Skip to content

- Fed’s rate-cut path in 2024 is a ‘very close call’ as market awaits Powell’s guidance (marketwatch)

- Chinese AI social media apps see demand rise in overseas markets amid slow mainland adoption (scmp)

- Stocks used to rise ahead of Fed meetings. Not anymore. (marketwatch)

- How the stock market performs when a CPI report and a Fed decision happen the same day (marketwatch)

- Opinion: Buffett partner Charlie Munger kept these rules about investing and life that you can use too (marketwatch)

- Natural gas surges over 7% to end at 5-month high on forecasts for extreme heat (marketwatch)

- Snowflake’s Ex-CEO Snaps Up Cheap Stock. He Had Been a Big Seller. (barrons)

- Fed Faces Dot-Plot Cliffhanger as May Inflation Report Looms (bloomberg)

- Nelson Peltz’s Trian amasses stake in pest control giant Rentokil (cnbc)

- VF Corp president buys $997k in company stock (investing)

- Wall St slips before inflation data, Fed decision; Apple rebounds (streetinsider)

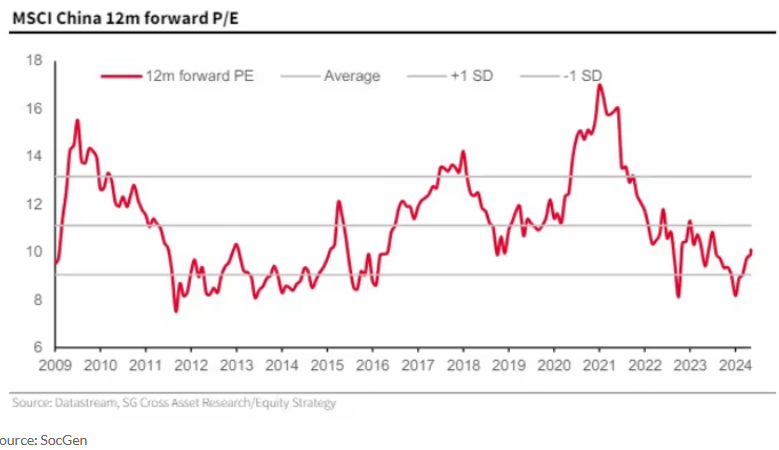

- Chinese stocks poised for more gains after ‘healthy correction’: Goldman Sachs (scmp)

- China sees 110 mln domestic tourist trips during Dragon Boat Festival holiday (cn)

- CFR’s Richard Haass on EU election fallout: It’s a really bad time to be an incumbent (cnbc)

- China’s Call for ‘Open Mind’ Spurs Hope of New Housing Measures (bloomberg)

- Tom Lee on Small Caps (cnbc)

- GM Is Returning $6 Billion More Cash to Shareholders. The Stock Is Rising. (barrons)

- ‘Don’t sell a dull market short’ is the advice stock investors need right now (marketwatch)

- Why Google is one of the big winners from Apple’s WWDC (marketwatch)

- How Elliott Plans to Fix Southwest—and Boost the Stock (barrons)

- Behind the Scenes at Disney’s R&D Lab With Its Top Imagineer (wsj)

- The Fed Gears Up to Show Its Hand: One Cut, Two or None at All (wsj)

- How to Build an Airplane: Boeing’s Urgent Mission to Train Thousands of Rookies (wsj)

- One City’s Downtown Plan: Empty Office Space That Is Too Cheap to Pass Up (wsj)

- Any way you slice it Century-old NYC pizza icon Totonno’s looks for someone to take over with just one condition: No pineapple (nypost)

- Old woman and the sea Maine’s oldest lobster woman just turned 104 and has no plans to leave her boat: ‘Still the boss’ (nypost)

- Inside the reawakening of NYC’s Fifth Avenue with swanky housing, shopping and offices (nypost)

- Are These Really ‘the World’s 50 Best Restaurants’? (nytimes)

- Tiana’s Bayou Adventure is the next step in Disney’s $60 billion theme park investment (cnbc)

- Goldman Sachs: Stock splits are near-term positive for shares (streetinsider)

- Diageo sells majority stake in Guinness Nigeria to Singapore’s Tolaram (ft)

- Biotechs line up for IPOs in bullish sign for US listings market (ft)

- Apple Set To Unveil AI Game Plan At WWDC 2024 (Live Coverage) (investors)

- RBC’s Calvasina Sees Risk of S&P 500 Sinking 8% If No Fed Cut (bloomberg)

- Ford CEO Jim Farley Explains Why EV Sales Are Slowing as Hybrids’ Boom (barrons)

- Elliott Takes Big Stake in Southwest Airlines (wsj)

- A Big Decision for Boeing’s Next C.E.O.: Is It Time for a New Plane? (nytimes)

- Here’s where the economy stands as the Fed makes its interest rate decision this week (usatoday)

- Homes for Sale Are Piling Up, Just Not Where the Buyers Are (bloomberg)

- Is the Fed put back? (streetinsider)

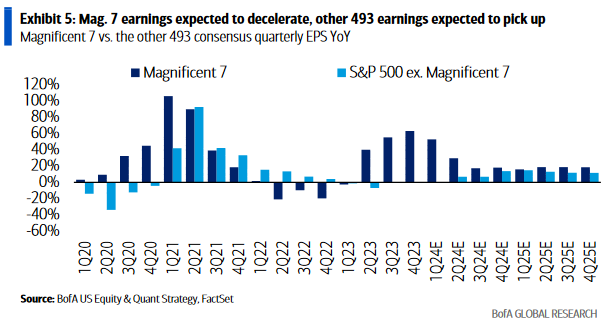

- BofA: Bank stocks should remain well bid into US elections (streetinsider)

- Alibaba Returns to the Scene of the Crime (stockcharts)

- Alibaba Cloud’s Qwen2 with Enhanced Capabilities Tops LLM Leaderboard (alizila)

- Why the Recession Still Isn’t Here (wsj)

- Freshippo Launches Private Label at North American Supermarkets, Eyes Global Expansion (alizila)

- Hiring and Wages are Up, Reinforcing the Economy’s Resilience (wsj)

- World’s 50 best restaurants for 2024 revealed — and one NYC spot made the list (nypost)

- The Former Amazon Intern Now Running Its Profit Engine (wsj)

- Economic Data Paint a Picture of Two Americas (wsj)

- We’re Spending Billions on This Work-From-Home Indulgence (wsj)

- The Great AI Challenge: We Test Five Top Bots on Useful, Everyday Skills (wsj)

- What to Watch: The Best Movies and TV Shows From April (wsj)

- 11 Fascinating Facts You Didn’t Know About the Record-Busting Rimac Nevera (robbreport)

- Cher’s Ferrari Dino 246 Spider Is Up For Grabs (maxim)

- This Elite Anguilla Beach Resort Just Debuted A New Luxury Villa (maxim)

- Alibaba and JD see performance boost during 618 shopping festival (technode)

- Apple is reportedly ready to announce AI — in the most Apple way possible (mashable)

- How much national debt is too much? (npr)

- The First Ferrari 250 GT SWB California Spider Ever Built Is Going to Auction (roadandtrack)

- Tight money hasn’t hurt corporate profits (scottgrannis)

- Amazon Could Join the $3 Trillion Club. How It Could Happen. (barrons)

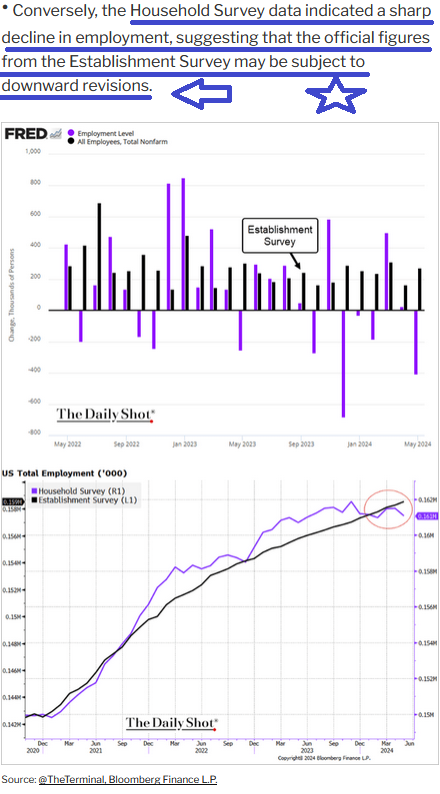

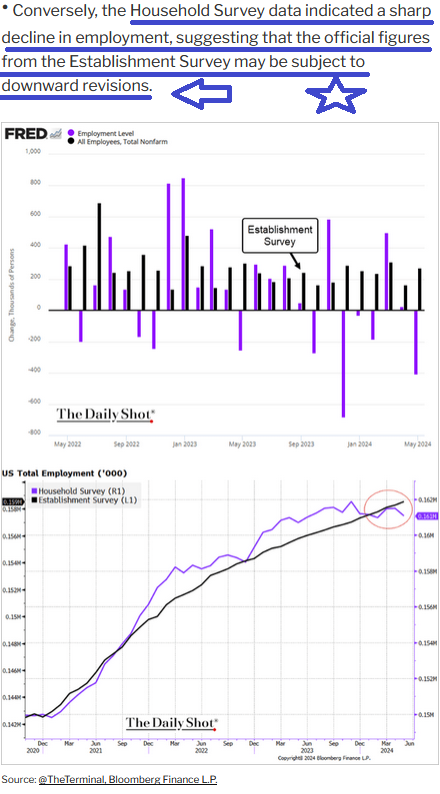

- The Jobs Report Is Like a Box of Chocolates. Pick the Data You Like. (barrons)

- SL Green to start deploying $1 billion arsenal for New York real estate this year (marketwatch)

- 3M Stock Is Rising. Wall Street Sentiment Is Turning. (barrons)

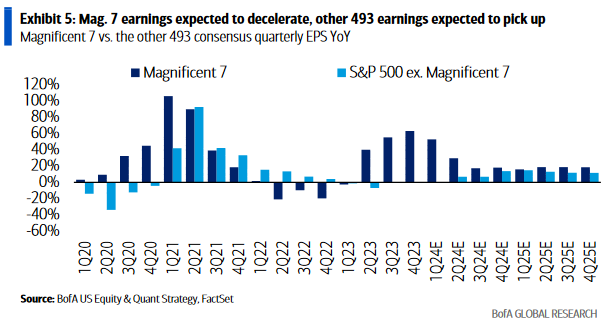

- Stock Market Concentration How Much Is Too Much? (morganstanley)

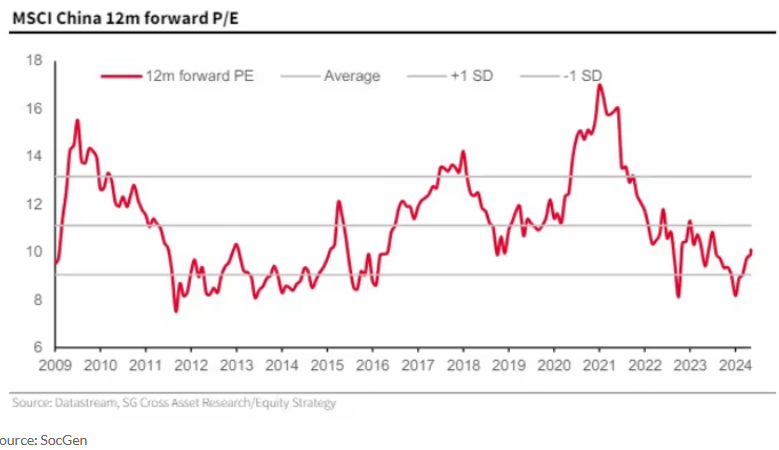

- KraneShares’ Brendan Ahern on China’s Economic Landscape: Is It Still Investable? (mebfaber)

- Alibaba says new AI model Qwen2 bests Meta’s Llama 3 in tasks like maths and coding (scmp)

- US Payroll Gains and Unemployment Rate Both Pick Up at Same Time (bloomberg)

- China’s foreign goods trade picks up steam in first 5 months (cn)

- Economists expect realty bounce soon (cn)

- Payrolls Instant Reaction: A Schizophrenic Report (zerohedge)

- Has Lululemon Athletica Turned a Corner? Perhaps Not, Wall Street Says. (barrons)

- ‘The China equity trade is back’ and here are the stocks to pick, says SocGen (marketwatch)

- A look inside a $1 billion real-estate bet on the future of San Francisco (marketwatch)

- Three stocks now account for 20% of the S&P 500’s value. That’s making some investors nervous. (marketwatch)

- Opinion: S&P 500 is now giving a ‘buy’ signal and there’s strong support for a summer rally (marketwatch)

- Too soon for small caps? This money manager is picking up bargains. (marketwatch)

- ECB Cuts Interest Rates for First Time Since 2019 (wsj)

- Big US Job Gains Is Out of Sync With Recent Weaker Economic Data (bloomberg)

- First-Quarter US Labor Costs Marked Down on Weaker Output, Hours (bloomberg)

- ECB Cuts Rates, Raises Inflation Forecasts for 2024, 2025 (bloomberg)

- US Payroll Gains Not as Robust as Reported, BLS Data Suggest (bloomberg)

- Citi Wealth Says Equal-Opportunity S&P Is a Way to Play Rally (bloomberg)

- Nvidia CEO Jensen Huang to Sell Up to $735 Million in Stock (barrons)

- Country Garden sees home sales jump as Beijing’s rescue package gives developers a boost (scmp)

- Bond Traders Pile Into Fresh Bets on Faster Pace of Fed Cuts (bloomberg)

- Investing in China ‘desirable’ despite risks, says hedge fund giant Ray Dalio (scmp)

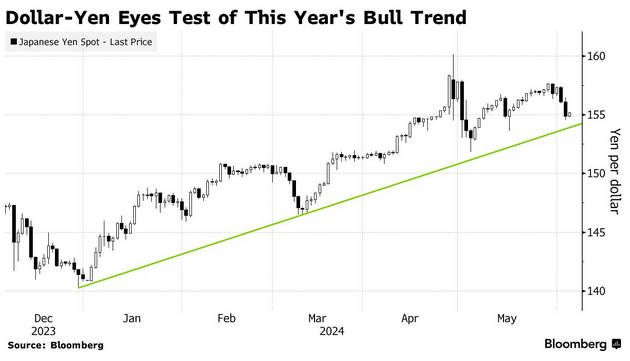

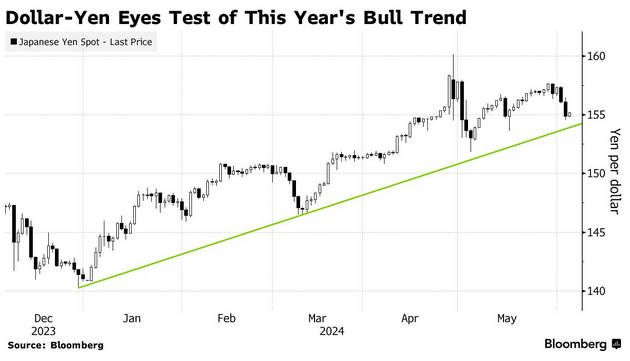

- Hedge Funds Flip Flop on Yen Option Trade as BOJ ‘Spooks’ Market (bloomberg)

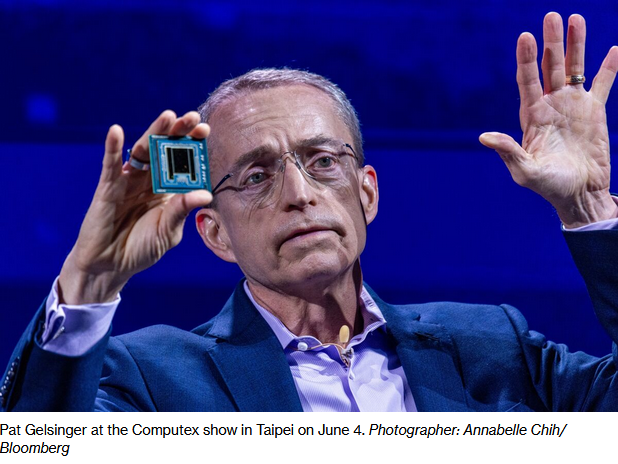

- ‘We want to build everybody’s AI chips’: Intel CEO talks of regaining market share (cnbc)

- Here’s what happened in 9 major bubbles in the last 100 years — and what’s going on now (marketwatch)

- Bank of Canada seen cutting rates (marketwatch)

- Traders expect a hawkish cut from the ECB. What it means for markets. (marketwatch)

- Intel, Apollo strike $11 billion deal over chip-manufacturing plant in Ireland (marketwatch)

- Citi Says ECB’s Interest Rate Path Hands European Stocks an Edge (bloomberg)

- These popular stock-market trades are unwinding as Fed bets shift. Here’s what happens next. (marketwatch)

- Margin Debt Is Rising. It’s a Sign Some Investors Are Amping Up Risk. (barrons)

- Americans Have More Investment Income Than Ever (wsj)

- The number of US homes for sale is slowly returning to normal: An ‘incredible trend,’ economists say (nypost)

- The Great Concert Ticket Bust (businessinsider)

- US dollar to weaken, but Fed rate cuts are required, say strategists (streetinsider)

- Alibaba shows strong momentum during 618 shopping festival, as chairman Joe Tsai eyes return to double-digit revenue growth (scmp)

- Ford US sales soar in May, powered by hybrids (yahoo)

- PayPal and Oracle are new top picks at Mizuho (streetinsider)

- Intel CEO Takes Aim at Nvidia in Fight for AI Chip Dominance (bloomberg)

- The Dollar Is at Its Strongest Since the 1980s. Can It Last? (wsj)

- Short Sellers in Danger of Extinction After Crushing Stock Gains (bloomberg)

- VF Corp. Replaces North Face President with Former Fashion Exec, Adds Two Board Members (outdoorretailer)

- China needs to inject US$276b into property market to stabilise prices: Goldman (scmp)

- Hong Kong stocks rise amid bets of stability in China property, US rate cut hopes (scmp)

- Chinese exporters anticipate strong performance on new growth drivers (cn)

- Fundstrat’s Tom Lee: S&P 500 will rise 4% to 5,500 by the end of June (CNBC)

- Hong Kong stocks jump by most in 3 weeks as Alibaba, Tencent gain on economic data boost (scmp)

- Hedge fund short sellers burnt by flurry of UK takeover bids (ft)

- A ‘pick and mix’ stock market has emerged thanks to higher interest rates, says Goldman Sachs (marketwatch)

- 10-year Treasury yield extends decline after U.S. job-openings data (marketwatch)

- US Job Openings Fall in Broad Cooldown (bloomberg)

- Treasuries Gain as JOLTS Spurs Faster Fed-Cut Bets (bloomberg)

- Intel unveils new AI chips as it seeks to reclaim market share from Nvidia and AMD (cnbc)

- After Years of Turbulence, the Cruise Lines Are Sailing Under Blue Skies (barrons)

- Logistics Operators Are Looking to Break the Sector’s IPO Logjam (wsj)

- BofA investment chief reveals his 2nd-half playbook: Buy dips in bonds, and sell stocks after the first rate cut (businessinsider)

- How Billionaires Bought 70% of Detroit’s Offices and Transformed the City (bloomberg)

- Ed Yardeni: We’re still in the early stages of a bull market (cnbc)

- Retail Earnings Season Is Done. Here Are 5 Big Takeaways. (barrons)

- China Caixin PMI Signals Faster Manufacturing Growth in Contrast to Official Gauge (wsj)

- Joe Tsai on Why Alibaba is All In on AI (alizila)

- <Research>BABA-SW Forecasts to Finish Dual Primary Listing at End-Aug; M Stanley Expects Southbound Inclusion in Sep Soonest (aastocks)

- China Needs Much More Central Government Debt, Key Adviser Says (bloomberg)

- OPEC+ Agrees to Extend Production Cuts in Bid to Boost Oil Prices (wsj)

- The U.S. Gave Chip Makers Billions. Now Comes the Hard Part. (wsj)

- Hong Kong stocks rally lead by Alibaba, Tencent after factory index surges (scmp)

- The Market Is Packed with ‘Pain Trades.’ How to Avoid Getting Hurt. (barrons)

- BofA Says Drop in US Tech Could Be Next Pain Trade for Equities (bloomberg)

- Corporations Learned The Maximum Amount They Can Charge For a Product (bloomberg)

- Lots More on the Troubled NYC Office Buildings Everyone’s Talking About (bloomberg)

- The Big Read. The transformative potential of computerised brain implants (ft)

- How the US Electricity Grid Squeezes Out Nuclear Power (bloomberg)

- How Online Sports Bettors Actually Make Their Money (bloomberg)

- Introduction to Probability and Statistics (mit)

- Using anecdotes to predict recessions (npr)

- Will Siri Become More Like ChatGPT? All Eyes on Apple’s WWDC (cnet)

- 14 Free Online Tools You Should Know About (gizmodo)

- 10 best Alfred Hitchcock movies, ranked (digitaltrends)

- How Does the European Union Work? (cfr)

- Don’t Believe the AI Hype (project-syndicate)

- From Mille Miglia to Mexico, these Ferraris battled with motorsport’s best (classicdriver)

- Rockefeller’s Giant Lives On. Energy Industry Mergers Are Resurrecting Standard Oil. (barrons)

- Stocks are up but investor behavior is ‘fragile.’ Is the bull market still in its early stages? (marketwatch)

- Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money (bloomberg)

- China Ramps Up Warning On Bond-Buying Frenzy With PBOC Selling in Focus (zerohedge)