Skip to content

Inside the turnaround plan to make Vans, Supreme, and The North Face cool again (fortune )

Apple Loses $113 Billion in Value After Regulators Close In (bloomberg )

China and US Start Working Group to Combat Flood of Fentanyl (bloomberg )

Japan’s Era of Stagnant Salaries, Steady Prices and Mortgages That Never Go Up Is Over (bloomberg )

Magnificent Seven? It’s More Like the Blazing Two and Tepid Five (bloomberg )

Cowboys owner Jerry Jones puts another $100 million into Frisco’s Comstock Resources (dallasnews )

China’s Central Bank Sees Room for More RRR Cuts (bloomberg )

Fed Officials Still See Three Interest-Rate Cuts This Year, Buoying Stocks (wsj )

Productivity is way up

The Billionaire Taking on Disney Just Wants Some Respect (nytimes )

Short Sellers Up Their Wagers Against Commercial Real Estate Again (bloomberg )

Fed’s interest-rate decision makes bank stocks more attractive: analyst (marketwatch )

Boeing targets a culprit of 737 MAX production woes: ‘Traveled work’ (yahoo )

For Real Estate, Rate Cuts Can’t Come Soon Enough (zerohedge )

Chewy (CHWY) stock jumps on better-than-anticipated Q4 top and bottom line (streetinsider )

Reddit prices stock at top of target range in biggest social media IPO since Pinterest (streetinsider )

6 Highest Yielding Dividend Kings With Yields Up To 9.9% (247wallst )

Private equity giant Apollo offers $11B for Paramount Pictures studio: report (nypost )

SocGen’s Kabra Is Now Among the Biggest Bulls on US Stock (bloomberg )

Apple Braces for Antitrust Lawsuit From DOJ (barrons )

The Stock Market Is Already Way Up. 8 Stocks That Can Still Outperform. (barrons )

Replacing Boeing CEO Calhoun Won’t Be Easy (barrons )

Fundstrat’s Tom Lee sees small-cap benchmark Russell 2000 surging by 50% in 2024 (cnbc )

Cheesecake Factory and 4 More Stocks Ready to Pop, From a Small-Cap Pro (barrons )

Home Sales Jumped in February to Fastest Pace in a Year. Prices Are Up, Too. (barrons )

Nike Reports Earnings Today. It Has Lots of Work to Do. (barrons )

Nvidia Is Using Its Old 1990s Playbook To Best Its AI Rivals (barrons )

Biden’s EPA Gives Automakers More Leeway to Phase Out Gas-Engine Cars (wsj )

Elon Musk’s Neuralink Shows First Patient Using Its Brain Implant (wsj )

Why Arizona Law Firms Are a Hot Investment for Private Equity (wsj )

Nelson Peltz Wins Key Endorsement in Disney Battle (wsj )

Airport Security Is a Confusing Mess Right Now (wsj )

US Initial Jobless Claims Ease in Sign of Resilient Labor Market (bloomberg )

The frugal life of Warren Buffett: How the billionaire spends his fortune, from McDonald’s breakfasts to a rare and ‘indefensible’ splurge (yahoo )

Apple’s Tim Cook meets key suppliers in Shanghai as 57th China store opens (scmp )

How Has the Fed’s Outlook Changed? Here’s What to Watch Today (wsj )

PDD Stock Soars as Temu Parent Posts Huge Earnings Beat. What It Means for Alibaba. (barrons )

Intel Gets Up to $8.5 Billion in Chips Act Funding from Biden Administration (barrons )

Is a June rate cut still possible? Fed’s Powell will look to keep options open this week. (marketwatch )

The Bank of Japan Just Handicapped a Winning Strategy. What to Know About the Yen Carry Trade. (barrons )

Energy Suppliers Are Racing to Keep Up with the Data-Driven Energy Surge (barrons )

The big tech rally is living on borrowed time, says UBS (marketwatch )

‘Mr. Yen’ says authorities may soon intervene as Japanese currency eyes multi-decade lows (marketwatch )

Apple CEO Tim Cook Is in China After iPhone Sales Weaken. (barrons )

The Latest Options Craze Resembles Past Manias. That’s Not a Good Thing. (barrons )

Fed is ‘so far from equilibrium’ as markets await rate guidance, BlackRock’s Rick Rieder says (marketwatch )

Boeing CFO Talks Cash, Spirit, And How to Fix Quality. (barrons )

Apple Looks to External Partners to Boost AI Efforts (wsj )

Why the Fed’s ‘Dot Plot’ Is the Center of Attention (wsj )

The Era of No-Brainer 5% Returns on Cash Is Ending (wsj )

Shares of Gucci Owner Tumble After Sales Warning (wsj )

Understanding the Boeing Mess (wsj )

NYC landlords luring workers back to offices with pickleball, golf simulators, arcade games and gourmet food (nypost )

Here’s everything to expect from the Federal Reserve’s policy meeting (cnbc )

Hong Kong’s national security law has analysts divided on its social and economic ramifications (cnbc )

A Lady Gaga Google Search shows how AI is upending the world’s most profitable online business. ‘Site owners are terrified.’ (businessinsider )

Once Again, Baltimore Hopes to Fight Blight With $1 Homes (governing )

4 signals that suggest the stock market’s bull rally could soon reverse (businessinsider )

China’s Central Bank Names Two Scholars as New Policy Advisers (bloomberg )

China to Use Public Auctions for Sale of Special Ultra-Long Debt (bloomberg )

Intel prepares for $100 billion spending spree across four US states (reuters )

West is ‘too optimistic’ on nuclear projects, warns engineering chief (ft )

Alibaba-backed Moonshot AI expands Chinese-character prompt for Kimi chatbot (scmp )

Tencent doubles share buy-backs while earnings miss estimates (scmp )

Wouldn’t be surprised if more FOMC members predicted less than two rate cuts in 2024: Jeremy Siegel (cnbc )

Rumors over ‘next James Bond’ left shaken and stirred by Aaron Taylor-Johnson speculation (wral )

How the BOJ’s plan for a smooth exit from negative rates unraveled (reuters )

BOJ Needs to Do More to Change Direction of Yen: Major (bloomberg )

Goldman’s Hatzius Says US on Track for 2.4% Core PCE (bloomberg )

Alibaba Raises $317 Million From Sale of Stake in EV Maker XPeng (bloomberg )

Buy 3M Stock Ahead of Healthcare Spinoff. Analyst Expects Higher Valuation. (barrons )

Natural Gas Prices Won’t Stay Low for Long. An Export Boom Is Coming. (barrons )

1 No-Brainer Growth Stock to Buy Now With $100 and Hold Through 2024 (and Beyond) (fool )

Japan Finally Raises Rates. Global Markets Will Feel It. (barrons )

As Electric-Vehicle Shoppers Hesitate, Hybrid Sales Surge (wsj )

UK Reality TV Stars, Influencers Join AliExpress’ New Livestreaming E-Commerce Community (alizila )

Alibaba brings 5-day delivery to the US in race against Shein, Temu (scmp )

Marissa Pardini Steps Down from Vans; More Layoffs Hit Office (shop-eat-surf )

Ant Sets Up Board for International Operations in Broad Overhaul (bloomberg )

BABA-SW’s Hema Global Shopping Biz GMV Rises 1x+ YoY in 2023 (aastocks )

Developing | Ant Group restructures part of its businesses into units, promotes veteran finance chief as president to spur growth (scmp )

Commercial Real Estate Is a Slow Burn,’ Says Bank of America CEO Moynihan (bloomberg )

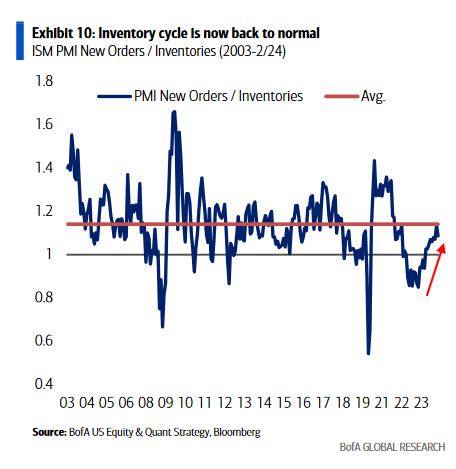

Small Caps Can Shine With Reasonable Rates: BofA (bloomberg )

BofA’s Moynihan on US Consumer, Trading Activity and CRE (bloomberg )

BofA’s Moynihan: Banks Have ‘Tremendous Amounts of Capital’ (bloomberg )

BofA CEO Moynihan: Customers ‘Remarkably Resilient’ (bloomberg )

Central bankers see ‘immaculate disinflation’ within reach (ft )

The ferocious US pushback against new banking rules (ft )

Warren Buffett Says Even The Bottom 2% Of Earners ‘All Live Better Than John D. Rockefeller’ – And He Was The Richest Man In The World (yahoo )

New-Home Construction Rose in February. Builders Are Confident. (barrons )

Don’t want to chase Big Tech? Money manager flags three unloved stocks to bet on now. (marketwatch )

Fusion Pharmaceuticals Stock Soars. It’s Being Acquired by AstraZeneca in $2.4 Billion Deal. (barrons )

Odds of a June rate cut by Fed slip below 50%, according to this gauge (marketwatch )

ESPN Boss Jimmy Pitaro’s Chaotic Race to Remake the Sports Giant (wsj )

Once America’s Hottest Housing Market, Austin Is Running in Reverse (wsj )

Cities Face Cutbacks as Commercial Real Estate Prices Tumble (nytimes )

Japan Ends Era of Negative Rates With Few Clues on Further Hikes (bloomberg )

Warren Urges Powell to Cut Rates to Help Struggling Clean Energy (bloomberg )

Trading Floors Buzz With Excitement as BOJ Axes Negative Rates (bloomberg )

Real Estate Pain Is Showing Up in an Obscure Investment Product (bloomberg )

The Fed Has a Lot of Questions to Answer About Its Balance Sheet (bloomberg )

America’s Place in India’s Butter Chicken Fight (bloomberg )

Harvard-trained neuroscientist with 20+ years experience: 7 tricks I use to keep my memory sharp (cnbc )

Fed could cut rates fewer times than expected as economy keeps growing, according to CNBC survey (cnbc )

Nordstrom shares jump more than 10% on report retailer is trying to go private (cnbc )

Housing Starts And Permits Surged In February (Despite Plunging Rate-Cut Odds) (zerohedge )

A Bill Gates company is about to start building a nuclear power plant in Wyoming (businessinsider )

China Shares Lifted by Data. Expect More Gains. (barrons )

Meet the ‘Witch of Wall Street,’ a black-clad pioneering value investor who became the world’s richest woman—but is wrongly remembered as a cheapskate (fortune )

China kicks off the year on strong note as retail, industrial data tops expectations (cnbc )

Fed Rate Cuts Are on Hold. 3 Picks if They Come Sooner. (barrons )

Why Bank of Japan may shake up financial markets before Fed’s next interest-rate decision (marketwatch )

Inflation is NOT running hot (scottgrannis )

Apple Is in Talks to Let Google Gemini Power iPhone AI Features (bloomberg )

Fed rate cuts will be a tailwind for small caps, says Fundstrat’s Tom Lee (cnbc )

PayPal Stock Has Fallen Far Enough. It’s Time to Buy. (barrons )

A New Surge in Power Use Is Threatening U.S. Climate Goals (nytimes )

How China Could Swamp India’s Chip Ambitions (wsj )

The F-Bomb-Dropping Airline CEO About to Earn a $100 Million-Plus Bonus (wsj )

Dollar Stores Get Devalued as Low-Income Consumers Struggle (wsj )

A Big Disney Fight Isn’t Nelson Peltz’s Only Drama (wsj )

Suspense Builds for Fed as Growth Downshifts and Inflation Lingers (wsj )

Cisco stock still isn’t back to its 2000 high: Chart of the Week (yahoo )

Hertz CEO resigns after push to buy Tesla fleet backfires big time for company (foxbusiness )

Boeing bonds are still coveted by investors despite a rough 2024 for jet maker (marketwatch )

Steven Mnuchin’s interest in TikTok and NYCB echoes his pre-Trump investment playbook (marketwatch )

TikTok Bill’s Progress Slows in the Senate (nytimes )

S. stocks have beaten European equities but won’t for much longer, says JPMorgan (marketwatch )

The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj )

Markets capitulate to Fed on interest rates after months-long stand-off (ft )

US equity funds draw record inflow as investors bet on soft landing (ft )

‘Growth company with no growth’: Wells Fargo says Tesla stock could drop 23% in scathing downgrade (businessinsider )

It’s actually a good time to buy a new car (businessinsider )

The end of the Realtor monopoly (businessinsider )

Michelin Unveils 2024 List of Starred Restaurants in Hong Kong, Macau (bloomberg )

What Must Nelson Peltz Do to Get Some Respect? (nytimes )

10 Best Cheap Stocks to Buy Under $10 (morningstar )

Wall Street Doom Prophesy Falls Flat on Hottest Rally Since 2016 (bloomberg )

The Consumer Price Index Doesn’t Capture What’s Really Hurting Consumer Confidence (barrons )

Fast-Food Companies Could Be Heading Toward a Price War. Why McDonald’s Could Win (barrons )

How the Federal Reserve Could Throw Stocks for a Loop (barrons )

Masters in Business: Mark Wiedman (bloomberg )

remembering marcello gandini, italian car designer of lamborghini, ferrari, maserati and more (designboom )

Ex-Ford CEO warns of ‘real financial trouble’ for EV startups as adoption takes longer than expected (fortune )

Can Ferrari, the Winningest Team in F1 History, Get Back on Track? We Ask an Expert (robbreport )

Weekly Leading Economic Index (advisorperspectives )

Alexander Hamilton and the Birth of US Industrial Policy (bloomberg )

Who Will Be the Next James Bond? (townandcountrymag )

Scottie Scheffler defends Players Championship title with dominant Sunday charge (golf )

The End of Japan’s Negative Rates Will Be a Slow-Moving Tsunami (wsj )

Disney Board Seats for Nelson Peltz Are a Long Shot. He’s Winning Just the Same. (barrons )

Park Avenue landlords boast new leases after glowing Sixth Ave. report (nypost )

Dan Loeb Enters the Chip Wars (nytimes )

Florida Is Not So Cheap Compared With New York These Days (bloomberg )

Carbone Wants to Conquer the World With a Red Sauce Empire (bloomberg )

There’s Now a Fake Santorini in Abu Dhabi to Lure Luxury Travelers (bloomberg )

There’s really no need for the Fed to lower interest rates, says Ed Yardeni (cnbc )

Damo Academy plans to launch latest RISC-V chip this year as chip demand grows (scmp )

Good news is good news again in markets (ft )

Goldman Sachs raises US real GDP growth forecast (streetinsider )

TikTok’s Business, in Charts (wsj )

The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj )

How AI Is Sparking a Change in Power (barrons )

Investors Don’t Need to Sweat the Latest Boeing 737 Safety Incident. The Data Show Why. (barrons )

Dan Yergin Is Concerned About AI-Fueled Boom in Electricity Use (bloomberg )

The Everything Rally Comes to Derivatives Market (bloomberg )

Apple Without AI Looks More Like Coca-Cola Than High-Growth Tech (bloomberg )

America’s Office Fire Sale Has Barely Begun (wsj )

Berkshire Bought Back About $2.3 Billion in Stock (barrons )

The Big Read. The battle over TikTok (ft )

Barclays explains why S&P 500 keeps rallying despite hot CPI, PPI data (streetinsider )

Investors should buy cheap portfolio insurance now before stock market turns volatile, Goldman warns (marketwatch )

China’s Fiscal Stimulus Plan May Be Bigger Than It Appeared (bloomberg )

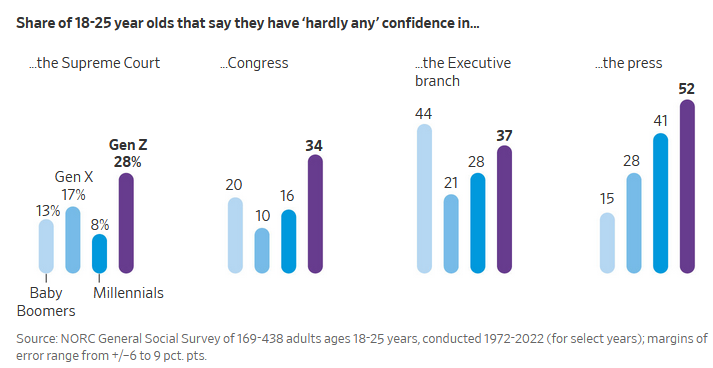

The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters (wsj )

Sorry Stock Bulls, the ‘Wall of Cash’ Isn’t All Headed Your Way (wsj )

UK Inflation Expectations Fall to Lowest Since BOE Hikes Began (bloomberg )

2024 Ford F-250: A Primitive, Powerful Beast of a Truck (wsj )

This Rare Ferrari Dino 246 Spider Is A Sought-After Tribute To Enzo’s Son (maxim )

The DNA of a Warren Buffett Company (morningstar )

Warren Buffett Minds the GAAP (wsj )

AMD Rally Looks More Fragile Than Nvidia’s as Traders Bid Up AI (bloomberg )

PayPal Stock Has Fallen Far Enough. It’s Time to Buy. (barrons )

Cockpit Mishap Seen as Likely Cause of Plunge on Latam Boeing 787 (wsj )

Nvidia led Phase 1 of the AI trade, these are the next three, says Goldman Sachs (marketwatch )

Disney’s Proxy War Is Getting Very Noisy. What Really Matters. (barrons )

Steven Mnuchin’s Bid for TikTok Isn’t as Strange as You Think (barrons )

Boeing’s problems don’t change the overall outlook for the commercial aerospace industry. Planes are in hot demand. (barrons )

Deals Are Coming Back. These 8 Companies Are Buyout Candidates. (barrons )

As War Rages On, the Stock Market Shrugs It Off. Will It Last? (barrons )

Dollar Store Stocks Tumbled. That Might Be a Buying Opportunity. (barrons )

Options trades to exceed stocks for first time since 2021 as $5 trillion in contracts come due Friday (marketwatch )

Real-estate prices have bottomed out and it’s now time to buy, Blackstone president says (marketwatch )

Nvidia is no longer Wall Street’s favorite stock. This company is. (marketwatch )

Private Equity Wants Your Credit Card Debt. And Car Loan. And Mortgage. (wsj )

Why That Hot Biotech IPO Could Be a Winner (wsj )

Fisker Preparing for Possible Bankruptcy Filing: Report (barrons )

Airfares Have Taken Off. Why They Might Not Drop Soon. (barrons )

Auto Insurance Prices Soared Last Month. Why They Finally Might Be Peaking. (barrons )

India Banned TikTok. Then Instagram and Other Copycats Took Off. (barrons )

Producer Price Data Will Be the Fed’s Last Look at Inflation Before Rate Decision (barrons )

Lennar Beats Forecasts as Incentives Boost New Orders (barrons )

‘I’m not sure we need 2% inflation’: How investors are absorbing Tuesday’s CPI report (marketwatch )

Inflation Remains Americans’ Top Concern Even as They Plan to Keep Spending (barrons )

Don’t Worry Over Apartment REITs. Some Can Still Raise the Rent. (barrons )

This is a long-term bull market, says Ed Yardeni (cnbc )

Chinese stocks are back in a bull market as investors buy into the nation’s economic rebuild (businessinsider )

3M (MMM) hikes first-quarter earnings forecast amid healthcare unit spin-off (streetinsider )

‘It’s just a fantasy’: Citadel CEO Ken Griffin says AI will not replace human fund managers (marketwatch )

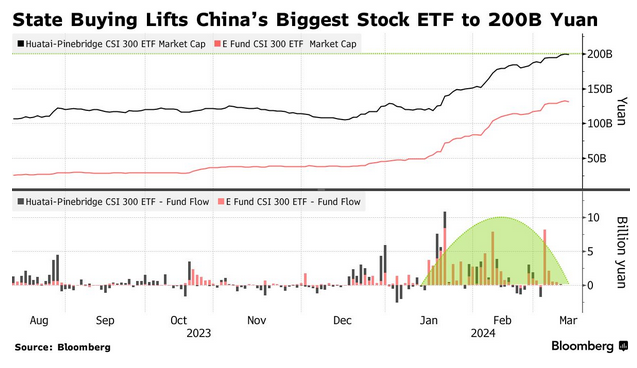

China’s Biggest ETF Reaches $28 Billion on National Team Buying (bloomberg )

3M hires outsider Bill Brown as CEO, shares jump (foxbusiness )

The last mile of inflation hits another big bump in the road (marketwatch )

Illegal immigration is giving Fed more scope to let economy run hot, researchers say. (marketwatch )

The Fed Has a Tricky Data Problem. The Economy Is Sending Lots of Mixed Signals. (barrons )

Auto Insurance Prices Soared Last Month. Why They Finally Might Be Peaking. (barrons )

For Golf Communities, It’s All About the Long Game (barrons )

This New AI Chip Makes Nvidia’s H100 Look Puny in Comparison (barrons )

How Safe Are Boeing Planes? A Look at the Data. (barrons )

Amazon Will Now Deliver Eli Lilly Weight Loss Drug (barrons )

Productivity Is Growing Fast. Don’t Give AI the Credit. (barrons )

Big Stocks Aren’t the Only Play. It’s Time to Look at Smaller Ones. (barrons )

Berkshire Buys More Liberty Sirius XM, Now Holds $2.6 Billion of Tracking Stock (barrons )

ADM Finds ‘Material Weakness’ in Accounting Probe (barrons )

Inflation Picks Up to 3.2%, Slightly Hotter Than Expected (wsj )

3M Names New CEO Amid PFAS Battles, Health Spinoff (wsj )

Alibaba’s Media Arm to Invest $640 Million in Hong Kong Entertainment (wsj )

Dollar Tree to Close About 1,000 Stores (wsj )

How China Tried to Fix the Stock Market—and Broke the Quants (wsj )

Miami’s Office Market Was Red-Hot. Now Its Tallest Planned Tower Can’t Fill Its Space. (wsj )

Activist Investor Land & Buildings Urges Office Owner to Liquidate (wsj )

Dodge drops the Challenger, flexes new 2024 Charger Daytona EV (usatoday )

China Pledges Central Government Funds For Equipment Upgrades (bloomberg )

The Fed Will Slow QT. What Matters Is Where It Stops (bloomberg )

Jamie Dimon endorses Disney CEO Bob Iger in proxy fight with activist (cnbc )

EV euphoria is dead. Automakers trumpet consumer choice for U.S. car shoppers (cnbc )

Top CFOs are as bullish on the Dow and as dovish on the Fed as they’ve been in a long time: CNBC survey (cnbc )

Forget Nvidia: Billionaire Investors Are Selling It and Buying These 2 Artificial Intelligence (AI) Stocks Instead (yahoo.finance )

AMD Rally Looks More Fragile Than Nvidia’s as Traders Bid Up AI (finance.yahoo )

Jerome Powell just revealed a hidden reason why inflation is staying high: The economy is increasingly uninsurable (fortune )

The Big Read. Shipbuilding: the new battleground in the US-China trade war (ft )