Skip to content

- China fires starting gun on $140bn debt sale to boost economy (ft)

- How Alibaba is leading the evolution of online luxury shopping (scmp)

- 1 Growth Stock Down 75% to Buy Right Now (fool)

- China to Start $138 Billion Bond Sale on Friday to Boost Economy (bloomberg)

- Japan Will Likely Restart World’s Biggest Nuclear Plant This Year, BNEF Says (bloomberg)

- Temu Cools on the U.S. After Shelling Out Billions (wsj)

- Japan on track to normalise monetary policy, says ruling party heavyweight (reuters)

- China Takes Advantage of Cheap Gas and Coal to Rebuild Stocks (bloomberg)

- Intel Nears Deal With Apollo for $11 Billion Ireland Partnership (wsj)

- 3 Reasons to Buy GXO Logistics Stock Now (fool)

- Wall Street Turns Up the Heat on Companies to Perform (wsj)

- Investors Crowd Into Soft-Landing Trade Ahead of Inflation Data (wsj)

- Suddenly There Aren’t Enough Babies. The Whole World Is Alarmed. (wsj)

- Wall Street Turns Up the Heat on Companies to Perform (wsj)

- The Secret to Talking to an AI Chatbot (wsj)

- How AI Has Already Begun to Change These Workers’ Jobs (wsj)

- Will AI Be a Job Killer? Call Us Skeptical (wsj)

- A Beginner’s Guide to Using AI: Your First 10 Hours (wsj)

- Why You Need to Tell an AI Chatbot It Has to Do Better (wsj)

- April CPI: Goldman Sachs expects in-line inflation figures (streetinsider)

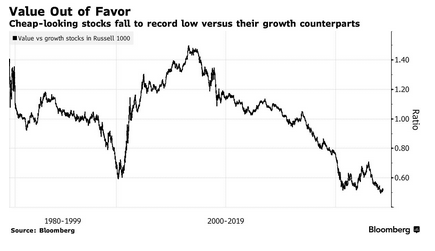

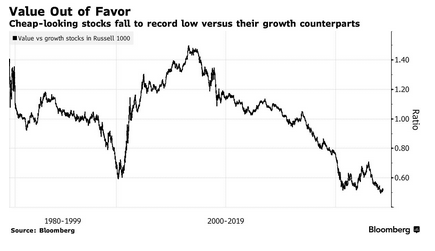

- GS: Unprofitable growth stocks to remain under pressure from higher interest rates (streetinsider)

- China, Hong Kong enhance Swap Connect scheme in time for its 1st birthday, easing access to mainland interbank derivatives (scmp)

- Hong Kong stocks: index hits 9-month highs, tops 19,000 on earnings optimism and policy support hopes (scmp)

- Can Europe’s economy ever hope to rival the US again? (ft)

- US and China to hold first talks to reduce risk of AI ‘miscalculation’ (ft)

- Hong Kong, mainland China tax waivers a ‘win-win’ for capital markets’ development, experts say (scmp)

- Meredith Whitney Advisory Group CEO: Proposed mortgage reform is a ‘massive game changer’ (cnbc)

- PayPal Business Cashback Mastercard review — Helpful perks with a simple rewards program (yahoo)

- One stock is dragging down the S&P 500’s earnings growth (yahoo)

- China’s visa-free policy ignites European enthusiasm, enhances exchanges (peoplesdaily)

- Alibaba leverages cloud business to become a leading AI investor in China (UNLOCKED LINK) (financialtimes)

- Alibaba Cloud’s Qwen LLM Tops 90,000 Enterprise Clients in First Year (alizila)

- Alphabet Bought Up Two Slumping Stocks (barrons)

- Stubbornly High Rents Prevent Fed From Finishing Inflation Fight (wsj)

- China to Nurture Stock Rally (bloomberg)

- Magic Pill — Johann Hari and the New “Miracle” Weight-Loss Drugs (timferriss)

- Charlie Munger and How Not to Invest (morningstar)

- Undervalued by 28%, This Stock Is a Buy for Patient Investors (morningstar)

- The 10 Best Dividend Stocks (morningstar)

- Will Japanese Yen Currency Rally From 40-Year Support? (kimblechartingsolutions)

- Zombie 2nd mortgages are coming back to life (npr)

- Living With the McLaren F1 (roadandtrack)

- Design Analysis – Why the Ferrari Testarossa became a superstar of the 1980s (classicdriver)

- China’s consumer prices rise for third month, signaling demand recovery (cnbc)

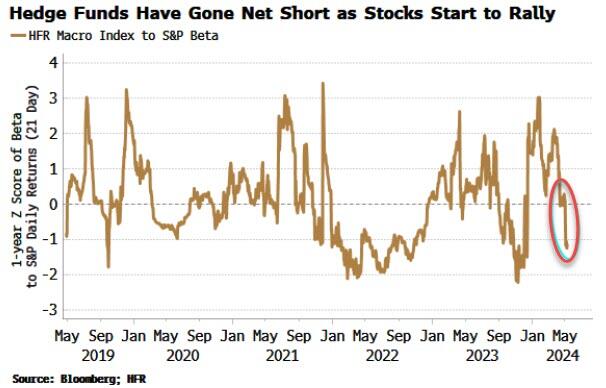

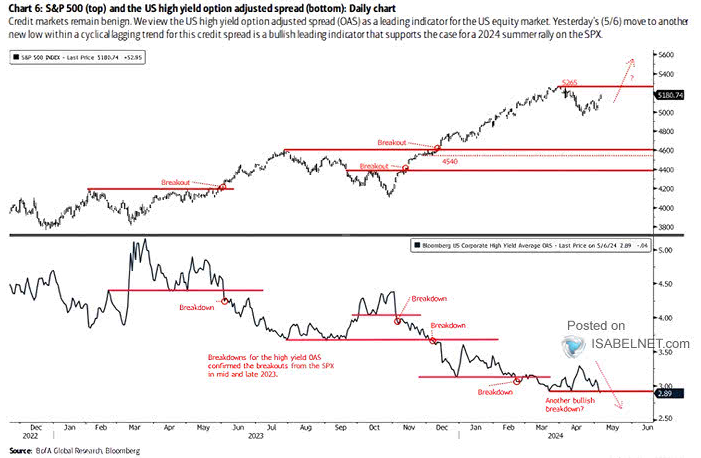

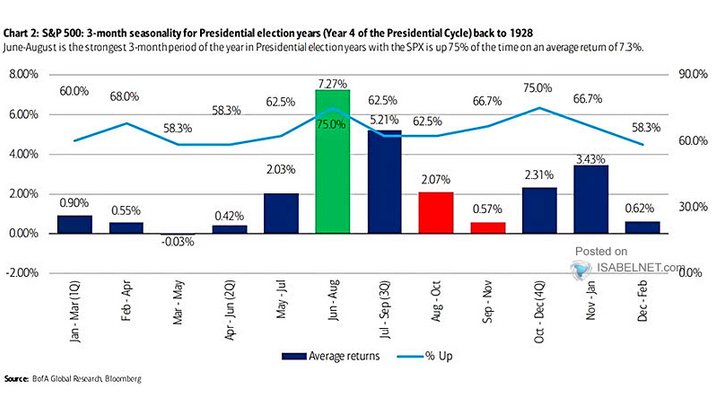

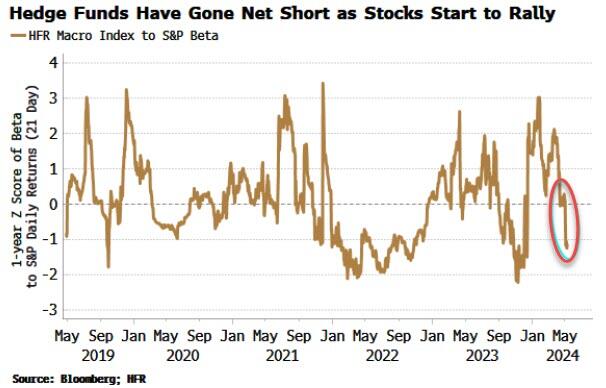

- Hedge Funds That Sold In May Might Now Push Stocks To New Highs (zerohedge)

- Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg)

- The ‘Fed Put’ Is Back, and That’s Great News for the Stock Market (barrons)

- Why Warren Buffett Hates Bonds (barrons)

- A Struggling Pfizer Looks for Help From a Wall Streeter (barrons)

- He Rebuilt Morgan Stanley. Now He’s Buying Disney Stock. (barrons)

- Life on the Edge: A Guide to the Newest Frontier in Computing (barrons)

- Howard Schultz Is Back-Seat Driving Starbucks. That’s a Problem for His Successor. (wsj)

- Jim Simons, billionaire hedge fund manager, math whiz and philanthropist, dies at 86 (nypost)

- The history of the iconic Lamborghini logo and badge (com)

- Apple Nears Deal With OpenAI to Put ChatGPT on iPhone (bloomberg)

- Consumer sentiment tumbles (cnbc)

- China’s Country Garden repays onshore coupons within grace period (yahoo)

- Generative AI Productivity Gains Will Come (institutionalinvestor)

- China tech is seeking growth in the Middle East (ft)

- Disney’s streaming success could point to next chief (ft)

- Hong Kong Gains, Zeekr Lists In US, Week in Review (chinalastnight)

- Earnings will make new record highs over the next few quarters, says Ed Yardeni (cnbc)

- Pininfarina Is Now Selling Bruce Wayne-Inspired Electric Hypercars (maxim)

- Alibaba says its AI models are used by 90,000 corporate clients in China (scmp)

- 3M Is Leaner and Ready to Grow. It’s Time to Buy the Stock. (barrons)

- China Property Stocks Surge as Home-Buying Easing Gains Momentum (bloomberg)

- PBOC May Trade Bonds to Shake Off Reliance on Banks, ANZ Says (bloomberg)

- Hong Kong Stocks Power to Nine-Month High on Dividends, Property (bloomberg)

- Public Companies Are Alive and Well (wsj)

- Profits Are Booming—and That’s Shielding the Economy (wsj)

- Buybacks Are Back: Corporate America Is on a Spending Spree (wsj)

- Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg)

- The Dow Is a Terrible Index. But It Is Telling Us Something Important. (wsj)

- UK exits recession with fastest growth in nearly three years (reuters)

- Stocks Haven’t Had an Earnings Boost. Why It Will Come. (barrons)

- Small-Caps Are Stuck. How They Get Moving Again. (barrons)

- The surprising reason why utilities stocks have suddenly transformed into the hottest sector on Wall Street (marketwatch)

- Where does China’s production capacity come from? (peoplesdaily)

- Valuation levels for Chinese stocks are attractive, says Kinger Lau (cnbc)

- Fed’s Bostic says economy likely slowing, though rate-cut timing uncertain (reuters)

- Alibaba opens new global headquarters in China on annual family day (scmp)

- The US can do one big thing to weaken the dollar and put pressure on China (businessinsider)

- Why China’s tolerance for a cheaper currency may be temporary (reuters)

- Loonie Surges After Canada Job Gains Blow Past Expectations (yahoo)

- What should the BoJ do with its huge stock portfolio? (ft)

- BOJ’s policy board becoming more concerned about effects of a weaker yen (marketwatch)

- China’s imports jump 8.4% in April, exceeding expectations as purchases from the U.S. grow (cnbc)

- Three overlooked stocks from a Spanish quant: ‘Now is not a time everyone is going to win.’ (marketwatch)

- UK’s FTSE 100 Outperforms in Europe as BOE Fuels Rate-Cut Bets (bloomberg)

- The Fed Is in a Holding Pattern. That Could Be Good for Stocks. (barrons)

- China’s foreign trade up 5.7 pct in first four months (peoplesdaily)

- China Mulls Dividend Tax Waiver on Hong Kong Stocks Connect (bloomberg)

- Hong Kong’s New Home Sales Hit Record High of $5.4 Billion (bloomberg)

- Chinese stocks hit 2024 highs on more property support, positive trade data (streetinsider)

- Solventum Reports Earnings. There Will Be No Dividend. (barrons)

- New Hertz CEO Bets $1 Million on the Battered Stock (barrons)

- Weekly jobless claims jump to 231,000, the highest since August (cnbc)

- Bruins-Panthers Game 2 ends in violence as David Pastrnak, Matthew Tkachuk fight during huge brawl: ‘Not afraid of him’ (nypost)

- ‘Seriously Underwater’ Home Mortgages Tick Up Across the US (bloomberg)

- Disney and Warner to Offer Bundle of Their Streaming Services (wsj)

- China rally hasn’t been chased by options traders, Bank of America says (marketwatch)

- Regional Bank Stocks Are Hated Again. It’s Time to Buy. (barrons)

- Media Mogul Byron Allen: This is just a speed bump for Disney, ‘Bob Iger is the best of the best’ (cnbc)

- The Fed has to cut because the economy is running out of gas, says Jim Cramer (cnbc)

- Stock buybacks hit highest level since 2018 (yahoo)

- Teva Pharmaceutical’s stock climbs as schizophrenia treatment shows promise (marketwatch)

- Billions in Chips Grants Are Expected to Fuel Industry Growth, Report Finds (nytimes)

- Celebrities pay this NYC man big bucks to get them reservations at exclusive eateries (foxbusiness)

- US 30-Year Mortgage Rate Falls for First Time Since March (bloomberg)

- Intel flags revenue hit as U.S. revokes certain export licenses to Chinese customer (reuters)

- Ledecky’s 800m gold medal hopes boosted as McIntosh opts out (reuters)

- Chinese firms’ earnings to rebound amid a pickup in the economy: UBS (scmp)

- Alibaba seeks growth in Mongolia with marketplace selling Chinese goods (scmp)

- These are the potential ‘shock’ scenarios around next week’s inflation data, says Goldman Sachs (marketwatch)

- Sweden becomes second major central bank to cut rates (marketwatch)

- Bond King Bill Gross to Bond Funds: Drop Dead (barrons)

- 3 Restaurant Stocks That Are Vying to Be the Next Chipotle (barrons)

- Rents Set to Be Last Domino to Fall in Global Inflation Battle (bloomberg)

- Cooper Standard Reports Continuing Year-over-year Margin Improvement in First Quarter 2024, Sees Upside to Full-year Guidance (cooperstandard)

- China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+ (cnbc)

- 10-year Treasury yield heads for fifth day of declines after buyers emerge (marketwatch)

- Einhorn Says Markets Are ‘Broken.’ Here’s What the Data Shows. (bloomberg)

- Overseas institutions encouraged to invest in domestic tech companies (peoplesdaily)

- Chevron CEO says natural gas demand will outpace expectations on data center electricity needs (cnbc)

- Why Disney Stock Is Down After Earnings Topped Estimates (barrons)

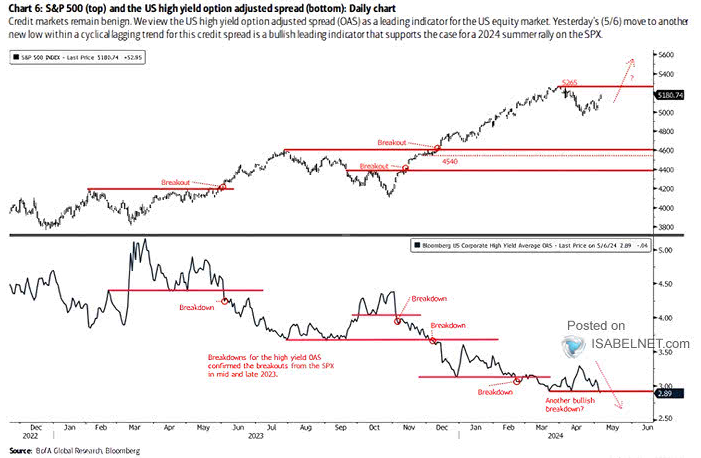

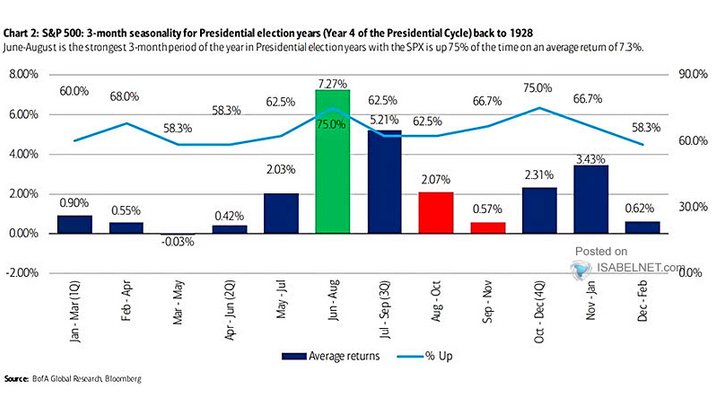

- The Stock Market Is Recovering. Why It Could Keep Gaining. (barrons)

- Pfizer Is Adding a Wall Street Analyst to Its C-Suite. What He Thinks the Company Needs to Do. (barrons)

- American Wagyu Is Drawing in a New Breed of Investors as Demand Grows (barrons)

- ‘Green Shoots’ Grow Out of Control on Wall Street (wsj)

- Buy stocks in May because inflation is set to plunge through the rest of 2024, Fundstrat’s Tom Lee says (businessinsider)

- The streaming future Disney promised is finally here as cable TV decays (cnbc)

- 3M Cut Its Dividend: It’s Time to Buy the Stock (yahoo)

- Disney CFO Hugh Johnston on Q2 results, strength of consumer and streaming growth (cnbc)

- A Rising Yen Is Good for Stocks. Here’s Why. (barrons)

- China’s stock market has staged a big rebound that’s poised to push on, strategist says (businessinsider)

- Slower Hiring Boosts Hopes of a Late-Summer Rate Cut (wsj)

- Full recap of Warren Buffett’s comments at the Berkshire Hathaway annual meeting: ‘I hope I come next year’ (cnbc)

- Warren Buffett says Berkshire Hathaway is looking at an investment in Canada (cnbc)

- Former CEO Howard Schultz says Starbucks needs to overhaul its customer experience (marketwatch)

- Boeing’s Starliner set for historic launch that will take two NASA astronauts into space (marketwatch)

- ECB rate cut case getting stronger, says chief economist Lane (reuters)

- Foxconn sees record April sales with 19% jump, offers positive Q2 outlook (scmp)

- China Stocks’ Rally Can Sustain for a Bit, Goldman Sachs Says (bloomberg)

- Warren Buffett pays tribute to Charlie Munger on a ‘tough day’ for shareholders (finance.yahoo)

- AI Engineers Say They’re Burning Out as Bosses Whiplash From One Desperate Idea to Another (futurism)

- Alibaba Cloud brings AI video generator EMO to Tongyi Qianwen app (technode)

- Robert Kiyosaki’s Track Record on Predicting Stock Market Crashes (usnews)

- bruce wayne inspires automobili pininfarina in ‘gotham’ and ‘dark night’ electric hypercars (designboom)

- You Probably Won’t Ever Play In The NHL, Unless You’re Born In This Weird Strip Of Land (digg)

- U.S. Dollar Peaking… As Momentum Indicator Reaches Historic High! (kimblecharting)

- The Most Important Skill of the Future is Being ‘Indistractable’ (nirandfar)

- The walls of Apple’s garden are tumbling down (theverge)

- Not too hot, not too cold: a ‘Goldilocks’ jobs report (npr)

- How the Super Rich Are Developing Their Own Real Estate Markets (bloomberg)

- 40 Lessons From Michael Dell’s Extraordinary Career (inc)

- Buffett talks succession plan, pays tribute to Munger at annual meeting (foxbusiness)

- Bandon Dunes at 25: The groundbreaking Oregon resort keeps getting bigger (and better) (golf)

- The Ferrari 12Cilindri is the Daytona’s V12 spiritual successor (classicdriver)

- How Crazy Would It Be If Warren Buffett Bought Boeing? (bloomberg)

- Treasury yields see biggest weekly drops in months as tepid April jobs report raises rate-cut hopes (marketwatch)

- Warren Buffett takes the stage at Berkshire Hathaway’s annual meeting: Live updates ()cnbc)

- What Will Warren Buffett Bet on Next? (nytimes)

- NYC is having a thrilling steakhouse boom — and these are the three best steaks (nypost)

- Berkshire Hathaway’s cash pile hits new record as Buffett dumps stocks (ft)

- Berkshire after Buffett: is Greg Abel up to the top job? (ft)

- The US could give homeowners a $980 billion stimulus at no additional cost (businessinsider)

- Why Banks These Days Are So Excited About Being Boring (bloomberg)

- Intel CEO Pat Gelsinger Picks Up Stock Near 2024 Low (barrons)