Skip to content

- Warren Buffett proves, once again, why he’s the best (marketwatch)

- Warren Buffett, Mum So Far on the Trade War, Steps Up to the Mic (wsj)

- 10 Burning Questions for Warren Buffett at the Annual Berkshire Meeting (barrons)

- Cooper Standard Reports Robust Operating Performance and Significant Margin Improvement in the First Quarter of 2025 (investing)

- Ford’s April sales, led by pickups, surged 16% ahead of tariffs (usatoday)

- Inside Ford’s Kentucky Truck Plant, It’s About as American as Can Be (barrons)

- General Motors to deploy ‘Covid playbook’ to offset $5bn tariff hit (ft)

- Chinese EV makers sell more plugin-hybrids in the EU to avoid tariffs, research firm says (reuters)

- China Signals Readiness to Respond to U.S. Trade Overtures (wsj)

- China Says Its ‘Door Is Wide Open’ for Trade Talks. What It Means for the Market. (barrons)

- China Quietly Exempts About a Quarter of US Imports from Tariffs (bloomberg)

- Hong Kong’s Growth Unexpectedly Picks Up on Tourism, Export Boom (bloomberg)

- Alibaba launches Taobao fast-delivery service ahead of time to challenge JD.com, Meituan (scmp)

- Emerging-Market Stocks Roar Back a Month After Tariff Shock (bloomberg)

- EU Could Offer to Buy $56 Billion of U.S. Products to End Trade War, Top Negotiator Says (wsj)

- Venmo gaining ground in payments as Cash App struggles (cnbc)

- Etsy is leveraging AI to boost personalization (yahoo)

- Baxter tops quarterly estimates on strong demand for medical devices (reuters)

- Trump Plans Record $1.01 Trillion National Security Budget (bloomberg)

- Amazon Shares Drop on Tariff Concerns Despite Strong Quarter (wsj)

- Why the dollar doom is overdone (ft)

- Investing Pros Haven’t Been This Worried About the Stock Market in at Least 28 Years, Our Exclusive Poll Finds (barrons)

- Chinese Stocks Look Like an Opportunity Amid Trump’s Tariff Chaos (barrons)

- China signals opening for trade talks with US (ft)

- US Has Reached Out to China to Initiate Tariff Talks, CCTV Says (bloomberg)

- Alibaba’s Qwen3 AI model family helps narrow tech gap between China and US: analysts (scmp)

- Goldman’s First-Take On Alibaba’s Hybrid Qwen3 Model (zerohedge)

- Chinese Automakers Report Robust Sales Growth in April (wsj)

- How the New Trump Tariffs on Car Parts Will Work (wsj)

- A Small, Affordable Pickup Truck? It’s Finally Here (wsj)

- Ford to Delay Price Increases to See How Rivals React to Tariffs (bloomberg)

- Home Builders Are Piling on Discounts as They Struggle to Entice Buyers (wsj)

- America’s housing crisis: Realtor.com CEO says there is way to solve it (foxbusiness)

- US Pending Sales of Existing Homes Increase by Most Since 2023 (bloomberg)

- US Treasury chief urges Fed to cut rates (reuters)

- U.S. Treasury Won’t Boost Bond Sizes for Refunding, Signals Changes to Buybacks (barrons)

- Small-Cap Stocks Have Suffered. It’s Time to Be Cautiously Optimistic. (barrons)

- EU to Present Trade Proposals to US Negotiators Next Week (bloomberg)

- Millions of people in Europe lost power for hours on Monday, and no one knows why (marketwatch)

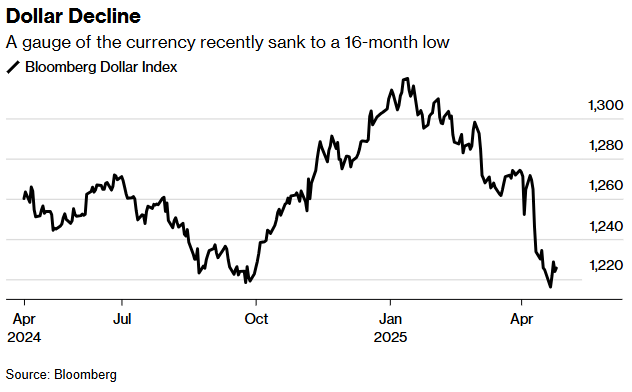

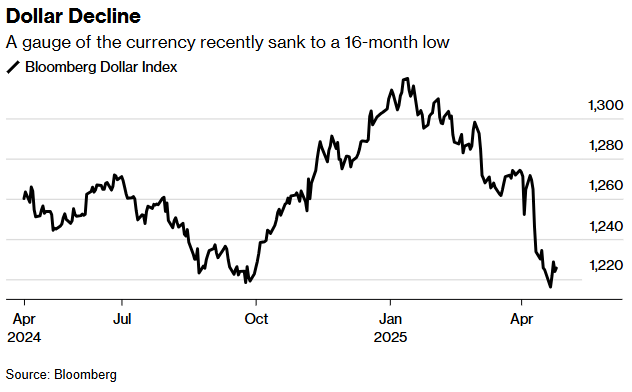

- Biggest Dollar Slump Since 2022 Hints at More Losses Ahead (bloomberg)

- U.S. Economy Shrank in First Quarter as Imports Surged Ahead of Tariffs (wsj)

- E-Commerce Sellers Brace for End of De Minimis (wsj)

- The 10 Best Companies to Invest in Now (morningstar)

- Estée Lauder Forecasts Return to Sales Growth in 2026 (bloomberg)

- Albemarle maintains 2025 outlook due to lithium tariff exemptions (reuters)

- Baxter shares rise as Q1 earnings top estimates, guidance raised (investing)

- Crown Castle Reports First Quarter 2025 Results and Maintains Outlook for Full Year 2025 (investing)

- Comstock Resources beats Q1 estimates, stock rises 3.5% (investing)

- Trump Softens Blow of Automotive Tariffs (wsj)

- For Ford, Tesla, the Worst Auto Tariff Case Is Off the Table (barrons)

- Trump eases auto tariffs burden as Lutnick touts first foreign trade deal (reuters)

- Stanley Black & Decker Raising Prices to Offset Tariff Costs (wsj)

- Generac tops Q1 forecasts, lowers bottom end of 2025 outlook (investing)

- Etsy tops quarterly revenue estimates on steady demand for apparel, gifts (reuters)

- Etsy shares pop on revenue beat as company says it’s ‘staying nimble’ to tariff uncertainty (cnbc)

- Intel Says Clients Preparing to Test New Production Process (bloomberg)

- Intel CEO Lip-Bu Tan charts foundry roadmap (streetinsider)

- PayPal Is Launching Programmatic Ads Powered By Shopping Data (adweek)

- Disney, Universal Films to Screen in China Despite Trade Dispute (bloomberg)

- Alibaba Rolls Out ‘Instant Commerce’ Feature as China Delivery Battle Heats Up (wsj)

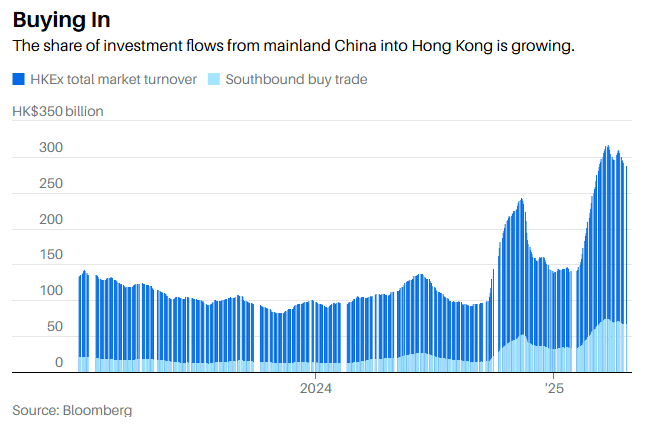

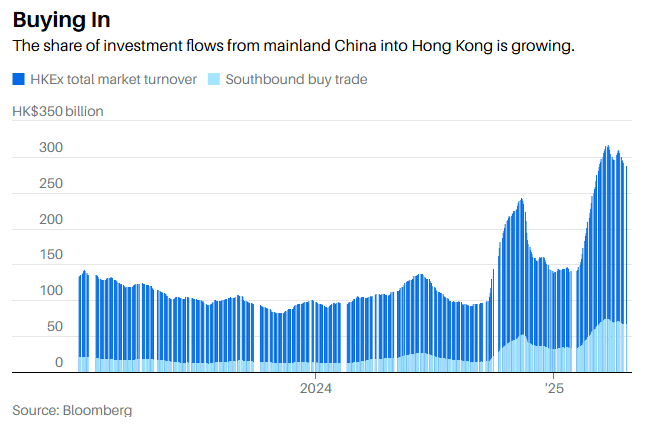

- Demand for Chinese stocks lifts Hong Kong exchange’s profits (ft)

- Alibaba gives Taobao on-demand delivery an upgrade in Meituan, JD.com competition (scmp)

- Huawei delivers advanced AI chip ‘cluster’ to Chinese clients cut off from Nvidia (ft)

- Chinese Set to Spend Record $1 Trillion in Local Travel Boom (bloomberg)

- A Weak Dollar Is A Blessing for Emerging Markets (zerohedge)

- Bessent Cites Digital Services Tax as Sticking Point in EU Talks (bloomberg)

- Tariff-Frontrunning Sends US Trade Deficit To New Record High In March (zerohedge)

- Hedge Funds Lose Market Conviction, Except for Shorting US Stocks (bloomberg)

- The Best Basic Materials Stocks to Buy (morningstar)

- US NatGas Deemed “Oversold” By Goldman Ahead Of Summer (zerohedge)

- Bank of America, Mattel, and 5 Other Stocks Have Priced in Recession. Buy Them. (barrons)

- Starbucks’ Sales Keep Falling, Amping Up Turnaround Stakes (bloomberg)

- US Economy Contracts for First Time Since 2022 on Imports Surge (bloomberg)

- US Firms Add 62,000 Jobs, Smallest Gain Since July in ADP Data (bloomberg)

- PayPal Reports Strong First-Quarter Earnings. Turnaround Strategy is Working, CEO Says. (barrons)

- PayPal Profit Gauge Tops Estimates in Sign of Turnaround Success (bloomberg)

- Venmo revenue grows 20%, with debit card payment volume soaring (cnbc)

- Alibaba launches new Qwen LLMs in China’s latest open-source AI breakthrough (cnbc)

- Alibaba Rolls Out Latest Flagship AI Model in Post-DeepSeek Race (bloomberg)

- China Offers Olive Branch to U.S. Firms After Boeing Delivery Halt (wsj)

- Bessent Says China Must Take Lead on Tariffs Talks, Hints at India Deal (barrons)

- The Best Chinese Stocks to Buy (morningstar)

- China’s E-Commerce Giants Are Putting Up a Fight (bloomberg)

- What’s the De Minimis Tariff Loophole Trump Is Closing? (bloomberg)

- Huawei Races To Replace Nvidia: New Ascend 910D AI Chip Will Begin Testing Next Month In China (zerohedge)

- Nvidia’s Chip Market Problems Aren’t Just in China (wsj)

- Trump to Soften Blow of Automotive Tariffs (wsj)

- Boeing Removed From Credit Watch by S&P in Turnaround Boost (bloomberg)

- India Plans to Highlight Boeing Order Pipeline in US Trade Talks (bloomberg)

- Why Restarting a Power Grid After Massive Collapse Is So Hard (bloomberg)

- Housing on Federal Lands Aims to Ease Affordability Crisis (nytimes)

- How to Invest Like Warren Buffett (morningstar)

- Dollar on track for biggest two-month fall in more than two decades (streetinsider)

- Has sentiment bottomed out? (ft)

- Buyback Blackout Period Ends: Record Stock Repurchases On Deck (zerohedge)

- Woodside Energy Approves $17.5 Billion Louisiana LNG Development (wsj)

- GM Beats Earnings Estimates, Delays Conference Call. It’s Waiting for Trump Tariff Changes. (barrons)

- Royal Caribbean raises annual profit forecast on strong cruise demand (reuters)

- American Tower beats quarterly revenue estimate on strong telecom infrastructure leasing demand (reuters)

- Starbucks Is Reinventing Itself. Earnings Will Show the Progress. (barrons)

- Unhedged and Burned, Stock Investors Brace for More Dollar Pain (bloomberg)

- The Dollar’s Weakness Creates an Opportunity for the Euro. Can It Last? (nytimes)

- Morgan Stanley’s Wilson Says Weak Dollar Will Buoy US Stocks (bloomberg)

- China moves to protect economy from trade war, vows to hit 5% growth target (scmp)

- China rolls out employment support and hints at more stimulus as U.S. tensions escalate (cnbc)

- Goldman says China funds to buy US$110 billion of Hong Kong-listed stocks (scmp)

- China’s Huawei Develops New AI Chip, Seeking to Match Nvidia (wsj)

- Goldman Sachs Offers Advice on Tariffs to Countries Scrambling to Please Trump (wsj)

- Philippines Aims to Lower US Tariff to Zero During Talks (bloomberg)

- Emerging-Market Stocks Extend Rally Amid Earnings Optimism (bloomberg)

- Riyadh Air willing to buy Boeing planes from cancelled Chinese orders, CEO says (reuters)

- Bernstein raises Boeing stock rating, price target to $218 (investing)

- Boeing Stock Is Rising for Two Reasons (barrons)

- Inflation Fear Is Making Some People Spend More—and Others Less (wsj)

- Home prices starting to crack: Here’s why (youtube)

- The 7-year car loan is here. Do you really want to be paying off your car in 2032? (usatoday)

- It’s Becoming a Better Time to Buy a Home—If You Know Where to Look (barrons)

- Housing market inventory with a price cut just hit a decade high (fastcompany)

- California housing market shift: Buyers are gaining power (fastcompany)

- Ackman Says Time Is Friend of US, Enemy of China in Trade War (bloomberg)

- Will China’s shoppers cushion the Trumpian blow? (economist)

- This Is What President Biden’s CHIPS Office Actually Did (bloomberg)

- Loopholes, logistics, luck: Taobao and DHgate’s US moment (techinasia)

- China Widens Tax Rebates for Foreign Tourists to Boost Spending (bloomberg)

- China’s e-commerce giants dial back “no-return refunds” amid merchant backlash and regulatory pressure (technode)

- Boeing will find it ‘relatively easy’ to find customers for China’s rejected planes, says jet leasing CEO (yahoo)

- Lip-Bu Tan, the man trying to save Intel (economist)

- Why American tech stocks are newly vulnerable (economist)

- A Reckoning for the Magnificent Seven Tests the Market (wsj)

- Grid-Scale Battery Storage Is Quietly Revolutionizing the Energy System (wired)

- TikTok is changing the perfume business (economist)

- Warren Buffett Could Turn the Tariffs Chaos Into a Payday for Himself and Coca-Cola. Here’s How (inc)

- Houston, We Have A Zweig Breadth Thrust and Four More Bullish Developments (carsongroup)

- Drinks giants’ moves in no-and-low alcohol (yahoo)

- Jeff Bezos-backed automaker unveils affordable EV pickup truck (foxbusiness)

- Porsche Teases New Hypercar Inspired by the First Street-Legal 917 (thedrive)

- 50 best golf courses in the Northeast | GOLF’s 2024-25 ranking (golf)

- Warren Buffett Is Still at the Top of His Game at 94. Berkshire Hathaway Faces a Future Without Him. (barrons)

- Americans Are Downbeat on the Economy. They Keep Spending Anyway. (wsj)

- As Markets Swooned, Pros Sold—and Individuals Pounced (wsj)

- The Mistake You’re Making in Today’s Stock Market—Without Even Knowing It (wsj)

- America’s Factory Era Isn’t Coming Back. Where the Jobs of the Future Really Are. (barrons)

- Donald Trump claims to have received call from Xi Jinping and to have cut ‘200 deals’ on trade (ft)

- Trump Administration Lays Out Roadmap to Streamline Tariff Talks (wsj)

- China Quietly Exempts Some U.S.-Made Products From Tariffs (wsj)

- Alipay leads China’s payments apps with tap-and-pay service amassing 100 million users (scmp)

- China’s Xi calls for self sufficiency in AI development amid U.S. rivalry (reuters)

- China Reiterates Hitting 2025 Growth Target Amid Trade Tension (bloomberg)

- Asked about delisting Chinese companies, SEC Chair Atkins says agency will take action if companies do not abide by laws (investing)

- Reeves and Bessent can see ‘landing zone’ for a UK-US trade deal, say British officials (ft)

- Bullish Signal Coming From Stock Breadth (zerohedge)

- Etsy to sell music gear marketplace Reverb (retaildive)

- Intel’s older chips get a second life from US-China trade tensions (scmp)

- After years of failed AI deals, Intel plans homegrown challenge to Nvidia (reuters)

- Intel CEO says he met with TSMC CEO to discuss collaboration (reuters)

- Intel CEO Lip Bu Tan Takes Bold Steps To Revive Chipmaker, Says Bureaucracy Is ‘Suffocating The Innovation (benzinga)

- Intel’s new boss starts with wafer-thin expectations (ft)

- Trump Sees Trade Deals Coming in Three to Four Weeks (bloomberg)

- Trump says Xi called him, lays out trade and other deal plans in TIME interview (reuters)

- How Team Trump is working overtime to close face-saving trade deals (nypost)

- US Seeks India Trade Deal on E-Commerce, Crops and Data Storage (bloomberg)

- Bessent Sees US, Korea Trade ‘Understanding’ by Next Week (bloomberg)

- China Ramps Up Cash Injection as It Braces for Tariff Impact (bloomberg)

- China grants some tariff exemptions for US imports as trade war bites (ft)

- China Aims to Step Up Policy Support Amid Trade Uncertainty (wsj)

- Cutting Off Chinese Companies Risks a US Policy Own Goal (bloomberg)

- China pledges to ramp up targeted support for businesses as U.S. trade war hits (cnbc)

- Automakers rush to meet surging China demand for long-range hybrids (reuters)

- Air India in talks with Boeing to take 10 planes snubbed by Chinese airlines, sources say (reuters)

- Massive Buying Of Boeing Aircraft Sends US Durable Goods Orders Soaring In March (zerohedge)

- Boeing Sees Skies Clear After MAX, Covid, and Quality Woes Took a $240 Billion Toll (barrons)

- Bessent Says He Wants Treasury Yields Down. Believe Him. (barrons)

- US Bonds Rally as Fed’s Hammack Revives Odds of a June Rate Cut (bloomberg)

- A couple of Fed heads hint at rate cuts (streetinsider)

- Hedge Funds Walk, Retail Talks When It Comes To US Stocks (zerohedge)

- U.S. Needs More Power for AI—but Critical Equipment Is Pricey and Scarce (wsj)

- Buy Healthcare Stocks Despite RFK Jr., Tariffs, and UnitedHealth (barrons)

- Dividends Could Be Under Threat. Here Are 9 Stocks With Safe 5% Yields. (barrons)

- American liquor exports hit record high in 2024, driven by tariffs (cnbc)

- U.K. Retailers Post Surprise Rise in Sales Ahead of Tariff Turmoil (wsj)

- US Officials Mull Easing Tariffs Targeting the Auto Industry (bloomberg)

- Europe Car Sales Rebound as UK Demand Boosts Battered Industry (bloomberg)

- Japanese Carmakers’ US Sales Surge Ahead of Trump Tariffs (bloomberg)

- As Tesla Falters, These New EVs Are Picking Up the Pace (bloomberg)

- White House Considers Slashing China Tariffs to De-Escalate Trade War (wsj)

- Ejecting China Inc from US exchanges would be an own goal (ft)

- China pushes for tariff cancellation to end US trade war (reuters)

- Chinese Firms Rush to Announce Buybacks as Tariff War Deepens (bloomberg)

- Indonesia plans to import more from the U.S. to ‘narrow’ trade surplus, finance minister says (cnbc)

- Customers canceled 30% of US orders from China but demand in shipments from other countries have massively increased (nypost)

- Vietnam Kicks Off Trade Talks With US as Plane Deal Takes Shape (bloomberg)

- Vietnam Airlines to finalise 50 Boeing narrow-body order soon, sources say (reuters)

- Boeing CEO Confirms China Halted Orders; Goldman Notes “Improved Earnings Results” For Planemaker (zerohedge)

- Boeing Earnings: Recovery Plan Progresses, Shares Undervalued (morningstar)

- Trump Meets His Match: The Markets (wsj)

- Deutsche Sees ‘Major’ Dollar Decline as Investors Dump US Assets (bloomberg)

- UBS Cuts Dollar Outlook Again, Says US-China Is Key for Its Path (bloomberg)

- New Data Show Foreign Investors Are Still Buying U.S. Treasuries (barrons)

- It’s hedge funds, not foreign investors, that have been dumping stocks, says JPMorgan (marketwatch)

- US New-Home Sales Top All Estimates on Surge in the South (bloomberg)

- Whirlpool Says Tariffs to Benefit Business Going Forward (bloomberg)

- Tariffs Could Boost the Market for Secondhand Goods. These Stocks Could Benefit. (barrons)

- It’s Electricity Realism, Not Climate Denialism (bloomberg)

- Intel partners with AI firm ModelBest, chip designer Black Sesame on smart car systems (scmp)

- Mobileye Global beats revenue estimates on strong self-driving tech demand (reuters)

- Here’s How Big the AI Revolution Really Is, in Four Charts (wsj)

- Coinbase waives fees on PayPal’s stablecoin in crypto payments push (reuters)

- Dow Logs Loss, Launches Cost-Cutting Measures Due to Slowdown (wsj)

- Trump Rejects Millionaires Tax Hike (wsj)

- Boeing Loss Narrows as Backlog and Sales Grow (wsj)

- Boeing to seek FAA approval to increase 737 Max production as losses narrow (cnbc)

- Boeing to Sell Some of Its Navigation Business in $10.55 Billion Deal (wsj)

- Boeing’s Earnings Were Better Than Expected. It’s a Relief for the Stock. (barrons)

- Auto groups lobby Trump administration against parts tariffs in rare unified message (cnbc)

- Trump’s Tariff Threats Spark Retail, Auto Lobbying Blitz (bloomberg)

- Bessent says he expects ‘de-escalation’ in U.S.-China tariff fight in the ‘very near future’ (cnbc)

- US markets rally as Treasury secretary says China trade war is ‘unsustainable’ (ft)

- Trump Floats ‘Substantial’ China Tariffs Cuts in Trade Deal (bloomberg)

- China Signals Openness to U.S. Trade Talks—but Not Under Duress (wsj)

- Chinese Stocks in Hong Kong Rally on Bets Trade Tensions to Ease (bloomberg)

- Flurry of Chinese AI updates come from Big Tech amid further restrictions on Nvidia chips (scmp)

- Zhipu AI ramps up overseas expansion strategy ahead of IPO (reuters)

- EM Stocks Erase Loss for the Year, Extending Lead Over US Peers (bloomberg)

- Treasury Secretary Bessent Predicts Tax Cuts to Pass by July 4 (nytimes)

- Trump Says He Has ‘No Intention’ of Firing Fed Chair Powell (wsj)

- As Professional Traders Panic Sell, Retail Investors Just Can’t Stop Buying (zerohedge)

- How Market Turmoil Made Low-Volatility Stocks Great Again (morningstar)

- Tariffs Have Crushed Small-Cap Stocks. It’s Time for a Bounce. (barrons)

- Intel Plans to Slash More Than 20% of Workforce: Report. The Stock Is Rising. (barrons)

- PayPal Aims To Boost Stablecoin Use By Offering 3.7% on Balances (bloomberg)

- 10 Best Dividend Aristocrats to Buy Now (morningstar)

- Stocks That Pay Almost 10% Dividend Yields: Dow and Lyondell (barrons)

- Etsy Exits Reverb in Surprise Deal–Here’s Who’s Taking Over (yahoo)

- CEOs Haven’t Been This Gloomy About the US Economy Since the Financial Crisis (bloomberg)

- Nearly Half Of US Home-Sellers Are Offering Buyer Concessions (zerohedge)

- Nike Adds New Strategy Head to Aid Company Turnaround (bloomberg)

- Tesla Has a Deep Hole to Pull Out Of (wsj)