Skip to content

Alibaba’s Hong Kong primary listing can be magnet for China’s 210 million investors (scmp )

Softer US Inflation, Retail Data Offer Fed Some Leeway (bloomberg )

China Considers Government Buying of Unsold Homes to Save Property Market (bloomberg )

Alibaba, Tencent beat forecasts with strong results, a harbinger of China’s improving corporate earnings as economic growth takes root (scmp )

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market (zerohedge )

JPMorgan’s Jamie Dimon Calls For ‘Full Engagement’ With China (bloomberg )

Google’s I/O Event Kicks Off With Promise of More AI (barrons )

The Super Rich Are Eating Out, but Families Aren’t. Restaurants Are Starving. (marketwatch )

Is it worth it to own Treasurys right now? These 5 charts might hold the answer. (marketwatch )

Amazon Gets New Cloud-Computing Boss as AI Battle Shakes Up Its Top Profit Engine (wsj )

He Quit Wall Street to Coach Ivy League Tennis—and Built a Columbia Powerhouse (wsj )

How China Rose to Lead the World in Cars and Solar Panels (nytimes )

Why Is Car Insurance So Expensive? (nytimes )

Cramer: Ford and GM are winners after Biden raises tariffs on Chinese imports (cnbc )

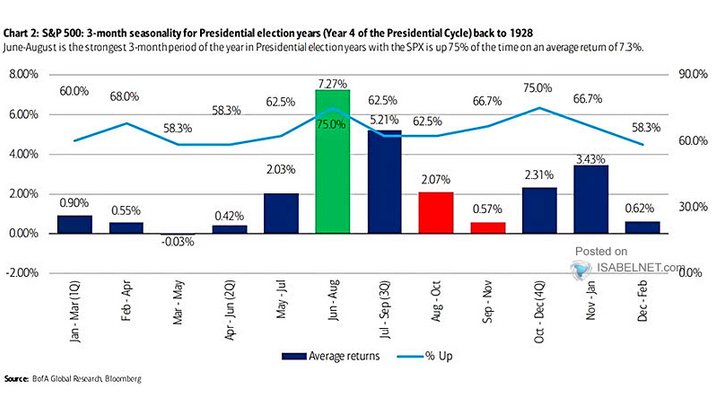

The S&P 500 just flashed a bullish signal that suggests the stock market will hit record highs this summer (businessinsider )

AI Is Electrifying These Power Producers’ Shares (wsj )

NYCB’s loan sale to JPM praised as ‘important first step’ in turnaround (marketwatch )

Traders Ramp Up Bets in Options Market on Large ECB Rate Cuts (bloomberg )

PBOC Rolls Over Policy Loan With Growth, Currency on Mind (bloomberg )

Dollar hits one-month low against euro before US data, falls vs yen (streetinsider )

OpenAI co-founder and chief scientist Ilya Sutskever departs (ft )

Brazilian government ousts Petrobras chief after dispute over dividends (ft )

China’s Alibaba beats quarterly revenue estimates (up 7% yoy), profit drops primarily due to valuation changes from equity investments (reuters )

Alibaba sees most profitable year since 2021 amid a refocus on e-commerce, AI businesses and rising competition at home (scmp )

Alibaba sees AI traction. “During the quarter, our core public cloud offerings, which include products such as elastic compute, database and AI products, recorded double-digit year-over-year growth in revenue,” Alibaba said. Alibaba’s board of directors has approved a dividend consisting of two parts. This includes an annual cash dividend of $1.00 per ADS and a “one-time extraordinary cash dividend” of 66 cents per ADS. (marketwatch )

BofA Strategist Hartnett Warns Stock Rally Is Exposed to Stagflation Risk (bloomberg )

BofA’s Moynihan Talks US Economy, Lending and M&A (bloomberg )

BABA-SW (09988.HK) Expects to Finish Conversion to Dual Primary Listing in HK by End-Aug 2024 (aastocks )

Alphabet to spotlight AI innovations at developer conference (reuters )

The Fed Depends on Data but Numbers Are Getting Shakier. That’s a Problem. (barrons )

Berkshire Hathaway’s Mystery Stock Purchase Could Be Revealed on Wednesday (barrons )

Wholesale inflation surges again, PPI shows. Takeaway: Inflation remains sticky. (marketwatch )

Money managers are more bullish than at any point since November 2021, survey shows (marketwatch )

Temu Cools on the U.S. After Shelling Out Billions (wsj )

What’s on TV? For Many Americans, It’s Now YouTube (wsj )

Investors Crowd Into Soft-Landing Trade Ahead of Crucial Inflation Data (wsj )

The UK Is No Longer the Most Hated Market (bloomberg )

Israel’s Once-Dominant Drugmaker Is Revived by Innovation (wsj )

China fires starting gun on $140bn debt sale to boost economy (ft )

How Alibaba is leading the evolution of online luxury shopping (scmp )

1 Growth Stock Down 75% to Buy Right Now (fool )

China to Start $138 Billion Bond Sale on Friday to Boost Economy (bloomberg )

Japan Will Likely Restart World’s Biggest Nuclear Plant This Year, BNEF Says (bloomberg )

Temu Cools on the U.S. After Shelling Out Billions (wsj )

Japan on track to normalise monetary policy, says ruling party heavyweight (reuters )

China Takes Advantage of Cheap Gas and Coal to Rebuild Stocks (bloomberg )

Intel Nears Deal With Apollo for $11 Billion Ireland Partnership (wsj )

3 Reasons to Buy GXO Logistics Stock Now (fool )

Wall Street Turns Up the Heat on Companies to Perform (wsj )

Investors Crowd Into Soft-Landing Trade Ahead of Inflation Data (wsj )

Suddenly There Aren’t Enough Babies. The Whole World Is Alarmed. (wsj )

Wall Street Turns Up the Heat on Companies to Perform (wsj )

The Secret to Talking to an AI Chatbot (wsj )

How AI Has Already Begun to Change These Workers’ Jobs (wsj )

Will AI Be a Job Killer? Call Us Skeptical (wsj )

A Beginner’s Guide to Using AI: Your First 10 Hours (wsj )

Why You Need to Tell an AI Chatbot It Has to Do Better (wsj )

April CPI: Goldman Sachs expects in-line inflation figures (streetinsider )

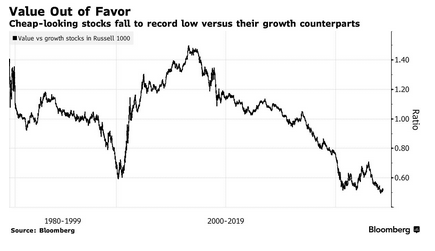

GS: Unprofitable growth stocks to remain under pressure from higher interest rates (streetinsider )

China, Hong Kong enhance Swap Connect scheme in time for its 1st birthday, easing access to mainland interbank derivatives (scmp )

Hong Kong stocks: index hits 9-month highs, tops 19,000 on earnings optimism and policy support hopes (scmp )

Can Europe’s economy ever hope to rival the US again? (ft )

US and China to hold first talks to reduce risk of AI ‘miscalculation’ (ft )

Hong Kong, mainland China tax waivers a ‘win-win’ for capital markets’ development, experts say (scmp )

Meredith Whitney Advisory Group CEO: Proposed mortgage reform is a ‘massive game changer’ (cnbc )

PayPal Business Cashback Mastercard review — Helpful perks with a simple rewards program (yahoo )

One stock is dragging down the S&P 500’s earnings growth (yahoo )

China’s visa-free policy ignites European enthusiasm, enhances exchanges (peoplesdaily )

Alibaba leverages cloud business to become a leading AI investor in China (UNLOCKED LINK) (financialtimes )

Alibaba Cloud’s Qwen LLM Tops 90,000 Enterprise Clients in First Year (alizila )

Alphabet Bought Up Two Slumping Stocks (barrons )

Stubbornly High Rents Prevent Fed From Finishing Inflation Fight (wsj )

China to Nurture Stock Rally (bloomberg )

Magic Pill — Johann Hari and the New “Miracle” Weight-Loss Drugs (timferriss )

Charlie Munger and How Not to Invest (morningstar )

Undervalued by 28%, This Stock Is a Buy for Patient Investors (morningstar )

The 10 Best Dividend Stocks (morningstar )

Will Japanese Yen Currency Rally From 40-Year Support? (kimblechartingsolutions )

Zombie 2nd mortgages are coming back to life (npr )

Living With the McLaren F1 (roadandtrack )

Design Analysis – Why the Ferrari Testarossa became a superstar of the 1980s (classicdriver )

China’s consumer prices rise for third month, signaling demand recovery (cnbc )

Hedge Funds That Sold In May Might Now Push Stocks To New Highs (zerohedge )

Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg )

The ‘Fed Put’ Is Back, and That’s Great News for the Stock Market (barrons )

Why Warren Buffett Hates Bonds (barrons )

A Struggling Pfizer Looks for Help From a Wall Streeter (barrons )

He Rebuilt Morgan Stanley. Now He’s Buying Disney Stock. (barrons )

Life on the Edge: A Guide to the Newest Frontier in Computing (barrons )

Howard Schultz Is Back-Seat Driving Starbucks. That’s a Problem for His Successor. (wsj )

Jim Simons, billionaire hedge fund manager, math whiz and philanthropist, dies at 86 (nypost )

The history of the iconic Lamborghini logo and badge (com )

Apple Nears Deal With OpenAI to Put ChatGPT on iPhone (bloomberg )

Consumer sentiment tumbles (cnbc )

China’s Country Garden repays onshore coupons within grace period (yahoo )

Generative AI Productivity Gains Will Come (institutionalinvestor )

China tech is seeking growth in the Middle East (ft )

Disney’s streaming success could point to next chief (ft )

Hong Kong Gains, Zeekr Lists In US, Week in Review (chinalastnight )

Earnings will make new record highs over the next few quarters, says Ed Yardeni (cnbc )

Pininfarina Is Now Selling Bruce Wayne-Inspired Electric Hypercars (maxim )

Alibaba says its AI models are used by 90,000 corporate clients in China (scmp )

3M Is Leaner and Ready to Grow. It’s Time to Buy the Stock. (barrons )

China Property Stocks Surge as Home-Buying Easing Gains Momentum (bloomberg )

PBOC May Trade Bonds to Shake Off Reliance on Banks, ANZ Says (bloomberg )

Hong Kong Stocks Power to Nine-Month High on Dividends, Property (bloomberg )

Public Companies Are Alive and Well (wsj )

Profits Are Booming—and That’s Shielding the Economy (wsj )

Buybacks Are Back: Corporate America Is on a Spending Spree (wsj )

Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg )

The Dow Is a Terrible Index. But It Is Telling Us Something Important. (wsj )

UK exits recession with fastest growth in nearly three years (reuters )

Stocks Haven’t Had an Earnings Boost. Why It Will Come. (barrons )

Small-Caps Are Stuck. How They Get Moving Again. (barrons )

The surprising reason why utilities stocks have suddenly transformed into the hottest sector on Wall Street (marketwatch )

Where does China’s production capacity come from? (peoplesdaily )

Valuation levels for Chinese stocks are attractive, says Kinger Lau (cnbc )

Fed’s Bostic says economy likely slowing, though rate-cut timing uncertain (reuters )

Alibaba opens new global headquarters in China on annual family day (scmp )

The US can do one big thing to weaken the dollar and put pressure on China (businessinsider )

Why China’s tolerance for a cheaper currency may be temporary (reuters )

Loonie Surges After Canada Job Gains Blow Past Expectations (yahoo )

What should the BoJ do with its huge stock portfolio? (ft )

BOJ’s policy board becoming more concerned about effects of a weaker yen (marketwatch )

China’s imports jump 8.4% in April, exceeding expectations as purchases from the U.S. grow (cnbc )

Three overlooked stocks from a Spanish quant: ‘Now is not a time everyone is going to win.’ (marketwatch )

UK’s FTSE 100 Outperforms in Europe as BOE Fuels Rate-Cut Bets (bloomberg )

The Fed Is in a Holding Pattern. That Could Be Good for Stocks. (barrons )

China’s foreign trade up 5.7 pct in first four months (peoplesdaily )

China Mulls Dividend Tax Waiver on Hong Kong Stocks Connect (bloomberg )

Hong Kong’s New Home Sales Hit Record High of $5.4 Billion (bloomberg )

Chinese stocks hit 2024 highs on more property support, positive trade data (streetinsider )

Solventum Reports Earnings. There Will Be No Dividend. (barrons )

New Hertz CEO Bets $1 Million on the Battered Stock (barrons )

Weekly jobless claims jump to 231,000, the highest since August (cnbc )

Bruins-Panthers Game 2 ends in violence as David Pastrnak, Matthew Tkachuk fight during huge brawl: ‘Not afraid of him’ (nypost )

‘Seriously Underwater’ Home Mortgages Tick Up Across the US (bloomberg )

Disney and Warner to Offer Bundle of Their Streaming Services (wsj )

China rally hasn’t been chased by options traders, Bank of America says (marketwatch )

Regional Bank Stocks Are Hated Again. It’s Time to Buy. (barrons )

Media Mogul Byron Allen: This is just a speed bump for Disney, ‘Bob Iger is the best of the best’ (cnbc )

The Fed has to cut because the economy is running out of gas, says Jim Cramer (cnbc )

Stock buybacks hit highest level since 2018 (yahoo )

Teva Pharmaceutical’s stock climbs as schizophrenia treatment shows promise (marketwatch )

Billions in Chips Grants Are Expected to Fuel Industry Growth, Report Finds (nytimes )

Celebrities pay this NYC man big bucks to get them reservations at exclusive eateries (foxbusiness )

US 30-Year Mortgage Rate Falls for First Time Since March (bloomberg )

Intel flags revenue hit as U.S. revokes certain export licenses to Chinese customer (reuters )

Ledecky’s 800m gold medal hopes boosted as McIntosh opts out (reuters )

Chinese firms’ earnings to rebound amid a pickup in the economy: UBS (scmp )

Alibaba seeks growth in Mongolia with marketplace selling Chinese goods (scmp )

These are the potential ‘shock’ scenarios around next week’s inflation data, says Goldman Sachs (marketwatch )

Sweden becomes second major central bank to cut rates (marketwatch )

Bond King Bill Gross to Bond Funds: Drop Dead (barrons )

3 Restaurant Stocks That Are Vying to Be the Next Chipotle (barrons )

Rents Set to Be Last Domino to Fall in Global Inflation Battle (bloomberg )

Cooper Standard Reports Continuing Year-over-year Margin Improvement in First Quarter 2024, Sees Upside to Full-year Guidance (cooperstandard )

China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+ (cnbc )

10-year Treasury yield heads for fifth day of declines after buyers emerge (marketwatch )

Einhorn Says Markets Are ‘Broken.’ Here’s What the Data Shows. (bloomberg )

Overseas institutions encouraged to invest in domestic tech companies (peoplesdaily )

Chevron CEO says natural gas demand will outpace expectations on data center electricity needs (cnbc )

Why Disney Stock Is Down After Earnings Topped Estimates (barrons )

The Stock Market Is Recovering. Why It Could Keep Gaining. (barrons )

Pfizer Is Adding a Wall Street Analyst to Its C-Suite. What He Thinks the Company Needs to Do. (barrons )

American Wagyu Is Drawing in a New Breed of Investors as Demand Grows (barrons )

‘Green Shoots’ Grow Out of Control on Wall Street (wsj )

Buy stocks in May because inflation is set to plunge through the rest of 2024, Fundstrat’s Tom Lee says (businessinsider )

The streaming future Disney promised is finally here as cable TV decays (cnbc )

3M Cut Its Dividend: It’s Time to Buy the Stock (yahoo )

Disney CFO Hugh Johnston on Q2 results, strength of consumer and streaming growth (cnbc )

A Rising Yen Is Good for Stocks. Here’s Why. (barrons )

China’s stock market has staged a big rebound that’s poised to push on, strategist says (businessinsider )

Slower Hiring Boosts Hopes of a Late-Summer Rate Cut (wsj )

Full recap of Warren Buffett’s comments at the Berkshire Hathaway annual meeting: ‘I hope I come next year’ (cnbc )

Warren Buffett says Berkshire Hathaway is looking at an investment in Canada (cnbc )

Former CEO Howard Schultz says Starbucks needs to overhaul its customer experience (marketwatch )

Boeing’s Starliner set for historic launch that will take two NASA astronauts into space (marketwatch )

ECB rate cut case getting stronger, says chief economist Lane (reuters )

Foxconn sees record April sales with 19% jump, offers positive Q2 outlook (scmp )

China Stocks’ Rally Can Sustain for a Bit, Goldman Sachs Says (bloomberg )