Skip to content

Alibaba has spoken with investment banks about selling bonds that can be converted into US-listed stock, the people said, asking not to be identified discussing private information. The aim is to fund share repurchases and growth, the people said. (yahoo )

Alibaba bets on AI to fuel cloud growth as it expands globally to catch up with U.S. tech giants (cnbc )

Washington’s Pivot on Bank Rules Could Free Up Tens of Billions (wsj )

Retail-investor stock appetite has not yet fully recovered (marketwatch )

One of the biggest U.S. lenders is offering 0%-down-payment mortgages for first-time home buyers. Here’s the catch. (marketwatch )

Jobless claims fall again to 215,000. Strong labor market fuels U.S. economy. (marketwatch )

Xi urges hard work to improve people’s well-being (cn )

Ford (F) new Buy at Bernstein amid ‘clear path to significant operating leverage’ (streetinsider )

Fed Minutes Show Officials Were Wary About Inflation at May Meeting (nytimes )

The race for an AI-powered personal assistant (ft )

Nvidia Is Booming. Here’s What Could Slow It Down. (wsj )

Hims & Hers Is Selling Copycat Weight-Loss Drugs. Here’s How. (barrons )

Carmakers Dangle Big Discounts as Inventory Swells (bloomberg )

JPMorgan says China can’t be ignored: ‘You have to do business there’ (cnbc )

Pfizer aims to save $1.5 billion by 2027 in first wave of new cost cuts (cnbc )

Elon Musk predicts smarter-than-humans AI in 2 years. The CEO of China’s Baidu says it’s 10 years away (cnbc )

This Is What Hedge And Mutual Funds Did In Q1: Goldman’s HF and MF Monitors (zerohedge )

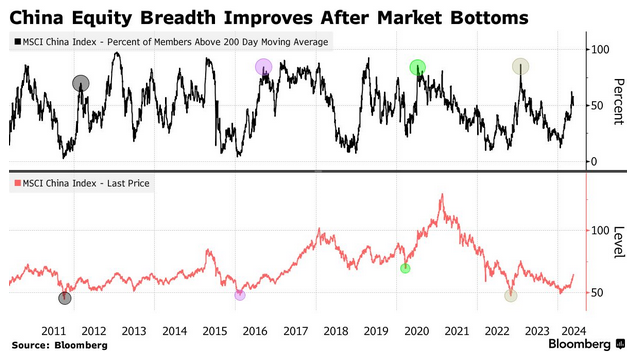

China’s Improving Market Breadth Is Good News for Stock Bulls (bloomberg )

China’s online retail sales up 11.5 pct in January-April period (cn )

China’s 618 shopping festival: Alibaba touts early sales after withholding data last year, a sign of brighter outlook (scmp )

China’s property stimulus bazooka fuels instant rebound in sentiment as inquiries, home sales in Shanghai, Beijing jump (scmp )

China stock rally far from over as Beijing doles out stimulus: Alpine Macro (streetinsider )

Hedge Funds Trim Big Tech Exposure in Hunt for Other AI Winners (bloomberg )

The SEC’s T+1 settlement rule will transform stock trading: Here’s what you need to know. (marketwatch )

Risky Bonds Join Everything Rally (wsj )

The Highest Paid CEOs of 2023 (wsj )

Biogen to Pay Up to $1.8 Billion for Immune Drug Developer (bloomberg )

The last bear on Wall Street: Why JPMorgan’s Marko Kolanovic is sticking by his forecast for a 20% market sell-off (businessinsider )

‘Not a good sign:’ Lululemon (LULU) stock down after CPO departs (streetinsider )

A tidal wave of cash is headed for markets post-Nvidia results, this strategist argues. (marketwatch )

Several Chinese cities slash down payments, mortgage rates to boost property demand (yahoo )

Meta AI chief says large language models will not reach human intelligence (ft )

Japan’s 10-year yield tops 1% for first time in 11 years (ft )

Time to Pounce: 2 Ultra-High-Yield S&P 500 Dividend Stocks That Are Screaming Buys Right Now (fool )

BABA-SW Pumps US$230M into Lazada (aastocks )

Chinese premier stresses financial support for real economy (cn )

It’s not your imagination. Pickleball courts are everywhere (cnbc )

Intel Set to Launch AI-Centric Processors Meeting Microsoft Standards by Q3 2024 (elblog )

Vans’ New Sneaker Is a Beautiful Slip-on Skate Shoe Hybrid (highsnobiety )

Goldman Says Equity Investors Bracing for Return of Volatility (bloomberg )

The Fed Still Needs a Few Months of Good Data to Cut Rates, Says a Governor (barrons )

Microsoft’s Week of AI Starts With News About PCs (barrons )

ChatGPT Has Competition. How Google’s Gemini Compares. (barrons )

Can Artificial Intelligence Make the PC Cool Again? (nytimes )

Many Quit Weight-Loss Drugs Too Early for Benefits, Insurer Says (bloomberg )

The $367,000 Ferrari 296 GTS Hybrid Joins the Great Car Hall of Fame (bloomberg )

Quantum Computing Gets Real: It Could Even Shorten Your Airport Connection (wsj )

Wall Street’s biggest bear flips, raises S&P 500 price target by 20% (yahoo )

Deck Maker’s $450 Million Bet on America’s Renovation Boom (wsj )

Alibaba Shares Rise as Investors Grow Confident in Long-Term Outlook (wsj )

‘Dumb Money’ Loses $13.1 Billion In Latest GameStop Stock Mania (investors )

Chinese stocks see ‘golden cross’ in latest sign rally could continue (marketwatch )

<Research>G Sachs Raises 12-Mth Target of MSCI China Index to 70 pts, CSI 300 to 4,100 pts (aastocks )

BABA’s Taobao Tmall ‘618’ To Offer RMB200B Rapid Repayment Quota to Merchants (aastocks )

Will China’s plan for housing buys help smooth the road to economic recovery? (scmp )

China’s capital markets set for ‘renewed growth for many years to come’ after Beijing’s rescue actions: investors (scmp )

Florida’s 125% Surge in Property-Insurance Bills Sows Havoc (bloomberg )

Opinion: Corporate insiders at these companies are telling us that consumers are cruising (marketwatch )

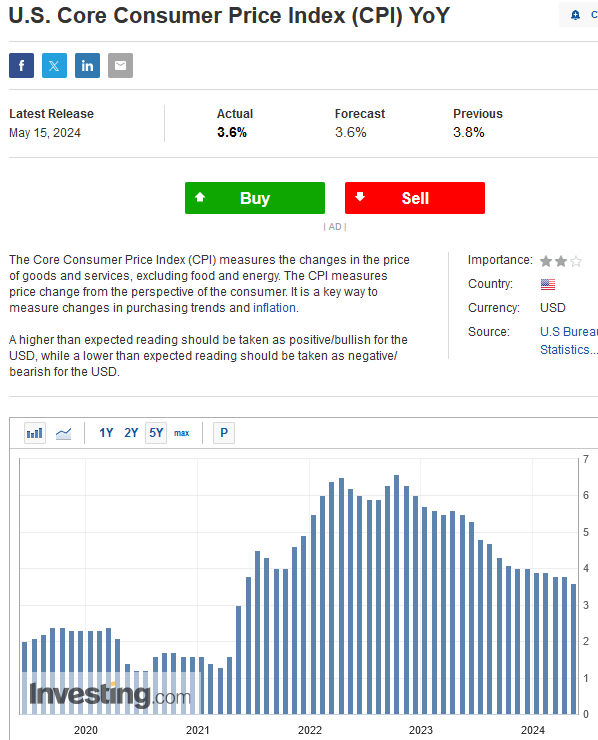

Dollar rally falters as falling inflation raises hopes of rate cuts (ft )

S&P Profit Recovery Revs Up on Big Tech and Strong Consumer (bloomberg )

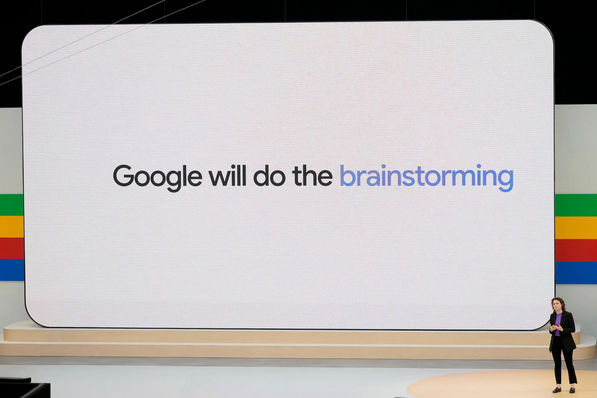

Google Is Hitting Back in the AI Race. Travel Could See the First Big Change. (barrons )

AI companies seek big profits from ‘small’ language models (ft )

The PBOC (“Big Momma”) Releases Real Estate Policy Bazooka, Week in Review (chinalastnight )

China abolishes mortgage floor rates, cuts minimum down payment ratios to boost property market (cn )

How Spirit AeroSystems fits into Boeing’s rebound plan (cnbc )

Can Google Give A.I. Answers Without Breaking the Web? (nytimes )

BlackRock’s Rieder: Federal Reserve Rate Cuts Needed to Tame Inflation (cnbc )

Companies are leaning into opportunity in China (cnbc )

China’s industrial output up 6.7 pct in April (cn )

3 Reasons to Buy Alphabet Stock Like There’s No Tomorrow (fool )

Buy Nestlé Stock. Despair Is Turning to Hope. (barrons )

A Cheap Dividend Aristocrat to Buy Before It Bounces Back (morningstar )

Weekly Leading Economic Index (advisorperspectives )

Inside Disney’s Hunt to Replace Bob Iger as CEO: Bibbidi Bobbidi Who Will It Be? (vanityfair )

Alibaba sees steady revenue increase, GMV and order numbers on Taobao and Tmall return to double-digit growth track (technode )

AI creates level playing field, can provide most people with equal opportunities, says Sundar Pichai (firstpost )

The highs and lows of US rents (npr )

Google Puts AI in Its Search Engine (inc )

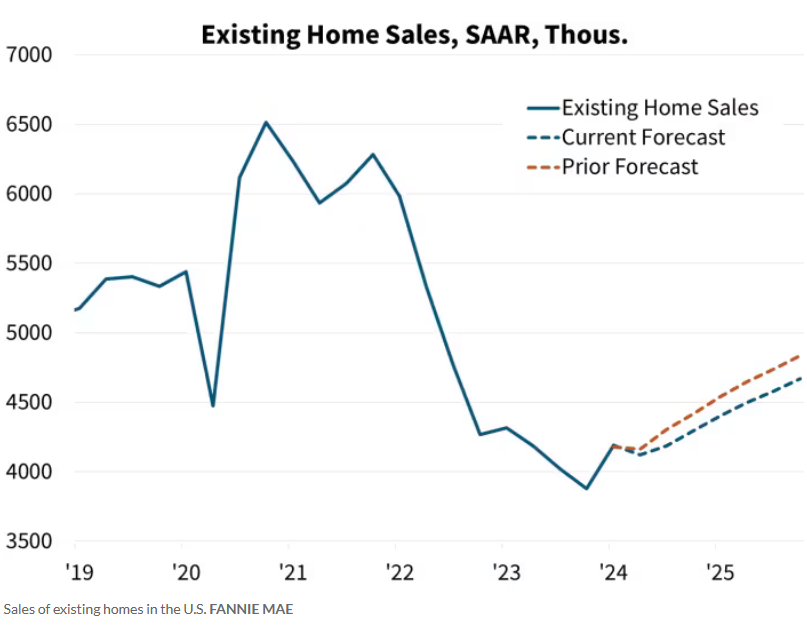

Charts with a message (scottgrannis )

Alibaba Back on Growth Track with GMV Up Double Digits, Extra Dividend to Shareholders (alizila )

Alibaba Overhauls Taobao Website Ahead of Revamped 6.18 Sale (alizila )

Chinese vice-premier calls on cities to buy back residential land, unsold homes (scmp )

China’s e-commerce market still has ‘ample room’ for growth: JPMorgan analyst (scmp )

Emerging-Market Stocks Are Breaking Out, and Could Beat the S&P 500 From Here (barrons )

China Attempts to End Property Crisis With Broad Rescue Package (bloomberg )

Vietnam’s Economy Is Humming. 3 Growth Stocks to Play. (barrons )

Utilities Are Meant to Be Sleepy. They’re the New Growth Stocks. (barrons )

Is PayPal a Millionaire Maker? (yahoo )

China Is Finally Getting Serious About a Housing Rescue (wsj )

Walgreens and CVS Are Trying to Fix America’s Flailing Pharmacies (bloomberg )

David Tepper Scoops Up Alibaba as Hedge Funds Hunt for Bargains in China (bloomberg )

PBOC Earmarks $42 Billion for State Buying of Unsold Homes (bloomberg )

Intel Inside Ohio (bloomberg )

Canada Goose jumps 16% after the company reports growth surge in China (cnbc )

China just unveiled the strongest remedies yet for its troubled housing market (businessinsider )

Openwashing (nytimes )

Alibaba rallies to 7-mth high as ‘Big Short’ investor Burry increases stake (streetinsider )

After bumping S&P 500 target, BMO is also turning more bullish on Canada (streetinsider )

Canada Goose Beats Estimates on China Strength; Shares Surge (bloomberg )

David Tepper’s Appaloosa is betting big on Chinese tech stocks (cnbc )

Alibaba’s Hong Kong primary listing plan can open the doors to China’s 210 million investors (scmp )

Buy 3M Stock. Analyst Sees a ‘Turning Point’ (barrons )

<Research>BofAS Raises BABA-SW (09988.HK) TP to $101, Rating Buy (aastocks )

More Companies Are Selling Shares to Help Cut Debt (bloomberg )

Warren Buffett’s Top Q1 Stock Buys And Sells; Berkshire’s ‘Mystery’ Bet Revealed (investors )

There Are Signs of Cooling Everywhere. It Isn’t Just Inflation. (barrons )

Bond King Bill Gross Isn’t Into Bonds Anymore. What’s He Buying Instead. (barrons )

Here’s what Druckenmiller did as he sold Nvidia — it’s a risky bet on an unloved asset (marketwatch )

Cisco Stock Jumps on Earnings. What Drove the Beat. (barrons )

Inflation Eases as Core Prices Post Smallest Increase Since 2021 (wsj )

Florida and Texas Show Signs of Home Prices Falling (wsj )

Walmart Sales Surge as Wealthier Shoppers Flock to Retailer (bloomberg )

Auto incentives are back (cnbc )

How Google CEO Sundar Pichai shook up his leadership team for the AI era (businessinsider )

BMO raises S&P 500 price target to 5600 (streetinsider )

UBS sees two Fed cuts in 2024, yields falling below 4% (streetinsider )

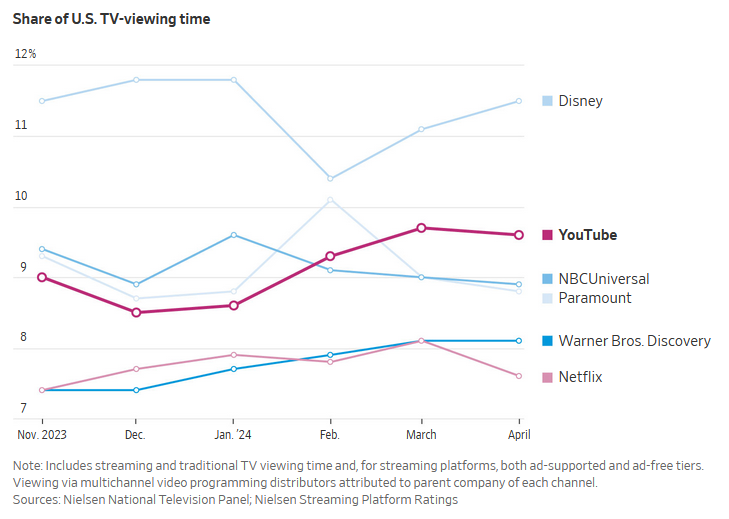

Bob Iger says Disney is ‘dramatically’ cutting investment in traditional TV (yahoo )

Michael Burry Adds Stake in JD.com (JD.US) and Alibaba (BABA.US) During 1Q (aastocks )

China’s cross-border e-commerce accelerates (peoplesdaily )

China property shares jump on report of government plans to buy unsold homes (reuters )

Yen Escapes Intervention Zone Helped by Decline in US Yields (bloomberg )

Japan’s Shrinking Economy Hints at Stagflationary Risk (bloomberg )

China to Discuss Property Aid With Banks, Regulators on Friday (bloomberg )

China’s First Special Bond Issuance Likely to See Solid Demand (bloomberg )

PDD’s Temu shopping app hit with EU consumer rights complaint (scmp )

Big global investors reap rewards as they stay the course in Chinese blue chips (scmp )

Alibaba’s Hong Kong primary listing can be magnet for China’s 210 million investors (scmp )

Softer US Inflation, Retail Data Offer Fed Some Leeway (bloomberg )

China Considers Government Buying of Unsold Homes to Save Property Market (bloomberg )

Alibaba, Tencent beat forecasts with strong results, a harbinger of China’s improving corporate earnings as economic growth takes root (scmp )

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market (zerohedge )

JPMorgan’s Jamie Dimon Calls For ‘Full Engagement’ With China (bloomberg )

Google’s I/O Event Kicks Off With Promise of More AI (barrons )

The Super Rich Are Eating Out, but Families Aren’t. Restaurants Are Starving. (marketwatch )

Is it worth it to own Treasurys right now? These 5 charts might hold the answer. (marketwatch )

Amazon Gets New Cloud-Computing Boss as AI Battle Shakes Up Its Top Profit Engine (wsj )

He Quit Wall Street to Coach Ivy League Tennis—and Built a Columbia Powerhouse (wsj )

How China Rose to Lead the World in Cars and Solar Panels (nytimes )

Why Is Car Insurance So Expensive? (nytimes )

Cramer: Ford and GM are winners after Biden raises tariffs on Chinese imports (cnbc )

The S&P 500 just flashed a bullish signal that suggests the stock market will hit record highs this summer (businessinsider )

AI Is Electrifying These Power Producers’ Shares (wsj )

NYCB’s loan sale to JPM praised as ‘important first step’ in turnaround (marketwatch )

Traders Ramp Up Bets in Options Market on Large ECB Rate Cuts (bloomberg )

PBOC Rolls Over Policy Loan With Growth, Currency on Mind (bloomberg )

Dollar hits one-month low against euro before US data, falls vs yen (streetinsider )

OpenAI co-founder and chief scientist Ilya Sutskever departs (ft )

Brazilian government ousts Petrobras chief after dispute over dividends (ft )

China’s Alibaba beats quarterly revenue estimates (up 7% yoy), profit drops primarily due to valuation changes from equity investments (reuters )

Alibaba sees most profitable year since 2021 amid a refocus on e-commerce, AI businesses and rising competition at home (scmp )

Alibaba sees AI traction. “During the quarter, our core public cloud offerings, which include products such as elastic compute, database and AI products, recorded double-digit year-over-year growth in revenue,” Alibaba said. Alibaba’s board of directors has approved a dividend consisting of two parts. This includes an annual cash dividend of $1.00 per ADS and a “one-time extraordinary cash dividend” of 66 cents per ADS. (marketwatch )

BofA Strategist Hartnett Warns Stock Rally Is Exposed to Stagflation Risk (bloomberg )

BofA’s Moynihan Talks US Economy, Lending and M&A (bloomberg )

BABA-SW (09988.HK) Expects to Finish Conversion to Dual Primary Listing in HK by End-Aug 2024 (aastocks )

Alphabet to spotlight AI innovations at developer conference (reuters )

The Fed Depends on Data but Numbers Are Getting Shakier. That’s a Problem. (barrons )

Berkshire Hathaway’s Mystery Stock Purchase Could Be Revealed on Wednesday (barrons )

Wholesale inflation surges again, PPI shows. Takeaway: Inflation remains sticky. (marketwatch )

Money managers are more bullish than at any point since November 2021, survey shows (marketwatch )

Temu Cools on the U.S. After Shelling Out Billions (wsj )

What’s on TV? For Many Americans, It’s Now YouTube (wsj )

Investors Crowd Into Soft-Landing Trade Ahead of Crucial Inflation Data (wsj )

The UK Is No Longer the Most Hated Market (bloomberg )

Israel’s Once-Dominant Drugmaker Is Revived by Innovation (wsj )