Skip to content

Fed’s Goolsbee lays out dovish case for potential rate cuts and flags ‘a couple of warning signs’ on economy (marketwatch )

Chicago Fed President Austan Goolsbee: Slowing inflation data would open the door to easier policy (cnbc )

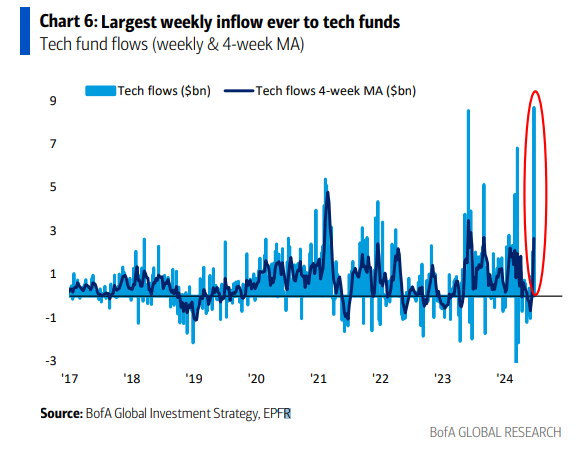

Tech Collision: Hedge Funds Selling and Retail Buying (zerohedge )

Chinese e-commerce sales up 14% for 618 shopping festival, report says (scmp )

Chinese banks could improve their bottom lines with AI adoption, experts say (scmp )

The Fed Has Avoided a Recession. But Some Have Been Left Behind. (barrons )

Why more homeowners are dropping their insurance (usatoday )

AI Is Already Wreaking Havoc on Global Power Systems (bloomberg )

Chances of ‘no landing’ grows by the day: Bank of America (streetinsider )

BREAKING: UPS sells Coyote to RXO (finance.yahoo )

Humanoid robot with highest operational time in tests by US logistics giant (interestingengineering )

Odd Lots: Why Tom Lee Thinks We Could See S&P 15,000 by 2030 (bloomberg )

Nvidia Insiders Cash In on Rally as Share Sales Top $700 Million (bloomberg )

Nvidia CEO Jensen Huang Sold $95 Million of Stock. Other Chip CEOs Are Selling. (barrons )

Protesters Disrupted a PGA Tournament. It Didn’t Stop Scottie Scheffler. (wsj )

Intel’s Gaudi 3 will cost half the price of Nvidia’s H100 (tomshardware )

Taobao and Tmall’s 2024 6.18 Campaign Scores Brand, Loyalty Program Wins (alizila )

Global Investors Turn Cautious on Once Favorite Japanese Stocks (bloomberg )

I Can’t Believe This Wild Stanley Cup Final. What the Heck Is Going On? (wsj )

Even without access to high end semiconductors, there is evidence that China was able to approximate high end semiconductor performance through very aggressive use of low end semiconductors. Hence AI has ended up boosting the demand for all semiconductors. This would explain the phenomenal performance of Philadelphia Semiconductor Index. The embargo is creating demand across the entire semi spectrum. (zerohedge )

57 Sandwiches That Define New York City (nytimes )

The Semiconductors Have Topped; Look Elsewhere For Opportunities (stockcharts )

Mizuho recently upgraded PayPal’s stock from a neutral rating to a buy, with senior analyst Dan Dolev estimating that PayPal will eventually be able to charge 0.70% of each transaction for Fastlane and that the product will add $1 to $1.5 billion to its annual $14 billion in gross profits over the next 18 months or so. (forbes )

The New York Power Lunch Is Back (robbreport )

The Inside Story Of Bugatti’s Greatest Hypercar Yet: The $4 Million, V16-Powered Tourbillon (maxim )

The New American Mall (theatlantic )

What It Really Takes to Build an AI Datacenter (bloomberg )

Boeing could evade criminal charges for violating a settlement linked to fatal crashes (fastcompany )

Here’s how to hit the power draw that helped Bryson DeChambeau win the U.S. Open (golfdigest )

Japan’s Retail Investors Eye Risky Wagers on Yen Intervention (bloomberg )

Nvidia Stock Stumbles (barrons )

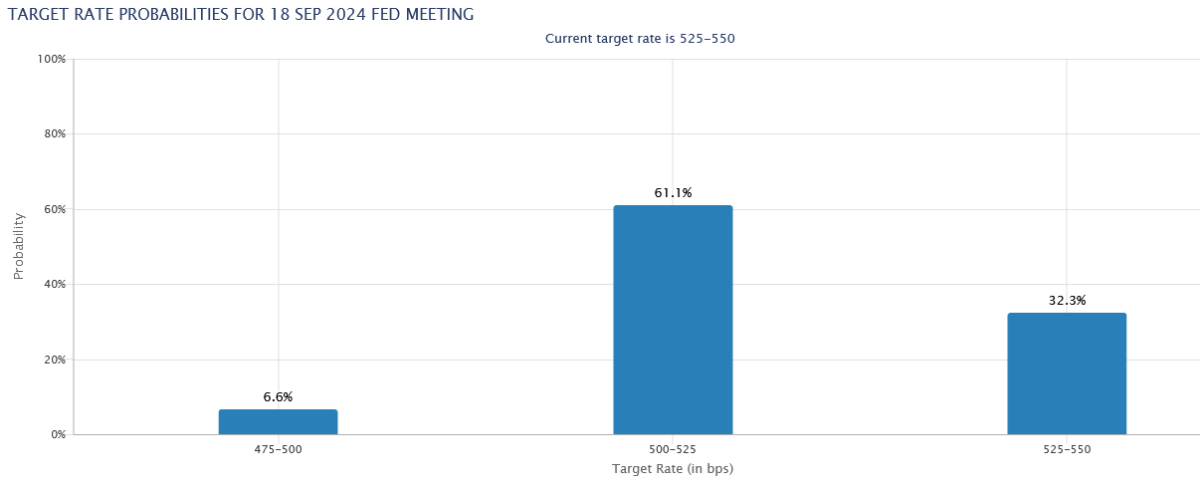

Wharton’s Jeremy Siegel: Expect the Fed to move to a ‘two-cut camp’ with one more good CPI reading (cnbc )

Starbucks Will Get a Jolt. Its Stock Is a Buy. (barrons )

Penn Could Be Bought. Wall Street Doesn’t Agree on What It Means for the Stock. (barrons )

CarMax Stock Rises After Earnings Dip. There’s a Used-Car Shortage. (barrons )

Nike Stock Is a Buy. The ‘Last Bad’ Earnings Report Is Coming, Says Analyst. (barrons )

Larry Culp Saved GE. Now He’s Aiming to Transform the Aerospace Industry. (barrons )

Alphabet Stands to Win From Tesla’s Robotaxi Day (barrons )

Why Home-Builder Stocks Can Continue Their Bull Run (barrons )

Robber Baron Retreats: Homes of Storied Business Titans Now Make for Luxurious Stays (barrons )

Koch family’s 15% stake in Nets (buying from Joe Tsai) values struggling NBA franchise at $3.8 billion: source (nypost )

The Big Read. Can Nvidia stay at the heart of the new AI economy? (ft )

Odd Lots: Why Tom Lee Thinks We Could See S&P 15,000 by 2030 (bloomberg )

2028 L.A. Olympics unveil venue plan: Swimming in SoFi, softball in Oklahoma City (nytimes )

Bullish bets on top stocks like Nvidia surged to a record high this week (marketwatch )

Fed’s Kashkari sees some signs of ‘some softening’ in the economy (marketwatch )

Partnership Lessons from Buffett-Munger (bloomberg )

The Best Cyclical Stocks to Buy (morningstar )

Nvidia Sheds $220 Billion After Short Run as Top Stock (bloomberg )

It’s Time to Be Bullish on Britain (bloomberg )

What Small-Cap Stocks Need to Finally Join the Market Rally (barrons )

Where Will Intel Stock Be in 3 Years? (fool )

U.S. and China hold first informal nuclear talks in five years (reuters )

As Nvidia Soars, History Advises Caution. (barrons )

FedEx Stock Has Delivered Disappointment. Next Week’s Earnings Could Change That. (barrons )

Gilead’s Twice-Yearly Shot Prevents HIV. Where the Stock Is Headed. (barrons )

2025 McLaren Artura Spider: An Unobnoxious Supercar (wsj )

Nvidia’s Success Is the Stock Market’s Problem (wsj )

New Home Construction Slows as Mortgage Rates Remain High (nytimes )

Elon Musk Wants You to Have More Babies (bloomberg )

US business activity inches up in June; price pressures abating (reuters )

Chart Master: Is a REIT revival incoming? (cnbc )

Bugatti Unveils V-16 Hybrid Supercar ‘Tourbillon’ (bloomberg )

US Services Activity Expands by Most in More Than Two Years (bloomberg )

Boeing-Spirit Aero Deal Nears Close as Airbus Talks Advance (bloomberg )

Odd Lots: John Arnold on Why It’s Hard To Build Things (bloomberg )

How YouTube Became Must Watch TV (bloomberg )

Nike Stock Can Just Do It. It’s Time to Buy. (barrons )

VF Stock Keeps Sliding. CEO Bracken Darrell Just Bought $1 Million of Shares. (barrons )

Chances of ‘no landing’ grows by the day: Bank of America (streetinsider )

Wells Fargo tells its clients to reduce exposure to ‘overvalued’ tech stocks (streetinsider )

Amazon stock target lifted at Baird on revised margin outlook (streetinsider )

China talks up support for IPOs. Investors are watching the speed of approval (cnbc )

Leading economic index falls again, but it’s not signaling recession (marketwatch )

Hertz upsizes junk-bond offering to $1 billion as it pushes ahead with fleet refresh (marketwatch )

JPMorgan Analyst Known for Bearish Call Touts China Tech Stocks (bloomberg )

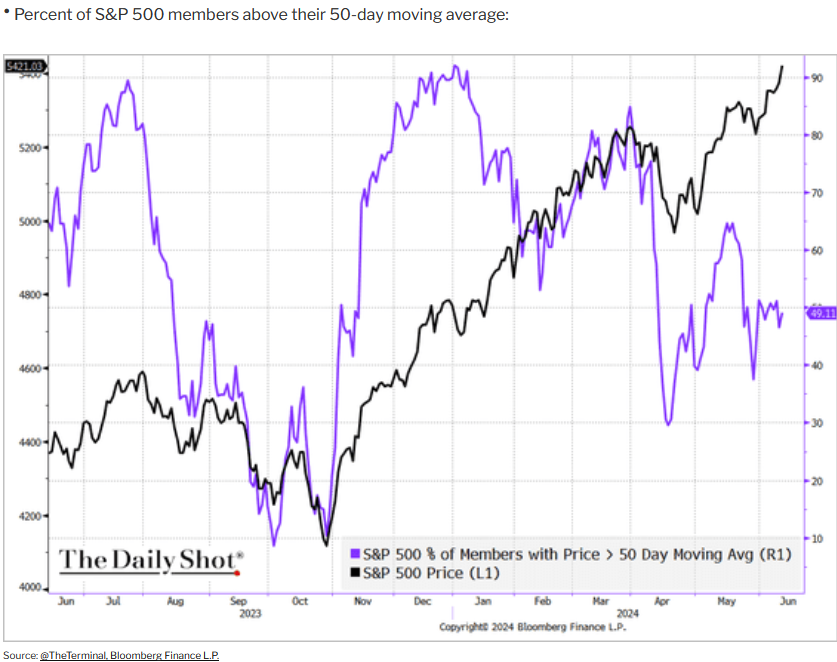

‘Sellers Are Entering the Market’ With S&P Faltering Beyond Tech (bloomberg )

Swiss National Bank presses ahead as rate cutting front-runner (reuters )

Opinion: Why AMD, Intel, Qualcomm and other PC giants need Apple’s AI effort to succeed (marketwatch )

This indicator suggests unloved small-cap stocks may be poised for a turnaround (marketwatch )

Nvidia’s Ascent to Most Valuable Company Has Echoes of Dot-Com Boom (wsj )

Inside Citigroup’s Most Mysterious Business (wsj )

Tiger Woods’ son Charlie 15, to play in first USGA event after winning qualifier (nypost )

Treasuries Are a Whisker Away From Erasing This Year’s Loss (bloomberg )

US Initial Jobless Claims Lingered Near 10-Month High Last Week (bloomberg )

Fed’s Kaskhari sees some signs of ‘some softening’ in the economy (marketwatch )

Xi’s Mystery PBOC Plans Surface With Biggest Shift in Years (bloomberg )

EU imposes sanctions on Russian LNG (ft )

This Undervalued Stock Could Join Nvidia in the $3 Trillion Club (fool )

Is This Amazon’s Next $100 Billion Opportunity? (fool )

America’s ‘cardboard-box recession’ is finally over, BofA says (businessinsider )

2 states where home prices are falling because there are too many houses and not enough buyers (businessinsider )

US Housing Starts & Building Permits Plunge To COVID Lockdown Lows (zerohedge )

Forget AMD: 2 Artificial Intelligence (AI) Stocks to Buy Instead (fool )

The Fed could tip the US into recession if it waits too long to cut rates, Mohamed El-Erian says (businessinsider )

Hong Kong Stocks Jump on Hopes for Market-Boosting Policies (bloomberg )

Hong Kong may reap bonanza as China expedites approvals for offshore IPOs (scmp )

The Fed Is in Wait-and-See Mode on Rate Cuts (barrons )

Inflation Drops to U.K. Target. Why BOE’s Likely to Follow Fed With Rate Freeze Anyway. (barrons )

M&A Is Back. 4 Stocks That Could Be Targets. (barrons )

Dell Stock Extends Rally. Wall Street Is Bullish on the AI Servers. (barrons )

Nvidia’s Ascent to Most Valuable Company Echoes Dot-Com Boom (wsj )

Insane six-man golf brawl breaks out during Father’s Day round (nypost )

Retail sales rise by paltry 0.1% as shoppers feel pinch of high inflation (nypost )

Boeing C.E.O. Apologizes for Quality and Safety Issues at Senate Hearing (nytimes )

US Mortgage Rates Drop Below 7% for First Time Since March (bloomberg )

China CSRC Unveils Policy Package to Shore Up Star Market (bloomberg )

Woods gets special exemption into PGA Tour Signature Events (reuters )

Fed needs to cut interest rates sooner rather than later (ft )

BofA Poll Shows Investors Primed to Fuel Stock Rally With Cash (bloomberg )

Why small caps, cyclicals are ‘an exciting opportunity’ (yahoo )

Traders price in higher odds of two Fed rate cuts this year (bloomberg )

Fed’s Barkin, Kugler, Goolsbee Among Those Set to Speak (barrons )

Retail Sales Miss Again. Consumers Are Losing Steam. (barrons )

Corporate Tax Rate Spurs Political Fight With More Than $1 Trillion at Stake (wsj )

Market concentration could be a warning the rally is slowing: Carson Group’s Ryan Detrick (cnbc )

A lot of the drivers for inflation are falling away, says Fundstrat’s Tom Lee (cnbc )

Intel’s China arm invests in telecoms subsidiary of Apple supplier Luxshare (scmp )

Hong Kong IPO market pipeline has ‘new-found positivity’ after slow first half (scmp )

Midsize Companies Are Big Business for Wall Street’s Megabanks (wsj )

Retail Sales Disappoint In May, April Revised Even Lower… (zerohedge )

Alibaba Health resumed with a Buy at Goldman Sachs (thefly )

BofA: Cash sees largest weekly inflow, money market AUM hits $6.1 trillion (streetinsider )

Bank of America sees continued buyback strength (streetinsider )

Citi Pitches Its Money-Moving Services Business as Central to Its Revamp (bloomberg )

China May retail sales beat expectations (cnbc )

Goldman ups S&P 500 target for a third time — and says 6,300 is possible (marketwatch )

A Big Bond Rally Is Promising Some Help for Home Buyers(wsj )

The Dow Has Been a Dog. Markets Won’t Throw It a Bone. (barrons )

Investors Fear Long Stretch of Calm in Markets Can’t Last (wsj )

If Ray Kurzweil Is Right (Again), You’ll Meet His Immortal Soul in the Cloud (wired )

Review: McLaren Artura Spider Hybrid (wired )

These Are the Best AI Music Generators You Can Use Right Now (gizmodo )

Bryson DeChambeau wins another U.S. Open with a clutch finish to deny Rory McIlroy (npr )

Bryson DeChambeau fixed his swing with this state-of-the-art tech (golf )

The Bizarre Scientific Experiment That Helped Bryson DeChambeau Win the U.S. Open (wsj )

Taobao and Tmall Upgrades Consumer Shopping Experience and Merchant Support Through AI (alizila )

How the US Mopped Up a Third of Global Capital Flows Since Covid (bloomberg )

Bill Gates Says He’s Ready to Put Billions Into Nuclear Power (bloomberg )

China Home-Price Slump Accelerates Despite More Stimulus (bloomberg )

China Leaves Key Rate Unchanged on Currency Pressure, Liquidity (bloomberg )

Activist Starboard amasses Autodesk stake (cnbc )

The Dial-Toning of AI (wsj )

May Inflation Data Was ‘Very Good,’ Fed’s Goolsbee Says (barrons )

Don’t Bet on Fed Rate Cuts. Do This Instead. (barrons )

Hurricane Season Begins With a Deluge in Florida. Are Insurers Ready? (barrons )

Treasury yields see biggest two- and three-week declines since December as bonds keep rallying (marketwatch )

Consumer sentiment falls to 7-month low on worries over inflation and weaker incomes (marketwatch )

Inflation is cooling — but Americans’ concerns about it are hotter than ever, by one measure (marketwatch )

Bank of America wins upgrade on business lending, healthier balance sheet (marketwatch )

Goldman Sachs Boosts S&P 500 Target on Upbeat Profit Outlook (bloomberg )

It Turns Out Apple Is Only Paying OpenAI in Exposure (futurism )

Jerry Seinfeld and Maria Popova (#746) (timferriss )

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans (bloomberg )

The US needs to build 2 million houses to revive the American dream of homeownership (finance.yahoo )

The S&P 500 would be nearly 20% lower without AI mania, says this chart (marketwatch )

Ford Motor Director Scooped Up Stock (barrons )

Yen, Japanese bond yields fall on Bank of Japan ‘stalling tactic’ (marketwatch )

Import prices fall sharply in another sign of fading U.S. inflation (marketwatch )

Chinese companies fuel convertible bond surge, likely ‘precursor’ to IPO rush (scmp )

Premier Li says China’s economic upgrade to bring new opportunities for global development (people.cn )

Stockton: The steady uptrend we’ve seen in tech since October may not keep repeating itself (cnbc )

Both Intel and Advanced Micro Devices are rolling out AI-GPUs designed to target Nvidia’s H100 GPU in high-compute data centers. (fool )

China sees major rebounds in outbound, inbound tourism (people.cn )

How a non-profit academy in Beijing is fuelling China’s adoption of AI (scmp )

Home foreclosures are on the rise again nationwide (foxbusiness )

Dollar’s Best Streak Since February Threatened as Bulls Retreat (bloomberg )

Chinese company develops human-like robots that can display complex facial expressions, emotions (nypost )

10-year Treasury yield remains at lowest since March on fourth day of bond rally (morningstar )

“A Major Step To Protect Women’s Sports”: Trans Swimmer Lia Thomas Has Discrimination Case Against World Aquatics Dismissed (zerohedge )

A Killer Golf Swing Is a Hot Job Skill Now (wsj )

Inside Callaway’s aerodynamic research area where employees control a ‘ball launcher’ that can project balls at various launch angles, speeds and spin rates. (wsj )