Skip to content

China’s economy is on track for ‘strong’ March performance, survey says (cnbc )

The Big Read. Will Xi’s manufacturing plan be enough to rescue China’s economy? (ft )

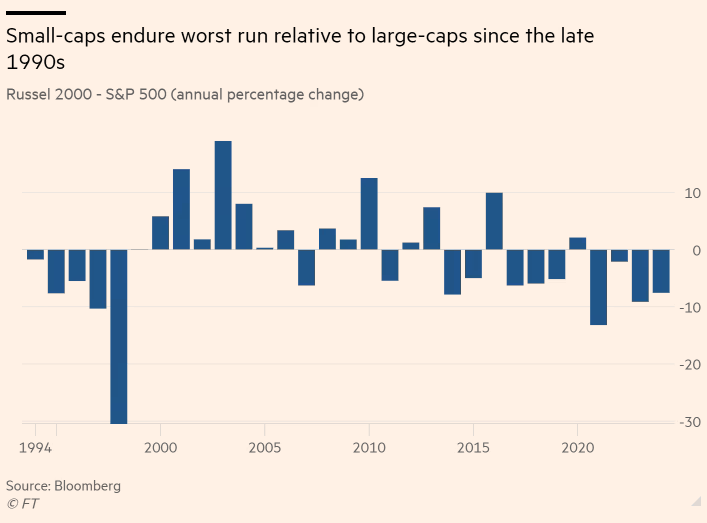

“The only other time you’ve seen relative multiples this cheap was during 1999 and 2000, and that ended up being a great decade for small-caps,” she said. (ft )

Reddit Insiders Selling Days After IPO; Shares Fall Late (investors )

China Signals More Property Support, But Substance to Be Key for Turnaround (wsj )

Why the Fed’s Waller Is in ‘No Rush’ to Cut Rates (barrons )

The Stock Market Is So Strong, Even Some Skeptics Won’t Bet Against It (barrons )

China’s Xi meets with U.S. business leaders, calls for closer ties (marketwatch )

China’s Xi Seeks to Soothe Anxieties of American CEOs (wsj )

Barron’s: Nvidia Stock Slips. Why It Might Lose Out in a Frothy Market. (marketwatch )

Opinion: Boeing had a good week cleaning house — but now comes the hard part (marketwatch )

These GE and 3M Spinoffs Are Set to Join the S&P 500 (barrons )

Los Angeles Office Tower Dumped by Brookfield Faces Foreclosure Sale (bloomberg )

3M’s Healthcare Spinoff Stock Fell. This Is What It’s Worth. (barrons )

Individual investors are buying fewer stocks, but using more leverage (marketwatch )

Disney, Florida Settle Litigation Over Special District. Sunnier Skies Could Be Ahead. (barrons )

Point72 Takes a Large Stake in Fox (institutional investor )

Taobao to Launch Several Biz-Friendly Initiatives for All Platform Merchants Starting Apr (aastocks )

The market may be due for a decline. Cramer explains why you shouldn’t fear it (cnbc )

Vans Skateboarding and Anthony Van Engelen Skate to the Future with the All-New AVE 2.0 (vans )

China: Industrial profits hit a 25-month high amid signs of bottoming out (ing )

China’s Xi meets U.S. executives as businesses navigate bilateral tensions (cnbc )

Xi Says US CEOs Should Invest in China, Economy Hasn’t Peaked (bloomberg )

Airbus Has Its Own Issues. Can It Keep Its Lead Over Boeing? (barrons )

Boeing Needs a New CEO. What History Says About Who Can Right the Stock. (barrons )

Commercial real estate is itching for a rebound two years after start of Fed rate hikes (marketwatch )

Fees in Settlement. It Could Save Merchants $30 Billion. (barrons )

Although Chinese consumer confidence has yet to meaningfully rebound, the overall mood has started to improve slightly, Madjo wrote. (barrons )

Boeing Delivered Just 3 MAX Jets in a Week. That Is a Good Thing. (barrons )

Krispy Kreme Stock Rises Sharply on Sweet Deal With McDonald’s (barrons )

Home Prices Rose at Fastest Pace Since 2022 in January (barrons )

This bull market is not over, says Wharton’s Jeremy Siegel (cnbc )

The Office Market Is in Turmoil. So Why Are Rents More Expensive? (wsj )

Canada Goose to cut 17% of its corporate workforce (cnbc )

Boeing Delivered Just 3 MAX Jets in a Week. That Is a Good Thing. (barrons )

China’s Premier Says Nation Off to Good Start on 2024 Goals (bloomberg )

China Rolls Out Welcome Mat for U.S. CEOs as It Nods to Its Economic Problems (wsj )

Disney stock upgraded by Barclays as turnaround plan takes shape (yahoo )

As Boeing’s New Chairman, Steve Mollenkopf Returns to the Spotlight (barrons )

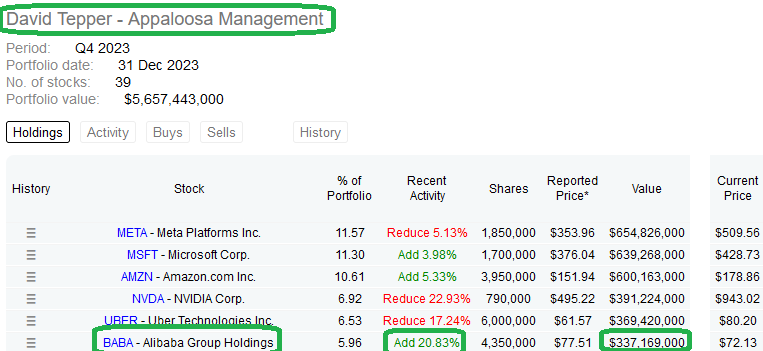

Are Chinese Tech Stocks Value Plays Now? (wsj )

Alibaba to buy Cainiao stake for up to $3.75 billion as it drops IPO plan (reuters )

PBOC head says China’s property crisis has abated as default rumours vex Vanke (scmp )

Home Prices Rose at Fastest Pace Since 2022 in January (barrons )

Visa, Mastercard Reach $30 Billion Swipe-Fee Deal With Merchants (bloomberg )

Apple could double down on China market, Wedbush says, as iPhone sales drop (cnbc )

Yuan Rebounds as PBOC Sends Strong Message of Support Via Fixing (bloomberg )

China told it faces ‘fork in the road’ as officials meet CEOs (reuters )

China to safeguard equal treatment for foreign-funded firms (reuters )

Why ESG Investing Might Never Recover (wsj )

New Blood Thinners Will Prevent Blood Clots Without Causing Bleeding (wsj )

China blocks use of Intel and AMD chips in government computers: report (foxbusiness )

Fed’s Powell Ready to Support Job Market, Even If It Means Lingering Inflation (bloomberg )

UK Pledges £350 Million for Nuclear Defense and Energy By 2030 (bloomberg )

Amgen wants in on the booming weight loss drug market — and it’s taking a different approach (cnbc )

Alphabet is set to pop 15% as Google is a clear winner in AI, Wedbush says (businessinsider )

Why a Fed rate cut in June is not yet a done deal (marketwatch )

U.S. stocks shot up nearly 30% in 5 months. Is it time to worry about a correction? (marketwatch )

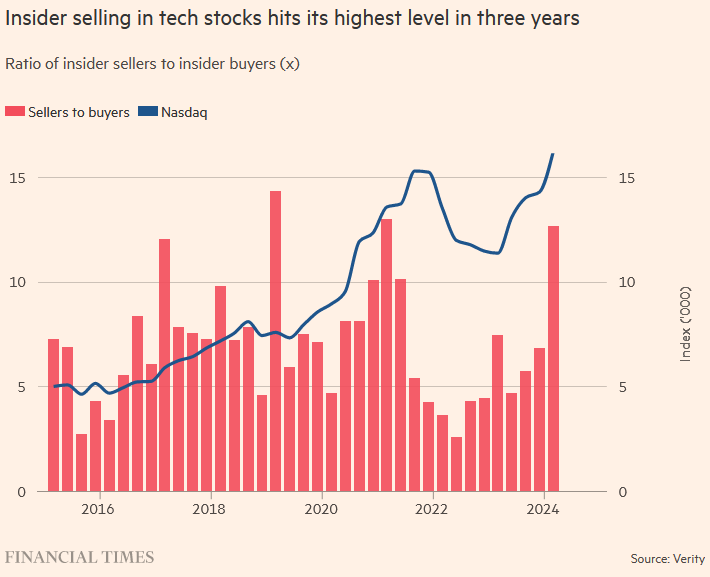

Thiel, Bezos and Zuckerberg join parade of insiders selling tech stocks (ft )

Investor Nelson Peltz: ‘I’m not trying to fire Bob Iger, I want to help him’ (ft )

Sam Altman’s Under-The-Radar SPAC Fuses AI Expertise With Nuclear Energy: Here Are The Others Involved (benzinga )

Ele.me outlines business plan for the next three years amid leadership reshuffle (technode )

Three Ant Group subsidiaries to go independent in Chinese fintech giant’s biggest restructure since blocked IPO (technode )

PDD’s cost of revenue nearly tripled last year as Temu expanded aggressively (technode )

United States v. Apple is pure nerd rage (theverge )

Financial Times tests an AI chatbot trained on decades of its own articles (theverge )

How Big Steel in the U.S. fell (npr )

Freshippo’s Global Grocery Business More Than Doubles GMV (alizila )

Chinese Premier Downplays Economy Risks, Highlights Policy Space (bloomberg )

Wall Street’s biggest bull renews call for small-cap stocks to rise 50% in 2024 (marketwatch )

China’s Policy Meeting on Property Raises Hope of Aid for Sector (bloomberg

Bill Gross Laments ‘Excessive Exuberance’ as Stocks Surge (bloomberg )

The Best Places to Visit in Portugal—and When to Go (mensjournal )

Didi Global’s Revenue Jumps Ahead of Its Planned Hong Kong IPO (bloomberg )

Apple’s Cook Meets Chinese Commerce Minister, Unveils Investment (bloomberg )

Fed’s Bostic Now Anticipates Just One Rate Cut This Year (bloomberg )

Trillion-dollar rebound prompts debate: is the worst over for Chinese stocks? (scmp )

Meituan Crushes Analyst Estimates, Alibaba’s Must-Read Regulatory Filing, Week in Review (chinalastnight )

Best Six Months Ends in April (almanactrader )

The great central bank policy reversal kicks off (reuters )

We Test-Drove The Amazing McLaren 750S Through The Portuguese Riviera (maxim )

Inside the turnaround plan to make Vans, Supreme, and The North Face cool again (fortune )

Apple Loses $113 Billion in Value After Regulators Close In (bloomberg )

China and US Start Working Group to Combat Flood of Fentanyl (bloomberg )

Japan’s Era of Stagnant Salaries, Steady Prices and Mortgages That Never Go Up Is Over (bloomberg )

Magnificent Seven? It’s More Like the Blazing Two and Tepid Five (bloomberg )

Cowboys owner Jerry Jones puts another $100 million into Frisco’s Comstock Resources (dallasnews )

China’s Central Bank Sees Room for More RRR Cuts (bloomberg )

Fed Officials Still See Three Interest-Rate Cuts This Year, Buoying Stocks (wsj )

Productivity is way up

The Billionaire Taking on Disney Just Wants Some Respect (nytimes )

Short Sellers Up Their Wagers Against Commercial Real Estate Again (bloomberg )

Fed’s interest-rate decision makes bank stocks more attractive: analyst (marketwatch )

Boeing targets a culprit of 737 MAX production woes: ‘Traveled work’ (yahoo )

For Real Estate, Rate Cuts Can’t Come Soon Enough (zerohedge )

Chewy (CHWY) stock jumps on better-than-anticipated Q4 top and bottom line (streetinsider )

Reddit prices stock at top of target range in biggest social media IPO since Pinterest (streetinsider )

6 Highest Yielding Dividend Kings With Yields Up To 9.9% (247wallst )

Private equity giant Apollo offers $11B for Paramount Pictures studio: report (nypost )

SocGen’s Kabra Is Now Among the Biggest Bulls on US Stock (bloomberg )

Apple Braces for Antitrust Lawsuit From DOJ (barrons )

The Stock Market Is Already Way Up. 8 Stocks That Can Still Outperform. (barrons )

Replacing Boeing CEO Calhoun Won’t Be Easy (barrons )

Fundstrat’s Tom Lee sees small-cap benchmark Russell 2000 surging by 50% in 2024 (cnbc )

Cheesecake Factory and 4 More Stocks Ready to Pop, From a Small-Cap Pro (barrons )

Home Sales Jumped in February to Fastest Pace in a Year. Prices Are Up, Too. (barrons )

Nike Reports Earnings Today. It Has Lots of Work to Do. (barrons )

Nvidia Is Using Its Old 1990s Playbook To Best Its AI Rivals (barrons )

Biden’s EPA Gives Automakers More Leeway to Phase Out Gas-Engine Cars (wsj )

Elon Musk’s Neuralink Shows First Patient Using Its Brain Implant (wsj )

Why Arizona Law Firms Are a Hot Investment for Private Equity (wsj )

Nelson Peltz Wins Key Endorsement in Disney Battle (wsj )

Airport Security Is a Confusing Mess Right Now (wsj )

US Initial Jobless Claims Ease in Sign of Resilient Labor Market (bloomberg )

The frugal life of Warren Buffett: How the billionaire spends his fortune, from McDonald’s breakfasts to a rare and ‘indefensible’ splurge (yahoo )

Apple’s Tim Cook meets key suppliers in Shanghai as 57th China store opens (scmp )

How Has the Fed’s Outlook Changed? Here’s What to Watch Today (wsj )

PDD Stock Soars as Temu Parent Posts Huge Earnings Beat. What It Means for Alibaba. (barrons )

Intel Gets Up to $8.5 Billion in Chips Act Funding from Biden Administration (barrons )

Is a June rate cut still possible? Fed’s Powell will look to keep options open this week. (marketwatch )

The Bank of Japan Just Handicapped a Winning Strategy. What to Know About the Yen Carry Trade. (barrons )

Energy Suppliers Are Racing to Keep Up with the Data-Driven Energy Surge (barrons )

The big tech rally is living on borrowed time, says UBS (marketwatch )

‘Mr. Yen’ says authorities may soon intervene as Japanese currency eyes multi-decade lows (marketwatch )

Apple CEO Tim Cook Is in China After iPhone Sales Weaken. (barrons )

The Latest Options Craze Resembles Past Manias. That’s Not a Good Thing. (barrons )

Fed is ‘so far from equilibrium’ as markets await rate guidance, BlackRock’s Rick Rieder says (marketwatch )

Boeing CFO Talks Cash, Spirit, And How to Fix Quality. (barrons )

Apple Looks to External Partners to Boost AI Efforts (wsj )

Why the Fed’s ‘Dot Plot’ Is the Center of Attention (wsj )

The Era of No-Brainer 5% Returns on Cash Is Ending (wsj )

Shares of Gucci Owner Tumble After Sales Warning (wsj )

Understanding the Boeing Mess (wsj )

NYC landlords luring workers back to offices with pickleball, golf simulators, arcade games and gourmet food (nypost )

Here’s everything to expect from the Federal Reserve’s policy meeting (cnbc )

Hong Kong’s national security law has analysts divided on its social and economic ramifications (cnbc )

A Lady Gaga Google Search shows how AI is upending the world’s most profitable online business. ‘Site owners are terrified.’ (businessinsider )

Once Again, Baltimore Hopes to Fight Blight With $1 Homes (governing )

4 signals that suggest the stock market’s bull rally could soon reverse (businessinsider )

China’s Central Bank Names Two Scholars as New Policy Advisers (bloomberg )

China to Use Public Auctions for Sale of Special Ultra-Long Debt (bloomberg )

Intel prepares for $100 billion spending spree across four US states (reuters )

West is ‘too optimistic’ on nuclear projects, warns engineering chief (ft )

Alibaba-backed Moonshot AI expands Chinese-character prompt for Kimi chatbot (scmp )

Tencent doubles share buy-backs while earnings miss estimates (scmp )

Wouldn’t be surprised if more FOMC members predicted less than two rate cuts in 2024: Jeremy Siegel (cnbc )

Rumors over ‘next James Bond’ left shaken and stirred by Aaron Taylor-Johnson speculation (wral )

How the BOJ’s plan for a smooth exit from negative rates unraveled (reuters )

BOJ Needs to Do More to Change Direction of Yen: Major (bloomberg )

Goldman’s Hatzius Says US on Track for 2.4% Core PCE (bloomberg )

Alibaba Raises $317 Million From Sale of Stake in EV Maker XPeng (bloomberg )

Buy 3M Stock Ahead of Healthcare Spinoff. Analyst Expects Higher Valuation. (barrons )

Natural Gas Prices Won’t Stay Low for Long. An Export Boom Is Coming. (barrons )

1 No-Brainer Growth Stock to Buy Now With $100 and Hold Through 2024 (and Beyond) (fool )

Japan Finally Raises Rates. Global Markets Will Feel It. (barrons )

As Electric-Vehicle Shoppers Hesitate, Hybrid Sales Surge (wsj )

UK Reality TV Stars, Influencers Join AliExpress’ New Livestreaming E-Commerce Community (alizila )

Alibaba brings 5-day delivery to the US in race against Shein, Temu (scmp )

Marissa Pardini Steps Down from Vans; More Layoffs Hit Office (shop-eat-surf )

Ant Sets Up Board for International Operations in Broad Overhaul (bloomberg )

BABA-SW’s Hema Global Shopping Biz GMV Rises 1x+ YoY in 2023 (aastocks )

Developing | Ant Group restructures part of its businesses into units, promotes veteran finance chief as president to spur growth (scmp )

Commercial Real Estate Is a Slow Burn,’ Says Bank of America CEO Moynihan (bloomberg )

Small Caps Can Shine With Reasonable Rates: BofA (bloomberg )

BofA’s Moynihan on US Consumer, Trading Activity and CRE (bloomberg )

BofA’s Moynihan: Banks Have ‘Tremendous Amounts of Capital’ (bloomberg )

BofA CEO Moynihan: Customers ‘Remarkably Resilient’ (bloomberg )

Central bankers see ‘immaculate disinflation’ within reach (ft )

The ferocious US pushback against new banking rules (ft )

Warren Buffett Says Even The Bottom 2% Of Earners ‘All Live Better Than John D. Rockefeller’ – And He Was The Richest Man In The World (yahoo )

New-Home Construction Rose in February. Builders Are Confident. (barrons )

Don’t want to chase Big Tech? Money manager flags three unloved stocks to bet on now. (marketwatch )

Fusion Pharmaceuticals Stock Soars. It’s Being Acquired by AstraZeneca in $2.4 Billion Deal. (barrons )

Odds of a June rate cut by Fed slip below 50%, according to this gauge (marketwatch )

ESPN Boss Jimmy Pitaro’s Chaotic Race to Remake the Sports Giant (wsj )

Once America’s Hottest Housing Market, Austin Is Running in Reverse (wsj )

Cities Face Cutbacks as Commercial Real Estate Prices Tumble (nytimes )

Japan Ends Era of Negative Rates With Few Clues on Further Hikes (bloomberg )

Warren Urges Powell to Cut Rates to Help Struggling Clean Energy (bloomberg )

Trading Floors Buzz With Excitement as BOJ Axes Negative Rates (bloomberg )

Real Estate Pain Is Showing Up in an Obscure Investment Product (bloomberg )

The Fed Has a Lot of Questions to Answer About Its Balance Sheet (bloomberg )

America’s Place in India’s Butter Chicken Fight (bloomberg )

Harvard-trained neuroscientist with 20+ years experience: 7 tricks I use to keep my memory sharp (cnbc )

Fed could cut rates fewer times than expected as economy keeps growing, according to CNBC survey (cnbc )

Nordstrom shares jump more than 10% on report retailer is trying to go private (cnbc )

Housing Starts And Permits Surged In February (Despite Plunging Rate-Cut Odds) (zerohedge )

A Bill Gates company is about to start building a nuclear power plant in Wyoming (businessinsider )