Skip to content

Shares of Citi Rise After Earnings Beat (barrons )

Consumer Sentiment Slips in April as Inflation Remains Sticky (barrons )

Solventum Stock Is Cheap. Why Wall Street Says to Wait. (barrons )

Mario Gabelli comes out against Paramount’s merger with Skydance: ‘I’d rather see no sale’ (nypost )

Musk and Milei share their love of free markets in first meeting (ft )

The Podcast Host Who Also Manages a $1.6 Trillion Investment Fund (wsj )

China’s policy to boost demand by $700 billion will have a ‘bigger and bigger’ impact, official says (cnbc )

Citi Profit Beats as Companies, Consumers Go on Borrowing Binge (bloomberg )

3M Could Lose Its Elite Dividend Status After 64 Years. What It Means for the Stock. (barrons )

Boeing Knows What It Needs to Do—So Do It. Change the Culture. (barrons )

U.K. stocks eye record as higher commodity prices boost miners and oil groups (marketwatch )

Interest Rates Have Investors Worried. Profits Give Them Comfort. (wsj )

Golf Is Booming. But Can the Good Times Last? (wsj )

The Masters Still Sizzles. But Is Golf Scaring Off Its Fans? (wsj )

Bank of England scraps outdated inflation forecast model after Fed boss’ review (cnbc )

China has strong fundamentals and should remain a focus for businesses: Gan Kim Yong (cnbc )

Amazon CEO Touts AI Revolution While Committing to Cost Cuts (wsj )

China’s March exports and imports shrink (reuters )

Ford spotlights a new lineup of popular trucks (foxbusiness )

Charting the Fed’s rate path – Nick Timiraos (cnbc )

Fed Favors Reducing Monthly Asset Runoff Pace by Roughly Half (bloomberg )

Fed Prepares Slower Pace of Runoff for $7.4 Trillion Portfolio ‘Fairly Soon’ (wsj )

Nike Stock Jumps On Upgrade As Estimates ‘Finally Look Achievable’ Ahead Of Paris Olympics (investors )

Producer Prices Rise Less Than Expected (barrons )

US Producer Prices Rise But Show Some Relief in Key Categories (bloomberg )

Give us a (tax) break How empty office buildings could help NYC solve its housing crisis (nypost )

ECB’s Lagarde Says ‘a Few’ Were Ready to Cut Rates Today (bloomberg )

Alphabet Heads Toward $2 Trillion With Investors Cheering AI Progress (bloomberg )

China will remain the world’s No. 1 growth driver, says the Asian Development Bank (cnbc )

China’s commercial property segment is seeing some bright spots amid a slump in the wider realty sector (cnbc )

Fed likely to cut rates before ECB blinks, former BOE member says (cnbc )

What PPI tells us about PCE: Fed’s preferred inflation gauge may not look so bad for March (marketwatch )

These in-the-know investors are more bearish than they’ve been since 2014 (marketwatch )

Costco’s March Sales Jump. E-Commerce Is Taking Off. (barrons )

Hot Inflation Report Derails Case for Fed June Rate Cut (wsj )

<Research>CITIC Securities: BABA-SW’s Focus on Core E-commerce Yields Results; Good Shareholders’ Return Expected to be Kept (aastocks )

Maybe core inflation isn’t as bad as it seems (marketwatch )

Alibaba’s Jack Ma steps out from the shadows with morale-boosting post (reuters )

Intel Says New Gaudi 3 AI Chips Top Nvidia H100s in Speed and Cost (barrons )

Alibaba shares jump after founder Jack Ma reemerges with praise of Chinese giant’s ‘transformations’ (cnbc )

‘We turned the company from a cumbersome organisation into one that is simple and agile, where efficiency comes first, and the market comes first,’ Ma wrote (this week) (scmp )

US consumer prices rise more than expected in March (reuters )

Beijing retail rents jump by most since 2019 amid ‘demand surge’ (scmp )

Boeing Engineer Says Company Used Shortcuts to Fix 787 Jets (wsj )

Hot Inflation Report Weakens Case for Fed’s June Rate Cut (wsj )

Google, Intel debut new AI chips to fight Nvidia’s dominance (scmp )

Bank Earnings Are Here Again. Keep Your Eyes on This Metric. (barrons )

How the End of ‘Curb Your Enthusiasm’ Flipped the ‘Seinfeld’ Finale on Its Head (wsj )

Commodities Rally Reflects a Better Economy, but Also Poses Inflation Risks (wsj )

China Vehicle Sales Rebound (wsj )

The 22-Year-Old Beanpole Who Just Played His Way Into the Masters (wsj )

The Merchant Banker Who Could Win the Masters (wsj )

Goldman Says It’s Time to Take Tech Profits and Invest Elsewhere (bloomberg )

Alphabet’s stock nabs fresh high, is only ‘Magnificent Seven’ name to finish at a record (marketwatch )

Earnings Are Last Pillar of Equity Strength as Rate Cuts Recede (bloomberg )

Disney’s parks are its top money maker — and it plans to spend $60 billion to keep it that way (cnbc )

Iger Won the Battle — But Disney’s ‘Woke’ War Isn’t Over (bloomberg )

The Sheikh Who Dominates One of the World’s Hottest Stock Markets (bloomberg )

Everyone Is Rich, No One Is Happy. The Pro Golf Drama Is Back (bloomberg )

Michelin Picks 24 Top Hotels in France in First-Ever Ranking (bloomberg )

Strategas’ Chris Verone gets technical with tech stocks (cnbc )

‘Now They’re Voting Red’: A Pennsylvania Fracking Boom Weighs on Biden’s Re-Election Chances (wsj )

Earnings Season to Test Stock-Market Rally (wsj )

How the End of ‘Curb Your Enthusiasm’ Flipped the ‘Seinfeld’ Finale on Its Head (wsj )

A Lotus First (barrons )

Chinese Automaker FAW Group Taps Alibaba Cloud’s Gen AI for Business Intelligence (alizila )

Yellen says US-China relations on ‘stronger footing’ (ft )

Alibaba Cloud cuts prices again, this time for international customers as AI generates surging demand (scmp )

Alibaba Group Invests for Strategic Growth with Cainiao Share Purchase Offer (alizila )

Alibaba News Roundup: Share Repurchase Update; Alibaba Cloud Launches Open Source Video Generation Tools (alizila )

These 10 perfect McLarens are for sale. Which one would you pick? (classicdriver )

Moderate growth and disinflation still alive and well (scottgrannis )

For the Ultimate Lesson in Car Control, Go Drifting (roadandtrack )

Bugatti EB110: The First Modern Hypercar Is 30 Years Old (roadandtrack )

Lexus GX550 vs. Land Rover Defender 130 vs. Mercedes-Benz G550: Which Luxury SUV Is Best Off-Road? (roadandtrack )

Japan had a vibrant economy. Then it fell into a slump for 30 years. (npr )

VF Corp. To Roll Out 300 Additional Mono-Brand Retail Stores (sgbonline )

Vans’ OTW Label Is Taking the Past & Making It Better (highsnobiety )

Earnings Season Is Coming. What the Market Needs Now. (barrons )

Many investors are more exposed to China than they think, says Brendan Ahern (cnbc )

0:02 / 8:39There’s still ‘gas in the tank’ in this stock market rally, says Fundstrat’s Tom Lee (cnbc )

The Big Read. Is Japan finally becoming a ‘normal’ economy? (ft )

Global dominance of biggest stocks rises to highest in decades (ft )

Jamie Dimon Says 8% Rates Could Lie Ahead (barrons )

Doubts Creep In About a Fed Rate Cut This Year (wsj )

How A Texas Oil Billionaire Hit A Gusher In Hotels (forbes )

Earnings Season to Test Stock-Market Rally (wsj )

Is the S&P 500 Flashing a Spring Sell Signal? (kimblechartingsolutions )

Dollar Tree, Walgreens CFOs Snap Up the Stocks (barrons )

Nvidia’s Stock Reaches Crossroads At Key Fibonacci Price Level (kimblechartingsolutions )

18 Surprising Facts About the McLaren P1 Hypercar (robbreport )

United States Non Farm Payrolls (tradingeconomics )

Masters in Business: Ed Hyman (bloomberg )

Buy Carnival Stock. Choppy Market Conditions Will Pass. (barrons )

We “stepped on our own foot” in recent years, admits Alibaba chairman Joe Tsai (technode )

Biogen, Moderna, and 6 More Healthcare Stocks That Wall Street Thinks Have Upside (barrons )

Walgreens, CVS, and Other Pharmacy Chains Are in a World of Hurt. What’s to Blame. (barrons )

Big Pharma Stocks Need a Rethink. Investors Keep Making the Same Mistake. (barrons )

How Ozempic and Wegovy Could Break the Healthcare System (barrons )

Stock Market Will Feel a Tremor if Payrolls and Inflation Keep Rising (barrons )

Krispy Kreme Stock Jumps on Upgrade. McDonald’s Deal Could Boost Earnings. (barrons )

The World’s First Flying Motorcycle Could Hit the Skies by the End of the Decade (robbreport )

Inside Italy’s Grand Hotel Villa Serbelloni, The Ultimate Lake Como Retreat (maxim )

This Revived Lamborghini Countach Channels Classic Wedge-Shaped Supercar (maxim )

Alibaba to test rocket package delivery service with China’s startup Space Epoch (technode )

33 Undervalued Stocks (morningstar )

Happy Coca-Cola Dividend Day Warren Buffett (DGI )

Reed Hastings, Co-Founder of Netflix — How to Cultivate High Performance, The Art of Farming for Dissent, Favorite Failures, and More (#730) (Tim Ferriss )

Yielding Almost 5%, This Undervalued Dividend Stock Is a Buy (morningstar )

The Long View. Rising Fed chatter is not making life in markets easy (ft )

The 100 Best Restaurants in New York City in 2024 (nytimes )

Supercar Blondie Is Going Into the Auction Business (barrons )

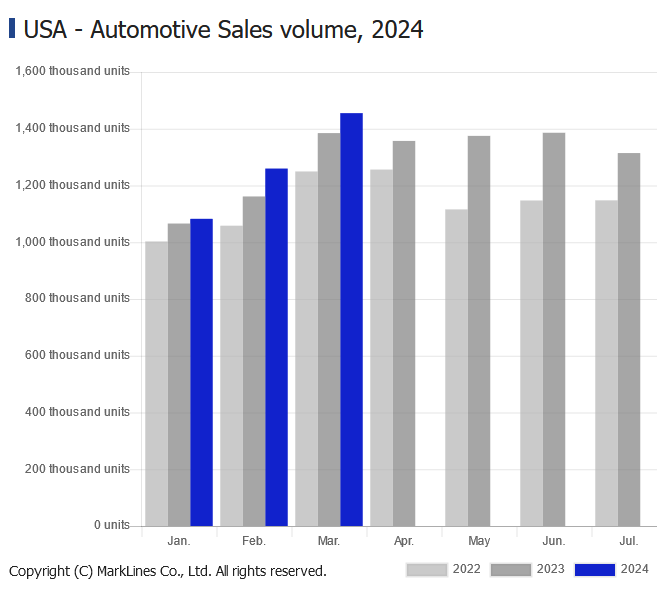

USA – Automotive Sales Volume, 2024 (marketlines )

S Added 303,000 Jobs in March, Surging Past Estimates (bloomberg )

Chinese fintech Ant Group targets global growth after Jack Ma’s exit (ft )

Services PMI Beats, Biden & Xi Discuss The San Francisco Vision (chinalastnight )

Joe Tsai Co-founder & Chair of Alibaba | In Good Company | Norges Bank Investment Management (Norges Bank )

Disney to crack down on password-sharing after CEO Bob Iger wins board fight (nypost )

Europe’s Biggest Asset Manager Is Looking to Buy Dips After Missing Out on Stocks Rally (bloomberg )

Fixing Boeing’s Broken Culture Starts With a New Plane (bloomberg )

Four Seasons’ New Yacht Cruises Come With Record-High Price Tags (bloomberg )

Fed on Track to Cut in June, Morgan Stanley’s Zentner Says (bloomberg )

Biden Tells Netanyahu US Support Hinges on Protecting Civilians (bloomberg )

Earnings Season Is Coming. What Markets Need Now. (barrons )

Nvidia’s stall means the momentum trade has lost its mojo. (marketwatch )

Yellen Is Back in China. What She Could Actually Accomplish. (barrons )

Intel expects to be the world’s second-largest contract chip producer by 2030, trailing only TSMC. (barrons )

Stocks Drop After Fed Officials Cast Doubt on Rate Cuts (wsj )

The Underrated iPhone App That Makes Everyday Tasks Easier (wsj )

Fed’s Kashkari raises prospect of zero rate cuts — but Goldman says that would be ‘very surprising’ (cnbc )

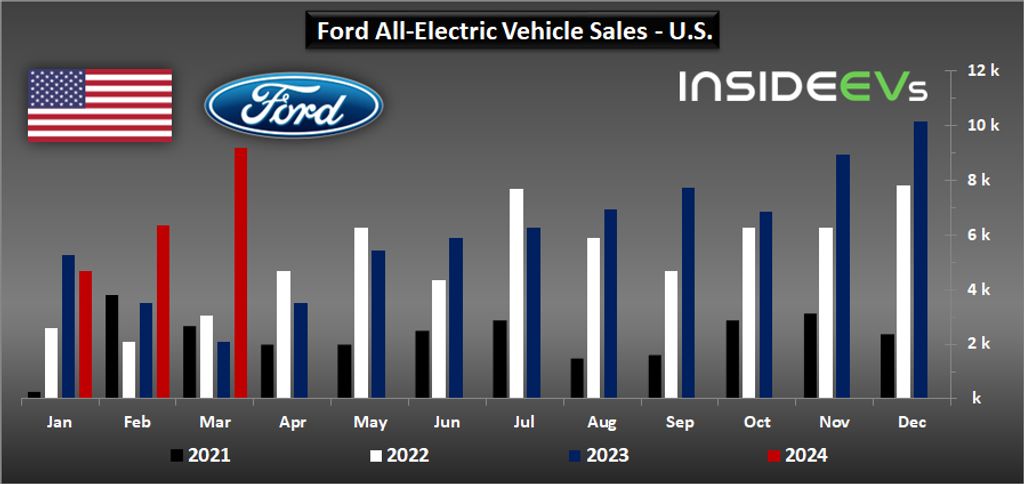

Ford to “Re-Time” New EV Production, Expand Hybrid Production (mishtalk )

The Big Read. Will Xi’s manufacturing plan be enough to rescue China’s economy? (ft )

Ford U.S. EV Sales Almost Doubled In Q1 2024 To Over 20,000 (insideEVs )

Disney defeats activist investor Nelson Peltz in proxy fight (finance.yahoo )

Hunt for Disney CEO Bob Iger’s successor kicks into high gear (reuters )

Google considers charging for AI-powered search in big change to business model (ft )

Powell says Fed’s inflation fight is ‘not done’ (ft )

Alibaba steps up stock buy-back in Hong Kong, New York to boost returns (scmp )

Dollar dips, yen steady after inching near 152 level (streetinsider )

Apple Explores Home Robotics as Potential ‘Next Big Thing’ (bloomberg )

BOJ Is Likely to Wait Until Fall on Next Hike, Ex-Board Member Says (bloomberg )

Citigroup Sees ‘Exciting Market’ for Japan Bonds After BOJ Move (bloomberg )

Why stocks will stay under pressure until tax day on April 15 (businessinsider )

The stock market could face a near-term correction of as much as 12% before continuing its bull rally this summer, BofA says (businessinsider )

Google Is More Resilient Than Its AI Stumbles Imply (wsj )

The Jobs Numbers Aren’t Adding Up. Immigration Helps Explain Why. (wsj )

Why the Stock Market Has Dropped—and What to Do Now (barrons )