Skip to content

Building-Products Distributor QXO Clinches Deal for Beacon Roofing ( wsj ) China is tackling weak consumption with child care subsidies ( cnbc ) Boeing Sees Cash Flow Improve as Jet Factories Stabilize ( bloomberg ) Exclusive: Air India in talks for dozens of new widebody jets from Airbus, Boeing, sources say ( reuters ) BofA: Boeing’s March deliveries set for end of quarter surge ( streetinsider ) Fed Projections See an Economy Dramatically Reset by Trump’s Election ( wsj ) The Fed Pencils in 2 Rate Cuts. Anything Could Happen. ( barrons ) A Housing Expert Sizes Up the Outlook for Home Sales, Mortgage Rates, and Tariff Impacts ( barrons ) Is this the start of a period of European exceptionalism in markets? ( ft ) Hold the Obituary: Europe Comes to Life as U.S. Stumbles ( wsj ) US natural gas prices up on record flows to LNG export plants, cooler weather forecasts ( reuters ) Disney and Universal Prepare for a Theme Park Brawl. What’s at Stake in Orlando. ( barrons ) Temu-Owner PDD’s Revenue Misses Estimates as Expansions Slow ( bloomberg ) Nike’s Earnings Are Here. Expect News About Its Turnaround. ( barrons ) Signs of an Office Market Bottom: ‘The Worst Is Probably Over’ ( nytimes ) The Dream Team With a ‘Miracle’ Coach: Can Anyone Stop This Hockey Powerhouse? (wsj )

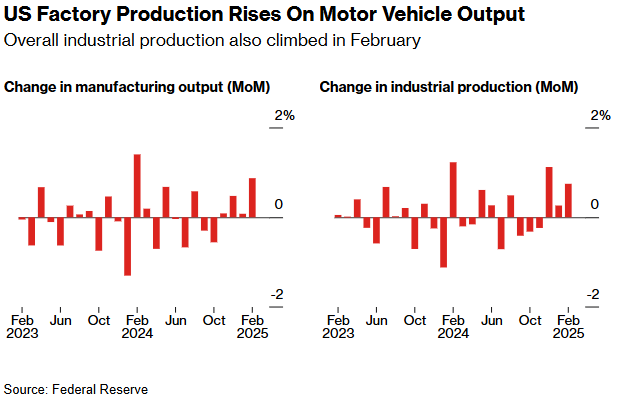

US Factory Production Rises by Most in a Year on Auto Output ( bloomberg ) Investors Are Ditching U.S. Stocks. When That Could Be a Buy Signal. ( barrons ) China markets are set to outperform Wall Street as U.S. exceptionalism comes to a pause ( cnbc ) China Banks Cut Consumer Loan Rates to Record Low to Spur Demand ( bloomberg ) Confidence in German economy surges as parliament approves huge spending plan ( marketwatch ) Tencent AI Plans Seen as Key for Further China Tech Stock Gains ( bloomberg ) Retail investors ditch buy-the-dip mentality during the market correction ( cnbc ) Big Tech’s data center boom poses new risk to US grid operators ( reuters ) The ‘Energy Transition’ May Be Disappearing, but Renewable Energy Isn’t ( barrons ) Why China is suddenly flooding the market with powerful AI models ( ft ) China Electric Vehicles Roar (Silently) ( chinalastnight ) Dollar Is In The Crosshairs As Europe Jumps US Ship ( zerohedge ) Japan Airlines to buy 17 more Boeing 737-8s ( reuters ) Ram Owner Wants to Bring Cheaper Pickup Back to US ( bloomberg ) Dell CEO explains why he thinks the PC refresh cycle is starting ( cnbc ) The North Face Just Took an Era-Defining ’90s Jacket Off Ice ( gq ) Nike Returns to Sports While Investors Impatiently Await Reset ( bloomberg ) 10 Best Value Stocks to Buy for the Long Term ( morningstar ) March Dot Plot to Highlight Fed Officials’ Outlook ( wsj ) Nvidia Was Once a Hot Stock, Why It’s Now Leaving the Market Cold. (barrons )

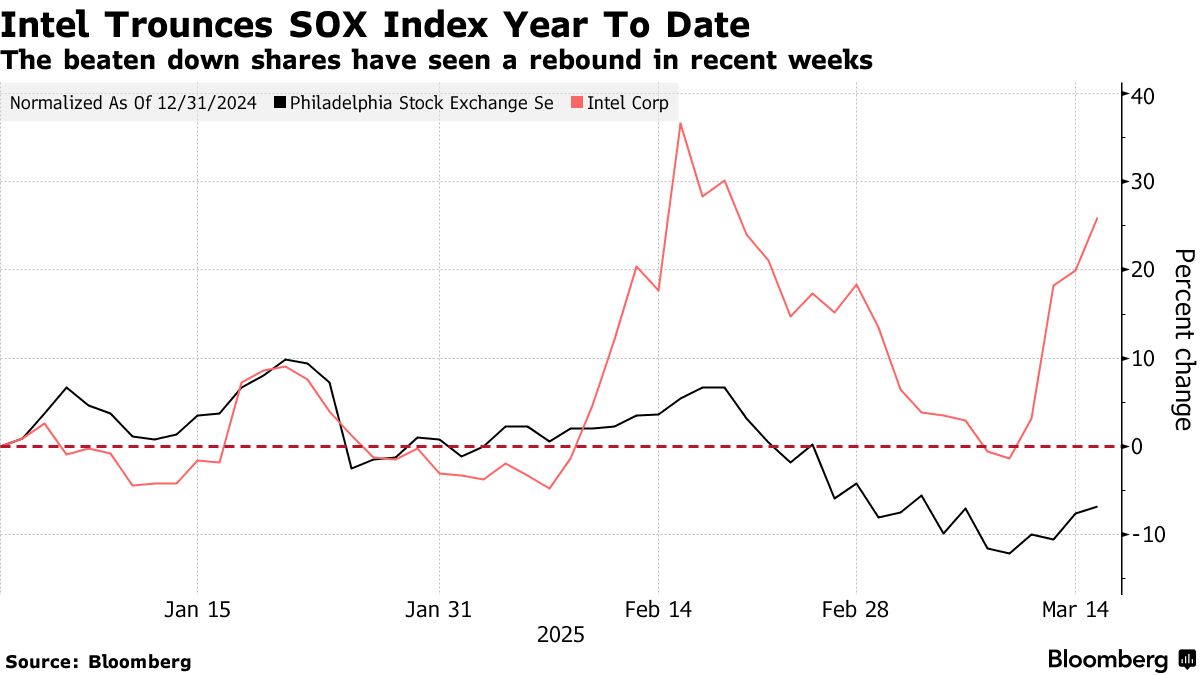

Intel’s new CEO is putting his money where his mouth is ( marketwatch ) Exclusive: Intel’s new CEO plots overhaul of manufacturing and AI operations ( reuters ) Intel’s New CEO Faces ‘Show Me’ Moment After $22 Billion Rally (bloomberg ) Why is China spending billions to get people to open their wallets? ( bbc ) Alibaba and Other Chinese Stocks Are Crushing U.S. Shares. Here’s Why. ( barrons ) More China Consumers Feel Better Off, Deutsche Bank Survey Shows ( bloomberg ) China’s Onshore Markets See Record Inflows Despite Trade Angst ( bloomberg ) Hong Kong stocks hit 3-year high on hopes Trump-Xi talks could ease trade tensions ( scmp ) Alibaba’s ‘killer app’: Quark draws positive reviews in China as AI agent race heats up ( scmp ) The Action Plan For Boosting Consumption Includes Stock Market & Real Estate Support ( chinalastnight ) Donald Trump says China’s Xi Jinping to visit US in ‘not too distant future’ ( ft ) Cheap Chinese Cars Are Taking Over Roads From Brazil to South Africa ( bloomberg ) Warren Buffett said it’s best to ‘be greedy when others are fearful,’ Thomas Hayes says ( foxbusiness ) BofA Survey Shows Biggest-Ever Drop in US Stock Allocations ( bloomberg ) Corporate Insiders’ Buying Burst Gives Confidence to S&P Bulls ( bloomberg ) Bessent Sees No Reason for Recession, Economic Data ‘Healthy’ ( bloomberg ) How many rate cuts does the market expect this year? ( foxbusiness ) Cadillac expects one of every three vehicle sales to be EVs in 2025 ( cnbc ) More home builders cut prices to lure buyers put off by high costs ( marketwatch ) US Housing Starts Increase by More Than Forecast After Storms ( bloomberg ) Germany’s economic sentiment hits 2-year high, EU exports to US soar ( yahoo ) Euro hits five-month high before German vote on massive spending surge ( streetinsider ) Short Positioning Can Push Euro Yet Higher ( zerohedge ) What to Expect During Disney’s Annual Meeting ( morningstar ) Norwegian Cruise Stock Gets an Upgrade. Why Demand Fears Are Just ‘Noise.’ ( barrons ) Yeti Stock Surges on Deal with Activist (barrons )

How Jack Ma’s pivot to AI rehabilitated Alibaba ( ft ) China unveils plan to ‘vigorously boost’ weak consumption ( ft ) China Says It Started Year on Strong Economic Footing as Trump Tariffs Hit ( wsj ) China Plans for Global CEOs to Meet Xi in Beijing Next Week ( bloomberg ) Policy Optimism Lifts Markets, Week In Review ( chinalastnight ) Investors Were Confident Heading Into 2025. That Was a Bad Sign. ( wsj ) Treasury’s Bessent Isn’t Worried About Stock Market ( barrons ) Exclusive: Intel’s new CEO plots overhaul of manufacturing and AI operations ( reuters ) How ‘inference’ is driving competition to Nvidia’s AI chip dominance ( ft ) Tech still at the top of the crowding ranks in the U.S., Citi warns ( streetinsider ) This sector may be the ‘accidental beneficiary’ of a U.S. growth scare, says JPMorgan ( marketwatch ) EM Stocks Set for Best Month Since September on China Boost ( bloomberg ) Asset Managers Boost Euro Bets as Hedge Funds Cut Shorts ( bloomberg ) Pfizer Has a New Playbook for Reviving Sales—and It’s Starting to Pay Off ( wsj ) Trump’s Moves Are Boosting Stocks … Overseas ( nytimes ) Trump Wants to Build Homes on Federal Land. Here’s What That Would Look Like. ( wsj ) Disney Executives Audition to Be the Company’s Next CEO ( bloomberg ) Goldman sees double trouble for U.S. exceptionalism ( streetinsider ) Stocks Haven’t Traded at These Levels Since September ( wsj ) Yeti expands board, adds two directors after discussions with activist Engaged ( reuters ) US Bitcoin ETFs Shed $5.5 Billion in Longest Run of Outflows ( bloomberg ) Tesla Stock Drops Again. It Could Drop for a 9th Straight Week. ( barrons ) February Retail Sales Missed Expectations. Spending Still Rebounded. (barrons )

How PayPal is bolstering its branded business ( yahoo ) China’s AI boom is reaching astonishing proportions ( economist ) As Intel welcomes a new CEO, a look at where the company stands ( techcrunch ) Stifel maintains Buy on GXO Logistics with $66 target ( investing ) New-Vehicle Affordability Improves Again in February ( coxautomotive ) Alibaba Unveils Flagship AI Super Assistant Application Quark ( alizila ) China Maps Out Plan to Raise Incomes and Boost Consumption ( bloomberg ) Valentino’s Collaboration With Vans Is Already The Most Coveted Release Of 2025 ( vogue ) Lithium-ion batteries are remaking Google’s data centers ( techcrunch ) Spirits giant Diageo suggests alternative to Trump’s tariffs – letter ( reuters ) With Manus, AI experimentation has burst into the open ( economist ) Houston, We Have a Correction. Now What? ( carsongroup ) Inflation update ( scottgrannis ) The Lilo & Stitch Trailer Has Given Disney Another Brag-Worthy Milestone ( gizmodo ) Teeing off at the wildly high-tech future of golf ( theverge ) 5 collector cars to put into your garage this week (classicdriver )

Intel is the best chip stock this year in a surprising reversal ( marketwatch ) Today’s Coolest Men’s Sneakers Share One Thing: Extremely Slim Soles ( wsj ) Why lowering the yield on 10-year bonds is more important to Trump than the stock market or interest rates ( fortune ) China courts global CEOs for meeting with Xi Jinping ( ft ) Are value stocks finally taking the baton from growth? ( investmentnews ) New Intel chief cheered by investors after board sought alternatives ( ft ) Intel’s New CEO Gets Pay Package Valued at About $69 Million ( bloomberg ) Boeing Names Longtime Executive Don Ruhmann to Safety Chief Role ( bloomberg ) Why some Wall Street power players aren’t worried about stocks ( nypost ) Investors should take stock of the shift in volatility ( ft ) Consumer Sentiment Tanks as Americans Expect More Pain Ahead ( wsj ) Investors get the jitters over Donald Trump’s approach to dollar ( ft ) Hollywood Studios Embrace Live Experiences Amid Film, TV Gloom ( bloomberg ) Billions In AI Capex May Already Be Paying Off. How We Know. ( barrons ) ‘Lilo & Stitch’ Becomes Disney’s Second Most Viewed Live-Action Trailer With 158M (deadline )

Crown Castle to Sell Fiber Segment for $8.5 Billion ( wsj ) Etsy, eBay Aim to Imitate Social Media With Hyper-Personalized Shopping ( wsj ) Intel’s New CEO Thrills Wall Street. There’s Still a Lot of Work Ahead. ( barrons ) Inside the Mind of Intel’s New CEO: ‘Disrupt and Leapfrog’ ( wsj ) Chinese Stocks Surge as Beijing Plans Briefing on Consumption ( bloomberg ) There Are Plenty of Reasons to Be Optimistic About Europe ( bloomberg ) ‘We Hear You, Mr. President’: The World Lines Up to Buy American Gas ( nytimes ) BofA Says Policy Moves to Keep Stocks Away From Bear Market ( bloomberg ) Data center build-out stokes fears of overburdening biggest US grid ( reuters ) Energy Bosses Shrug Off DeepSeek to Focus on Powering AI Boom ( bloomberg ) Euro rallies on rising prospect of historic German debt deal ( streetinsider ) Chinese stocks hit highest level this year ( ft ) What we need to see to go all in on European stocks ( ft ) Donald Trump makes Chinese stocks (somewhat) great again ( reuters ) Consumer Stocks Drove Strength In China Ahead Of Policy Presser To Boost Consumption ( zerohedge ) Morgan Stanley’s Dim US Dollar Outlook Gets Darker as Economic Risks Mount ( bloomberg ) Tesla Is No Mag 7 Stock. It’s Built on a Dream. ( barrons ) ‘Risks to the Equity Markets Are Tailwinds to Infrastructure’ (institutionalinvestor )

Intel Names Lip-Bu Tan as Chief Executive Officer ( wsj ) Intel CEO Signals That He’ll Stick With Contentious Foundry Plan ( bloomberg ) Five Things to Know About Lip-Bu Tan, Intel’s Next CEO ( wsj ) Alibaba revamps Quark search engine into AI super assistant as China’s tech race picks up ( scmp ) Boeing Stock Is Too Cheap For Citi. How Trump and a Trade War Have Left Their Mark. ( barrons ) Dollar General Rises With Sales Guidance Higher Than Estimates ( bloomberg ) AI Data Center Build-Out Raises Concerns About America’s Future Power Needs ( zerohedge ) Is the US housing market becoming a buyer-friendly market? ( foxbusiness ) Is There an Extremely Simple Fix for Affordable Housing? ( bloomberg ) ECB Will Be Back to 2% Target at End of Year, Nagel Tells BBC ( bloomberg ) Winners and losers from the Wall Street sell-off ( ft ) Lilo & Stitch Looks Like The Best Disney Live-Action Remake Ever ( screenrant ) Estée Lauder continues generative AI push with Adobe integration ( marketingdive ) Wholesale inflation flattens out in February in another sign of easing inflation ( marketwatch ) US Jobless Claims Edge Down, Remaining Near Pre-Covid Levels (bloomberg )

People ‘underestimate’ the importance of Chinese President Xi’s entrepreneur meeting: Alibaba’s Tsai ( cnbc ) Alibaba’s Joe Tsai: Xi Jinping’s entrepreneur meeting fuels business confidence in China ( scmp ) China needs to unleash ‘$20 trillion’ in household savings to drive economic growth, says Alibaba chair Joe Tsai ( fortune ) AI agent Manus partners with Alibaba’s Qwen to develop Chinese version ( scmp ) Hong Kong’s Stock Market Booms With Wall Street in Turmoil ( bloomberg ) Alibaba Releases AI Model That Reads Emotions to Take On OpenAI ( bloomberg ) China’s Retail Investors Pile Into New Funds as Stocks Rally ( bloomberg ) Exclusive-TSMC pitched Intel foundry JV to Nvidia, AMD and Broadcom, sources say ( streetinsider ) Weekly mortgage demand surges 11% higher, as interest rates dropped for the sixth straight week ( cnbc ) Boeing’s Jet Deliveries Top Airbus for Second Straight Month ( bloomberg ) Fitch says Boeing made progress in resuming production post-labor strike ( reuters ) Kelley Blue Book Report: New-Vehicle Prices Increase Year Over Year in February, With Record EV Incentives and Booming Six-Figure Vehicle Sales ( coxautomotive ) US investors seek refuge in value funds ( reuters ) Disney announces major updates that will make fans very happy ( thestreet ) CMA calls for comment on GXO proposals to make Wincanton acquisition competitive ( motortransport ) Global EV sales soared in February, as China’s market kept its growth pace with 76% surge ( scmp ) Traders Ramp Up Bets on Fed Rate Cuts as Recession Angst Builds ( bloomberg ) REITs Are a Safe Haven in the Market Storm. What to Play Now. ( barrons ) Buy the U.S. Market Downturn? These Strategists Are Looking Abroad. ( barrons ) The Latest Overhaul of Starbucks—by the Numbers ( wsj ) Palantir’s Alex Karp takes on critics as he cashes in on surging shares ( ft ) Introducing the ‘Maleficent 7’ ( ft ) Magnificent 7 stocks lose $1.5T in what might be ‘textbook correction’ ( nypost ) The case for China ( ft ) US Inflation Comes In Lower Than Forecast, Offering Some Relief (bloomberg )

US car buyers rush to dealer lots to avoid tariff-related price hikes ( reuters ) U.S., China Discuss a Trump-Xi Summit for June ( wsj ) Alibaba.com targets 100% AI adoption by merchants in 2025 in global expansion drive ( scmp ) Mainland Chinese investors snap up a record amount of Hong Kong stocks to play AI ( cnbc ) Chinese stocks find favour on DeepSeek trade as Citigroup downgrades US equities ( scmp ) Deflation Weighs On China’s Markets, Mainland Investors Buy Dip In Hong Kong ( chinalastnight ) Chinese Stocks Notch Best NPC Gain in Seven Years on Tech Boost ( bloomberg ) Chinese EV Stocks Jump After Robust Sales Outlook, Tesla’s Selloff ( marketwatch ) Top US Utility Says Gas Can Meet Only a Fraction of Power Demand ( bloomberg ) Volkswagen Touts US Spending in Face of Trump’s Tariff Threats ( bloomberg ) Euro surges on hopes of German defence deal; dollar slips again ( streetinsider ) US transportation chief to meet with Boeing CEO on safety efforts ( reuters ) Companies seek AI solutions to supply chain fragility ( ft ) U.K. Retail Sales Grew Slightly in February Supported by Growth in Food ( wsj ) The S&P 500 Has a Case of the ‘Mondays’ Blues ( barrons ) The Stock Market Selloff Has Been Savage. Why It’s More Blip Than Crisis and 5 Other Things to Know Today. ( barrons ) Trump meets Corporate America as economic fears nip stocks (reuters )