Skip to content

Intel Betting on AI Well Beyond Data Centers (wsj )

Alibaba signs David Beckham as AliExpress global ambassador (technode )

Companies Counter Pushback on Price Increases With Promotions (nytimes )

Masters in Business: Jeffrey Sherman (bloomberg )

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders (bloomberg )

Inside Kevin Costner’s $38 Million Horizon Gamble (gq )

S&P Downgrades France Credit Rating to AA- (tradingeconomics )

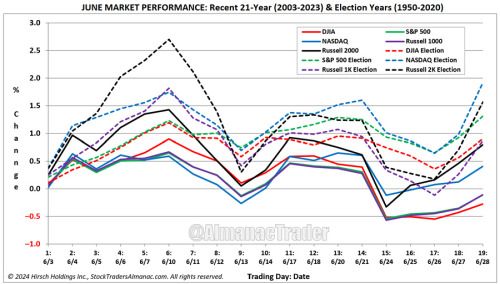

June Better in Election Years: Average Gains Range from 0.9% DJIA to 1.9% NASDAQ (almanactrader )

Let there be gamma (ft )

Dr Pepper Ties Pepsi as America’s No. 2 Soda (wsj )

We Drove a Trio of Classic Ferraris, and Now They’re up for Grabs (robbreport )

The 5 Most Exciting New Restaurant Openings of May (robbreport )

Carl Icahn reportedly owns sizable stake in Caesars, sending shares soaring (nypost )

VF Corp. Is Hiring Former Lululemon Product Chief. Analysts Are Upbeat. (barrons )

Boeing Executives Unlikely to Be Charged for 737 Max Crashes (bloomberg )

Disney Is Banking On Sequels to Help Get Pixar Back on Track (bloomberg )

Why you should buy the dip in stocks before next week’s jobs report, Fundstrat says (businessinsider )

Nvidia Stock Falls. What Dell’s Earnings Mean for the Chip Maker. (barrons )

The Chips Act Is Working. Why a Big Investor Is Bullish on U.S. Production. (barrons )

Nike Stock Is at a Crucial Moment. A Comeback Hangs in the Balance. (barrons )

Where to Find 7% Yields on Preferred Stock (barrons )

Don’t fear the PCE. The recent market dip leaves stocks more likely to rally in coming days (marketwatch )

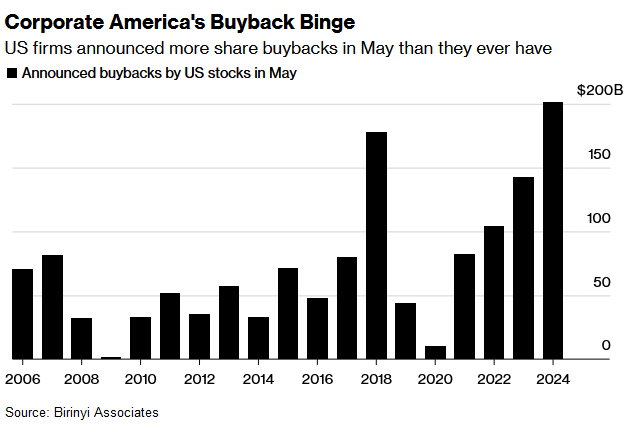

Buybacks Reach $201 Billion, a Record for May, Data Show (bloomberg )

Our U.S. summer natural gas consumption forecast for electric power matches 2023 record (eia )

VF Corporation Appoints Sun Choe (from lululemon) as Global Brand President, Vans® (vfc )

The FAA Has a Boeing Update. It’s Good News. (barrons )

New York Fed’s Williams Sees 2% Inflation in 2025, Soft Landing Ahead (barrons )

Nvidia Stock Drops. CEO Jensen Huang Heads to Taiwan. (barrons )

US Is Slowing AI Chip Exports to Middle East by Nvidia, AMD (bloomberg )

What’s a Carry Trade Again? And When Is It Not a Moneymaker? (bloomberg )

What Are Block Trades? Why Are They in the Spotlight? (bloomberg )

Tokyo Inflation Picks Up, Keeping BOJ on Track for Rate Hike (bloomberg )

Warning Signals Are Flashing for Homeowners in Texas and Florida (bloomberg )

US Malls Avoid Death Spiral With Help of Japanese Video Arcades (bloomberg )

SpaceX Weighs Plan to Sell Shares at $200 Billion Valuation (bloomberg )

3 signs the housing market’s affordability recession is finally ending (businessinsider )

Ads will help Amazon’s retail margins hit new highs: BofA (streetinsider )

10 Life Lessons From Warren Buffett Everyone in Their 20s Should Hear (247wallst )

Warren Buffett Says He Knows In ‘5 Minutes’ If An Investment Is Worth It (yahoo )

Alibaba e-commerce unit’s latest executive reshuffle sees veterans retire as younger leaders take over (scmp )

Semiconductor International Corporation Rallies on 3 Nanometer Chip News (chinalastnight )

BABA-SW Plans to Pay Div. for FY24 in Jul (aastocks )

PayPal’s stock packs nearly 50% upside, a renewed bull says. Here’s why. (marketwatch )

‘Father of emerging markets’ Mark Mobius turns bullish on China stock as property measures restore confidence (scmp )

Container throughput at China’s ports up 9 pct in January-April (cn )

IMF ups China’s 2024 GDP growth forecast to 5 pct (cn )

The Rise in Consumers’ Late Debt Payments Is Slowing Down (wsj )

This Record Stock Market Is Riding on Questionable AI Assumptions (wsj )

You Can Thank Private Equity for That Enormous Doctor’s Bill (wsj )

Money Supply Rose for the First Time in More Than a Year. What That Signals for the Economy. (barrons )

Warren Buffett Is a Big Fan of Shareholder Equity. 10 Companies With the Most. (barrons )

The S&P 500 may be overbought, but most of its stocks are not (marketwatch )

Blackstone executive says commercial real estate is bottoming (marketwatch )

The South Park jinx could be coming for high-flying weight-loss stocks (businessinsider )

US Pending Home Sales Plunged To Record Lows In April As Rates Rose (zerohedge )

Richard Li States Strong Confidence in HK Economy (aastocks )

High Interest Rates Are Working, Fed’s Williams Says (bloomberg )

Fed’s Williams expects inflation to cool in the second half of the year (marketwatch )

Alibaba expands AI portfolio with US$27 million start-up investment (scmp )

Why This Legendary Value Manager Likes Alphabet and Citigroup Stock (barrons )

Fed Rate Cuts Are Coming. Get Ready for the Stock Market’s Next Phase. (barrons )

Cruise Stocks Are Steaming Ahead. It Isn’t Too Late to Jump Aboard. (barrons )

Chewy Stock Gains After Earnings. Autoship Sales Are Strong. (barrons )

Hedge funds sell out of U.S. cyclical stocks at fastest rate this year (marketwatch )

Activist Investor Irenic Builds Stake in Forward Air (wsj )

Consumer confidence rebounds for first time in 3 months (finance.yahoo )

Yen May Ironically Get Help From The Fed Of All Places (zerohedge )

A ‘robust’ earnings outlook is driving further optimism for stocks in 2024 (finance.yahoo )

IMF raises China growth forecast but warns on industrial policy (ft )

In China’s Tech Sphere, Everything Eventually Descends Into a Price War (bloomberg )

ECB member says rates to ease ‘gradually,’ as market awaits June cut (cnbc )

How China Pulled So Far Ahead on Industrial Policy (nytimes )

PayPal Is Planning an Ad Business Using Data on Its Millions of Shoppers (wsj )

China, Hong Kong stock markets are back in favour with global investors, HKEX CEO Bonnie Chan says (scmp )

CPC leadership reviews measures to further energize central region, provisions to defuse financial risks (cn )

China’s Xi Pledges to Make Youth Employment a Top Priority (bloomberg )

U.S. consumer confidence rebounds in May after three months of decline (marketwatch )

Home prices reach new high in March, Case-Shiller says, fueled by scarcity (marketwatch )

This Wall Street Shake-Up Will Put Money in Your Hands Faster (barrons )

UBS leapfrogs UBS with new S&P 500 price target (marketwatch )

Apple iPhone Shipments In China Rebound 52%, Market Share Loss To Huawei May Be Stabilizing (zerohedge )

7 Biases That Can Cloud Investors’ Judgment About Finances (barrons )

New Rules for Buying a Home Are Coming. A Guide to Getting the Best Deal. (barrons )

China Raises $48 Billion for Semiconductor Fund to Bolster Chip-Making Capabilities (wsj )

Hate Chatbots? You Aren’t the Only One (wsj )

How to Have a Great Vacation: What Science Tells Us (wsj )

Bullish Investors Are Piling Into Stock and Bond Funds (wsj )

Bankruptcies Have Left More Stores Vacant, but the Space Doesn’t Sit Empty for Long (wsj )

AI Is Driving ‘the Next Industrial Revolution.’ Wall Street Is Cashing In. (wsj )

San Francisco’s Hot Tourist Attraction: Driverless Cars (nytimes )

The small town life beckons for many as Americans continue to flee big cities (usatoday )

Hedge Funds Split Over Stocks’ Move From Here (zerohedge )

Guangzhou Follows Shanghai Real Estate Policy (chinalastnight )

Western businesses backtrack on their Russia exit plans (ft )

What’s Andy Jassy’s Best Business Advantage? A Positive Attitude (inc )

Alibaba News Roundup: Alibaba Raises $4.5B Via Convertible Bonds; Alibaba Cloud Partners with Olympic Broadcasting Services (alizila )

Alibaba Cloud Expands Data Center Network and Global Gen AI Offerings (alizila )

Explore our latest Top 100 Courses in the World ranking (golf )

How the world’s best memorizers remember things (fastcompany )

The Curse is Broken, Charles Leclerc Wins the Monaco Grand Prix (roadandtrack )

I analyzed 1,353 shots from Scottie Scheffler’s historic streak—these are the secrets to his success (golfdigest )

The Best Cars That Still Offer a Manual Transmission in 2024, Ranked (roadandtrack )

Google Set to Make Its Largest Acquisition Ever, Threatening Microsoft (gizmodo )

For AI to Deliver on Its Promises, People Need to Trust It (cnet )

Google scrambles to manually remove weird AI answers in search (theverge )

5 best Netflix comedy movies you should watch on Memorial Day (digitaltrends )

Darshan Shah’s KPIs for Healthy Aging (ypo )

With AI, anyone can be a coder now (ted )

An activist investor on challenging the status quo (ted )

How Red Lobster got cooked and other indicators (npr )

How Horsepower Works (howstuffworks )

Spy Slang: 24 Top Secret Terms You Should Know (mentalfloss )

The Origins of All 32 NHL Team Names (mentalfloss )

Nuclear Energy’s Bottom Line (theatlantic )

The Man Who Moves Markets (theatlantic )

Don’t Believe the AI Hype (project-syndicate )

Why the US Can’t Win the Trade War With China (project-syndicate )

Surfing the American Dream (slate )

Something Just Flipped in the Credit Market for the First Time Since 2020 (bloomberg )

4 Predictions for What Happens If TikTok Gets Banned in the U.S., According to a Harvard Business School Professor (inc )

Here are the companies OpenAI has made deals with to train ChatGPT (fastcompany )

The Hidden Driver of Soaring Home Insurance Costs (wsj )

US equity funds see massive weekly inflows on rate cut expectations (reuters )

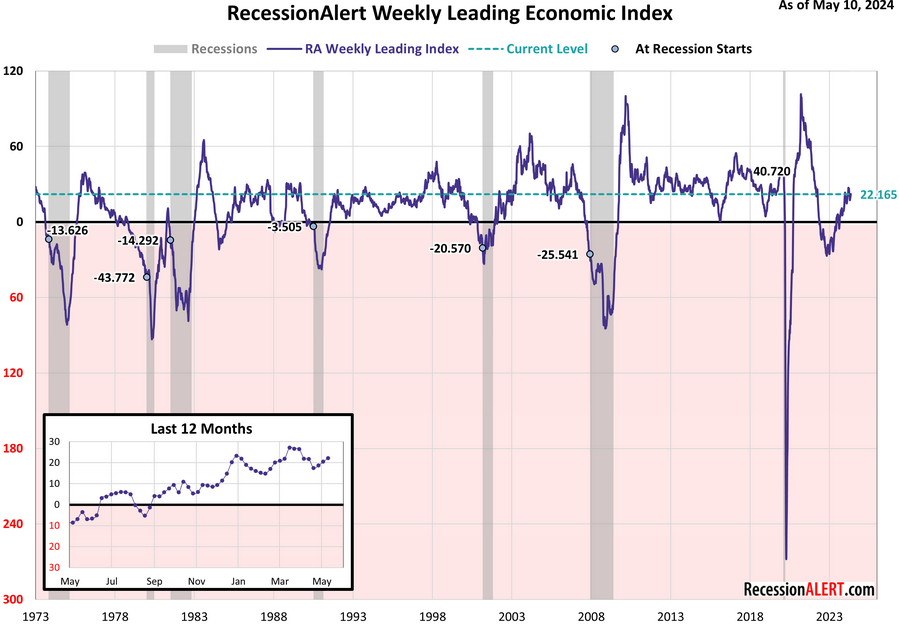

Weekly Leading Economic Index (advisorperspectives )

Banks don’t want to inspect your home office, so they’re forcing hundreds of employees to come in five days a week (fortune )

Could drugs like Ozempic and Wegovy help people live longer? Some experts see them as potential longevity pills (fortune )

Can the rich world escape its baby crisis? (economist )

AI tutors are quietly changing how kids in the US study, and the leading apps are from China (techcrunch )

‘Luck is what happens when preparation meets opportunity.’ (psyche )

The ECB May Beat the Fed to Cutting Rates. Here Are the Risks. (barrons )

Cancer Biotech Stocks Are on the Move Ahead of a Big Event. What to Know. (barrons )

Warner Bros. Discovery Exec Bought Up the ‘Undervalued’ Stock (barrons )

In early May, Stellantis unveiled the new sales program for dealers, which provides cash awards for hitting aggressive monthly targets. (wsj )

Bearish Trades Crater Fast in Wall Street’s High-Momentum Rally (bloomberg )

Nvidia ‘seems bubbly’ because it won’t be able to maintain its dominant market share, investing legend Rob Arnott says (businessinsider )

‘‘I told the guy that if he reads Security Analysis [by Benjamin Graham and David Dodd] and The Intelligent Investor [by Benjamin Graham] and then reads all of Warren Buffett’s annual reports, and if he really understands what they were saying, he will know everything there is to know about investing.’’ (Bill Miller )

Benetti Superyachts Are Favored by Everyone From Jay-Z To James Bond (maxim )

How The Ferrari 250 GTO Became The World’s Most Valuable Production Car (maxim )

This N.Y.C. Steakhouse Is America’s Best, According To Meaty New Rankings (maxim )

Joe Tsai and Eddie Wu’s 2024 Letter to Shareholders (alizila )

Alibaba’s convertible bond sale to fund buy-backs ‘oversubscribed’ (scmp )

Alibaba raises $5bn for share buybacks (ft )

JPMorgan is ‘positive’ on China stocks and ‘constructive’ on its real estate (cnbc )

BofA’s Hartnett Says Stock Rally Is Moving Closer to Sell Signal (bloomberg )

“Looking beyond to the next 4-6 quarters, we believe a decline in demand for Nvidia compute is inevitable, as model providers shift toward focusing on driving computational efficiency and their largest customers…all develop their own silicon,” Luria wrote in a research note. (barrons )

Hello Nvidia, Goodbye Intel? What the AI Stock’s Split Could Mean for the Dow. (barrons )

Do companies’ stocks tend to outperform after they are removed from the Dow Jones index? (ai )

Cathie Wood sees a Great Depression-like search for safety in the stock market (marketwatch )

Home builders are slashing prices to lure home buyers, but it may not be enough (marketwatch )

Treasury Bills Are the Best Place to Park Your Cash. Just Ask Warren Buffett. (barrons )

SEC Widens Accessibility of Crypto Investing With Approval of ETFs for Ether (wsj )

How Singapore Got Rich, and Can It Last (bloomberg )

Carry Trade Is All the Rage Across Global Bond and FX Markets (bloomberg )

Rate Cuts Will Trigger Flood of Bond Buying, PGIM Says (bloomberg )

Goldman Axes Bet on July Fed Rate Cut (bloomberg )

A Hedge-Fund Volatility Trade Risks Getting Crushed by the Crowd (bloomberg )

Reuben Brothers Bet on $2 Billion Puerto Rico Development (bloomberg )

Lululemon Shares at Bottom of S&P 500 as Sales Concerns Grow (bloomberg )

A global labor shortage will send tech stocks soaring, with the sector poised to grow to 50% of the total stock market, Fundstrat says (businessinsider )

Sam Altman’s time as the golden child of tech might be coming to an end (businessinsider )

China’s Second Special Ultra-Long Bond Sale Sees Solid Demand (bloomberg )

This is how stock splits are performing 12 months after announcement (streetinsider )

China’s mutual funds top record with US$4.1 trillion invested (scmp )

Chinese sovereign bond trading suspended after frantic retail buying (ft )