4% to 5,500 by the end of June (CNBC)

- Hong Kong stocks jump by most in 3 weeks as Alibaba, Tencent gain on economic data boost (scmp)

- Hedge fund short sellers burnt by flurry of UK takeover bids (ft)

- A ‘pick and mix’ stock market has emerged thanks to higher interest rates, says Goldman Sachs (marketwatch)

- 10-year Treasury yield extends decline after U.S. job-openings data (marketwatch)

- US Job Openings Fall in Broad Cooldown (bloomberg)

- Treasuries Gain as JOLTS Spurs Faster Fed-Cut Bets (bloomberg)

- Intel unveils new AI chips as it seeks to reclaim market share from Nvidia and AMD (cnbc)

- After Years of Turbulence, the Cruise Lines Are Sailing Under Blue Skies (barrons)

- Logistics Operators Are Looking to Break the Sector’s IPO Logjam (wsj)

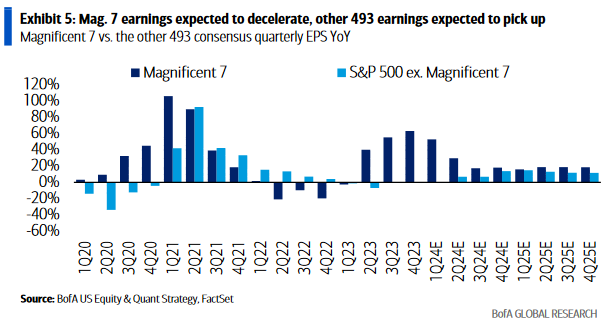

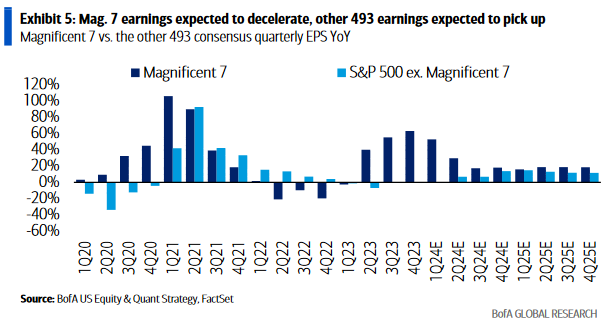

- BofA investment chief reveals his 2nd-half playbook: Buy dips in bonds, and sell stocks after the first rate cut (businessinsider)

- How Billionaires Bought 70% of Detroit’s Offices and Transformed the City (bloomberg)

- Ed Yardeni: We’re still in the early stages of a bull market (cnbc)

- Retail Earnings Season Is Done. Here Are 5 Big Takeaways. (barrons)

- China Caixin PMI Signals Faster Manufacturing Growth in Contrast to Official Gauge (wsj)

- Joe Tsai on Why Alibaba is All In on AI (alizila)

- <Research>BABA-SW Forecasts to Finish Dual Primary Listing at End-Aug; M Stanley Expects Southbound Inclusion in Sep Soonest (aastocks)

- China Needs Much More Central Government Debt, Key Adviser Says (bloomberg)

- OPEC+ Agrees to Extend Production Cuts in Bid to Boost Oil Prices (wsj)

- The U.S. Gave Chip Makers Billions. Now Comes the Hard Part. (wsj)

- Hong Kong stocks rally lead by Alibaba, Tencent after factory index surges (scmp)

- The Market Is Packed with ‘Pain Trades.’ How to Avoid Getting Hurt. (barrons)

- BofA Says Drop in US Tech Could Be Next Pain Trade for Equities (bloomberg)

- Corporations Learned The Maximum Amount They Can Charge For a Product (bloomberg)

- Lots More on the Troubled NYC Office Buildings Everyone’s Talking About (bloomberg)

- The Big Read. The transformative potential of computerised brain implants (ft)

- How the US Electricity Grid Squeezes Out Nuclear Power (bloomberg)

- How Online Sports Bettors Actually Make Their Money (bloomberg)

- Introduction to Probability and Statistics (mit)

- Using anecdotes to predict recessions (npr)

- Will Siri Become More Like ChatGPT? All Eyes on Apple’s WWDC (cnet)

- 14 Free Online Tools You Should Know About (gizmodo)

- 10 best Alfred Hitchcock movies, ranked (digitaltrends)

- How Does the European Union Work? (cfr)

- Don’t Believe the AI Hype (project-syndicate)

- From Mille Miglia to Mexico, these Ferraris battled with motorsport’s best (classicdriver)

- Rockefeller’s Giant Lives On. Energy Industry Mergers Are Resurrecting Standard Oil. (barrons)

- Stocks are up but investor behavior is ‘fragile.’ Is the bull market still in its early stages? (marketwatch)

- Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money (bloomberg)

- China Ramps Up Warning On Bond-Buying Frenzy With PBOC Selling in Focus (zerohedge)

- Intel Betting on AI Well Beyond Data Centers (wsj)

- Alibaba signs David Beckham as AliExpress global ambassador (technode)

- Companies Counter Pushback on Price Increases With Promotions (nytimes)

- Masters in Business: Jeffrey Sherman (bloomberg)

- How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders (bloomberg)

- Inside Kevin Costner’s $38 Million Horizon Gamble (gq)

- S&P Downgrades France Credit Rating to AA- (tradingeconomics)

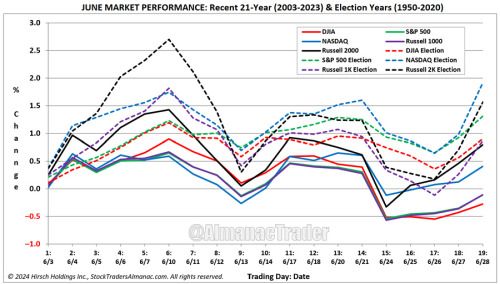

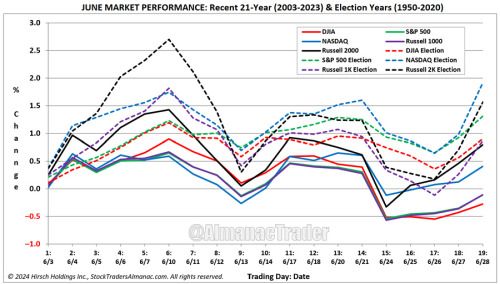

- June Better in Election Years: Average Gains Range from 0.9% DJIA to 1.9% NASDAQ (almanactrader)

- Let there be gamma (ft)

- Dr Pepper Ties Pepsi as America’s No. 2 Soda (wsj)

- We Drove a Trio of Classic Ferraris, and Now They’re up for Grabs (robbreport)

- The 5 Most Exciting New Restaurant Openings of May (robbreport)

- Carl Icahn reportedly owns sizable stake in Caesars, sending shares soaring (nypost)

- VF Corp. Is Hiring Former Lululemon Product Chief. Analysts Are Upbeat. (barrons)

- Boeing Executives Unlikely to Be Charged for 737 Max Crashes (bloomberg)

- Disney Is Banking On Sequels to Help Get Pixar Back on Track (bloomberg)

- Why you should buy the dip in stocks before next week’s jobs report, Fundstrat says (businessinsider)

- Nvidia Stock Falls. What Dell’s Earnings Mean for the Chip Maker. (barrons)

- The Chips Act Is Working. Why a Big Investor Is Bullish on U.S. Production. (barrons)

- Nike Stock Is at a Crucial Moment. A Comeback Hangs in the Balance. (barrons)

- Where to Find 7% Yields on Preferred Stock (barrons)

- Don’t fear the PCE. The recent market dip leaves stocks more likely to rally in coming days (marketwatch)

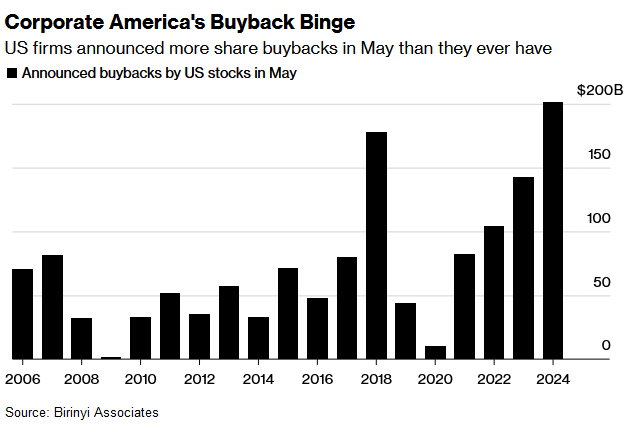

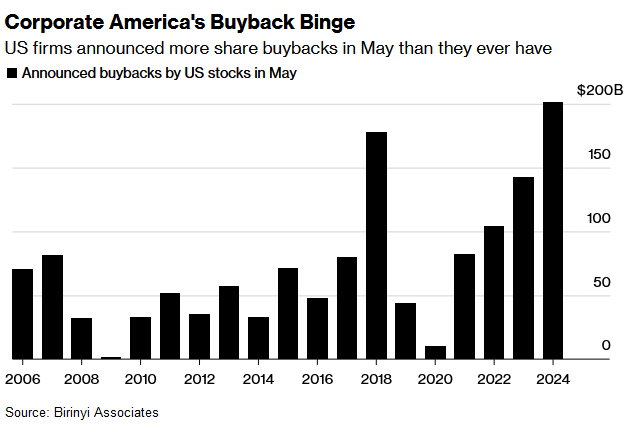

- Buybacks Reach $201 Billion, a Record for May, Data Show (bloomberg)

- Our U.S. summer natural gas consumption forecast for electric power matches 2023 record (eia)

- VF Corporation Appoints Sun Choe (from lululemon) as Global Brand President, Vans® (vfc)

- The FAA Has a Boeing Update. It’s Good News. (barrons)

- New York Fed’s Williams Sees 2% Inflation in 2025, Soft Landing Ahead (barrons)

- Nvidia Stock Drops. CEO Jensen Huang Heads to Taiwan. (barrons)

- US Is Slowing AI Chip Exports to Middle East by Nvidia, AMD (bloomberg)

- What’s a Carry Trade Again? And When Is It Not a Moneymaker? (bloomberg)

- What Are Block Trades? Why Are They in the Spotlight? (bloomberg)

- Tokyo Inflation Picks Up, Keeping BOJ on Track for Rate Hike (bloomberg)

- Warning Signals Are Flashing for Homeowners in Texas and Florida (bloomberg)

- US Malls Avoid Death Spiral With Help of Japanese Video Arcades (bloomberg)

- SpaceX Weighs Plan to Sell Shares at $200 Billion Valuation (bloomberg)

- 3 signs the housing market’s affordability recession is finally ending (businessinsider)

- Ads will help Amazon’s retail margins hit new highs: BofA (streetinsider)

- 10 Life Lessons From Warren Buffett Everyone in Their 20s Should Hear (247wallst)

- Warren Buffett Says He Knows In ‘5 Minutes’ If An Investment Is Worth It (yahoo)

- Alibaba e-commerce unit’s latest executive reshuffle sees veterans retire as younger leaders take over (scmp)

- Semiconductor International Corporation Rallies on 3 Nanometer Chip News (chinalastnight)

- BABA-SW Plans to Pay Div. for FY24 in Jul (aastocks)

- PayPal’s stock packs nearly 50% upside, a renewed bull says. Here’s why. (marketwatch)

- ‘Father of emerging markets’ Mark Mobius turns bullish on China stock as property measures restore confidence (scmp)

- Container throughput at China’s ports up 9 pct in January-April (cn)

- IMF ups China’s 2024 GDP growth forecast to 5 pct (cn)

- The Rise in Consumers’ Late Debt Payments Is Slowing Down (wsj)

- This Record Stock Market Is Riding on Questionable AI Assumptions (wsj)

- You Can Thank Private Equity for That Enormous Doctor’s Bill (wsj)

- Money Supply Rose for the First Time in More Than a Year. What That Signals for the Economy. (barrons)

- Warren Buffett Is a Big Fan of Shareholder Equity. 10 Companies With the Most. (barrons)

- The S&P 500 may be overbought, but most of its stocks are not (marketwatch)

- Blackstone executive says commercial real estate is bottoming (marketwatch)

- The South Park jinx could be coming for high-flying weight-loss stocks (businessinsider)

- US Pending Home Sales Plunged To Record Lows In April As Rates Rose (zerohedge)

- Richard Li States Strong Confidence in HK Economy (aastocks)

- High Interest Rates Are Working, Fed’s Williams Says (bloomberg)

- Fed’s Williams expects inflation to cool in the second half of the year (marketwatch)

- Alibaba expands AI portfolio with US$27 million start-up investment (scmp)

- Why This Legendary Value Manager Likes Alphabet and Citigroup Stock (barrons)

- Fed Rate Cuts Are Coming. Get Ready for the Stock Market’s Next Phase. (barrons)

- Cruise Stocks Are Steaming Ahead. It Isn’t Too Late to Jump Aboard. (barrons)

- Chewy Stock Gains After Earnings. Autoship Sales Are Strong. (barrons)

- Hedge funds sell out of U.S. cyclical stocks at fastest rate this year (marketwatch)

- Activist Investor Irenic Builds Stake in Forward Air (wsj)

- Consumer confidence rebounds for first time in 3 months (finance.yahoo)

- Yen May Ironically Get Help From The Fed Of All Places (zerohedge)

- A ‘robust’ earnings outlook is driving further optimism for stocks in 2024 (finance.yahoo)

- IMF raises China growth forecast but warns on industrial policy (ft)

- In China’s Tech Sphere, Everything Eventually Descends Into a Price War (bloomberg)

- ECB member says rates to ease ‘gradually,’ as market awaits June cut (cnbc)

- How China Pulled So Far Ahead on Industrial Policy (nytimes)

- PayPal Is Planning an Ad Business Using Data on Its Millions of Shoppers (wsj)

- China, Hong Kong stock markets are back in favour with global investors, HKEX CEO Bonnie Chan says (scmp)

- CPC leadership reviews measures to further energize central region, provisions to defuse financial risks (cn)

- China’s Xi Pledges to Make Youth Employment a Top Priority (bloomberg)

- U.S. consumer confidence rebounds in May after three months of decline (marketwatch)

- Home prices reach new high in March, Case-Shiller says, fueled by scarcity (marketwatch)

- This Wall Street Shake-Up Will Put Money in Your Hands Faster (barrons)

- UBS leapfrogs UBS with new S&P 500 price target (marketwatch)

- Apple iPhone Shipments In China Rebound 52%, Market Share Loss To Huawei May Be Stabilizing (zerohedge)

- 7 Biases That Can Cloud Investors’ Judgment About Finances (barrons)

- New Rules for Buying a Home Are Coming. A Guide to Getting the Best Deal. (barrons)

- China Raises $48 Billion for Semiconductor Fund to Bolster Chip-Making Capabilities (wsj)

- Hate Chatbots? You Aren’t the Only One (wsj)

- How to Have a Great Vacation: What Science Tells Us (wsj)

- Bullish Investors Are Piling Into Stock and Bond Funds (wsj)

- Bankruptcies Have Left More Stores Vacant, but the Space Doesn’t Sit Empty for Long (wsj)

- AI Is Driving ‘the Next Industrial Revolution.’ Wall Street Is Cashing In. (wsj)

- San Francisco’s Hot Tourist Attraction: Driverless Cars (nytimes)

- The small town life beckons for many as Americans continue to flee big cities (usatoday)

- Hedge Funds Split Over Stocks’ Move From Here (zerohedge)

- Guangzhou Follows Shanghai Real Estate Policy (chinalastnight)

- Western businesses backtrack on their Russia exit plans (ft)