Skip to content

image: NYTimes

Asian Currencies Set for Best Week in Two Months on Intervention (bloomberg )

Carry Trades Wobble as Yen Swings Roil One of Year’s Best Bets (bloomberg )

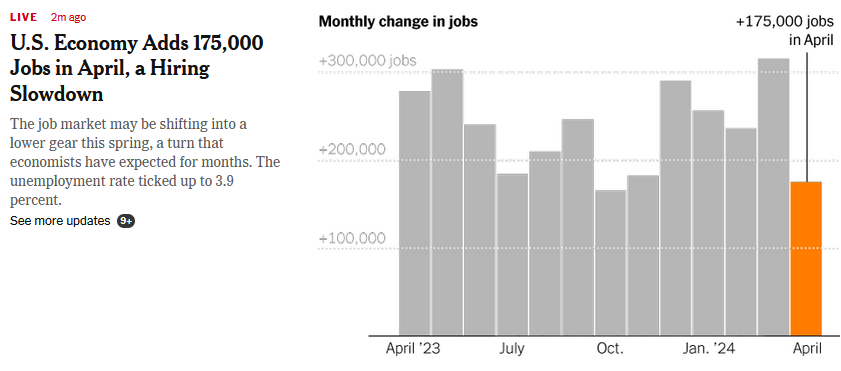

Average hourly earnings growth slipped below 4% (investors )

Apple Earnings Were a Relief. What the Street Says. (barrons )

Amgen Jumps on Obesity Drug Hope. What’s Next. (barrons )

Jobs Growth Slows More Than Expected in April (barrons )

XPO Stock Soars on Earnings Beat. The U.S. Freight Market Is Soft, Though. (barrons )

Online Marketplaces Like eBay, Etsy Are Counting on AI to Supercharge Shopping (wsj )

The Wealthy Are Refusing to Sell Their Luxury Homes (wsj )

Americans Went All-In on Self-Storage. That Demand Is Suddenly Cooling. (nytimes )

Yen Rally Takes Pressure Off Japan to Prop Up Battered Currency (bloomberg )

Most of Warren Buffett’s wealth was accumulated after age 65. Here’s what that can teach individual investors (cnbc )

The mortgage reform that could unleash the next big US stimulus (ft )

China Tech’s Stealth Rally Continues Unnoticed (chinalastnight )

Billionaire investor Mario Gabelli: Warren Buffett has created enormous wealth for his shareholders (cnbc )

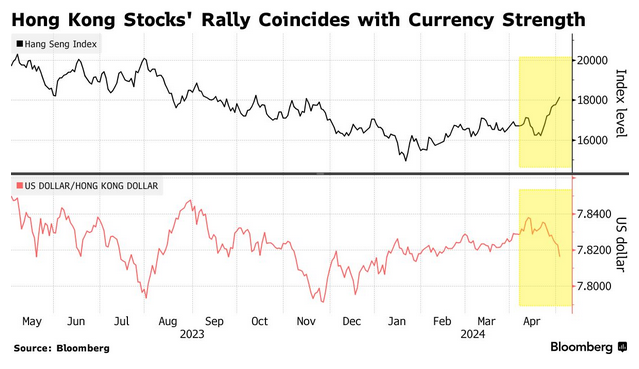

Hong Kong Stocks March Into Bull Market as Global Money Returns (bloomberg )

New stimulus is coming as Politburo pledges to cut housing inventory: analysts (scmp )

MGM Stock Rises as Wall Street Praises Earnings. There’s ‘Momentum in Macau.’ (barrons )

Third Point made ‘substantial investment’ in Alphabet as shares fell on Google’s Gemini fiasco (marketwatch )

Fed Chair Projects Optimism Despite Stubborn Inflation (wsj )

BorgWarner raises full-year 2024 adjusted profit outlook (reuters )

Intel Bets $28 Billion Comeback on High-Tech US Chip Designs (bloomberg )

Unforgiving Investors Want Bumper Earnings After Record Rally (bloomberg )

Japan Likely Spent About $23 Billion in Latest Yen Intervention (bloomberg )

Powell Keeps Rate Cuts on Table But Leaves Timing Less Certain (bloomberg )

Odd Lots: Duolingo CEO on the Power of AI Learning (bloomberg )

Apple’s Earnings Come With a Low Bar and Big Buyback Hopes (bloomberg )

Number of Chinese Tourists Traveling Overseas Jumps (bloomberg )

Hybrid Cars Are Surging in Popularity Over EVs. Here’s the Real Reason They’re So Popular. (barrons )

The Reign of Portland, Maine, as the Top U.S. Luxury Hot Spot Continues for Third-Straight Quarter (barrons )

Opinion: Mario Gabelli reveals his market-beating secrets and offers some favorite stock picks (marketwatch )

The Fed Will Be Stuck On Hold Until Something Gives (barrons )

Albemarle Beats Earnings Estimates. Investors Hope for a Commodity Trough. (barrons )

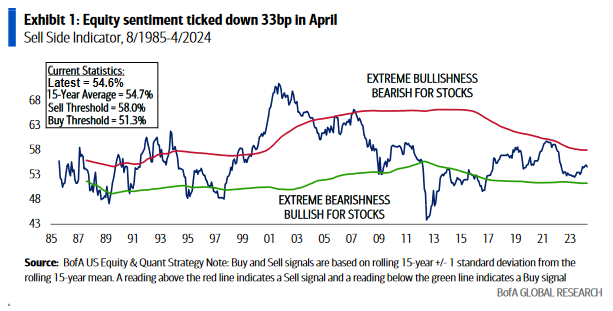

Why ‘sell in May and go away’ could be a bit premature for stocks, according to one chart (marketwatch )

Fed Says Inflation Progress Has Stalled and Extends Wait-and-See Rate Stance (wsj )

Amazon Gets More Fuel for AI Race (wsj )

Bored Ape Yacht Club NFTs sold for millions in 2021—prices have dropped 90% since then (cnbc )

Goldman Sachs still sees two rate cuts this year after Powell speech (streetinsider )

Berkshire after Buffett: the risk ‘genius’ pulling the insurance strings (ft )

There are ‘very favorable signs’ inflation will come down, says Wharton’s Jeremy Siegel (cnbc )

Chinese Stocks See Longest Foreign-Buying Streak in a Year (bloomberg )

Fed to Signal Delay of Interest-Rate Cuts (bloomberg )

NYCB’s Results Are Better Than Worst Fears After Rocky Quarter (bloomberg )

Intel’s Gelsinger Fights Ghosts of History as Well as Rivals Nvidia, AMD (bloomberg )

Beijing ends curbs on home ownership in outer districts to stimulate buying (scmp )

Amazon’s Twitch launches TikTok rival amid push to ban the Chinese app (scmp )

Berkshire after Buffett: can any stockpicker follow the Oracle? (ft )

Amazon Q1 results top estimates as cloud demand rides AI wave higher (streetinsider )

The Fed Certainly Won’t Cut Rates. Here’s What to Focus on Instead. (barrons )

Generac Holdings Inc. (GNRC) Q1 2024 Earnings: Surpasses Revenue Estimates and Demonstrates … (yahoo )

PayPal lifts 2024 profit forecast as spending stays resilient, margins improve (reuters )

PayPal’s stock climbs as company boosts its earnings forecast (marketwatch )

PayPal Earnings Pop 27% Under New Reporting Method. PayPal Stock Is Set To Break Out. (investors )

PayPal’s Payment Volume Rises in Beginning of ‘Transition Year’ (bloomberg )

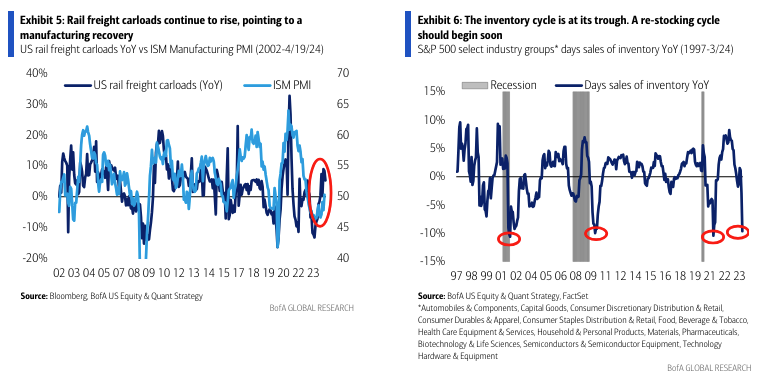

China Factory Activity Holds Up, Signaling Recovery Has Legs (bloomberg )

3M ‘Reset’ Its Dividend. Why Its Stock Is Soaring. (barrons )

BofA on China’s Recovery as Factory Activity Holds Up (bloomberg )

Beijing Further Loosens Home Buying Curbs in Non-Core Areas (bloomberg )

Goldman Says Funds Likely Selling Japan Stocks to Buy Hong Kong (bloomberg )

China Stock Rebound Driven by Earnings Growth: JPMorgan (bloomberg )

3M’s stock surges toward a 14-month high after profit, sales beat expectations (marketwatch )

China’s Leaders Hint at New Plan to Fix Biggest Drag on Economy (bloomberg )

Amazon Earnings Day Is Here. Focus On AWS, AI, and Advertising. (barrons )

Amazon Can Afford a Dividend. Its Earnings Will Underscore That. (barrons )

Fed to Signal It Has Stomach to Keep Rates High for Longer (WSJ )

Office-Loan Defaults Near Historic Levels With Billions on the Line (wsj )

The Yen’s Plunge and Dollar Devaluation (wsj )

China Hints at Rate Cuts, Property-Market Support (wsj )

China’s Leaders Hint at New Plan to Fix Biggest Drag on Economy (bloomberg )

McDonald’s Supersizes China Bet as Corporate America Pulls Back (wsj )

Buyers Are Back in Control as Luxury Home Sellers Slash Prices (wsj )

Bruins, Hurricanes, Avalanche, Canucks can clinch tonight: How to watch (usatoday )

China to Hold Delayed Party Conclave On Reform in July (bloomberg )

Molson Coors beats Q1 estimates on higher prices, strong demand (reuters )

China’s problem is excess savings, not too much capacity (ft )

Outlook ‘significantly brighter’ as Hong Kong attracts investors from US, Japan shares (scmp )

Hong Kong stocks round out biggest monthly gain since January 2023 (scmp )

Yen Rebounds Strongly After First Slide Past 160 Since 1990 (bloomberg )

Hong Kong stock index closes near bull market territory on earnings optimism (scmp )

Japan Intervenes After Yen Slides Against the Dollar (wsj )

The Fed Won’t Cut Rates This Week. Focus on Balance Sheet Plans. (barrons )

Cooper Standard Named a 2023 Supplier of the Year by General Motors (cooperstandard )

Air Conditioning and AI Are Demanding More of the World’s Power—Renewables Can’t Keep Up (wsj )

Alibaba’s Dingtalk Launches AI Agent Marketplace, Upgrades AI Assistant (alizila )

The Resort at Paws Up Is the Best Dude Ranch to Live Like a ‘Yellowstone’ Dutton (mensjournal )

Padre-Figlia combines every father’s two loves: his daughter and his Ferrari! (classicdriver )

Warming Up with Brooks Koepka (youtube )

M2 still points to lower inflation (scottgrannis )

Inside the China-US Competition for AI Experts (bloomberg )

The Scholar of Comedy (newyorker )

Tesla’s Musk Gets Self-Driving Approval in China (barrons )

Market needs to be ‘disabused’ of the expectation for two rate cuts this year, says Ed Yardeni (cnbc )

Chengdu scraps home purchase qualifications to support housing market (scmp )

Boeing Looks to Sell Bonds After Reporting Cash Burn (bloomberg )

Knight-Swift Is Hunting for Trucking Acquisitions (wsj )

Wall Street Has Spent Billions Buying Homes. A Crackdown Is Looming. (wsj )

What tech’s choppy action means for stocks this week, according to this 20-year analysis (marketwatch )

May Almanac: Historically Poor in Election Years (AlmanacTrader )

Even If the Fed Cuts, the Days of Ultralow Interest Rates Are Over (wsj )

Forget Moonshots. Investors Want Profit Now. (wsj )

She Owns Several Showstopping Cars. This Rare Ferrari Comes First. (wsj )

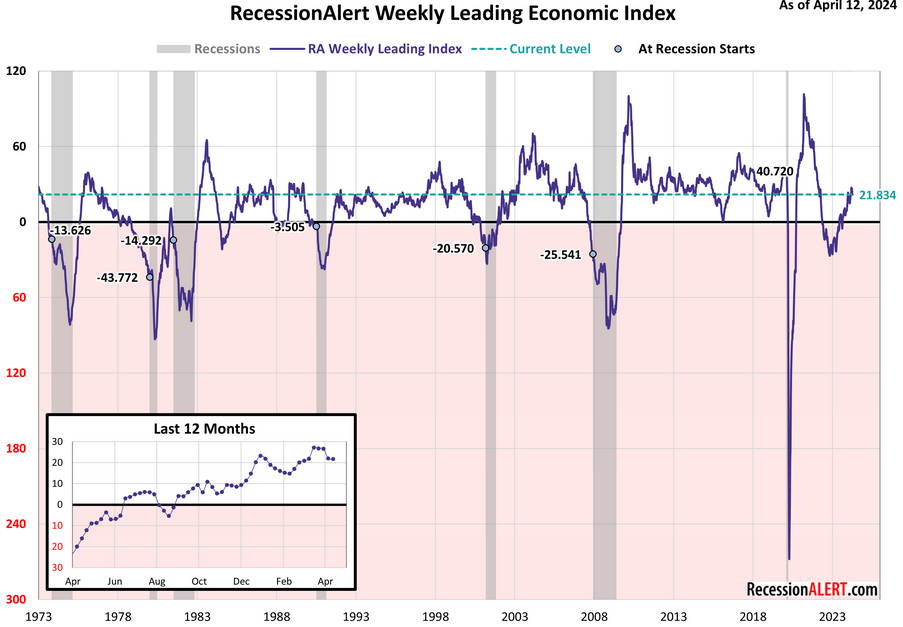

Weekly Leading Economic Index (advisorperspectives )

Boeing’s CEO search hits a roadblock—now an ‘insider/outsider’ who runs the planemaker’s biggest supplier is on the short list and near the top (fortune )

Wall Street finds a back door into the AI stock boom as energy demand soars: utilities (fortune )

Hennessey Performance Unveils 850-HP Cadillac Escalade-V (maxim )

This Stunning St. Lucia Resort Is Straight Out Of A James Bond Movie (maxim )

Alibaba Cloud brings AI video generator EMO to Tongyi Qianwen app (technode )

Emerging Market Bonds Are Catching Wall Street’s Eye. What the Attraction Is. (barrons )

Buy Enphase Energy Stock, Analyst Says. It’s Only Up From Here. (barrons )

Big Tech Is Spending Gazillions on AI. Earnings Offer a Peek. (barrons )

Warren Buffett or Not, Berkshire Hathaway Stock Is Built to Last (barrons )

Alphabet Closes Above $2 Trillion Market Cap for the First Time (barrons )

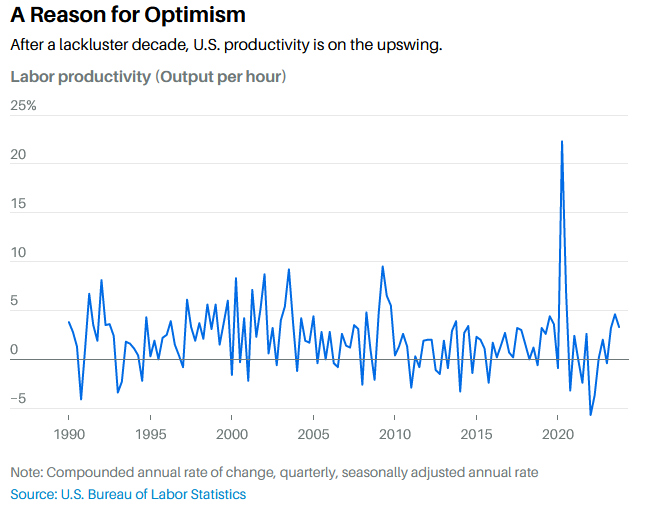

How a Chicken Sandwich Shows a Hidden Power in the U.S. Economy (barrons )

Kraft Heinz’s CEO Is a Health Nut. Can He Remake a Processed-Food Giant? (wsj )

Jamie Dimon starts every morning reading five newspapers — guess which he peruses first (nypost )

Florida real estate sellers slashing home prices as inventory surges to uncomfortable levels (nypost )

The UK Market May Have Found Its Catalyst (bloomberg )

Digital ad market is finally on the mend, bouncing back from the ‘dark days’ of 2022 (cnbc )

Ed Yardeni on Long-Term Bull Market (mib )

Intel CEO confident in its AI future after posting soft guidance (yahoo )

Newell’s stock rallies on revenue beat as it boosts margins and carries out restructuring plan (marketwatch )

S. natural gas-fired electricity generation consistently increased in 2022 and 2023 (eia )

The Thrill Factor Is Back for Retail Investors (wsj )

2 Wide-Moat Stocks Trading at Rare Discounts (morningstar )

10 Best Blue-Chip Stocks to Buy for the Long Term (morningstar )

Leon Cooperman, Hedge Fund Icon, Billionaire & Philanthropist (youtube )

Why The Four Seasons Anguilla Is Among The Caribbean’s Best Beach Resorts (maxim )

Treasury yields slip from 2024 highs even after Fed’s favored inflation report signals stalled progress (marketwatch )

Ant Group adds 14 foreign payment apps in access boost for Hong Kong merchants (scmp )

Hong Kong stocks hit 5-month peak after positive earnings surprises (scmp )

Global funds build ‘significant exposure’ to Chinese stocks in mood shift: HSBC (scmp )

Yellen confident U.S. inflation will continue to cool (marketwatch )

Treasuries Gain as Traders Find Relief in Key Inflation Readings (bloomberg )

High Borrowing Costs Have Some Democrats Urging Biden to Pressure the Fed (nytimes )

Microsoft Cloud Strength Drives March-Quarter Beat (investors )

How to Get a Meeting With the UAE’s $1.5 Trillion Man (bloomberg )

Alphabet’s Market Value Poised to Overtake Nvidia’s (barrons )

For Second City, Making People Laugh is a Serious Business (barrons )

Google Sales Accelerate as Ad, Cloud Businesses Hold Up Amid Costly AI Push (wsj )

Warren Buffett Built Berkshire. What Happens When He’s No Longer There? (barrons )

‘How Disney Built America’ Review: Mickey Mouse Mythology (wsj )

Microsoft Earnings Jump on AI Demand (wsj )

Pfizer Receives FDA Approval for Bleeding Disorder Treatment (barrons )

This isn’t ‘some brink’ for the U.S. consumer despite concerning economic data, says TCW (marketwatch )

After Friday’s inflation report, fed-funds futures show Fed rate cuts may begin in September (marketwatch )

San Francisco Buyers Bring Its Luxury Housing Market Back to Life (wsj )

The Dream of Fed Rate Cuts Is Slipping Away (wsj )

Alphabet’s Revenue Jumps 15% to $80.5 Billion (nytimes )

Billionaire ‘bond king’ Bill Gross tells investors to avoid tech and stick to value stocks (businessinsider )

Consumer sentiment weakens in late April, University of Michigan survey says (marketwatch )

EM Stocks on Track for Best Week Since July on US Tech Spillover (bloomberg )

Hong Kong stocks advance as fund positioning shows investors returning to China (scmp )

Charlie Munger Explained If You Want To Become Rich, Stop Trying To Be ‘Intelligent’ And Aim For ‘Not Stupid’ Instead (yahoo )

Alphabet Earnings: Ads and AI Are the 2 Things to Watch (barrons )

Intel Earnings Day Is Here. Better PC Demand Could Provide a Boost. (barrons )

Durable-goods orders get boost from autos and planes, but most manufacturers tread water (marketwatch )

S. GDP Growth Disappoints as Consumers Pull Back (barrons )

Opinion: U.S. dollar — and its No. 1 status — could become a casualty of economic war (marketwatch )

For Beaten-Down Maker of Alzheimer’s Drug, Good Enough Will Do (wsj )

Meta’s License to Spend on AI Gets Checked (wsj )

TSMC in race with Intel over who can make the world’s fastest chips (scmp )

Hermes Sees China Sales Jump, Defying Luxury Slowdown (bloomberg )

Bullish Boeing Analyst Says ‘Didn’t Expect Things To Start Falling Apart In Midair:’ ‘If They Get It Right, It’s An Incredible Opportunity’ (benzinga )

Japan feels inflation heat from Fed’s ‘higher for longer’ shift (ft )

David Einhorn Sees ‘Compelling Values’ in ‘Broken Market’ (institutionalinvestor )

Comcast Earnings Top Estimates on a Rise in Peacock Subscribers (barrons )

Royal Caribbean Earnings Tick All the Boxes. The Stock Is Sailing Higher. (barrons )

What Meta’s results may mean for Nvidia (marketwatch )

US Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes (bloomberg )

Why the AI Industry’s Thirst for New Data Centers Can’t Be Satisfied (wsj )

Billionaire investor Howard Marks says AI’s impact doesn’t make it immune to a crash (businessinsider )

Hong Kong’s Hang Seng hits 2024 high as traders warm to ‘un-investable’ China stocks (marketwatch )

Expect Citigroup stock to double by the end of 2026, says Wells Fargo’s Mike Mayo (cnbc )

Hong Kong stocks at five-month highs on corporate optimism as earnings pick up (scmp )

Boeing reports better-than-feared quarter, says supply chain is stabilizing amid 737 Max crisis (cnbc )

EV Woes Crushed This Lithium Stock. Now It Looks Ready to Rally. (barrons )

(Leo Liu) emphasised that Alibaba Cloud would not do price cuts at a loss, describing it as positive behaviour with promising feedback from customers. (aastocks )

Why China’s market slump is far from a crisis (ft )

China Tells Brokers to Limit Exposure to ‘Snowball’ Derivatives (bloomberg )

Tencent Shares Blow Past Magnificent Seven on China Tech Outlook (bloomberg )

Durable-goods orders get boost from autos and planes, but most manufacturers tread water (marketwatch )

“Bloomberg News is reporting that total Mainland China equity ETF buying by China’s sovereign wealth fund was at least $43 billion in Q1 2024 versus only $6.8 billion in the second half of 2023. The report does not touch on individual stock buying. Does this scenario sound familiar? Hopefully, Chinese stocks will follow the same path as Japanese stocks, i.e., higher!” (chinalastnight )

JPMorgan CEO Dimon says US economy is booming (reuters )

Biogen cost cuts drive profit beat, Alzheimer’s drug sales jump (yahoo )

Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes (bloomberg )

Mercedes’ Electric G-Class Plays It Safe Amid Slacking EV Sales (bloomberg )