Skip to content

Dealmaking Is Looking Up as Companies Stop Waiting Out the Fed (wsj )

ASML Orders Plunge as Chipmakers Pause High-End Gear Purchases (bloomberg )

Serious investors need China exposure, should ‘forget about the short-term pain’, asset managers say (scmp )

Fed’s Beige Book Holds Clues to Predicting Downturn, Study Shows (bloomberg )

The stock market just flashed bullish a signal suggesting 19% upside by August 2025, BofA says (business )

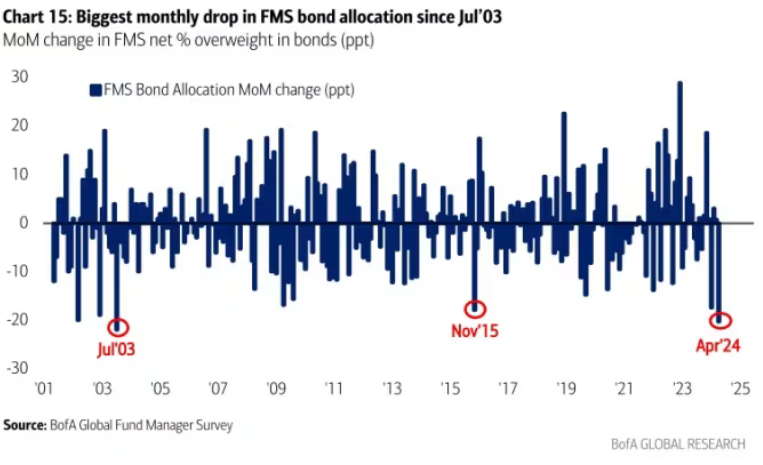

Fund managers are giving up on bonds in a way they haven’t in 20 years (marketwatch )

Do cash-gushing stocks outperform the S&P 500? Here’s what history has to say. (marketwatch )

Consumer spending has slowed but is hanging in there, says BofA CEO Brian Moynihan (cnbc )

Oakmark’s Bill Nygren shares his thoughts on CITI (cnbc )

Bonds are a good diversifier for risk assets over most cycles: Steve Laipply (foxbusiness )

China warns west of ‘survival of the fittest’ as manufacturing boosts economy (ft )

Powell Dials Back Expectations on Rate Cuts (wsj )

Rents have finally stopped skyrocketing. (marketwatch )

Boeing Defends Safety of 787 Dreamliner After Whistle-Blower’s Claims (nytimes )

China Q1 GDP grows 5.3%, more than expected (streetinsider )

How Legatum Succeeds at Generating Capital, Ideas, and Helping People Prosper (barrons )

Bank of America tops estimates on better-than-expected interest income, investment banking (cnbc )

BofA Beats Estimates for Trading and Profit Even as Costs Soar (bloomberg )

China’s Economy, Propelled by Its Factories, Grew More Than Expected (nytimes )

China’s Rising Youth Unemployment Needs Attention, Official Says (bloomberg )

Alibaba strengthens commitment to open-source development of AI model (scmp )

European bank stocks are a better bet than U.S. peers, says JPMorgan (marketwatch )

What If Fed Rate Hikes Are Actually Sparking US Economic Boom? (bloomberg )

Why the Dollar Is Causing Chaos in Emerging Markets (bloomberg )

New York Tops Destinations for Relocating Tech Workers (wsj )

Boeing defends 787 Dreamliner safety after whistleblower allegations (cnbc )

Stock-market pullbacks are price of admission. Historically, markets rise afterwards, this strategist says. (marketwatch )

The Best Chinese Stocks to Buy (morningstar )

Alibaba News Roundup: Alipay Sees Inbound Payment Surge; Hong Kong Consumers Score Festive Deals at Freshippo; Alibaba Cloud AI Assistant Helps Write Code (alizila )

Chinese Stocks Advance as Beijing Renews Regulatory Support (bloomberg )

Wharton legend Jeremy Siegel sees Tesla’s fall from grace in Wall Street’s ‘Magnificent 7’ as a sign of good market health (yahoo )

Rory McIlroy is close to joining LIV Golf for a whopping $850,000,000 according to reports (sportskeeda )

Want to play Augusta National? Here are 10 ways to get a tee time (golf )

Boeing’s CEO search has a new front-runner—and insiders say it could mean a radical change for the $104 billion ailing planemaker (yahoo )

Masters 2024: The clubs Scottie Scheffler used to win at Augusta National (golfdigest )

Energy grid faces demand strains from AI, EVs: Generac CEO (yahoo )

Retail sales rose sharply in the first quarter — and could boost U.S. GDP (marketwatch )

Wall Street Powers Goldman to Higher Quarterly Earnings (wsj )

What Higher for Longer Means for the Stock Market (wsj )

Inside the Controversial Bid to Buy the Studio Behind The Godfather and Top Gun: Maverick (vanityfair )

The United States exported a record volume of natural gas in 2023 (eia )

To Answer the Question of Why I Invest in China (Ray Dalio )

JP Morgan Annual Letter (Jamie Dimon )

4 Undervalued Stocks That Just Raised Dividends (morningstar )

The Best Technology Stocks to Buy (morningstar )

Citigroup Earnings: Laser Focus on Expenses Needed to Achieve Long-Term Targets (morningstar )

3 Cheap Stocks to Watch in the Fight Over Sports Streaming (morningstar )

The Crazy Swing That Made Scottie Scheffler a Two-Time Masters Champion (wsj )

Here’s What Higher for Longer Means for the Stock Market (wsj )

The Home-Solar Boom Gets a ‘Gut Punch’ (wsj )

Steve Mnuchin seeks AI partner to rebuild TikTok’s algorithm in takeover bid: sources (nypost )

Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War (bloomberg )

Why Car Insurance Keeps Getting More Expensive (bloomberg )

There’s a global shortage of stocks that will backstop the market for the foreseeable future (businessinsider )

3 Facts That Help Explain a Confusing Economic Moment (nytimes )

The 25 Best Restaurants in Boston Right Now (nytimes )

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up (nytimes )

UK’s Smaller Stocks Are Ripe for a Catchup as Profits Reignite (bloomberg )

The U.S. Is Trying to Cripple Russia’s Vast Arctic LNG Project (wsj )

The New, More-Hopeful Face of Alzheimer’s Disease (wsj )

April Monthly Option Expiration Week – DJIA Up 33 of Last 42 (almanactrader )

Meet The New AI-Robot Billionaire (forbes )

Michigan Consumer Sentiment Moves Sideways for 4th Straight Month (advisorperspectives )

Weekly Leading Economic Index (advisorperspectives )

Nike’s boss says remote work was hurting innovation, so the company realigned and is ‘ruthlessly’ focused on building a disruptive pipeline (fortune )

Car of the Week: This Restored 1962 Mercedes-Benz 300 SL Roadster Could Be Yours for $2.6 Million (robbreport )

The 9 Best Vintage Ferraris Ever Made (robbreport )

The 20 Most Expensive Cities in the US—And Why They Might Be Worth It (architecturaldigest )

Google goes all in on generative AI at Google Cloud Next (techcrunch )

2024 Aston Martin DB12 Volante First Drive Review: Possibly the Best Aston, Roofless (thedrive )

Apple iPhone Shipments Drop 10% in First Quarter (barrons )

Intel Has Slumped This Year. Why One Analyst Sees a Rebound Ahead. (barrons )

Cisco Stock Gets Upgraded to Buy. Why Wall Street Is Abuzz. (barrons )

Defense Stocks Haven’t Rallied, but There’s Opportunity (barrons )

What do the royals do all day, anyway? (npr )

Why companies spin off (npr )

Hal Lawton on Tractor Supply’s Phenomenal Growth (bloomberg )

Former auto executives warn electric vehicle push happened ‘too soon and too fast’ (foxbusiness )

Meta’s AI chief: LLMs will never reach human-level intelligence (tnw )

Third Point, Saddle Point win board seats at Advance Auto Parts. A plan to improve margins may unfold (cnbc )

Generac Eyes Power Deals With $1 Billion to Spend (bloomberg )

Texas Warns of Possible Power Emergency Next Week (bloomberg )

High Rates Have Been a Profit Machine for Banks. Not Anymore. (wsj )

China Tells Telecom Carriers to Phase Out Foreign Chips in Blow to Intel, AMD (wsj )

China Exports Rise as Trade Tensions Mount (wsj )

The 18 Handicap Who’s Spending Billions on Golf (wsj )

Two Brothers, a Big Biotech Bet and an $8 Billion Payout (wsj )

Warehouse Rents Slipping on Declining Demand (wsj )

Iran Launches Drone and Missile Attack at Israel (wsj )

Tiger Woods’s Record-Breaking 23-Hole Marathon (wsj )

Who can run Disney? The four insiders competing for Bob Iger’s job (ft )

The pound is no longer so vulnerable (ft )

The Golf Apps and Gear Changing Our Love of the Game (bloomberg )

The stunning strength of the US economy means the soft landing may already be here, Evercore founder says (businessinsider )

Shares of Citi Rise After Earnings Beat (barrons )

Consumer Sentiment Slips in April as Inflation Remains Sticky (barrons )

Solventum Stock Is Cheap. Why Wall Street Says to Wait. (barrons )

Mario Gabelli comes out against Paramount’s merger with Skydance: ‘I’d rather see no sale’ (nypost )

Musk and Milei share their love of free markets in first meeting (ft )

The Podcast Host Who Also Manages a $1.6 Trillion Investment Fund (wsj )

China’s policy to boost demand by $700 billion will have a ‘bigger and bigger’ impact, official says (cnbc )

Citi Profit Beats as Companies, Consumers Go on Borrowing Binge (bloomberg )

3M Could Lose Its Elite Dividend Status After 64 Years. What It Means for the Stock. (barrons )

Boeing Knows What It Needs to Do—So Do It. Change the Culture. (barrons )

U.K. stocks eye record as higher commodity prices boost miners and oil groups (marketwatch )

Interest Rates Have Investors Worried. Profits Give Them Comfort. (wsj )

Golf Is Booming. But Can the Good Times Last? (wsj )

The Masters Still Sizzles. But Is Golf Scaring Off Its Fans? (wsj )

Bank of England scraps outdated inflation forecast model after Fed boss’ review (cnbc )

China has strong fundamentals and should remain a focus for businesses: Gan Kim Yong (cnbc )

Amazon CEO Touts AI Revolution While Committing to Cost Cuts (wsj )

China’s March exports and imports shrink (reuters )

Ford spotlights a new lineup of popular trucks (foxbusiness )

Charting the Fed’s rate path – Nick Timiraos (cnbc )

Fed Favors Reducing Monthly Asset Runoff Pace by Roughly Half (bloomberg )

Fed Prepares Slower Pace of Runoff for $7.4 Trillion Portfolio ‘Fairly Soon’ (wsj )

Nike Stock Jumps On Upgrade As Estimates ‘Finally Look Achievable’ Ahead Of Paris Olympics (investors )

Producer Prices Rise Less Than Expected (barrons )

US Producer Prices Rise But Show Some Relief in Key Categories (bloomberg )

Give us a (tax) break How empty office buildings could help NYC solve its housing crisis (nypost )

ECB’s Lagarde Says ‘a Few’ Were Ready to Cut Rates Today (bloomberg )

Alphabet Heads Toward $2 Trillion With Investors Cheering AI Progress (bloomberg )

China will remain the world’s No. 1 growth driver, says the Asian Development Bank (cnbc )

China’s commercial property segment is seeing some bright spots amid a slump in the wider realty sector (cnbc )

Fed likely to cut rates before ECB blinks, former BOE member says (cnbc )

What PPI tells us about PCE: Fed’s preferred inflation gauge may not look so bad for March (marketwatch )

These in-the-know investors are more bearish than they’ve been since 2014 (marketwatch )

Costco’s March Sales Jump. E-Commerce Is Taking Off. (barrons )

Hot Inflation Report Derails Case for Fed June Rate Cut (wsj )

<Research>CITIC Securities: BABA-SW’s Focus on Core E-commerce Yields Results; Good Shareholders’ Return Expected to be Kept (aastocks )

Maybe core inflation isn’t as bad as it seems (marketwatch )

Alibaba’s Jack Ma steps out from the shadows with morale-boosting post (reuters )

Intel Says New Gaudi 3 AI Chips Top Nvidia H100s in Speed and Cost (barrons )

Alibaba shares jump after founder Jack Ma reemerges with praise of Chinese giant’s ‘transformations’ (cnbc )

‘We turned the company from a cumbersome organisation into one that is simple and agile, where efficiency comes first, and the market comes first,’ Ma wrote (this week) (scmp )

US consumer prices rise more than expected in March (reuters )

Beijing retail rents jump by most since 2019 amid ‘demand surge’ (scmp )

Boeing Engineer Says Company Used Shortcuts to Fix 787 Jets (wsj )

Hot Inflation Report Weakens Case for Fed’s June Rate Cut (wsj )

Google, Intel debut new AI chips to fight Nvidia’s dominance (scmp )

Bank Earnings Are Here Again. Keep Your Eyes on This Metric. (barrons )

How the End of ‘Curb Your Enthusiasm’ Flipped the ‘Seinfeld’ Finale on Its Head (wsj )

Commodities Rally Reflects a Better Economy, but Also Poses Inflation Risks (wsj )

China Vehicle Sales Rebound (wsj )

The 22-Year-Old Beanpole Who Just Played His Way Into the Masters (wsj )

The Merchant Banker Who Could Win the Masters (wsj )

Goldman Says It’s Time to Take Tech Profits and Invest Elsewhere (bloomberg )

Alphabet’s stock nabs fresh high, is only ‘Magnificent Seven’ name to finish at a record (marketwatch )

Earnings Are Last Pillar of Equity Strength as Rate Cuts Recede (bloomberg )

Disney’s parks are its top money maker — and it plans to spend $60 billion to keep it that way (cnbc )

Iger Won the Battle — But Disney’s ‘Woke’ War Isn’t Over (bloomberg )

The Sheikh Who Dominates One of the World’s Hottest Stock Markets (bloomberg )

Everyone Is Rich, No One Is Happy. The Pro Golf Drama Is Back (bloomberg )

Michelin Picks 24 Top Hotels in France in First-Ever Ranking (bloomberg )

Strategas’ Chris Verone gets technical with tech stocks (cnbc )

‘Now They’re Voting Red’: A Pennsylvania Fracking Boom Weighs on Biden’s Re-Election Chances (wsj )

Earnings Season to Test Stock-Market Rally (wsj )

How the End of ‘Curb Your Enthusiasm’ Flipped the ‘Seinfeld’ Finale on Its Head (wsj )

A Lotus First (barrons )

Chinese Automaker FAW Group Taps Alibaba Cloud’s Gen AI for Business Intelligence (alizila )

Yellen says US-China relations on ‘stronger footing’ (ft )

Alibaba Cloud cuts prices again, this time for international customers as AI generates surging demand (scmp )

Alibaba Group Invests for Strategic Growth with Cainiao Share Purchase Offer (alizila )

Alibaba News Roundup: Share Repurchase Update; Alibaba Cloud Launches Open Source Video Generation Tools (alizila )

These 10 perfect McLarens are for sale. Which one would you pick? (classicdriver )

Moderate growth and disinflation still alive and well (scottgrannis )

For the Ultimate Lesson in Car Control, Go Drifting (roadandtrack )

Bugatti EB110: The First Modern Hypercar Is 30 Years Old (roadandtrack )

Lexus GX550 vs. Land Rover Defender 130 vs. Mercedes-Benz G550: Which Luxury SUV Is Best Off-Road? (roadandtrack )

Japan had a vibrant economy. Then it fell into a slump for 30 years. (npr )

VF Corp. To Roll Out 300 Additional Mono-Brand Retail Stores (sgbonline )

Vans’ OTW Label Is Taking the Past & Making It Better (highsnobiety )

Earnings Season Is Coming. What the Market Needs Now. (barrons )

Many investors are more exposed to China than they think, says Brendan Ahern (cnbc )

0:02 / 8:39There’s still ‘gas in the tank’ in this stock market rally, says Fundstrat’s Tom Lee (cnbc )

The Big Read. Is Japan finally becoming a ‘normal’ economy? (ft )

Global dominance of biggest stocks rises to highest in decades (ft )

Jamie Dimon Says 8% Rates Could Lie Ahead (barrons )

Doubts Creep In About a Fed Rate Cut This Year (wsj )