Skip to content

- Alibaba Share Repurchase Update as of June 30, 2024 (alibabagroup)

- Susquehanna Upgrades PayPal (NASDAQ:PYPL) to “Positive” (marketbeat)

- Alibaba Reports $26 Billion In Buybacks Left, Hong Kong Outperforms (chinalastnight)

- Alibaba’s Taobao adds 1-hour delivery short cut in race against ByteDance, JD.com (scmp)

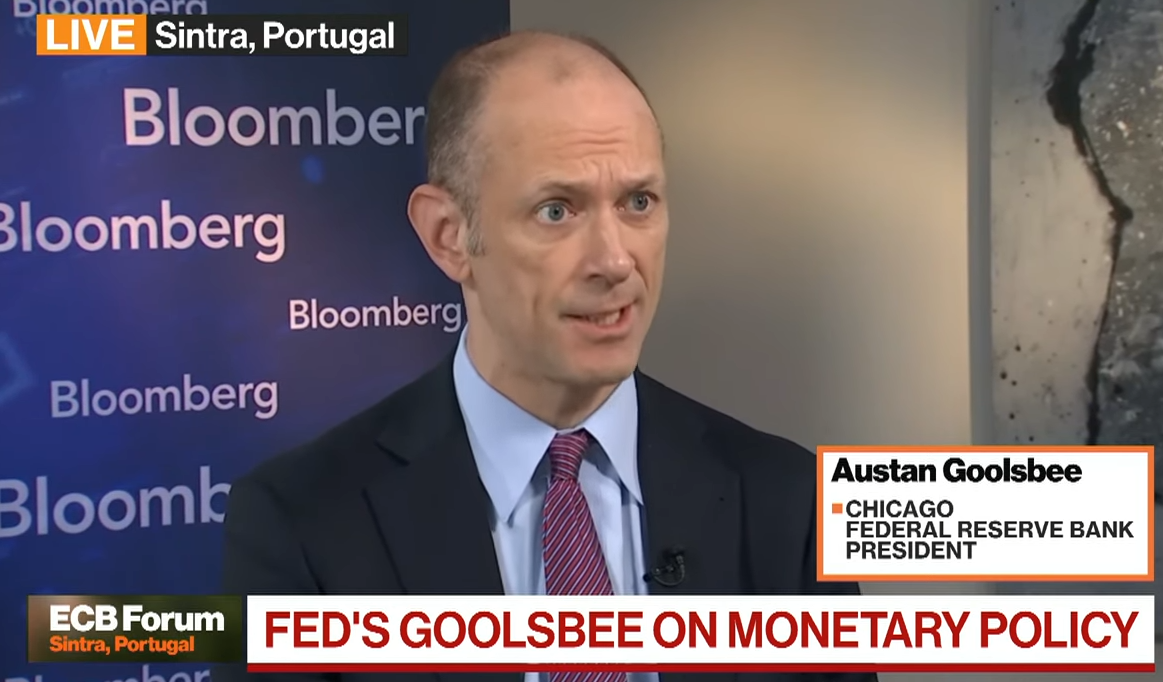

- Fed’s Goolsbee makes case for rate cut in coming months, citing ‘warning signs’ of a slowdown (marketwatch)

- Powell Talks Up Progress, Putting Rate Cuts Back Into View (wsj)

- Powell Cites ‘Real Progress’ as Central Bankers Assess Inflation Fight (nytimes)

- PayPal upgraded, Crowdstrike downgraded: Wall Street’s top analyst calls (thefly )

- Nvidia Stock Is Down Again. Why AI Chip Exports to China Remain a Problem. (barrons)

- 12 Stocks to Buy Before the Fed Cuts Rates (barrons)

- Constellation Brands Stock Is Rising After Earnings. What We Know. (barrons)

- Value Stocks Have Been on the Junk Heap. They’re Due for a Pop. (barrons)

- Stock market’s upcoming earnings season may delay ‘overdue’ pullback for S&P 500, says LPL (marketwatch)

- China leading generative AI patents race, UN report says (reuters)

- The Underground Network Sneaking Nvidia Chips Into China (wsj)

- Hedge fund selling of tech stocks has limited potential for crash, JPMorgan says (marketwatch)

- ADP says 150,000 private-sector jobs created in June, smallest gain in five months (marketwatch)

- ADP Payrolls Disappoint In June – 3rd Straight Monthly Decline In Additions (zerohedge)

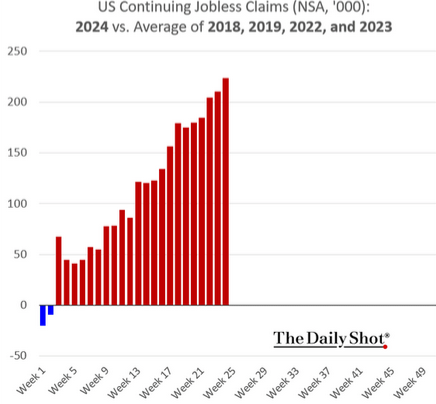

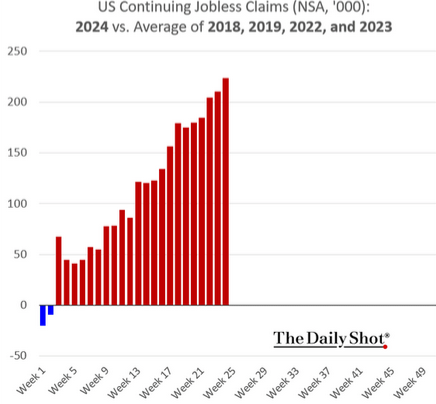

- Jobless claims — aka layoffs — rise to 238,000 and stay near one-year high (marketwatch)

- Initial Jobless Claims Disappoint (Again), Continuing Claims Worst Since Dec 2021 (zerohedge)

- Approval of Newest Alzheimer’s Drug Will Accelerate New Era of Treatment (wsj)

- Why Beryl Is the Strongest Hurricane to Form This Early (wsj)

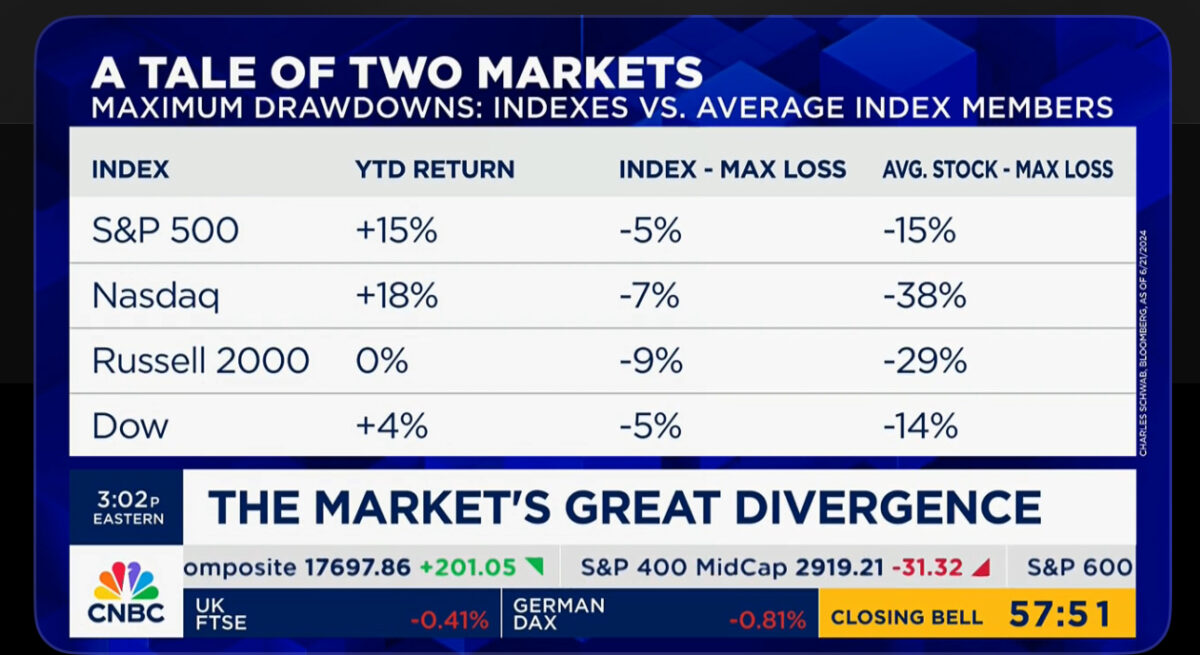

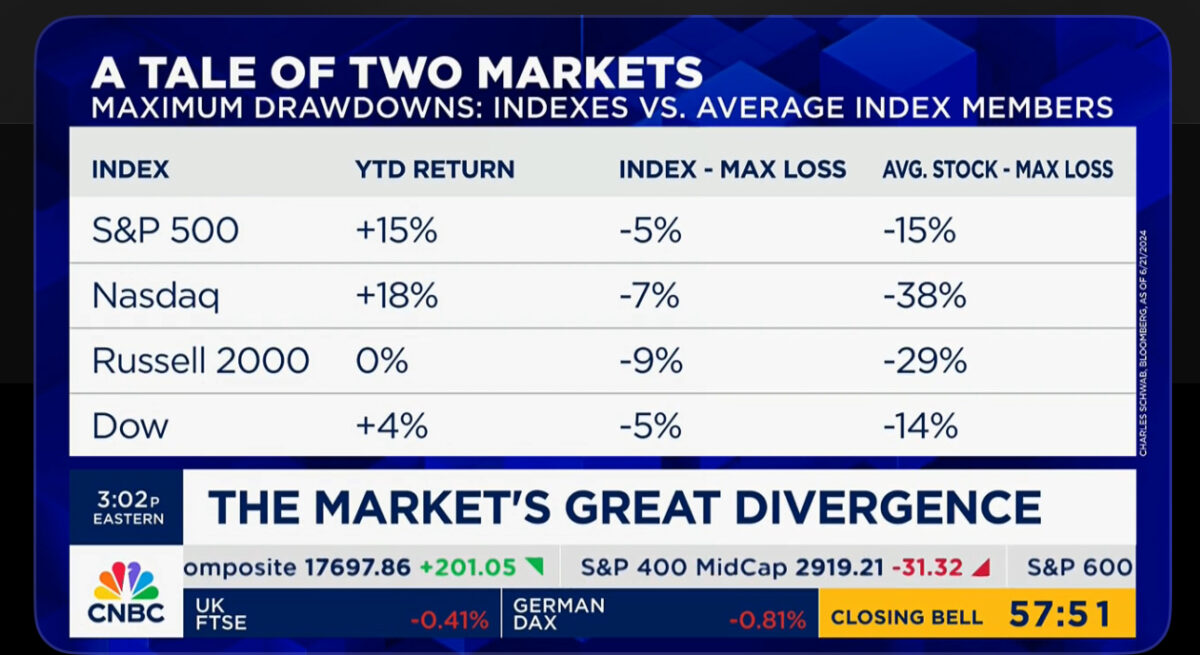

- The S&P 500’s reliance on a few winning stocks is getting worse (marketwatch)

- Biden’s LNG Export Ban Is Blocked (wsj)

- Auto Sales Grew Slightly in Second Quarter (nytimes)

- Home Affordability in the US Sinks to Lowest Point Since 2007 (bloomberg)

- Homebuilders Cut on ‘Sluggish’ Housing Market, Florida Woes (bloomberg)

- New York City Apartment Construction Is Grinding to a Halt (bloomberg)

- MrBeast has his critics, but creator marketing experts explain why he’ll always come out on top (businessinsider)

- Walt Disney numbers raised on ‘Inside Out 2’ strength (streetinsider)

- Yen slides to fresh lows, market ‘challenges’ Japan authorities to act (streetinsider)

- 2 Stocks Down 74% and 57.5% to Buy Right Now (yahoo)

- Amazon’s international unit on track to swing into annual profit (ft)

- China kicks off largest AI conference in Shanghai as tech rivalry with the US heats up (scmp)

- Alibaba’s online flea market draws moonlighters seeking side income in brutal job market (scmp)

- Chinese fintech giant Ant Group spins off database firm OceanBase, giving Alibaba a stake (scmp)

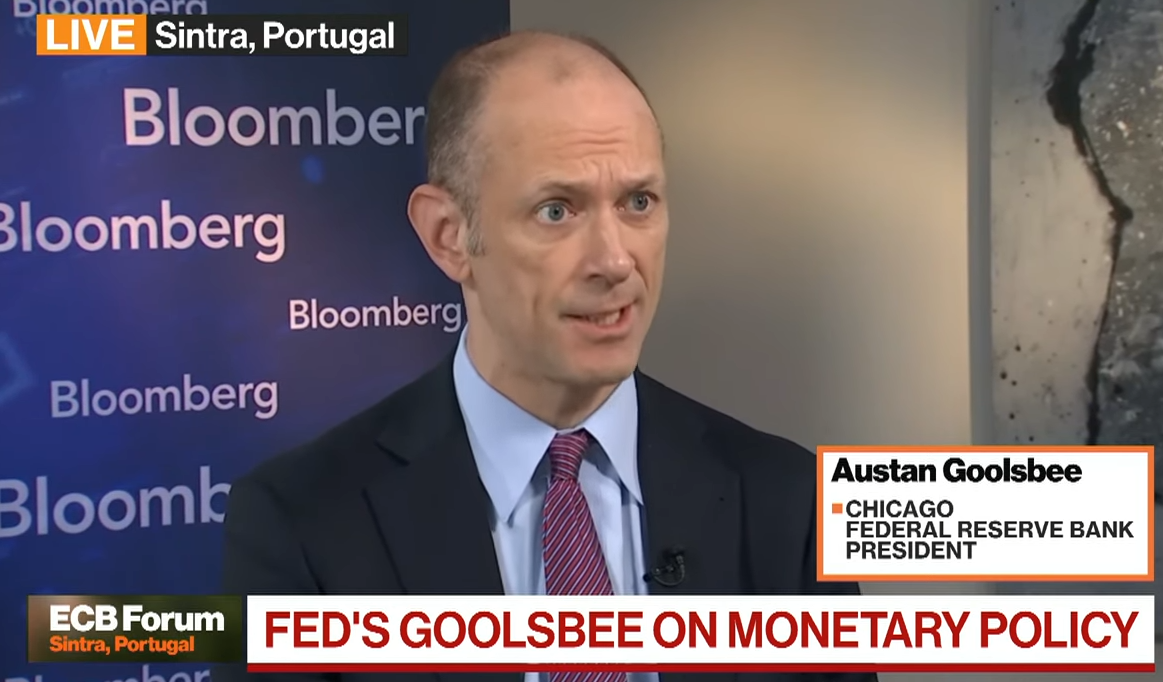

- Chicago Fed’s Goolsbee on Interest Rates, Inflation, Unemployment (bloomberg)

- 1 Incredible Growth Stock Down 81% You’ll Regret Not Buying on the Dip (fool)

- Euro zone inflation eases to 2.5% as core print misses estimate (cnbc)

- 5 Cheap Stocks Buying Back Shares at Reasonable Prices (barrons)

- Advice from a ‘nervous and jumpy’ Wall Street bull as second half gets under way (marketwatch)

- Fed’s Powell Takes the Stage With Other Global Bank Chiefs (barrons)

- Tech Industry Wants to Lock Up Nuclear Power for AI (wsj)

- A Real-Estate Fund Industry Is Bleeding Billions After Starwood Capped Withdrawals (wsj)

- Gavin Newsom Hailed Within China After Biden’s Debate Troubles (bloomberg)

- Manhattan is now a ‘buyer’s market’ as real estate prices fall and inventory rises (cnbc)

- How Brad Jacobs Will Invest $4.5 Billion to Reshape Building Supplies (bloomberg)

- Six Flags merges with Cedar Fair to become largest amusement park operator in North America (FoxBusiness)

- Goldman: Hedge funds sold global equities at the fastest pace in two years in June (streetinsider)

- Amazon’s international unit on track to swing into annual profit (ft)

- China’s central bank announces treasury bond borrowing to stabilize market yields (cn)

- Nvidia Stock Keeps Dropping. What’s Concerning the Market. (barrons)

- The Mouse House Sets Sail With Timely Cruise Expansion (wsj)

- Disney’s Pixar Notches First $1 Billion Film Since Barbie (barrons)

- Why China’s Central Bank Could Become More Like the Fed (bloomberg)

- Chewy Stock Is Soaring as Roaring Kitty Discloses Stake (barrons)

- Boeing to Buy Supplier Spirit Aero in $4.7 Billion Deal (barrons)

- Opinion: GameStop’s $2.1 billion stock sale taxes its shareholders and hurts the economy (marketwatch)

- Amazon and Rivals Have an AI Power Problem. Here’s the Solution. (barrons)

- Boeing Likely to Face Fraud Charges. What That Means. (barrons)

- The Tyranny of Today’s Tipping (wsj)

- Amazon, Built by Retail, Invests in Its AI Future (wsj)

- Alibaba, BYD Use the Global Game to Reach New Customers (bloomberg)

- Chinese factory activity up among smaller firms (reuters)

- China’s central bank moves to address bond frenzy (ft)

- China’s stock index climbs out of 4-month low after June’s factory data beat forecasts (scmp)

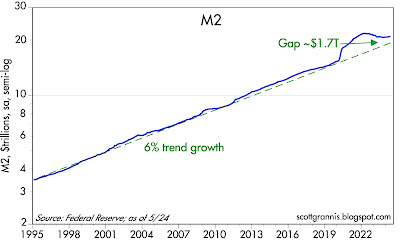

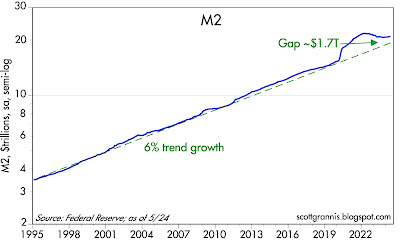

- Monetary conditions are returning to normal (scottgrannis)

- Vietnam Q2 GDP Growth Strongest in 7 Quarters (tradingeconomics)

- Why the Fed must change how it targets inflation (ft)

- Whole Foods is cutting prices and ditching its ‘Whole Paycheck’ aura to appeal to inflation-weary shoppers (fortune)

- Boeing could have a corporate monitor under an expected settlement with the Justice Department to resolve potential charges (fortune)

- Only 49 companies have been on the Fortune 500 for all 70 years. Here are their secrets to staying in power (fortune)

- The 25 Most Expensive Homes in the World for Sale (robbreport)

- Bentley’s New Continental GT Speed Is Here, and Its Design Has Already Wrankled Enthusiasts (robbreport)

- What It’s Like to Stay at Mango House, a Serene Hotel in Seychelles (robbreport)

- The 17 Most Beautiful Skylines in the World (architecturaldigest)

- 111 West 57th Street: Everything You Need to Know About the World’s Skinniest Skyscraper (architecturaldigest)

- Amazon hires founders away from AI startup Adept (techcrunch)

- This $68 Million Property Is Fit For A Supervillain. Take A Peek Around (digg)

- How American Entrepreneurs Helped Open up China’s Economy (bloomberg)

- One of the Hottest Trades on Wall Street, an Etymological Study (bloomberg)

- Inflation Cools After Months of Stagnation (barrons)

- 10 Undervalued Wide-Moat Stocks (morningstar)

- EU Asked Temu, Shein to Show Compliance With Services Act (bloomberg)

- Nice Is Quietly Becoming the Coolest Destination on the French Riviera (wsj)

- 5 Stocks to Buy Before the Fed Cuts Interest Rates in 2024 (morningstar)

- S. Airports Keep Setting New Daily Passenger Records. Here’s Why. (wsj)

- This ‘Achingly Cool’ California Steakhouse Has Been a Hollywood Favorite Since 1967 (wsj)

- Costco plans to build 800-unit apartment complex in bid to ease housing crisis (nypost)

- US banks announce dividend payouts after passing Fed’s ‘stress tests’ (ft)

- IMF warns US must ‘urgently’ address debt burden (ft)

- 10 Best Cyclical Stocks to Buy Now (morningstar)

- Nike’s Biggest Drop on Record Puts Pressure on CEO Donahoe (bloomberg)

- Boeing in Talks with DOJ to Resolve Charges Over Safety Lapses (bloomberg)

- Why nearly half of EV owners want to switch back to gas (businessinsider)

- Amazon beefs up AI development, hiring execs from startup Adept and licensing its technology (cnbc)

- Opinion: Buffett partner Charlie Munger kept these rules about investing and life that you can use too (marketwatch)

- Boeing Starliner crew not stranded in space, says NASA, but no date set for return (marketwatch)

- Why aren’t there more Warren Buffetts? (morningstar)

- Five stocks power US markets to 14% gain for first half of 2024 (ft)

- The Aston Martin Valiant Is An F1 Driver’s Dream Supercar (maxim)

- China Announces Key Reform Meeting, Emphasizing Party Leadership (bloomberg)

- Japan Will Take Appropriate Action Against Excessive Yen Moves, Finance Minister Says (wsj)

- PBOC Vows to Satisfy People’s Housing Needs As Downturn Drags On (bloomberg)

- Howard Marks – Co-founder of Oaktree | Podcast | In Good Company | Norges Bank Investment Management (youtube)

- Hedge Funds Have Sold Tech and Consumer Stocks, While Buying Banks and Energy, Says Goldman (barrons)

- After 40 Years, a Tech Columnist Says Farewell. But First, One More Thing. (barrons)

- REITs Had a Terrible First Half. It’s Time for a Turnaround. (barrons)

- Larry Summers Says the Economy Looks Healthy, and AI Should Bring ‘Profound’ Change (barrons)

- China’s Third Plenum Will Showcase the Country’s Contradictions (barrons)

- You Might Be Buying Your House at the Top of the Market (wsj)

- Amazon Takes On Chinese Rivals Temu and Shein With Plans for New Discount Service (wsj)

- Nike’s Slow Recovery Is Testing Investors’ Patience (wsj)

- Beijing Falls in Line With Other Top Chinese Cities to Help Home Buyers (wsj)

- Trucking Experts Project Spinoff of FedEx’s Freight Business (wsj)

- Ultimate Status Symbol: A $300,000, Souped Up Land Rover Defender, Warts and All (wsj)

- Alibaba Cloud is set to build new facilities in Mexico, Malaysia, the Philippines, Thailand and South Korea over the next three years (scmp)

- U.S. banks are in a good and resilient place, says Wells Fargo’s Mike Mayo (cnbc)

- Chinese Stocks Are in a Rut. How These Policy Meetings Could Change That. (barrons)

- AMZN Market Cap Pushes Further Past $2 Trillion. A Temu Move May Keep It Rising. (barrons)

- Amazon Plans New Discount Service to Take On Chinese Rivals (wsj)

- Boeing Said Cleared to Resume Wide-Body Jet Deliveries to China (bloomberg)

- This Company Helped Bryson DeChambeau Perfect His Stroke (cheddar)

- GXO | Apptronik (youtube)

- Boeing Doesn’t Want to Say This About Recent Problems. But It Should. (barrons)

- Micron Beats Q3 Targets, But In-Line Outlook Disappoints (investors)

- Nike Is on Brink of Recovery. Today’s Earnings Are a Test. (barrons)

- Bank woes in commercial real estate could ease with rate cuts, says Moody’s (marketwatch)

- Big Banks Can Withstand Disaster Scenario, Fed Says (barrons)

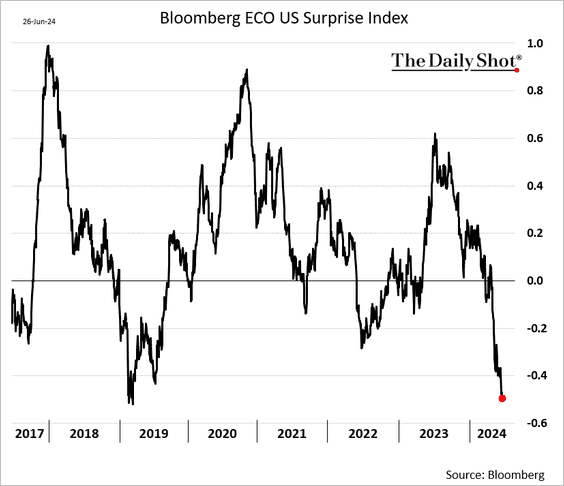

- First-quarter GDP grew a soft 1.4%, but the economy might have more ‘spring’ in its step (marketwatch)

- LVMH’s Arnault on How He Built an Empire of Opulence (bloomberg)

- Boeing Sees Fewer Fuselage Defects, Helping Lift Productivity (bloomberg)

- China sets mid-July for key ‘Third Plenum’ meeting to discuss ‘deepening reform’ (cnbc)

- Disney releases details about its new cruise in Singapore (cnbc)

- Japanese yen hits weakest level against dollar since 1986, reigniting intervention speculation (cnbc)

- Disney is about to change your theme park experience with new line-skipping passes (foxbusiness)

- Alibaba taps China’s top AI start-ups to boost enterprise offerings (scmp)

- Open AI’s Loss Is China AI’s Gain, Hong Kong Buyback Bonanza, Beijing Lifts Home Buying Restrictions (chinalastnight)

- Fed’s Bostic still backs one rate cut this year (marketwatch)

- Alibaba Stock Looks Poised for a Rally. Why China Trade Tensions Could Be a Catalyst. (barrons)

- Companies slash borrowing costs on $400bn of US junk loans (ft)

- Goldman Sachs bullish on China shareholder returns (streetinsider)

- Why should investors consider Disney? (foxbusiness)

- China’s Li Urges Stronger Employment Support for Graduates (bloomberg)

- Bond Traders Boldly Bet on 300 Basis Points of Fed Cuts by March (bloomberg)

- Beijing Becomes Last Mega China City to Ease Housing Rules (bloomberg)

- FedEx Scores an Upgrade After Strong Earnings, ‘Surprising’ Freight Decision (barrons)

- Fast-Food Chains Jacked Up Their Prices. Now They’re Trying to Win You Back With Value Menus. (barrons)

- The Clock Is Ticking on Jane Fraser’s Citigroup Turnaround (wsj)

- Mail-Order Drugs Were Supposed to Keep Costs Down. It’s Doing the Opposite. (wsj)

- ‘It’s All Happening Again.’ The Supply Chain Is Under Strain. (nytimes)

- The Man Who Waited Forever to Hold the Stanley Cup (wsj)

- This U.S. Team Has No Michael Phelps. Can Its Dominance in the Pool Survive? (wsj)

- Radical Technology Aims to Rev Up Oceans’ Power to Cool the World (wsj)

- Americans Chasing High Interest Rates Risk Falling Into a ‘Cash Trap’ (wsj)

- Yen Slides to Weakest Since 1986, Raising Risk of Intervention (bloomberg)

- BofA Bets Big on Steady Revenues From Transactional FX Business (bloomberg)

- Wall Street Banks Accelerate Buybacks Ahead of Fed Stress Tests (bloomberg)

- YouTube dominates streaming, forcing media companies to decide whether it’s friend or foe (cnbc)

- Waymo opens its driverless taxi service to all in San Francisco (marketwatch)

- Nvidia’s rebound from its correction only makes the stock more dangerous to buy (marketwatch)

- Carnival Cruise Line’s stock soars after company swings to a profit (marketwatch)

- Whirlpool Shares Surge 18% Amid Bosch Takeover Rumors (zerohedge)

- How the UK election could make or break the pound’s run (reuters)

- The Florida Panthers Win the Stanley Cup (wsj)

- Buy Intel instead of Nvidia: Thomas Hayes (FoxBusiness)

- Disney’s ‘Inside Out 2’ could be the first billion-dollar movie of 2024 (cnbc)

- Boeing Makes Offer For Parts Supplier Spirit AeroSystems (investors)

- Goldman Sachs bullish on China shareholder returns (streetinsider)

- Investors only have eyes for tech stocks right now. Here’s what they’re missing. (marketwatch)

- Something unusual is happening on Wall Street — and it likely bodes well for stocks (marketwatch)

- Warren Buffett’s Candy Company Is Trying to Scoop the Competition (barrons)

- New Rules for Buying a Home Are Coming. A Guide to Getting the Best Deal. (barrons)

- Apple Hit by First Charges Under New European Tech Law (wsj)

- The Clock Is Ticking on Jane Fraser’s Citigroup Turnaround (wsj)

- Mansion Global Daily: Investors and Celebrities Are Returning to Hong Kong (wsj)

- Stephen A. Smith Is the Face of ESPN. How Much Is That Worth? (wsj)

- China’s Rich Spend Millions on Shanghai Property (bloomberg)

- Tech giants bet next-generation optical networks will reduce AI’s climate impact, aid 6G transition (cnbc)

- Hedge Funds Bullish on the UK With Post-Election Calm in Sight (bloomberg)

- Boeing stock: These are 4 major catalysts to watch (streetinsider)

- Yellen tells YF she expects inflation to soon return to Fed’s target (finance.yahoo)

- Fed’s Goolsbee lays out dovish case for potential rate cuts and flags ‘a couple of warning signs’ on economy (marketwatch)

- Chicago Fed President Austan Goolsbee: Slowing inflation data would open the door to easier policy (cnbc)

- Tech Collision: Hedge Funds Selling and Retail Buying (zerohedge)

- Chinese e-commerce sales up 14% for 618 shopping festival, report says (scmp)

- Chinese banks could improve their bottom lines with AI adoption, experts say (scmp)

- The Fed Has Avoided a Recession. But Some Have Been Left Behind. (barrons)

- Why more homeowners are dropping their insurance (usatoday)

- AI Is Already Wreaking Havoc on Global Power Systems (bloomberg)

- Chances of ‘no landing’ grows by the day: Bank of America (streetinsider)

- BREAKING: UPS sells Coyote to RXO (finance.yahoo)

- Humanoid robot with highest operational time in tests by US logistics giant (interestingengineering)

- Odd Lots: Why Tom Lee Thinks We Could See S&P 15,000 by 2030 (bloomberg)

- Nvidia Insiders Cash In on Rally as Share Sales Top $700 Million (bloomberg)

- Nvidia CEO Jensen Huang Sold $95 Million of Stock. Other Chip CEOs Are Selling. (barrons)

- Protesters Disrupted a PGA Tournament. It Didn’t Stop Scottie Scheffler. (wsj)