- VF has plans to fix the Vans brand which lost its way more than a year ago (marketwatch)

- PayPal Earnings Beat. Payment Volume Edges By Estimates Amid Apple Worries (investors)

- ‘Well, it’s complicated’: PayPal shares fall 9% on flat profit outlook (streetinsider)

- Chinese equity flows turn positive as Beijing signals support (ft)

- Disney’s Epic Day: a Beat, a Payout Boost, and More (barrons)

- Disney’s new message of ‘urgency’ is resonating big time on Wall Street (marketwatch)

- Disney Turns to Taylor Swift, ‘Fortnite’ to Bolster Its Fortunes (wsj)

- Why Americans Are So Down on a Strong Economy (wsj)

- Investors Are Almost Always Wrong About the Fed (wsj)

- Super Bowl Ads Get More Star Power, More Candy (wsj)

- American CEOs Visiting China Can’t Escape It: They Have to Dance on Stage (wsj)

- Beijing is intensifying efforts to stem a painful slump in share prices (wsj)

- ‘Non, Merci Joe!’ – France Is (Was) The Biggest Importer Of US LNG (zerohedge)

- Why JPMorgan’s trading desk just reversed course and turned bullish on stocks (businessinsider)

- Market call: Chinese start-ups still crave US investors despite IPO challenges (scmp)

- Short-selling in China slumps to 3-year low after curbs imposed to lift market (scmp)

- Wynn Resorts beats profit estimates on improved Las Vegas, Macau performance (scmp)

- Google rebrands Bard chatbot as Gemini, rolls out paid subscription (reuters)

- Alibaba Beats On Bottom Line, Steps Up Buybacks (chinalastnight)

- China CPI inflation underwhelms in Jan, PPI sees limited improvement (streetinsider)

Category: What I’m Reading Today

Be in the know. 22 key reads for Wednesday…

- It’s halfway through earnings season. Tom Lee has four reasons results are better than they appear. (marketwatch)

- Alibaba Group Announces December Quarter 2023 Results (alibaba)

- Alibaba Q3 Revenue Beats Views As China’s Internet Giant Hikes Buyback Program By $25 Billion (IBD)

- Tom’s early take on BABA results (X)

- Chinese stocks showing signs of ‘capitulation’ as Wall Street analysts say bottom is in (marketwatch)

- China Replaces Top Markets Regulator as Xi Tries to End Rout (bloomberg)

- Disney Investors Seek Clarity on Elusive Streaming Profits (bloomberg)

- These Two Fifth Avenue Blocks Are at the Center of New York’s Retail Real Estate Revival (bloomberg)

- PayPal Earnings Are Here. Investors Need Evidence It Can Compete With Big Tech. (barrons)

- Commercial Real Estate Will Rebound, Including the Office Sector, Says Investor (barrons)

- New York Community Bank Was an ‘Outlier.’ Bank Stocks to Buy on the Dip. (barrons)

- Big Tech Is Expensive. Consider Buying These Value Stocks Instead. (barrons)

- PayPal Earnings Are Here. Investors Need Evidence It Can Compete With Big Tech. (barrons)

- Walt Disney, Fox, Warner Bros. Discovery to Team Up in Sports Streaming (barrons)

- Ford Could Get 50% More Profit Without EVs (wsj)

- Beijing Appoints Capital Markets Veteran As Regulatory Chief Amid Stock Meltdown (zerohedge)

- Who’s Who in the Battle Over Disney’s Board (wsj)

- Third Point Takes Large Stake in Alphabet (Again) (institutionalinvestor)

- New US-China economic exchanges show how status quo trumps substantive changes in ties, analysts say (scmp)

- Break Up Disney? Why the Latest Activist Proposal Could Be Good News for Disney Shareholders (fool)

- Amazon has the most ‘juice’ to the upside among Big Tech stocks, says Evercore ISI’s Mark Mahaney (cnbc)

- Why JPMorgan’s trading desk just reversed course and turned bullish on stocks (businessinsider)

VF Corp earnings will be covered in detail in this week’s note out tomorrow…

Be in the know. 15 key reads for Tuesday…

- Xi to Discuss China Stocks With Regulators as Rescue Bets Build (bloomberg)

- China Stocks Rebound as Beijing Intensifies Efforts to Stem Rout (bloomberg)

- Alphabet Gains Amid Fiber Plans, TSMC’s New Chip Plant and Other Tech News Today (barrons)

- Alibaba and Other China Stocks Surge. Beware of a Dead Cat Bounce. (barrons)

- Mahn Sees Upside for Stocks and Bonds (bloomberg)

- Alibaba Cloud To Keep Upgrading Product Performance & Services, Tightening Ties w/ Ecological Partners (aastocks)

- China market regulator’s rescue act seeks to guard financial and social stability (scmp)

- Toby Keith dies at age 62 (reuters)

- Chinese stocks surge as sovereign fund vows to buy more ETFs (streetinsider)

- China on cusp of next-generation chip production despite US curbs (ft)

- Western nations need a plan for when China floods the chip market (ft)

- The Big Read. How Huawei surprised the US with a cutting-edge chip made in China (ft)

- Why NYC Apartment Buildings Are on Sale Now for 50% Off (bloomberg)

- Blinken Meets Saudi Crown Prince on Mideast Push for Pause in Gaza War (nytimes)

- Why Is Big Tech Still Cutting Jobs? (nytimes)

Be in the know. 18 key reads for Monday…

- Estée Lauder stock soars toward best day in 13 years after earnings, job cuts (marketwatch)

- Falling US inflation opens door to rate cuts within months, says OECD (ft)

- Fed expects to make three rate cuts this year, says Powell (ft)

- Alibaba Cloud Advances Its Gen AI Capabilities with Serverless Solution (alizila)

- Alibaba’s Taobao and Tmall Group pushes new AI tools to support merchants (scmp)

- China Vows Plan to Attract Investment, Offers No New Detail (bloomberg)

- Powell Tells ‘60 Minutes’ Fed Is Wary of Cutting Rates Too Soon (bloomberg)

- China stocks rebound off five-year lows as stimulus comes into effect (cnbc)

- Powell: ‘Confidence Rising’ That Inflation Is Falling (barrons)

- Citigroup Fell Behind With Rich Customers. Can It Win Them Back? (wsj)

- China bets on open-source chips as US export controls mount (reuters)

- China Tightens Some Trading Restrictions for Domestic and Offshore Investors (bloomberg)

- 1 Magnificent Dividend Stock That’s Down 25% and Trading at a Once-in-a-Decade Valuation (fool)

- Alibaba’s DingTalk among Chinese apps launching on Apple Vision Pro (scmp)

- Fourth-quarter earnings are almost halfway done. Results overall have gotten better. (marketwatch)

- Powell Says Fed Has New Focus: When to Cut Rates (wsj)

- The College Professor Who Got a Weird Year for the Economy Right (wsj)

- Big Brands Are Playing the Long Game in China (wsj)

Be in the know. 22 key reads for Sunday…

- China Academic Calls for $1.4 Trillion Stock Stabilization Fund (bloomberg)

- Alphabet Stock’s a ‘Bargain’ in the Magnificent Seven, Says Analyst (barrons)

- Exclusive: Alibaba considers sale of consumer assets including Freshippo, RT-Mart – sources (reuters)

- Bringing Back The Balance Sheet (gavekal)

- US, UK Hit Dozens of Houthi Sites in Bid to End Ship Attacks (bloomberg)

- China to Prevent Abnormal Market Fluctuations, CSRC Says (bloomberg)

- The Rooftop Solar Industry Could Be on the Verge of Collapse (time)

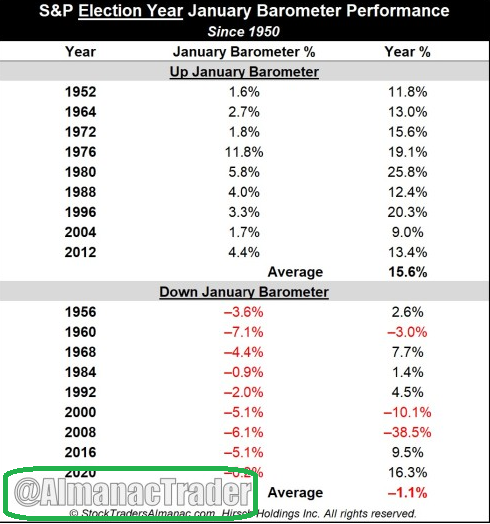

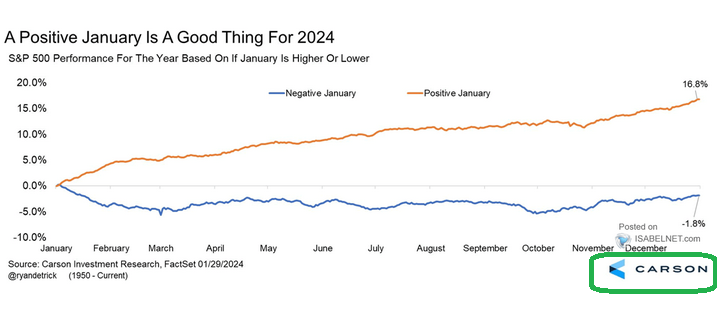

- Up January vs. Down January Beats All Months (AlmanacTrader)

- 2-Year Treasury Bond Yields Near Important Fibonacci Support! (kimblechartingsolutions)

- How Floatplanes Are Helping Elite Travelers Reach Remote Isles Off Florida and the Bahamas (robbreport)

- Ferrari Will Launch 3 New Cars in 2024 After Another Record-Breaking Year (robbreport)

- Apple Vision Pro review: the infinite desktop (techcrunch)

- Alibaba Cloud Advances Its Gen AI Capabilities with Serverless Solution (alizila)

- This Carbon Fiber ‘Superboat’ Is A Stylish Speed Demon (maxim)

- This Ultra-Rare Ferrari 250 Testa Rossa Just Sold For A Bonkers Price (maxim)

- The Man Who Moves Markets (theatlantic)

- Should You Invest in Stocks at All-Time Highs? (ofdollarsanddata)

- Tortured Jets Fans, NFL Fixes, and the 25-Year Run of ‘Curb Your Enthusiasm’ With Larry David (theringer)

- The Credit Market Is Quietly Booming Again (bloomberg)

- Kris Sidial on What’s Behind the Big Boom in Options Trading (bloomberg)

- The secret to hitting a push draw, according to a World No. 1 (golf)

- Pebble Beach history! Wyndham Clark blows away course record with stunning 12-under 60 (golfdigest)

Be in the know. 10 key reads for Saturday…

- Morgan Stanley’s Mike Wilson Leaving Firm’s Global Investment Committee (bloomberg)

- China’s Stocks Have Fallen for Three Years. Are They Finally Ready to Rally? (barrons)

- 10 of the Best Small-Cap Stocks to Buy Before They Rebound (morningstar)

- Opinion: Intel stock is not valued even close to its competition (marketwatch)

- Looking for the Next Great Value Stock? Don’t Start With the Price. Legendary Investor Bill Nygren Explains. (fool)

- Fundstrat’s Tom Lee: Stock market is getting stronger (cnbc)

- ‘Uninvestable’: China’s $2tn stock rout leaves investors scarred (ft)

- Why Tim Cook Is Going All In on the Apple Vision Pro (vanityfair)

- Banks on it Banksy painting that captures ‘raw energy’ of NYC could fetch $200K at auction (nypost)

- S. launches retaliatory strikes in Iraq, Syria, nearly 40 reported killed (cnbc)

Be in the know. 20 key reads for Friday…

- Amazon Stock Soars (barrons)

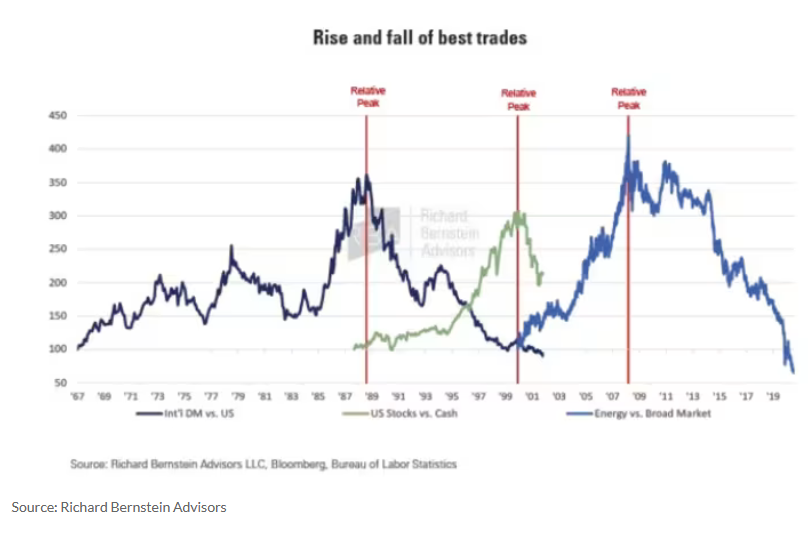

- The best trades of the last 50 years show what investors should do now (marketwatch)

- Wall Street is watching for a $10 billion domestic box office in 2026. Disney could get it there (cnbc)

- The Fed’s first rate cut won’t happen until June after surprisingly cautious guidance from the central bank, Bank of America says (businessinsider)

- More people than ever are upgrading their iPhones, and more on what we learned from Apple’s Q1 earnings (businessinsider)

- January Hiring Came in Strong With 353,000 Jobs Added (barrons)

- Commercial Real Estate Will Rebound, Including Office Sector, Says Investor (barrons)

- Brazil Is on a Roll. 5 Stocks to Play. (barrons)

- Bristol Myers New Drugs Drive Upbeat Outlook. The Stock Is On the Mend. (barrons)

- Amazon says the ‘magic words.’ They could spur a $100 billion market-cap boost. (marketwatch)

- Punxsutawney Phil predicts an early spring at Groundhog Day festivities (marketwatch)

- The GOAT of Formula One Is Set for Move to Ferrari (wsj)

- Apple Sales Rise in Holiday Quarter, Ending Streak of Declines (wsj)

- Donald Trump would not keep Jerome Powell, says Fed chair would ‘help the Democrats’ (nypost)

- Hermes Expands in Hong Kong Betting on Return of Luxury Shoppers (bloomberg)

- UMich Inflation Exp Slows, Sentiment Hits Highest Since 2021 (zerohedge)

- China and the U.S. Are Talking, but Their Détente Has Limits (nytimes)

- China needs to learn lessons from 1990s Japan (ft)

- Nvidia’s newly-tailored China chip to compete with rival Huawei product (scmp)

- Alibaba Spin-Off as PBOC Steps Up Real Estate Support (chinalastnight)

Be in the know. 24 key reads for Thursday…

- China Factory Activity Expands Again, Private Survey Shows (bloomberg)

- Canada Goose’s stock rockets after luxury outerwear company offers upbeat guidance (marketwatch)

- China pledges to stick with fiscal expansion to spur economy (reuters)

- Powell Navigates ‘Toxic’ Politics of Rate Cuts as Election Nears (wsj)

- Macau Casinos’ Revenue Climbs Ahead of Lunar New Year Holiday (bloomberg)

- Fed Signals Cuts Are Possible but Not Imminent as It Holds Rates Steady (wsj)

- It’s Amazon Earnings Day. 3 Things That Could Go Right. (barrons)

- Op-Ed: Two Wrongs on China Tariffs Certainly Don’t Make a Right (barrons)

- Teva Plans to Divest Drug Ingredients Business in Next Step of Strategic Shift (barrons)

- More Americans apply for unemployment benefits but layoffs still historically low (yahoo)

- Beijing Pledges More Fiscal Support (wsj)

- China Vows to Keep Up Spending in 2024 After Stimulus Cut (yahoo)

- The US House passes the bipartisan tax deal to expand the child tax credit. Up next: the Senate. (yahoo)

- Ant Group inks partnership with Shanghai to help the city’s AI ambitions (scmp)

- Eurozone inflation slows to 2.8% in January (ft)

- Big central banks are pivoting towards rate cuts (reuters)

- Decline in China’s property sector may be slowing (reuters)

- Alibaba Said to Weigh Sale of Mall Chain in Latest Overhaul Step (bloomberg)

- China’s Central Bank Adds $21 Billion in Cheap Funds for Housing (bloomberg)

- Disney (DIS) agrees to sell 60% of its India media unit at a $3.9B valuation – WSJ (streetinsider)

- Fed Shouldn’t Take Too Long to Conclude Inflation Is Beaten (wsj)

- The Companies Calling Workers Back to the Office Five Days a Week (wsj)

- The Wall Street strategist that nailed the 2023 bull market is mulling a boost to his 2024 price target after a strong January (businessinsider)

- US Companies Turning More Optimistic on China, Survey Shows (blooomberg)

Be in the know. 28 key reads for Wednesday…

- This money manager nailed two big stock-market turning points. These are his next ‘rocket ship’ ideas. (marketwatch)

- Sullivan says US and China aiming to set up Biden-Xi call ‘soon’ (ft)

- Cooper Standard Announces Partnership and Newly Expanded Technology Licensing Agreement with NIKE, Inc. (Cooper Standard)

- GM’s Mary Barra said that the company expects US industrywide auto sales to climb to about 16 million vehicles. That’s up from 15.5 million vehicles in the US last year and would be the highest level since 2019. (bloomberg)

- Employee costs in the U.S. rise at slowest pace in 2 1/2 years. More ammo for Fed rate cut? (marketwatch)

- Alphabet Stock’s a ‘Bargain’ in the Magnificent Seven, Says Analyst (barrons)

- Peltz’s Plan to Fix Disney Includes Bundling ESPN+ With Netflix (bloomberg)

- PayPal to Cut Global Workforce by 9% as Part of Turnaround Plan (wsj)

- Eliminating jobs will allow the firm to “move with the speed needed to deliver for our customers and drive profitable growth,” Chriss said in the letter. “At the same time, we will continue to invest in areas of the business we believe will create and accelerate growth.” (bloomberg)

- 3M’s $6 Billion Earplug Settlement Gets Support From Claimants (wsj)

- US EV Sales Climbed 29% In Q4 (zerohedge)

- Why a $2 trillion asset manager forecasts the Magnificent 7 to underperform this year (businessinsider)

- Companies Brought in Robots. Now They Need Human ‘Robot Wranglers.’ (wsj)

- S. and China Talk Fentanyl in Latest Sign of Thawing Ties (wsj)

- Amazon Can’t Afford a Race to the Bottom (wsj)

- Boeing Faces Tricky Balance Between Safety and Financial Performance (nytimes)

- Paramount Stock Surges. Byron Allen Is Bidding for Media Again. (barrons)

- The Fed Meeting Isn’t Just About Rate Cuts. What Might Matter More. (barrons)

- Consumer confidence climbs to 2-year high as inflation slows and economy keeps growing (marketwatch)

- Boeing Stock Edges Higher on Narrower-Than-Expected Loss. Investors Need More Detail. (barrons)

- UPS to Cut 12,000 Jobs and Mandate Return to Offices Five Days a Week (wsj)

- Apple Vision Pro Review: The Best Headset Yet Is Just a Glimpse of the Future (wsj)

- Israel and Hamas Weigh Three-Stage Cease-Fire (wsj)

- Private payroll growth slowed to 107,000 in January, below expectations, ADP says (cnbc)

- Hong Kong’s banks post bumper 2023 profits as rates swell margins (scmp)

- China unveils new property support measures amid concerns about Evergrande fallout (reuters)

- Investors punish Microsoft, Alphabet as AI returns fall short of lofty expectations (reuters)

- BABA-SW (09988.HK) Ratings & TPs (Table) (aastocks)

Be in the know. 20 key reads for Tuesday…

- GM upbeat on 2024, betting on a ‘resilient’ US economy (reuters)

- GM Provides Upbeat Outlook on 2024 Profit (wsj)

- IMF upgrades global growth forecast, citing U.S. resilience and policy support in China (cnbc)

- US and China launch talks on fentanyl trafficking in a sign of cooperation amid differences (abc)

- The Fed Meeting Isn’t Just About Rate Cuts. What Might Matter More. (barrons)

- Big Pharma Reports Earnings After a Year in ICU (barrons)

- Microsoft and Alphabet Kick Off Big Tech Earnings. Plus, AMD. (barrons)

- Here’s What China Is Doing to Boost Economy, Rescue Markets (bloomberg)

- Alibaba-backed Xreal, rival to Apple’s Vision Pro, claims it’s now an AR glasses unicorn (cnbc)

- Tesla, LVMH Earnings Show How China Impact Is Anyone’s Guess (bloomberg)

- Consumer confidence climbs to 2-year high as U.S. inflation cools and the economy keeps growing (marketwatch)

- BlackRock cites AI in upgrading U.S. stocks to overweight (marketwatch)

- Alphabet earnings: What to expect from the Google parent company (marketwatch)

- Microsoft earnings: What to expect from Azure, Office and — of course — AI (marketwatch)

- Earnings Season Needs the Rest of the Magnificent Seven to Ride In (barrons)

- Why analysts say the Fed risks clogging the financial plumbing without a policy change (marketwatch)

- China’s Economic Problems Drag On. Stocks Could Jump. (barrons)

- Billionaire Sternlicht Sees $1 Trillion Loss in Office Values (bloomberg)

- Citadel’s Ken Griffin says the economy looks ‘pretty damn good right now’ (cnbc)

- Steve Cohen, John Henry Group Set to Invest Billions in PGA Tour (wsj)