Skip to content

Goldman Sachs says China stocks may rise by 40% on market reforms as UBS goes overweight on mainland, Hong Kong shares

Hong Kong stocks surge most in 3 weeks as China’s support pledge lifts the mood (scmp )

Citi Strategists Say Buy the Dip in Stocks on Solid Earnings (bloomberg )

GM Raises Profit Outlook After Strong First-Quarter Earnings (wsj )

Triumphant homeowners who spent millions on houses reveal how they took on squatters — and won (nypost )

Billionaire’s new building to soar over Midtown for one very specific reason (nypost )

JPMorgan warns stock market sell-off has ‘further to go’ (yahoo )

PepsiCo’s first-quarter results beat as international demand drives growth (yahoo )

How US shale keeps sheltering America from the next oil price surge (ft )

Generative A.I. Arrives in the Gene Editing World of CRISPR (nytimes )

Goldman’s Rubner Says the Pullback in US Stocks Is Not Over Yet (bloomberg )

Apple’s China iPhone Sales Dive 19% in Worst Quarter Since 2020 (bloomberg )

The UK Housing Market Has Turned a Corner (bloomberg )

Google search boss warns employees of ‘new operating reality,’ urges them to speed up (cnbc )

Goldman says we’re still in phase 1 of AI’s stock-market takeover. Here’s how they expect phases 2 through 4 to play out. (businessinsider )

Goldman Sachs: These 30 stocks are primed to outperform in a strong economy since they’re investing heavily in future growth opportunities like artificial intelligence (businessinsider )

Goldman Sachs: These 30 stocks are primed to outperform in a strong economy since they’re investing heavily in future growth opportunities like artificial intelligence (businessinsider )

Goldman hasn’t given up on the stock-market rally, but is starting to get nervous (marketwatch )

Why you shouldn’t be too quick to dump your stocks just yet (marketwatch )

History says stock-market dips caused by geopolitical turmoil ‘should be bought, not sold’: BofA strategists (marketwatch )

Boeing Slows Production of Its 787 Jet. Relax, It’s Not a Quality Problem. (barrons )

Ford Doesn’t Have a Ferrari Division, but Ford Pro Could Be a Stock Catalyst (barrons )

Ford Stock Soared Today for 1 Big Reason and 3 Smaller Ones (barrons )

China Technology’s Outperformance vs. US Tech Since February Widens (chinalastnight )

Big Tech Faces Earnings Test After Market Rout (wsj )

Strategists Split on US Profit Outlook as Stocks Pull Back (bloomberg )

Strong Earnings Will Give S&P 500 a Boost (bloomberg )

Nike Shifts Course as Innovation Stalls and Rivals Gain Ground (wsj )

The Golfer Who Can’t Stop Winning (wsj )

Making a splash Top women’s golfer celebrates historic run with epic cannonball (nypost )

How NYC’s reclusive retail kingpin sold billions in buildings to Gucci, Prada in mere days (nypost )

Alphabet’s Cash Boom Is Raising Dividend Hopes on Wall Street (bloomberg )

5 reasons why the stock market’s multi-week sell-off will end soon, according to a Wall Street bull (businessinsider )

Mega-cap tech earnings kick off this week. Here’s what Wall Street is looking out for. (businessinsider )

Car dealers throw cold water on electric vehicles versus gas options: ‘I wouldn’t feel safe’ (foxbusiness )

Hong Kong stocks soar after China’s market regulator support pledge (scmp )

EU approves new antibiotic to tackle rise of superbugs (ft )

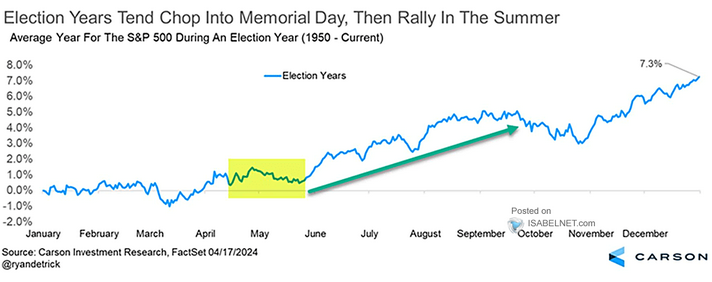

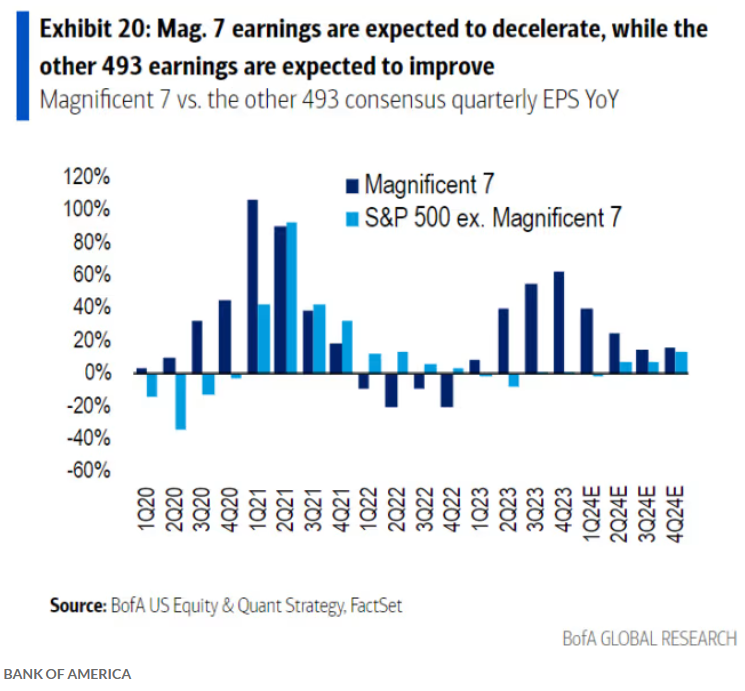

This chart shows why the stock-market rally should broaden out later this year (marketwatch )

30 Big Ideas from Seth Klarman’s Margin of Safety (Special Report) (niveshak )

Belated March CPI analysis (scottgrannis )

Higher Interest Rates Have Done Their Work. Start the Cuts. (barrons )

S. natural gas trade will continue to grow with the startup of new LNG export projects (eis )

House Passes Bill Banning TikTok Unless Chinese Owner Divests. Aid to Ukraine and Israel Is Approved. (barrons )

Nvidia’s stock plunge leads ‘Magnificent Seven’ to historic weekly market-cap loss (marketwatch )

Apple Has Been Left Behind in the AI Rally. Why It Might One Day Still Be the Big Winner (marketwatch )

MasterCraft Boat, SentinelOne, and More Stocks See Action From Activist Investors (barrons )

Alphabet, United Airlines, GE Vernova, and More Stocks Set to Climb (barrons )

The Secret Retreats That Have CEOs, VIPs and Billionaires Jockeying for Invites (wsj )

Wall Street Has Abandoned Wall Street (wsj )

He Loves Speed, Hates Bureaucracy and Told Ferrari: Go Faster (wsj )

These Home Sellers Are Done Waiting for the Fed to Lower Rates (wsj )

Fed’s Preferred Inflation Gauge Is Set to Back Rate-Cut Patience (bloomberg )

Tesla Cuts US Prices by $2,000 as Sales Slow, Inventories Swell (bloomberg )

Reed Hastings shares the 3-word tactic that helped make Netflix a $240 billion company—it’s called ‘farming for dissent’ (cnbc )

Report: Thanks to AI, China’s Data Centers Will Drink More Water Than All of South Korea by 2030 (futurism )

Florida Is Not So Cheap Compared With New York These Days (bloomberg )

Semiconductors (SMH) Could Be Rolling Over At Key Fibonacci Level, Says Joe Friday (kimblechartingsolutions )

A contrarian take on the US inflation freakout (ft )

A Legacy Structure Turns Cars Into Sculptures (forbes )

Meet The Skydiving Billionaire With Sky-High Returns (forbes )

3 Easy Steps That Will Make You the Most Interesting Person in a Conversation (inc )

T&C Hotel Awards 2024: The Best New Hotels on the Planet (townandcountrymag )

Ray Dalio Shares Investment, Career Insights (Columbia )

Big Pharma Stocks Need a Rethink. Investors Keep Making the Same Mistake. (barrons )

A 5-Star Dividend Stock to Buy With a 3.7% Yield (morningstar )

The 10 Best Dividend Stocks (morningstar )

Magnificent Seven Earnings Arrive With Stocks at Critical Moment (bloomberg )

Nvidia Won AI’s First Round. Now the Competition Is Heating Up. (barrons )

China’s Ant Group in talks to launch Alipay+ in Indonesia, says executive (reuters )

Investors underestimating China’s middle class ‘tidal wave’: private equity CEO (scmp )

The Cloud Giants Are Taking On Nvidia in AI Chips. Here’s Why—and How. (barrons )

American Express Profit Rises as Cardholder Spending Jumps (barrons )

Google consolidates teams with aim to create AI products faster (scmp )

$4 Million Bugatti Bolide Hypercar That Can Reach 300 MPH Will Be Track-Only (barrons )

Oil Prices Fall Back After Spike Following Israel Attack on Iran. Here’s Why. (barrons )

This Chemicals Stock Is Ready to Power Higher. Clean Hydrogen Is Helping. (barrons )

Five reasons the stock market’s ‘painful’ pullback may be nearing its end (marketwatch )

Why buying stocks in this hot sector may turn out to be a money-losing bet (marketwatch )

3M may be poised to cut its dividend — and break with a 64-year tradition, says analyst (marketwatch )

Nordstrom Says It Will Evaluate if Family Should Take Company Private (barrons )

Israel Strikes Iran in Narrow Attack Amid Escalation Fears (wsj )

Millennials Are Coming for Your Golf Communities (wsj )

Ultra-rich put off buying yachts, jets in hope of massive Trump tax break if he wins (nypost )

Is this the last stand for Connor McDavid, Leon Draisaitl and the Oilers? (theathletic )

Everything we know about the Coyotes’ move to Utah: What went wrong? Will team name change? (theathletic )

Banks Believe They Are Well-Prepared for Commercial Real Estate Fallout (wsj )

Bridgewater Adds China Stocks (bloomberg )

Is pickle juice good for you? Here’s what experts want you to know (usatoday )

China Vows to Support Hong Kong IPOs to Bolster Hub Position (bloomberg )

Yields fall as investors weigh economic data, Israel strike against Iran (cnbc )

The world’s largest chipmaker just issued a warning that the industry’s red-hot growth could slow (businessinsider )

JPMorgan warns of need for ‘reality check’ on phasing out fossil fuels (ft )

Billionaire Brad Jacobs: Meditation, thought experiments, and cognitive behavior therapy helped me succeed—and can do the same for you (fortune )

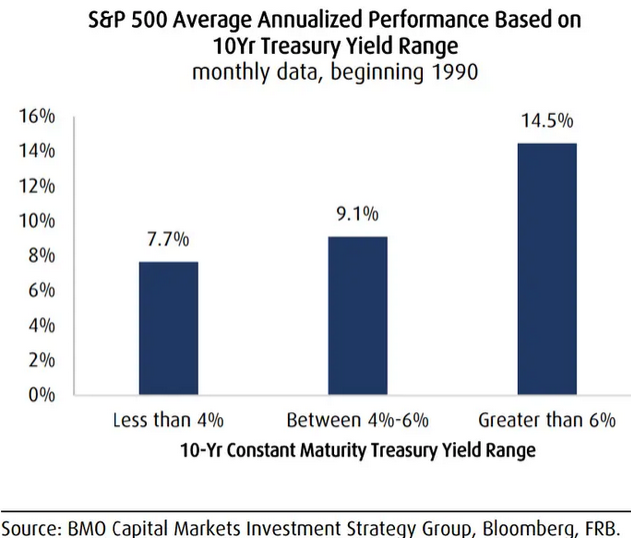

BMO shares 4 charts showing why stock investors shouldn’t fear higher-for-longer interest rates (businessinsider )

Alibaba has made dramatic changes to its corporate restructuring plan as founders Jack Ma and Joe Tsai return to the driver’s seat (scmp )

Chip Giant TSMC Offers Reassurance—and a Warning (wsj )

Inside Amazon’s Secret Operation to Gather Intel on Rivals (wsj )

Buyers Are Back in Control as Luxury Home Sellers Slash Prices (wsj )

China’s Youth Unemployment Level Remains Steady in March (bloomberg )

High rates haven’t always been a problem for stocks (yahoo )

Chinese and US firms collaborate on first global generative AI standards (scmp )

Alibaba’s Taobao launches 3D-capable app for use on Apple’s Vision Pro headset (scmp )

John Catsimatidis’ Red Apple Group taps energy exec to lead rollout of small nuclear reactors (nypost )

How an Obscure Chinese Real Estate Start-Up Paved the Way to TikTok (nytimes )

Dealmaking Is Looking Up as Companies Stop Waiting Out the Fed (wsj )

ASML Orders Plunge as Chipmakers Pause High-End Gear Purchases (bloomberg )

Serious investors need China exposure, should ‘forget about the short-term pain’, asset managers say (scmp )

Fed’s Beige Book Holds Clues to Predicting Downturn, Study Shows (bloomberg )

The stock market just flashed bullish a signal suggesting 19% upside by August 2025, BofA says (business )

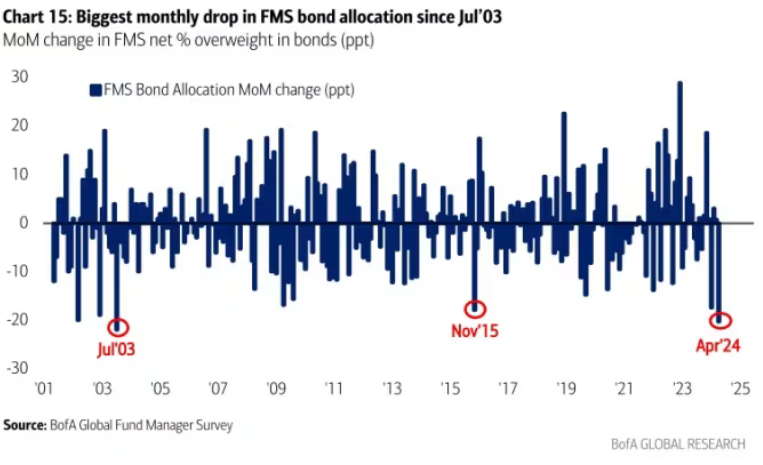

Fund managers are giving up on bonds in a way they haven’t in 20 years (marketwatch )

Do cash-gushing stocks outperform the S&P 500? Here’s what history has to say. (marketwatch )

Consumer spending has slowed but is hanging in there, says BofA CEO Brian Moynihan (cnbc )

Oakmark’s Bill Nygren shares his thoughts on CITI (cnbc )

Bonds are a good diversifier for risk assets over most cycles: Steve Laipply (foxbusiness )

China warns west of ‘survival of the fittest’ as manufacturing boosts economy (ft )

Powell Dials Back Expectations on Rate Cuts (wsj )

Rents have finally stopped skyrocketing. (marketwatch )

Boeing Defends Safety of 787 Dreamliner After Whistle-Blower’s Claims (nytimes )

China Q1 GDP grows 5.3%, more than expected (streetinsider )

How Legatum Succeeds at Generating Capital, Ideas, and Helping People Prosper (barrons )

Bank of America tops estimates on better-than-expected interest income, investment banking (cnbc )

BofA Beats Estimates for Trading and Profit Even as Costs Soar (bloomberg )

China’s Economy, Propelled by Its Factories, Grew More Than Expected (nytimes )

China’s Rising Youth Unemployment Needs Attention, Official Says (bloomberg )

Alibaba strengthens commitment to open-source development of AI model (scmp )

European bank stocks are a better bet than U.S. peers, says JPMorgan (marketwatch )

What If Fed Rate Hikes Are Actually Sparking US Economic Boom? (bloomberg )

Why the Dollar Is Causing Chaos in Emerging Markets (bloomberg )

New York Tops Destinations for Relocating Tech Workers (wsj )

Boeing defends 787 Dreamliner safety after whistleblower allegations (cnbc )

Stock-market pullbacks are price of admission. Historically, markets rise afterwards, this strategist says. (marketwatch )

The Best Chinese Stocks to Buy (morningstar )

Alibaba News Roundup: Alipay Sees Inbound Payment Surge; Hong Kong Consumers Score Festive Deals at Freshippo; Alibaba Cloud AI Assistant Helps Write Code (alizila )

Chinese Stocks Advance as Beijing Renews Regulatory Support (bloomberg )

Wharton legend Jeremy Siegel sees Tesla’s fall from grace in Wall Street’s ‘Magnificent 7’ as a sign of good market health (yahoo )

Rory McIlroy is close to joining LIV Golf for a whopping $850,000,000 according to reports (sportskeeda )

Want to play Augusta National? Here are 10 ways to get a tee time (golf )

Boeing’s CEO search has a new front-runner—and insiders say it could mean a radical change for the $104 billion ailing planemaker (yahoo )

Masters 2024: The clubs Scottie Scheffler used to win at Augusta National (golfdigest )

Energy grid faces demand strains from AI, EVs: Generac CEO (yahoo )

Retail sales rose sharply in the first quarter — and could boost U.S. GDP (marketwatch )

Wall Street Powers Goldman to Higher Quarterly Earnings (wsj )

What Higher for Longer Means for the Stock Market (wsj )

Inside the Controversial Bid to Buy the Studio Behind The Godfather and Top Gun: Maverick (vanityfair )

The United States exported a record volume of natural gas in 2023 (eia )

To Answer the Question of Why I Invest in China (Ray Dalio )

JP Morgan Annual Letter (Jamie Dimon )

4 Undervalued Stocks That Just Raised Dividends (morningstar )

The Best Technology Stocks to Buy (morningstar )

Citigroup Earnings: Laser Focus on Expenses Needed to Achieve Long-Term Targets (morningstar )

3 Cheap Stocks to Watch in the Fight Over Sports Streaming (morningstar )

The Crazy Swing That Made Scottie Scheffler a Two-Time Masters Champion (wsj )

Here’s What Higher for Longer Means for the Stock Market (wsj )

The Home-Solar Boom Gets a ‘Gut Punch’ (wsj )

Steve Mnuchin seeks AI partner to rebuild TikTok’s algorithm in takeover bid: sources (nypost )

Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War (bloomberg )

Why Car Insurance Keeps Getting More Expensive (bloomberg )

There’s a global shortage of stocks that will backstop the market for the foreseeable future (businessinsider )

3 Facts That Help Explain a Confusing Economic Moment (nytimes )

The 25 Best Restaurants in Boston Right Now (nytimes )

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up (nytimes )

UK’s Smaller Stocks Are Ripe for a Catchup as Profits Reignite (bloomberg )

The U.S. Is Trying to Cripple Russia’s Vast Arctic LNG Project (wsj )

The New, More-Hopeful Face of Alzheimer’s Disease (wsj )

April Monthly Option Expiration Week – DJIA Up 33 of Last 42 (almanactrader )

Meet The New AI-Robot Billionaire (forbes )

Michigan Consumer Sentiment Moves Sideways for 4th Straight Month (advisorperspectives )

Weekly Leading Economic Index (advisorperspectives )

Nike’s boss says remote work was hurting innovation, so the company realigned and is ‘ruthlessly’ focused on building a disruptive pipeline (fortune )

Car of the Week: This Restored 1962 Mercedes-Benz 300 SL Roadster Could Be Yours for $2.6 Million (robbreport )

The 9 Best Vintage Ferraris Ever Made (robbreport )

The 20 Most Expensive Cities in the US—And Why They Might Be Worth It (architecturaldigest )

Google goes all in on generative AI at Google Cloud Next (techcrunch )

2024 Aston Martin DB12 Volante First Drive Review: Possibly the Best Aston, Roofless (thedrive )

Apple iPhone Shipments Drop 10% in First Quarter (barrons )

Intel Has Slumped This Year. Why One Analyst Sees a Rebound Ahead. (barrons )

Cisco Stock Gets Upgraded to Buy. Why Wall Street Is Abuzz. (barrons )

Defense Stocks Haven’t Rallied, but There’s Opportunity (barrons )

What do the royals do all day, anyway? (npr )

Why companies spin off (npr )

Hal Lawton on Tractor Supply’s Phenomenal Growth (bloomberg )

Former auto executives warn electric vehicle push happened ‘too soon and too fast’ (foxbusiness )

Meta’s AI chief: LLMs will never reach human-level intelligence (tnw )

Third Point, Saddle Point win board seats at Advance Auto Parts. A plan to improve margins may unfold (cnbc )

Generac Eyes Power Deals With $1 Billion to Spend (bloomberg )

Texas Warns of Possible Power Emergency Next Week (bloomberg )

High Rates Have Been a Profit Machine for Banks. Not Anymore. (wsj )

China Tells Telecom Carriers to Phase Out Foreign Chips in Blow to Intel, AMD (wsj )

China Exports Rise as Trade Tensions Mount (wsj )

The 18 Handicap Who’s Spending Billions on Golf (wsj )

Two Brothers, a Big Biotech Bet and an $8 Billion Payout (wsj )

Warehouse Rents Slipping on Declining Demand (wsj )

Iran Launches Drone and Missile Attack at Israel (wsj )

Tiger Woods’s Record-Breaking 23-Hole Marathon (wsj )

Who can run Disney? The four insiders competing for Bob Iger’s job (ft )

The pound is no longer so vulnerable (ft )

The Golf Apps and Gear Changing Our Love of the Game (bloomberg )

The stunning strength of the US economy means the soft landing may already be here, Evercore founder says (businessinsider )